Giuseppe Lombardo/iStock via Getty Images

Investment Thesis

Masimo’s (NASDAQ:MASI) recent expansion into the consumer space is a logical move, but it has upended its cost curve that, in turn, brought down the net income and free cash flow. By examining layers of its core revenue segment as Professional Healthcare and the connection with the newly setup Non-Healthcare segment, we find its expansion can be seen as leveraging its core technologies and stable revenue to create additional value and income. Although it is met with macro headwinds in ’23, the company has gone a long way in setting up the platform, such as through acquisitions in ’22, to ensure the success in this new space. We consider there is more upside to come for the stock and recommend a buy at or below current levels.

Company Overview

Masimo Corporation, incorporated in 1989 and headquarters in Irvine, California, is a manufacturer of noninvasive patient monitoring devices with automation and connectivity solutions. The company has worldwide

Strengths and Weaknesses

The recent reinstatement by the Federal Circuit on Apple (AAPL) watch’s infringement of Masimo’s intellectual rights has been giving the company a lift in its stock price, but the recovery had already started in October of last year.

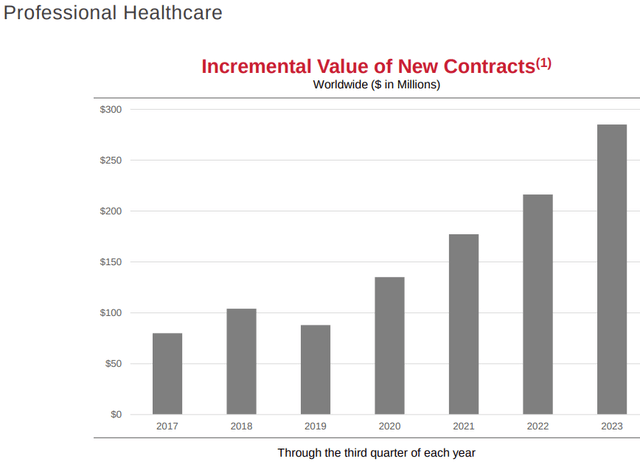

To see why Masimo has the courage to take on Apple, perhaps the robust revenue growth in its Professional Healthcare segment gives a clue. The core products in this segment are Measure-through Motion and Low Perfusion pulse oximetry, known as Masimo Signal Extraction Technology (SET ) pulse oximetry, and advanced rainbow ® Pulse CO-Oximetry parameters such as noninvasive hemoglobin (SpHb ®). But the expansion over the years has added multi-layer of diversification to its product offering, such as added optical features to monitoring blood constituents, monitoring of brain functioning, acoustic respiration, capnography and gas, nasal high flow ventilation, and minimally invasive neuromodulation technology for pain and addiction reduction, all provided under an automation solution for hospitals. The purchase of its core products such as the MX circuit board enables the original equipment manufacturers, such as GE Healthcare, Hillrom, etc., to have the options to incrementally adding additional rainbow ® software measurements. Such flexibility allows the customers to expand their patients monitoring system gradually as a cost-effective solution. Therefore, the management analyze the business in this segment by looking at the incremental revenue growth, taking into account not only the new customers but also additional spending of existing customers’ contracts. This shows the marginal growth of its revenue, which, except for a dip in 2019, has tripled since 2017.

Masimo: Incremental Value of New Contracts (Company Q3 Presentation)

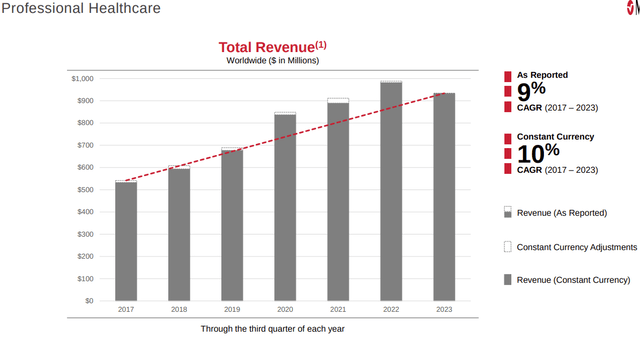

The sales growth has a seasonality that dips in the summer months and rises during Q4. For the total revenue in the healthcare segment, it has been growing at 9% CAGR as reported and 10% in constant currency. Breaking it down, the total Consumable revenue was growing at 10% CAGR, the rainbow and hemodynamics monitoring revenue growing at 20% CAGR, brain monitoring growing at 27% CAGR and capnography & gas monitoring was 16%. Consumables takes up about 88% of total revenue, which is why the total revenue growth is more aligned with Consumables’ growth.

