kenny hung photography/Moment via Getty Images

Douglas Emmett (NYSE:DEI) is a sparingly covered REIT that owns a portfolio of Class-A office space as well as a large complement of multifamily apartment units. The latter exposure provides a notable hedge against the downside risks relating to the company’s office holdings.

I last covered DEI in late 2022. I viewed shares bullishly due in part to the strong leasing momentum at the time and the defensive nature of their multifamily portfolio. I also cited the 6.7% dividend yield at the time of my article as a further draw to income-focused investors.

My favorable outlook proved ill-timed. Shares since the update have declined 20%. This compares to a 25% gain in the broader S&P (SPY) over the same period. DEI also slashed their dividend by 32%.

It’s worth noting, however, that the dividend cut was paired with the authorization of a repurchase plan of up to +$300M of its outstanding common shares. While positive to a degree, the reduction in the payout probably didn’t sit well with existing shareholders, as evidenced by the continued share price pressure since the update.

Presently, DEI is trading near the middle of its 52-week range at a forward multiple of funds from operations (“FFO”) of about 8x. And even at the lower quarterly payout rate, DEI’s dividend still yields north of 5.5%. While my overall bullishness on the stock has waned, I still view the company as a continued watch worthy of analyst coverage.

DEI Key Stock Metrics

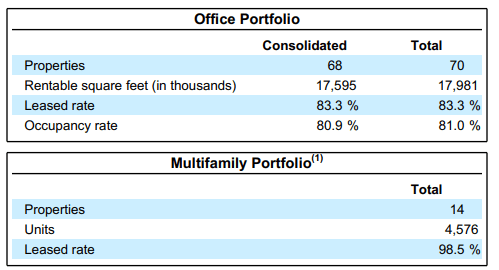

As of December 31, 2023, DEI’s total portfolio consisted of 68 office properties and nearly 4,600 multifamily apartment units, with the properties and its operations concentrated in the Los Angeles and Honolulu submarkets. The established presence in both could be viewed as a competitive advantage due to the significant barriers to entry in both markets but particularly in Honolulu.

DEI Q4 Investor Supplement – Summary Of Total Portfolio Composition

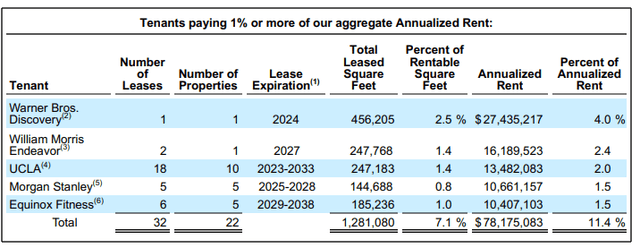

Though DEI owns a higher quality portfolio of office properties, the portfolio hasn’t been immune to the occupancy pressures affecting the broader sector. At year end, DEI reported a leased rate of 83.3% in the office portfolio, down from 87.1% at the end of 2022. And in the current year, DEI will also incur the move out of Warner Discovery, its top office tenant representing 2.5% of total rentable square footage.

DEI Q4 Investor Supplement – Summary Of Top Office Tenants

Recent DEI Operating Performance

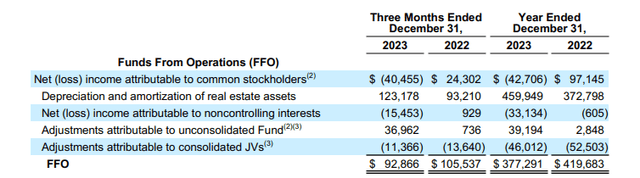

Lower occupancy levels and waning leasing momentum negatively impacted DEI’s operating results in 2023. In Q4, FFO and AFFO were each down 12% and 8.1%, respectively, due in part to a 30% YOY increase in interest expense in addition to lower occupancy levels.

DEI Q4 Investor Supplement – Comparative Snapshot Of FFO

DEI also reported a 1.1% decrease in same-property cash net operating income (“NOI”). This decrease, however, was primarily the result of a lopsided comparative to the prior year relating to tax refunds received in the residential portfolio. Excluding this one-time benefit, overall cash NOI would have been down 0.6%, a lower loss but a loss, nonetheless. And though cash rent spreads were down 6.1%, they were down to an even greater 9.9% last year.

On an overall basis, DEI logged 3.2 MSF of leasing activity during 2023, down about 500K SF from the leasing momentum realized in 2022. In Q4, quarterly activity was also lower but new signings were comparable, with 243K SF of new leases signed, in-line with the quarterly total from 2022.

DEI Outlook And Guidance

Looking ahead to fiscal 2024, the management team appears to be bracing for another challenging year operationally. For one, the lease with Warner Bros, their largest office tenant, will expire and will not be renewed. DEI is also incorporating the removal of one significant residential apartment unit from the rental market. This will offset some of the hedge provided by DEI’s multifamily portfolio.

And though DEI carries no corporate level debt and maintains a healthy share of unencumbered properties, higher interest rates on their existing loan balances are expected to create a headwind on overall FFO.

Combined with similar leasing trends in 2023, these factors are expected to contribute to another decline in FFO in 2024. At the midpoint of $1.67/share, 2024 FFO would be down about 10%. This would follow the 12% decline logged in 2023.

Is DEI Stock A Buy, Sell, Or Hold?

While I have previously expressed bullishness in DEI, I am more neutral today. The lower quarterly payout since my last update is one factor for the reassessment. The challenging outlook in DEI’s office portfolio is another.

In 2024, DEI will incur a large vacancy on a known move-out. And this vacancy, which will represent 2.5% of DEI’s square footage, may not be easily backfilled. To ultimately fill the space, DEI may have to increase concessions provided to prospective tenants.

This could add to ongoing pressure on rents. In 2023, for example, cash rental spreads were down 6.1% following a 9.9% decrease in 2022. The anticipated moveout could result in the negative trend in cash spreads to continue into 2024.

DEI’s shares have dropped about 20% since late 2022, alongside a 32% dividend reduction. At current trading values, DEI commands a multiple of 8x forward FFO. Shares also come attached with a 5.5% yielding dividend.

Despite the compressed valuation, DEI faces occupancy pressures and leasing challenges, with the management team foreseeing continued difficulties with lease expirations and higher interest rates through 2024. As a result, the midpoint of 2024 FFO is expected to be down 10%. This would follow a double-digit decline in 2023.

With these considerations in mind, investors may find it best to remain on pause on any new or further initiation. The successful backfill of vacating space and better than expected overall leasing performance may warrant another reassessment. But until then, shares would continue to be viewed as a “hold.”