KangeStudio

Earnings of Amalgamated Financial Corp. (NASDAQ:AMAL) will likely increase this year on the back of loan growth and slight margin expansion. I’m expecting the company to report earnings of $3.11 per share, up 8.9% year-over-year. The year-end target price suggests a moderate upside from the current market price. As a result, I’m maintaining a buy rating on Amalgamated Financial stock.

Loan Growth to Continue to Support Earnings

Loan growth decelerated in the last quarter of 2023. Nevertheless, Amalgamated Financial was able to report healthy full-year loan growth of 7%, which exceeded my expectations given in my last report on the company.

As mentioned in the earnings presentation, the management expects the balance sheet size to remain stable in the first half and then increase by around 3% in the second half of the year. During the conference call, the management seemed to be optimistic about its focus on social responsibility in banking, especially community solar projects. The management said, “. . . the market for climate risk alone is significant with an estimated $3 trillion of investment needed over the next 10 years in order for the US to achieve a goal of net zero emissions by 2050.”

In my opinion, the management’s target is easily achievable because historically Amalgamated Financial has achieved a higher rate of growth. The loan portfolio’s compounded annual growth rate stood at 6.2% for the last four years.

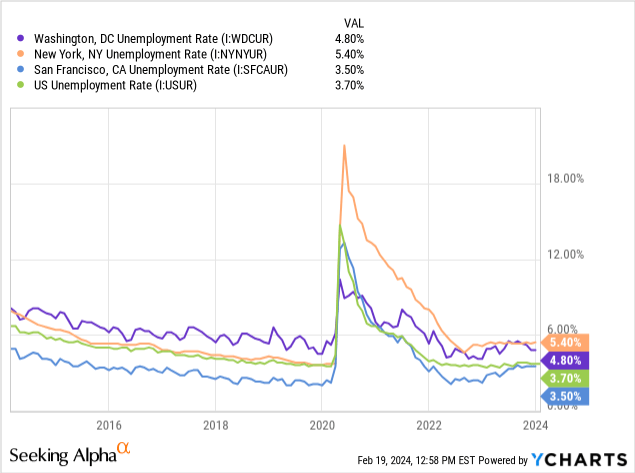

Further, the regional economy seems healthy enough to sustain loan growth. Amalgamated Financial lends nationally but it primarily focuses on Washington D.C., New York City, and San Francisco. Both San Francisco and Washington D.C. are currently doing quite well compared to their respective histories. Meanwhile, New York is lagging.

Considering these factors, I’m expecting the loan portfolio to grow by 5% in 2024. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net Loans | 3,439 | 3,447 | 3,276 | 4,061 | 4,346 | 4,567 |

| Growth of Net Loans | NA | 0.2% | (5.0)% | 23.9% | 7.0% | 5.1% |

| Other Earning Assets | 1,635 | 2,088 | 3,289 | 3,420 | 3,269 | 3,335 |

| Deposits | 4,641 | 5,339 | 6,356 | 6,595 | 7,012 | 7,442 |

| Borrowings and Sub-Debt | 137 | 53 | 132 | 698 | 305 | 317 |

| Common equity | 491 | 536 | 564 | 509 | 585 | 739 |

| Book Value Per Share ($) | 15.2 | 17.2 | 17.9 | 16.3 | 19.0 | 24.0 |

| Tangible BVPS ($) | 14.6 | 16.6 | 17.4 | 15.8 | 18.5 | 23.5 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Balance Sheet Changes to Keep the Margin Trending Upwards

After declining by 27 basis points in the first nine months, the net interest margin improved by 15 basis points in the last quarter of 2023. Overall, the margin shrank by twelve basis points in 2023, which was worse than my expectation given in my last report on the company.

I’m expecting the Fed funds rate to decline by 50-75 basis points in 2024. This interest rate outlook is unfavorable for the net interest margin because of the combination of the following two factors.

- Sticky Deposit Costs. The management stated in the presentation that its core deposits are highly sticky. Additionally, these core deposits make up around 52% of total deposits. As a result, the deposit cost can be expected to not be too responsive to the anticipated interest rate cuts this year.

- Re-Pricing Down of Some Assets. Around 30% of the total securities portfolio has a floating rate of interest, as mentioned in the presentation. Therefore, the yields on these securities will decline soon after every rate cut. Moreover, around $375 million of loans, representing 8.5% of total loans, are going to mature and need repricing this year, as mentioned in the conference call.

Nevertheless, I’m optimistic about margin expansion in 2024 because of the following two reasons.

- Management’s Planned Changes. The management mentioned in the conference call that it expects to see asset yields continue to grow as it turns over the balance sheet.

