Vithun Khamsong/Moment via Getty Images

IDEX (NYSE:IEX) reported its Q4 FY23 results on February 6th. I previously highlighted the challenges in the Health & Science Technologies segment in my previous coverage, and the segment declined by 19% year-over-year in Q4. I maintain a ‘Buy’ rating with a fair price target of $197 per share.

Inventory Improvement and Weak HST Growth

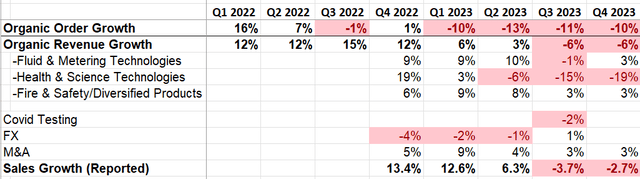

In Q4 FY23, they delivered -10% organic order growth and -6% organic revenue growth, facing significant headwinds from their Health & Science Technologies segment (HST), as illustrated in the table below. They maintain a robust balance sheet with a net debt leverage of 0.9x. Additionally, they generated $627 million of free cash flow, paid out $191 million in dividends, and repurchased $24 million of their own shares. Furthermore, $312 million has been deployed for acquisitions, reflecting a consistent capital allocation strategy as discussed in my previous coverage.

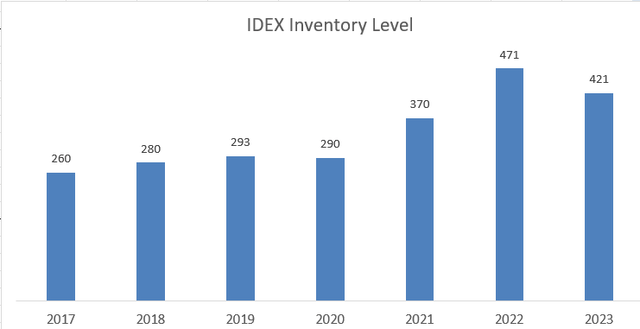

During the earnings call, my biggest takeaway was their inventory improvement. As depicted in the chart below, their inventory levels dropped from a peak of $471 million in FY22 to $421 million in FY23. Management anticipates a further 0.5% improvement in FY24, underscoring their ongoing efforts to streamline the excessive inventories amassed during the pandemic period. This inventory optimization is poised to enhance the company’s working capital and bolster its free cash flow in FY23. Amidst the broader industrial downturn, I find encouragement in the company’s proactive measures to reduce their working capital intensity and enhance their cash flow.

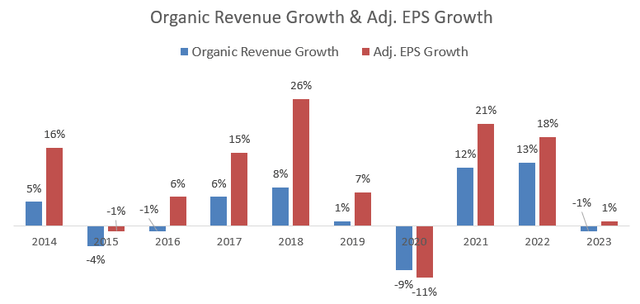

For the full year, their revenue declined by 1% organically, while the adjusted EPS improved by 1% year-over-year, as illustrated in the chart below.

There are several reasons why the company managed to achieve positive EPS growth during its down cycle. The primary factor is their strong pricing power over their customers. Even amidst the end-market downturn, they achieved a 4% pricing growth in Q4 FY23, with management anticipating an additional 2% growth from pricing in FY24. The company aims to maintain a price-to-cost spread in the range of 80-100 basis points, with the pricing increase expected to offset cost pressures and some volume declines effectively.

Furthermore, despite challenges in the weak HST business, the company has been aligning its cost structure to match volume growth. Management believes they have effectively controlled operational costs for HST amidst the end-market destocking activities, indicating a successful effort to balance costs with revenue in this segment.

