marcoisler/RooM via Getty Images

Introduction

Generally speaking, I’m very happy with the way things are going. The dividend stocks I own are all doing well, and while economic growth is far from favorable (especially in cyclical industries), I am not expecting any dividend cuts or highly unfavorable financial developments.

Unfortunately, that does not apply to all investments in my trading portfolio, which is different from the aforementioned dividend portfolio, as my dividend portfolio holds the majority of my net worth (>90%).

One of the stocks in my trading account is Antero Resources (NYSE:AR), one of America’s largest natural gas producers and the largest shareholder and partner of Antero Midstream (AM), which has become my largest high-yield investment, as discussed in this article.

While I love Antero Resources, the reason it’s not a part of my dividend portfolio isn’t just the fact that it doesn’t pay a dividend but the volatile nature of natural gas.

As much as I like following natural gas, it may be the most volatile commodity on my radar, as it’s so prone to demand headlines, including weather changes, economic growth, and geopolitical developments.

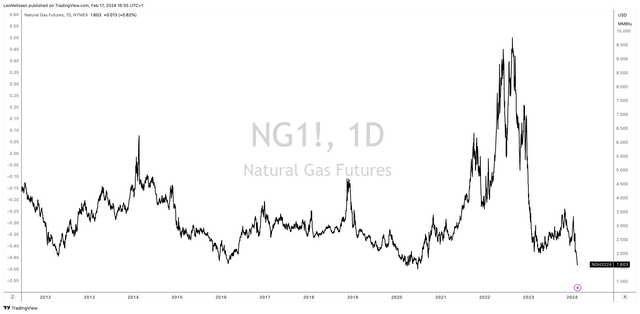

Right now, the front month of the NYMEX Henry Hub natural gas future is trading at roughly $1.60 per MMBtu, the lowest number since the bottom of the pandemic and even below the 2016 lows.

TradingView (NYMEX Henry Hub Futures)

In fact, as we can see below, the entire curve through October 2024 is trading below $2.40, which is, needless to say, bad news for producers.

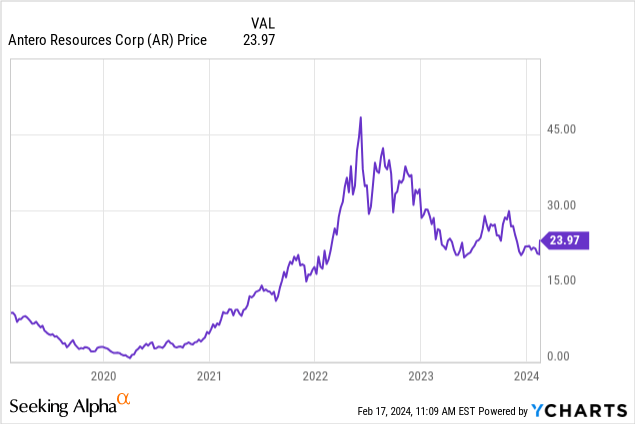

My most recent article on Antero Resources was written on November 5, when I went with the title “Antero Resources: Up 40% Since June With Much More Room To Run.”

While I have done well with most prior articles, AR shares are down 20% since then, lagging the S&P 500 by roughly 35 points.

Generally speaking, I have observed a few trends that explain why natural gas and the share prices of its producers are doing so poorly, and I believe we’re seeing both (temporary) supply and demand headwinds.

Supply:

- High inventory levels: Abundant natural gas in storage, particularly in Europe due to a mild winter last year, has reduced the urgency for buyers to purchase additional supplies, putting downward pressure on prices.

- Increased production: The U.S., the nation with the world’s strongest natural gas production growth rates, has seen a steady rise in production, further contributing to the supply glut.

- Lower LNG exports: With high (global) inventory levels and milder weather, demand for Liquefied Natural Gas (“LNG”) imports has softened, leading to decreased competition for global supplies.

Demand:

- Mild weather: A warmer-than-usual winter in both Europe and North America has reduced demand for natural gas for heating, impacting consumption. This reason overlaps the high inventory headwind in the supply segment.

- Economic slowdown: Weakening economic activity in major consuming regions like China and Europe has lowered industrial demand for natural gas.

With that in mind, in this article, I’m updating my bull case, using Antero Resources’ most recent quarterly numbers, its view on demand, and long-term natural gas developments.

So, let’s get to it!

Looking Beyond Current Weakness

Especially in light of current natural gas pricing struggles, I’m happy that I have bet on AR.