Masimo: Total Revenue (Company Q3 Presentation)

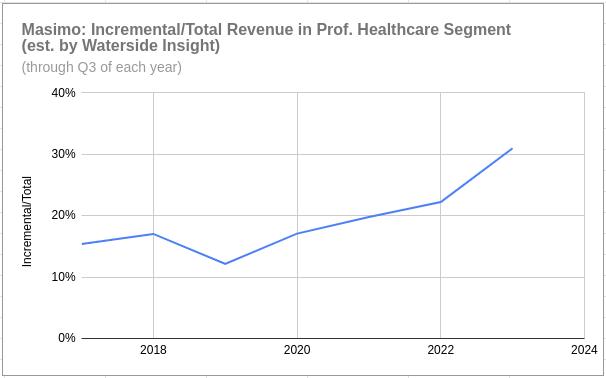

If you compare the incremental growth against the total revenue, not only the incremental contract value itself grew, as the percentage of revenue also grew by almost doubling since ’17. This is a sign of robust organic growth in Masimo’s core business.

Masimo: Incremental over Total revenue in Professional Healthcare Segment (Calculated and Charted by Waterside Insight with data from company)

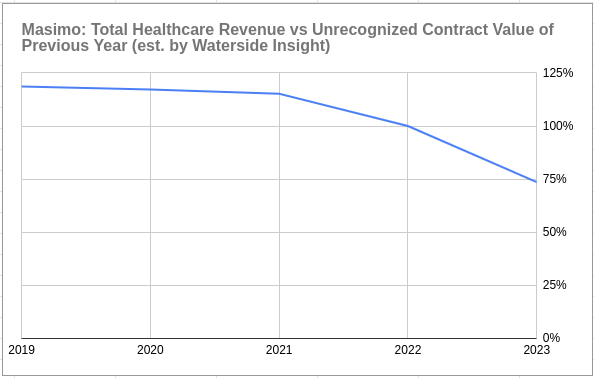

On the other hand, Masimo’s unrecognized contract revenue has been growing at an average 21% per year since 2018. The company does not disclose how much the unrecognized contract value were exactly realized in the next fiscal year. But if we’re comparing the total revenue as a percentage of the unrecognized, that percentage has been going down even as both have been growing steadily. The management has discussed in its 10K that some will be realized over a multi-year period. Typically, the actual amount realized within 12 months later is much smaller than total revenue. For example, in 2023, it expected $354.8 million to be realized from the approximately $1268.3 million of unrecognized contract revenue. By Q3 of last year, it had $1434.6 million of unrecognized contract revenue with $375.9 million to be realized within 12 months. But summing it up, with both total revenue and unrecognized contract revenue growing, this lower ratio indicates total revenue is growing slower than the unrecognized revenue, which could mean there is accumulated deferred revenue that can be supportive to the near-term top-line growth. In the Q3 earnings that, it discussed the slower-than-expected equipment installation from new hospital conversions, which led to it to reduce guidance for this segment for the year. But at the same time, it also reported elevated backlog by the OEM (“original equipment manufacturers”) partners. So Q3 still achieved a 10% sequential increase as a seasonally slow quarter.

Masimo: Total Healthcare Revenue vs Unrecognized Contract Value of Previous Year (Calculated and Charted by Waterside Insight with data from company)

Since Masimo has been successful in setting the medical standard of non-invasive monitoring, perhaps it’s natural for it to extend into consumer space to build products utilizing its proprietary technologies as well. But it only started doing so for the past three years or so. Although larger and more deep-pocketed competitors have already dominated this scene, being late is better than never, perhaps. With the backing of its advanced proprietary technologies, success for the company shouldn’t be counted out simply for being late. Hence, initiating the dispute with Apple and subsequently winning it by Masimo has long been in the making. Although the related product Masimo was infringed on was Masimo W1, a wrist-worn continuous biosensing hospital-grade health watch, it has just received FDA’s approval in December last year to offer W1 watch for over-the-counter (“OTC”) and prescription use (“RX”), making it one step closer to ordinary consumers’ reach.

This newly emerged additional segment called Non-Healthcare in 2022 serves ordinary consumers with wearables, audio systems and home entertainment systems that utilized the same precision-emphasized technology it uses in medical devices. Its audio consumer business is built on the acquisition in ’22 of Sound United, which owns a portfolio of premium brands, such as Bowers & Wilkins, Denon, etc. They have direct product sales through their website and distributors, but also license their core audio technologies to high-end carmakers such as BMW, Maserati, McLaren, and Volvo, etc. Such a flexibility in generating revenue from their existing technologies gives it options to pursue it in either a cost-effective licensing way or in a direct sales to consumers, or a mixture of both. It will help bring down the cost curve in the long term. It reported rapid uptake of its hearable products in Q3 earnings, which helped to offset the slowdown induced by the macro environment.

