Prominent growth investor Cathie Wood is rebalancing her largest and most familiar growth-stock fund. The Ark Innovation ETF (ARKK -4.32%) exchange-traded fund has sold millions of shares in Coinbase Global (COIN -8.06%), Zoom Video Communications (ZM -1.61%), and Twilio (TWLO -3.24%) in recent weeks.

These are some of Cathie Wood’s best-loved investments, and she often praises them in recent interviews. So why is she dumping these choice holdings by the boatload?

I don’t have a direct line to Wood’s fund management office, but let’s try to figure out why she’s leaning away from these particular stocks in February 2024.

What’s the Ark Innovation ETF all about?

The Ark Invest firm’s flagship fund seeks companies engaged in “disruptive innovation,” with the potential to change the world through groundbreaking products and services. The three stocks under my microscope still fit this description to a T.

- Coinbase is one of the world’s largest, oldest, and most trusted cryptocurrency trading services.

- Zoom Video became a household name in the lockdown phase of the coronavirus pandemic, but its user-friendly digital video conferencing solutions seemed destined for game-changing growth long before that unique event.

- Twilio provides custom cloud-based communication tools, allowing other companies to build the right audio and video tools into their core business apps.

Coinbase: Just a light trim

As of the President’s Day weekend, Ark Innovation ETF had sold 370,000 Coinbase shares in February. That’s a 7% trim, part of a larger 32% reduction since early December.

I don’t have to guess why Wood is making these moves — her funds are simply cashing in some profits after a “magnificent” bull run over the last few months.

“This is simple portfolio management,” she said in a video interview with Yahoo Finance on Friday. “It’s simply trimming and profit-taking, and really nothing more than that.”

Coinbase’s stock is indeed trading roughly 275% above last summer’s 52-week lows. Cathie Wood is just redistributing some of the fund’s gains into other high-growth investment ideas with lower stock prices and valuation ratios. She still believes in rapidly rising Bitcoin (BTC -0.05%) prices, hinged around the so-called “halving” event in late April, and argues that Coinbase’s commitment to regulatory compliance gives it a leg up on the crypto-trading competition.

In other words, Cathie Wood is a big fan of Coinbase even though she’s trimming her funds’ investments in this skyrocketing stock. This is still the largest holding in the Ark Innovation ETF portfolio, accounting for 9.6% of the fund’s overall holdings.

Zoom Video: Not the best investment in this market

Moving along, Zoom Video tells a very different story.

Wood isn’t sharing her rationale for her Zoom sales in public, so I’ll have to figure out what’s going on by other means. The fund has sold 2 million Zoom Video shares in February in a pretty sharp policy shift. This 25% sell-off was not a reaction to soaring share prices. Cathie Wood largely stopped buying Zoom Video shares in October 2022. The stock was down by 8% from there to early February, and that’s where the heavy selling started.

Wood isn’t throwing Zoom Video under the bus with bearish statements, but her trading actions speak louder than words. She clearly sees more long-term value in other growth stocks right now, to the point where it makes sense to take a modest loss on the Zoom Video investment and try again with a new idea.

This stock is modestly priced for a former market darling, but its sales growth has stalled as the multi-year contracts that drove its growth engines in the COVID-19 lockdowns started to expire. Zoom Video needs to reload its rocket engines with new fuel, since the video conferencing of yesteryear looks less effective in 2024.

So I take these sales as a sign of frustration with Zoom Video’s deferred growth dreams. If she goes back to building Ark’s Zoom Video stake again, I’ll certainly raise a curious eyebrow and take a closer look. For now, Zoom Video remains one of the Ark Innovation ETF’s 10 largest investments with a 4.8% portion of its total stock holdings.

Twilio: Unsteady progress under brand-new management

Dashing my hopes of finding a clear pattern in Wood’s recent trades, Twilio looks like a hybrid of her Coinbase and Zoom Video sales.

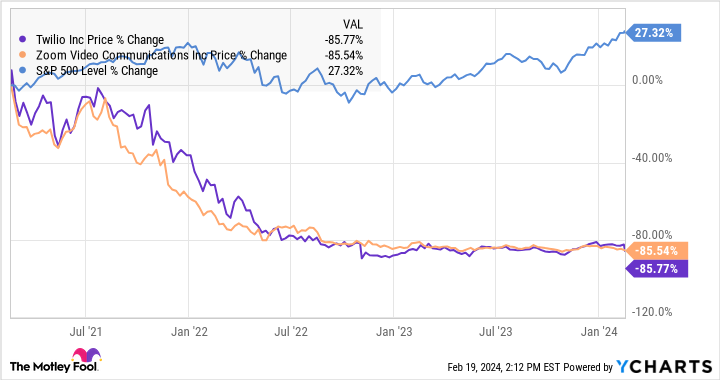

When Ark Innovation ETF’s rapid Twilio sales started in the last week of January, the stock had gained roughly 50% from last summer’s annual lows. On a longer time scale, however, Twilio’s chart looks like a Zoom Video twin at a nearly identical 86% price drop over the last three years:

Cathie Wood was quite excited about Twilio at the start of 2024, telling CNBC reporters that the stock looked undervalued in light of Twilio’s massive collection of priceless data. But the company runs under new management and Wood seems unimpressed by this former favorite so far. Her stake in the stock has decreased by 38% in February and Twilio accounts for just 2.1% of Ark Innovation ETF’s stock holdings now.

So the Ark Innovation ETF’s largest and most lucrative sales in February were just some prudent profit-taking moves, while the smaller moves seem to reflect disappointment with two underperforming growth stocks. You can’t win them all, but Cathie Wood is keeping a significant interest in all three stocks anyhow.

Anders Bylund has positions in Bitcoin, Coinbase Global, and Twilio. The Motley Fool has positions in and recommends Bitcoin, Coinbase Global, Twilio, and Zoom Video Communications. The Motley Fool has a disclosure policy.