Although my position is suffering at the moment, I picked AR for a reason: it’s very efficient.

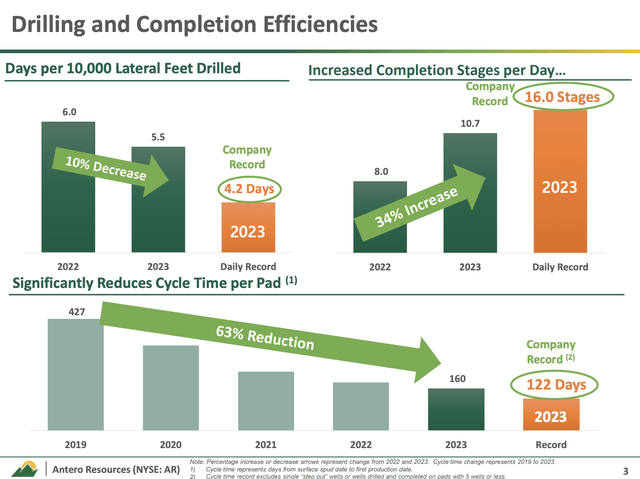

For example, through 2023, Antero made significant improvements in its drilling and completion efficiencies, marking a transformative year for the company’s entire operational performance.

Notably, the days per 10,000 feet of lateral drilled decreased by 14% since 2019, showing a notable improvement in drilling speed.

Moreover, the completion stages per day saw a remarkable 35% increase compared to the previous year and an impressive 80% surge from 2019 levels.

According to Antero, these achievements set both company and industry records, demonstrating its commitment to enhancing operational efficiency in its exploration and production activities.

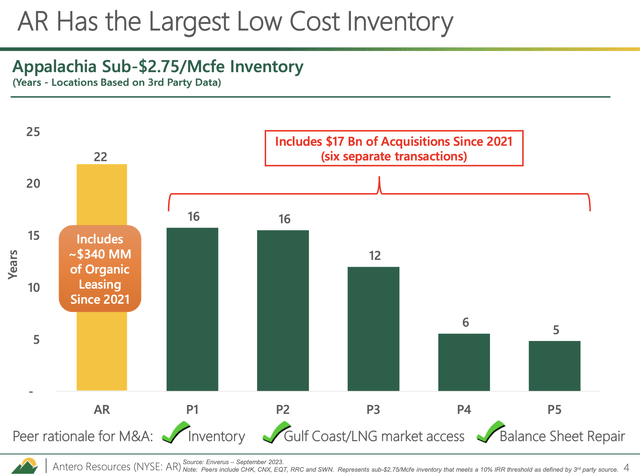

The company is also one of the leaders when it comes to benefitting from low-cost reserves, as it has more than 20 years’ worth of inventory breakeven below $2.75 per Mcfe.

This allows the company to produce gas when others are forced to cut production and benefit from elevated free cash flow once natural gas prices rebound.

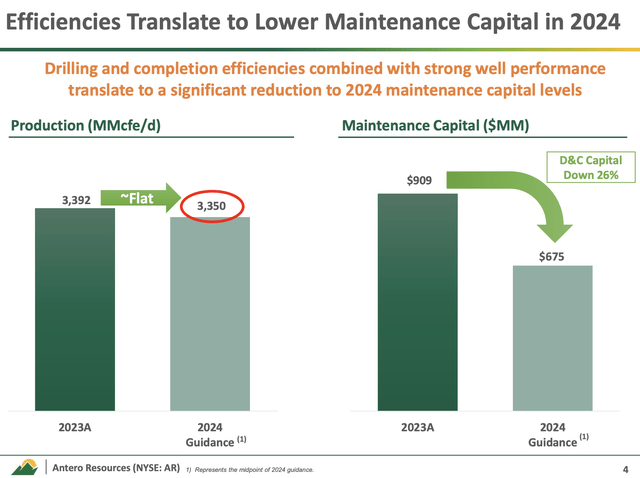

With this in mind, looking ahead to 2024, Antero anticipates a substantial reduction in maintenance capital expenditure, reflecting the operational efficiencies gained in 2023.

The company expects a maintenance capital budget midpoint of $675 million, representing a significant decrease from the $909 million spent in 2023.

Essentially, operational efficiency gains allowed Antero to optimize its resource allocation, resulting in the reduction of one drilling rig and one completion crew.

As a result, Antero plans to average two drilling rigs and just over one completion crew for its maintenance capital program in 2024, further enhancing capital efficiency.