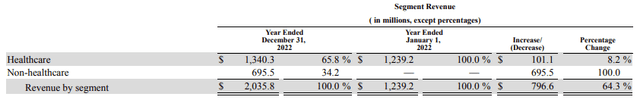

Masimo: Revenue by Segment (Company 2022 10K)

The first year result for Non-Healthcare as a separate segment in ’22 was adding $695.5 million or 34.2% to the total revenue, resulting in a 64.3% YoY jump for the total revenue for the full year. In the Non-Healthcare revenue, $550 is from consumer audio, which has been held steady around this level in the past three years. Its hearables on the other hand, has grown from about $15 million in ’21 to now almost $50 million by the end of ’23.

Masimo: Revenue by Segment of 2022 vs 2023 (Company 2022 10K)

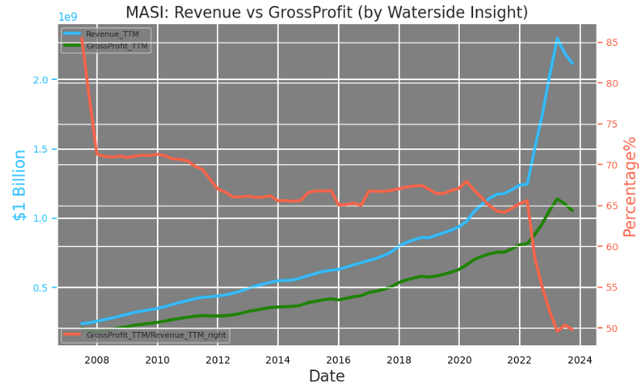

Producing the whole range of consumer-targeted products substantially increased its cost of revenue, which doubled from $430 in ’21 to $977 in ’22. This caused it gross margin to drop from 65% to just about 50%. This is the main reason that impacted it earning-per-share, operating margin and free cash flow. Its cost of revenue has gone from about 35% in ’22 to 50% in ’23, pulling down its gross margin from 65% to 50% during the same period.

Masimo: Revenue vs Gross Profit (Calculated and Charted by Waterside Insight with data from company)

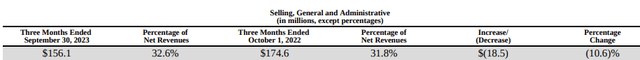

In comparison with its larger competitors, such as Sonos (SONO), Apple, Masimo is lacking the massive direct/indirect retail sales channels and certain customer loyalty they have. The company has increased its sales and marketing spending in 2022 by $262 million of Selling, General and Administrative spending, while R&D spending also rose by 39.5%. The pace of increase has come down in the latest quarter, during which the SGA expenses has decreased by 10.6% YoY.

Masimo: SGA Expenses (Company 10Q of Q3 of 2023)

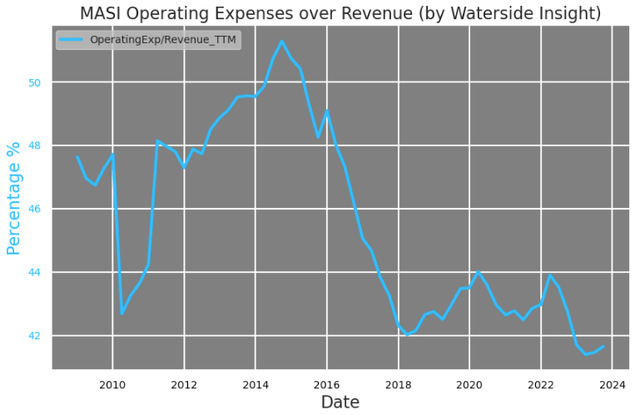

But the overall operating expenses as a percentage of revenue has actually gone down, due to the surge of the denominator. It is at the lowest levels in the past 15 years. Since a lot of the expenses spending needs to go before the sales materialized, this shows the management’s vision has been proven to be on target.

Masimo: Operating Expenses vs Revenue (Calculated and Charted by Waterside Insight with data from company)

In the newly launched products lineups, in the similar spirit of the OTC watch, Masimo has the first FDA-cleared OTC Fingertip Pulse Oximeter announced just last week. The Oxygen Reserve Index parameter (“ORi”) was the main product launch of ’23, and it continued to create add-on options for its Rainbow product series. This serves as an example of how it expands the revenue in an incremental way, as we discussed earlier. To thread all of its medical products in respiratory, cardiovascular, neurology and brain health care together is an AI-powered clinical decision support system that helps to drive transformation from episodic and reactive care model to a systematically predictive way that can be continuously providing care to patients. This not only strengthen its core product but also builds an ecosystem that is bound to drive more “incremental” growth. Also, the OTC offering is partially breaking down the borderline between hospital-grade product and consumer product, making the revenue from its core segment easier to be translated into the new Non-Healthcare segment.

On the consumer product side, it launched its STORK Baby Monitor in last August in both online and in-person stores. The upcoming earnings report should reveal how it has done during the holiday shopping season.

