Dividend-paying stocks can form an important part of an investment portfolio, helping to provide passive income as well as an additional layer of diversification. Even better is a stock with a long track record of paying dividends.

Enter Realty Income (O 0.27%), a real estate investment trust (REIT). As a REIT, Realty Income is required to pay out at least 90% of taxable income to investors each year. While there are many companies that pay a dividend, Realty Income has some unique features that set it apart from the competition.

For starters, the company pays a monthly dividend as opposed to offering it on a quarterly cadence. While this may not seem like a big deal on the surface, Realty Income’s consistent dividend increases are what really differentiates the company. Since going public in 1994, Realty Income has increased its dividend 123 times. It’s no wonder the company refers to itself as The Monthly Dividend Company!

Let’s dig into Realty Income’s business and understand why the company could be a good buy right now.

What does Realty Income do?

There are many different types of REITs. Realty Income is a retail REIT — meaning the company acts as a landlord for stores and other brick-and-mortar destinations. Many of the company’s tenants are cost-conscious retailers, including Walgreens, Dollar General, and Dollar Tree. The company also leases property to gyms, big-box retailers such as Walmart, and pharmacies like CVS Health.

The company also recently bolstered its presence through the acquisition of Spirit Realty.

Image source: Getty Images.

How is the company performing?

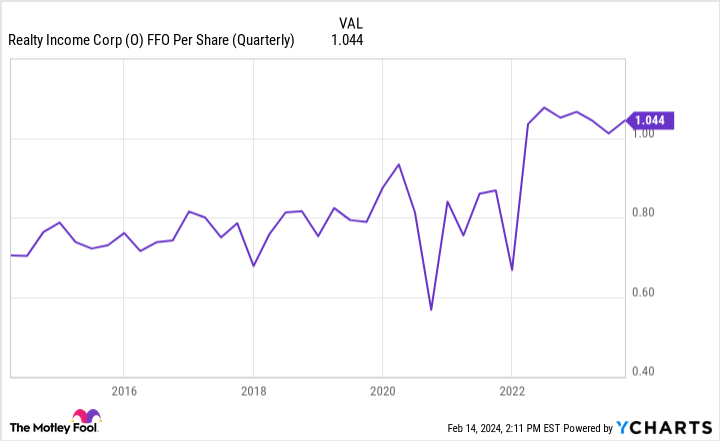

Two important metrics to look at when analyzing REITs are occupancy rate and funds from operations (FFO). Realty Income’s current occupancy rate is 98.8% — higher than its long-run historical average over the last two decades.

O FFO Per Share (Quarterly) data by YCharts.

Given the company’s impressive occupancy rate, it’s not surprising to see the upward momentum in FFO. The chart above clearly illustrates the company’s ability to generate higher FFO over a long-term horizon. It’s this dynamic that helps Realty Income continue raising its dividend and rewarding long-term shareholders.

Is now a good time to invest in Realty Income?

Some investors may be wary of investing in Realty Income given the stock’s 23% decline over the past year. While the stock has underperformed the broader market recently, there are some important things to keep in mind.

First, while the acquisition of Spirit Realty presents some interesting synergies and broadens Realty Income’s reach, the deal was an all-stock transaction. Dilution is a legitimate concern, but I see this as largely short-sighted.

I think the bigger question surrounding Realty Income is the health of the overall business. The macro economy has been plagued with lingering inflation and high borrowing costs for well over a year. As such, consumers are scaling back purchases, which could be detrimental to the retail space.

However, as I pointed out above, many of Realty Income’s tenants are actually cost-conscious stores. In other words, Realty Income may actually be somewhat insulated from an economic slowdown, should one occur.

Right now, Realty Income stock trades at a price-to-book (P/B) multiple of just 1.2 — far below its 10-year average of 2.0.

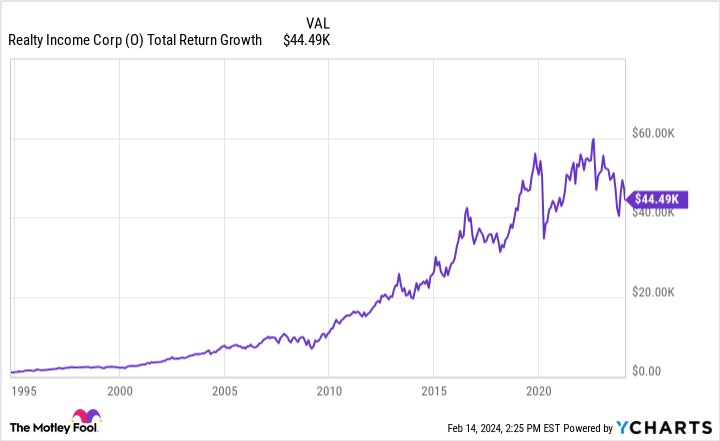

O Total Return Level data by YCharts.

I see concerns over the economy, as well as the integration of Spirit Realty, as largely overblown. The chart above illustrates that an investment of just $1,000 at Realty Income’s initial public offering (IPO) would now be worth nearly $45,000 on a total return basis. Not only does this highlight the power of reinvesting dividends, but it also demonstrates the resiliency of Realty Income’s business.

There have been other financial crises over the last few decades — perhaps most notably the Great Recession in 2008 and 2009. Nevertheless, Realty Income has navigated these challenges, and the trend above demonstrates that long-term investors have largely been rewarded.

The long-term picture makes one thing abundantly clear: Realty Income stock has proven to be a generous investment in the long run. With more growth opportunities on the horizon, I think the company will continue generating the financial flexibility needed to raise its dividend.

For investors looking to supplement their portfolio with some passive income, Realty Income’s monthly dividend could be a unique option to add another paycheck each month. With the stock trading at a steep discount to historical levels, now could be a good opportunity to use dollar-cost averaging to scoop up some shares.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Realty Income and Walmart. The Motley Fool recommends CVS Health. The Motley Fool has a disclosure policy.