The best thing is that despite lower maintenance spending, the company expects to maintain flat production levels averaging between 3.3 and 3.4 Bcf equivalent per day, which is also displayed in the overview above.

With that in mind, after reporting its earnings, Antero’s stock price soared by more than 10%, as the company noted that despite the challenging natural gas price environment, it anticipates generating positive free cash flow during 2024, supported by significant capital savings and an increase in NGL (natural gas liquids) prices.

Bear in mind that Antero Resources isn’t just a “random” natural gas producer.

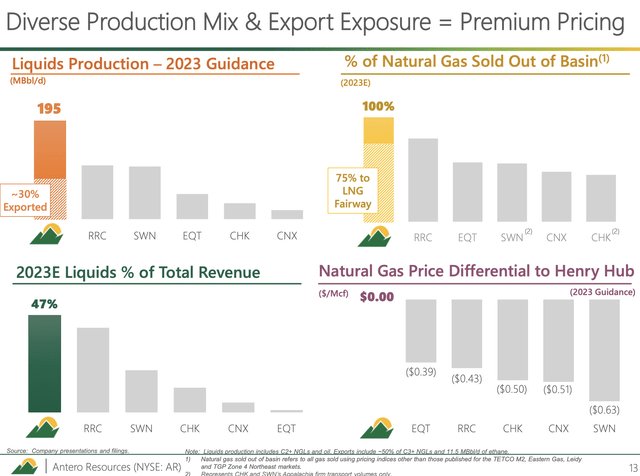

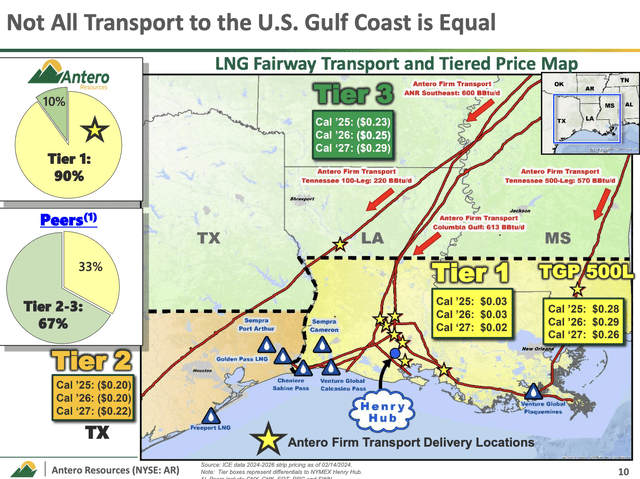

- 100% of its natural gas is sold out of the basin, with 75% of its natural gas entering the LNG Fairway. This has pricing benefits.

- Roughly half of the company’s production is natural gas liquids, which have higher margins than natural gas.

- 30% of its liquids are exported, which opens up new opportunities and more pricing benefits.

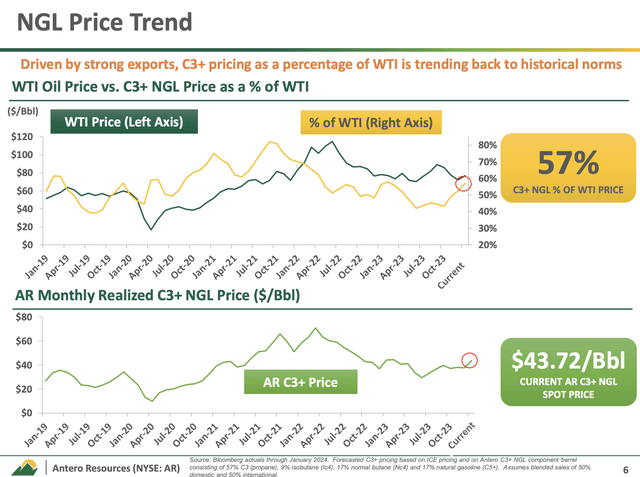

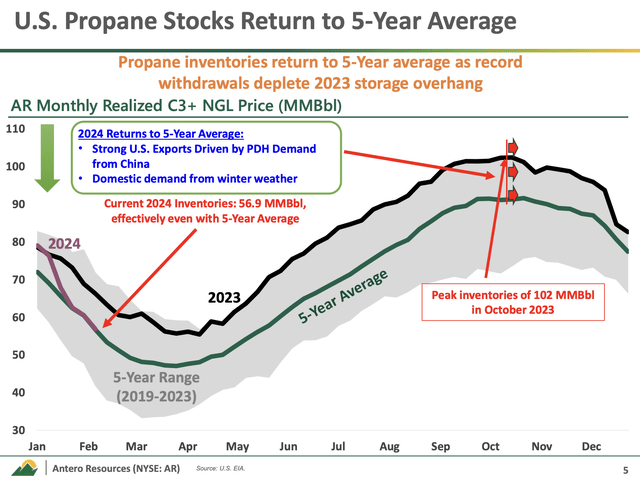

Based on this context, despite natural gas pricing pressure, the company noted significant improvement in the NGL market during the winter period due to robust domestic demand and consistently high export levels.