FY24 Outlook

IDEX is guiding for 0%-2% organic revenue growth in FY24, with GAAP diluted EPS projected to be in the range of $7.15 to $7.45. Notably, they have not forecasted a positive inflection year in FY24. In the Fluid & Metering Technologies business, management lacks visibility into market recovery due to the short-cycle nature of the business, thus only anticipating low-single-digit revenue growth. Conversely, there is optimism for some end-market recovery in the HST business, particularly in the Analytical Instrumentation space. However, for the Fire & Safety/Diversified Products segment, management anticipates a slight decline in FY24 due to market weakness.

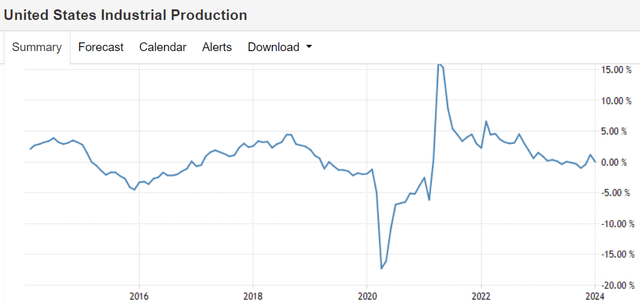

The overall industrial market has faced pressure in the post-pandemic era, as channels have overbuilt their inventory levels during the pandemic. Compounded by high interest rates, end-market demands in the industrial sector have remained weak. As depicted in the chart below, U.S. Industrial Production has regressed to pre-pandemic levels, with the overall market normalizing in the present day.

Given these factors, I anticipate IDEX will continue to face significant growth headwinds in FY24, albeit with some degree of end-market recovery. Assuming Fluid & Metering Technologies and HST experience growth of 2-3%, while Fire & Safety/Diversified Products decline by 2%, the overall organic revenue growth would likely hover around 1.1% in FY24. This projection falls within the guidance range provided by IDEX organically in FY24. Additionally, I anticipate that acquisitions could contribute around 3.3% to topline growth. In December, IDEX completed its previously-announced acquisition of STC Material Solutions for $260 million, enhancing its offerings as an integrated provider of advanced material science solutions. Management has indicated a robust M&A pipeline during the earnings call, supporting my estimate of 3.3% acquisition growth, assuming the company allocates around 10% of sales to tuck-in deals.

Valuation Update

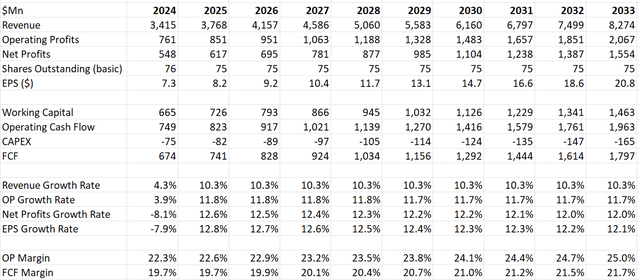

Regarding margins, pricing growth is expected to drive gross margin expansion, as analyzed previously. Another significant driver is operating leverage, with operating expenses estimated to grow by around 9.9% to support topline growth, including acquisitions. Consequently, the model assumes a 30bps margin improvement for IDEX.

With these parameters considered, the fair value is calculated to be $197 per share as per my estimate. Currently, the stock price is trading at 25 times forward free cash flow, representing a relatively inexpensive multiple for a company expected to achieve double-digit profit growth.

IDEX DCF – Author’s Calculation

Key Risks

The Agricultural business represents approximately 10% of the Fluid & Metering Technologies segment, translating to mid-single-digit revenue within the group. During the earnings call, management expressed ongoing challenges as OEMs grapple with end-market destocking and declining net farm income and crop prices.

In Q1 FY24, Deere (DE), the primary manufacturer of agricultural equipment, reiterated their expectation for a 10% to 15% decline in large ag equipment industry sales in the U.S. and Canada. Consequently, Fluid & Metering Technologies is expected to encounter subdued growth in its agricultural business throughout FY24.

Conclusion

It is highly probable that IDEX will experience another year of weak growth in FY24, albeit with a moderate recovery in the end market. Given that the majority of IDEX’s businesses are short-cycle in nature, any recovery is expected to be swift. Despite these challenges, I maintain a ‘Buy’ rating with a fair price target of $197 per share.