- Maturity of High-Cost Borrowings. The management mentioned in the conference call, “A key advantage for us in 2024 will be maturing of more than $300 million of higher-cost borrowings that can be replaced with lower-cost deposits.” According to my calculations, if the replaced deposits carry a cost that is 100 basis points lower than the cost of the outgoing borrowings, then the average funding cost for Amalgamated Financial could decline by four basis points.

Overall, I’m expecting, the net interest margin to grow by eight basis points in 2024.

Earnings to Continue on an Uptrend

The company reported earnings of $2.86 per share for 2023, up 9.4% year-over-year, which was close to my previous expectations. Earnings of Amalgamated Financial will most probably continue to increase this year because of both loan growth and margin expansion. I’m expecting the company to report earnings of $3.11 per share for 2024, up 8.9% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net interest income | 167 | 180 | 174 | 240 | 261 | 277 |

| Provision for loan losses | 4 | 25 | (0) | 15 | 15 | 16 |

| Non-interest income | 29 | 41 | 28 | 24 | 29 | 30 |

| Non-interest expense | 128 | 134 | 132 | 141 | 151 | 163 |

| Net income – Common Sh. | 47 | 46 | 53 | 81 | 88 | 96 |

| EPS – Diluted ($) | 1.47 | 1.48 | 1.68 | 2.61 | 2.86 | 3.11 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Risks Stem from the Deposit Book

The deposit book is the only major source of risk for Amalgamated Financial. Uninsured deposits amounted to $3.76 billion at the end of September 2023, representing 54% of total deposits (this figure hasn’t been updated for December 2023 as of the writing of this article).

Apart from the deposit book, the company’s risk level is low. Firstly, the valuation loss on the Available-for-Sale securities portfolio stood at $102.3 million at the end of December 2023, which is a sizable 17% of the total equity book value. Nevertheless, I’m not worried because interest rates are likely to decline this year, which should reverse the valuation loss. Moreover, office commercial real estate made up only around 2.1% of total loans, according to details given in the presentation.

Overall, I believe Amalgamated Financial’s risk level is low to moderate.

Maintaining a Buy Rating

Amalgamated Financial is offering a dividend yield of 1.7% at the current quarterly dividend rate of $0.10 per share. The earnings and dividend estimates suggest a payout ratio of 12.9% for 2024, which is below the five-year average of 17%. Therefore, there is a chance of a dividend hike this year. Nevertheless, to be on the safe side, I’m assuming no change in the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Amalgamated Financial. The stock has traded at an average P/TB ratio of 1.05 in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | FY23 | Average | |

| T. Book Value per Share ($) | 14.6 | 16.6 | 17.4 | 15.8 | 18.5 | |

| Average Market Price ($) | 17.4 | 12.7 | 16.3 | 20.8 | 19.2 | |

| Historical P/TB | 1.19x | 0.77x | 0.94x | 1.32x | 1.04x | 1.05x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $23.5 gives a target price of $24.7 for the end of 2024. This price target implies a 2.8% upside from the February 16 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.85x | 0.95x | 1.05x | 1.15x | 1.25x |

| TBVPS – Dec 2024 ($) | 23.5 | 23.5 | 23.5 | 23.5 | 23.5 |

| Target Price ($) | 20.0 | 22.3 | 24.7 | 27.0 | 29.4 |

| Market Price ($) | 24.0 | 24.0 | 24.0 | 24.0 | 24.0 |

| Upside/(Downside) | (16.8)% | (7.0)% | 2.8% | 12.6% | 22.4% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 9.0x in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | FY23 | Average | |

| Earnings per Share ($) | 1.47 | 1.48 | 1.68 | 2.61 | 2.86 | |

| Average Market Price ($) | 17.4 | 12.7 | 16.3 | 20.8 | 19.2 | |

| Historical P/E | 11.8x | 8.6x | 9.7x | 8.0x | 6.7x | 9.0x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.11 gives a target price of $27.9 for the end of 2024. This price target implies a 16.3% upside from the February 16 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.0x | 8.0x | 9.0x | 10.0x | 11.0x |

| EPS 2024 ($) | 3.11 | 3.11 | 3.11 | 3.11 | 3.11 |

| Target Price ($) | 21.7 | 24.8 | 27.9 | 31.0 | 34.1 |

| Market Price ($) | 24.0 | 24.0 | 24.0 | 24.0 | 24.0 |

| Upside/(Downside) | (9.6)% | 3.3% | 16.3% | 29.3% | 42.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $26.3, which implies a 9.6% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.2%.

In my last report on Amalgamated Financial, which was issued in April 2023, I adopted a buy rating with a December 2023 target price of $22.0, which implied a 26.6% price upside at that time. Since then, the stock price has rallied by 38.37%. My updated target price for December 2024 shows that there is still some upside left. Based on the total expected return, I’m maintaining a buy rating on Amalgamated Financial.