In an era where financial transactions are predominantly digital, credit card skimming has emerged as a significant threat. This deceptive practice involves illegally obtaining credit card information using hidden devices. Understanding how to identify these devices at ATMs and gas stations is essential for safeguarding your financial information.

Understanding Credit Card Skimmers

Credit card skimmers are discreet, illegal devices designed to capture credit card data. They are typically installed over the actual card reader slot of ATMs and gas pumps. These devices read the magnetic stripe of your card, stealing the data encoded on it. Skimmers can be incredibly sophisticated, often resembling the real hardware closely. Sometimes, they work in conjunction with hidden cameras or sham keypads to capture your PIN, providing scammers with everything they need to access your account.

How Skimmers Operate at ATMs and Gas Stations

Skimmers at ATMs and gas stations work by fitting snugly over the existing card reader. At ATMs, they are often accompanied by hidden cameras or overlay keypads to steal your PIN. Gas pumps present a particularly attractive target due to their less frequent supervision. Here, skimmers often use Bluetooth technology to transmit stolen data wirelessly, allowing the criminal to stay nearby and receive the information in real-time without having to retrieve the skimmer physically.

1. Inspect the Card Reader

Before using an ATM or gas pump, inspect the card reader carefully. If it protrudes more than usual or seems to have an unusual color or material compared to the rest of the machine, be wary. These can be telltale signs of a skimming device. Authentic card readers are usually seamless and do not offer any leverage for tampering. A quick visual and physical inspection can save you from falling victim to skimming.

2. Look for Discrepancies in the Keypad

The ATM’s keypad is another area vulnerable to skimming devices. A skimmer keypad may be placed over the actual keypad to record your PIN as you type it. If the keys feel unusually thick, hard to press, or raised higher than normal, it could be a sign of tampering. Compare the keypad of the ATM or gas pump with another machine if possible, to spot any inconsistencies.

3. Check for Hidden Cameras

Hidden cameras are often part of a skimmer’s toolkit. These cameras can be incredibly small and hidden anywhere on the ATM or gas pump, like in a brochure holder. They are usually positioned to get a clear view of the keypad to record your PIN entry. Always check for any unusual objects with holes or lenses around the machine, and shield the keypad with your hand when entering your PIN as a precaution.

4. Use ATMs in Secure Locations

Selecting where to withdraw cash or use your card can greatly reduce the risk of encountering a skimmer. ATMs located inside or near banks, or in well-trafficked and well-lit areas, are less likely to be tampered with. These machines are more frequently monitored and maintained, making them less appealing targets for skimmers.

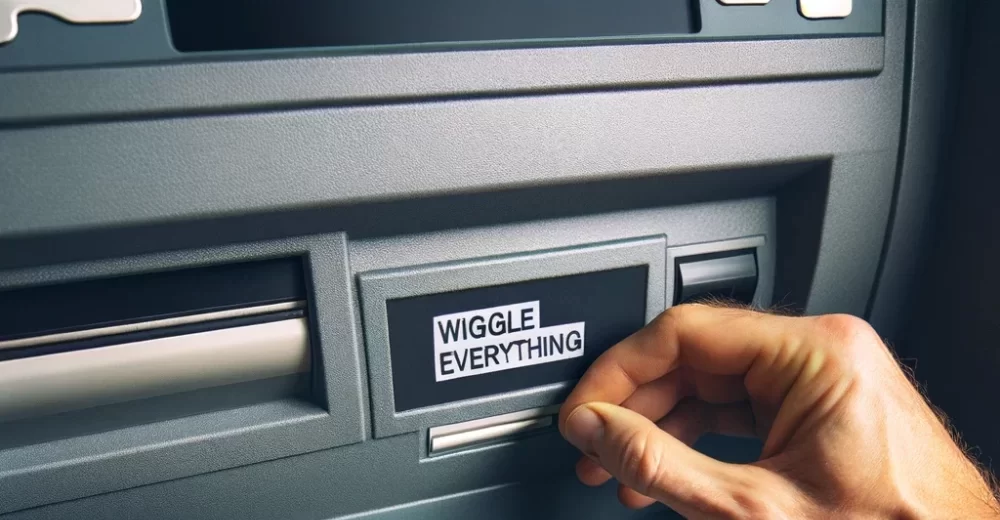

5. Wiggle Everything

Physically test the card reader and keypad before using them. Skimmers are often placed over the existing hardware and may feel loose or move when wiggled. If you notice any components that seem to shift or are not firmly attached, do not use the machine. It’s better to be safe and find another ATM or gas pump.

6. Beware of Unusual Instructions

Skimmers may sometimes use deceptive tactics like placing stickers or signs on the ATM or gas pump, directing you to use a specific device or instructing unusual actions. These can be tricks to guide you towards a compromised part of the machine. Always be skeptical of such out-of-place instructions and use your judgment before proceeding.

7. Use Contactless Payments When Possible

Opting for contactless payment methods, like NFC technology, can be a safer alternative. Many gas stations and ATMs now support contactless transactions, which do not require inserting your card into a potentially compromised machine. This technology significantly reduces the risk of your card information being skimmed.

8. Monitor Your Bank Statements Regularly

Regular monitoring of your bank statements is a critical habit for early detection of any fraudulent transactions. Unauthorized transactions, no matter how small, can be a sign that your card information has been compromised. Promptly reporting these to your bank can prevent further unauthorized access to your account.

9. Use Gas Pumps Closer to the Store

At gas stations, pumps that are closer to the attendant or the main building tend to be safer. These are more visible and less likely to be a target for skimmers. Pumps that are out of sight or located at the far end of the station are more susceptible to tampering due to reduced supervision.

10. Consider Cash Over Card

In locations where the risk of skimming seems higher, such as remote or less supervised ATMs and gas stations, consider using cash instead of your card. While carrying cash comes with its own risks, it eliminates the threat of digital skimming entirely in such scenarios.

11. Try Not to Use Your PIN at ATMs or Gas Stations

Avoid using your PIN at ATMs or gas stations whenever possible. Transactions that require a signature instead of a PIN generally provide more security against skimming. If a PIN is necessary, ensure to cover the keypad with your other hand while typing to prevent any hidden camera from capturing it.

12. Stay Informed About Skimming Devices

Staying informed about the latest trends in credit card fraud and skimming technology is crucial. Fraudsters continually evolve their methods, so being aware of the latest skimming devices and tactics can help you stay ahead. Follow credible financial security resources and participate in community awareness programs to stay updated.

Sophisticated Form of Theft

Credit card skimming is a sophisticated form of theft that requires vigilance to avoid. By applying these 12 tips, you can significantly reduce your risk of falling victim to skimmers at ATMs and gas stations. Remember, protecting your financial information starts with awareness and proactive measures.

Share this article to help others stay safe and informed about protecting themselves from credit card skimmers.