Overall, Masimo has a steadily growing core business in Professional Healthcare, with hospital-grade products setting standards that it can leverage to develop and pursue a broader consumer product offering. There are two factors to provide confidence for a reasonable future success; one is its multi-year visible revenue growth in the healthcare segment, another is its core technologies that are well tested in the hospital environment. It has the flexibility to either provide the tech as chips to original equipment manufacturers or to develop them into full-fledged consumer products. The remaining is the execution of the strategy. So far, it hasn’t been doing too bad, given the challenging macro environment for consumer spending. The higher cost of revenue and operating expenses, including the litigation cost, can be seen as paying for the initial spending to open up the market and building the foundation to scale up. They shall pass over time. Should the company continue to focus on product quality and opening up more diverse sale channels, its sales in the consumer space, either direct or indirect, it should have robust growth in the medium term. We expect margin to improve as its cost curve to come down over time with the several cost reduction initiatives planned for ’24.

Certainly, winning the litigation against Apple gave investors a lot of excitements about Masimo lately, but the bullish view point we derived is not entirely based on that at all. The company does not need to price in other watch sales to be interesting. It has a diverse offering due to the many applications its core technologies can be used in. Now it has the options to serve hospitals or consumers, caring facilities or homes, direct sales or original equipment manufacturers, the new chapter is really just the start. Its consumer products do not need to be as popular as Apple iWatch to be a success on its own. Wearables is still a vast new market that always has demand from precision-needed users. New investors might come to Masimo due to the recent hype, but could gain the impression of its solid core revenue and technologies when pondering whether to invest.

Financial Overview & Valuation

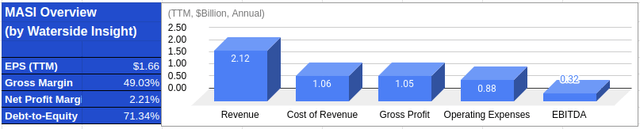

Masimo: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

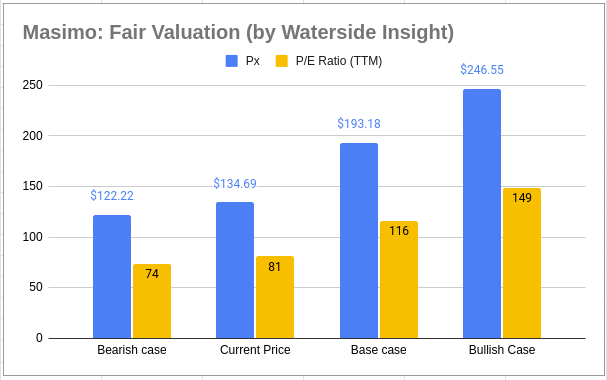

We use our proprietary models to assess Masimo’s fair value based on our analysis above. We use a cost of equity of 6.91% and a WACC of 7.65%. In the bullish case, the company was able to crash down the cost curve over the next 18 months while consumer spending picks up, it was priced at $246. In the base case, the macro recovery became delay, and it takes longer for the cost of revenue to come down in the near term, it was priced at 193.18. In the bearish case, the overall success in the non-healthcare segment continued being pushed out to five years from now due to either macro headwind or slow adaption by the consumers, and the long-term growth remain unimpressive, it was priced at $122.22. The current market price is only a tad higher than the bearish case.

Its new adventure in consumer products will have to be a total flop for its valuation to drop below our bearish case, which, we think, is unlikely. Not only its technological advancement is built on an incremental pace, which made its growth steady and solid, but also a lot of Masimo’s technologies-built-in chips are already at the core for other original product makers. That is not something manufacturers take lightly or change overnight. On top of that, the past three years’ growth of the Non-Healthcare segment has shown it to be steady and solid. All it needs to do is continue this trajectory while cutting down costs.

Masimo: Fair Value (Calculated and Charted by Waterside Insight with data from company)

For the upcoming earnings release, the consensus is $0.88 for EPS and revenue to be $544.809 million. The consumer spending in the holidays seasons and the strong momentum of ORi will show through better revenue while the trend of cost-cutting continues. We expect its revenue to be better than expected, in the range of $564 to $617 million for the last quarter of ’23, and the EPS to be around $0.90 to $0.93. The risks to our expectation will be a tepid revenue growth and sticky fixed costs as we look for more clues of its growth outlook in the release.

Conclusion

Masimo’s adventure into the consumer space has brought significant revenue increase, but also much higher cost associated with it. The high cost has impacted its net income, earnings, and free cash flow. On the other hand, its core products in Professional Healthcare space continue to have steady growth. We see the new adventure as a logical step for the company to take advantage of its strong core products both in financial position and in technological aspects. It might take time to bring down the cost curve, but as long as its core segment is doing well, the consumer products should have at least reasonable success based on its quality and the flexible sales options. The current market price is on the bearish side, which is not what we are counting on. We recommend a buy at or below current price.