Propane inventories have decreased notably since October, shifting to average levels and tightening the market.

This reduction has led to bullish sentiment, with propane prices rising above $0.90 a gallon, driven by strong exports and winter weather conditions.

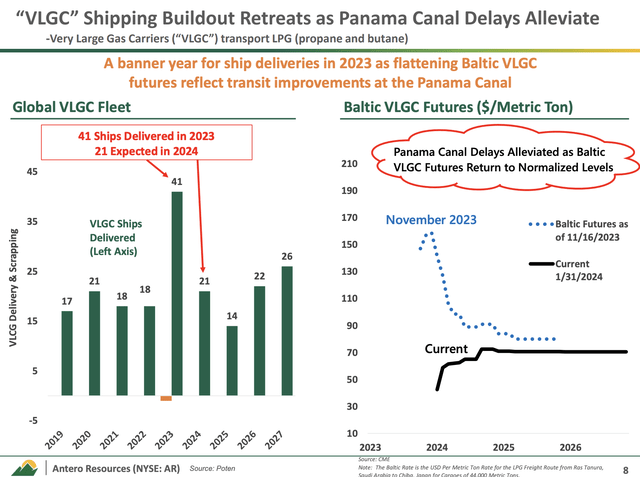

During its earnings call, the company also commented on disruptions in global shipping markets, noting that despite these challenges, there has been a reversal in the trend of increased shipping costs for liquefied petroleum gas (“LPG”) due to Panama Canal restrictions easing.

Additionally, there is an emphasis on a significant increase in VLGC (very large gas carriers) newbuild deliveries, with expectations of continued growth in 2024, aligned with the growth in U.S. LPG export demand and challenges facing global shipping.

This matters to the company as propane and butane exports account for more than 50% of its C3+ production.

In the oil and gas industry, C3+ refers to a fraction of hydrocarbons containing three or more carbon atoms. This fraction includes propane, butane, pentanes, and heavier hydrocarbons.

It’s often separated from natural gas, which primarily consists of methane (CH4) and ethane (C2H6).

Because of favorable shipping rates and the company’s ability to sell these products on international markets, it is witnessing an increasingly favorable spread between domestic and international pricing.

In other words, one of the reasons why AR shares are still way above 2020 levels despite low natural gas prices is the fact that oil and C3+ pricing is still very favorable.

After all, WTI crude oil is trading in the mid-$70 range.

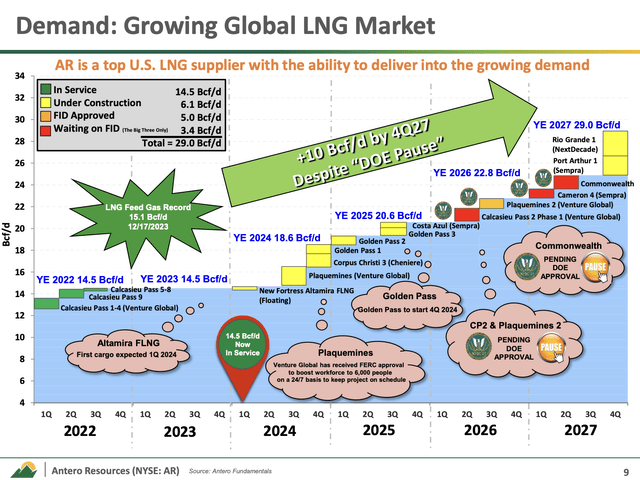

Furthermore, looking beyond current natural gas price weakness and a temporary pause on new LNG (liquid natural gas) facility approvals from the U.S. government, the company expects minimal impact on LNG demand growth into the end of the decade.

In fact, the company anticipates significant demand growth for LNG, which would tie U.S. natural gas prices more closely to higher international prices.

Hence, as I already mentioned, LNG is very bullish for LNG.

Not only will higher LNG production allow U.S. Henry Hub prices to move closer to international prices, but the company currently sells a lot of its gas to the LNG corridor – especially to Tier 1 markets.

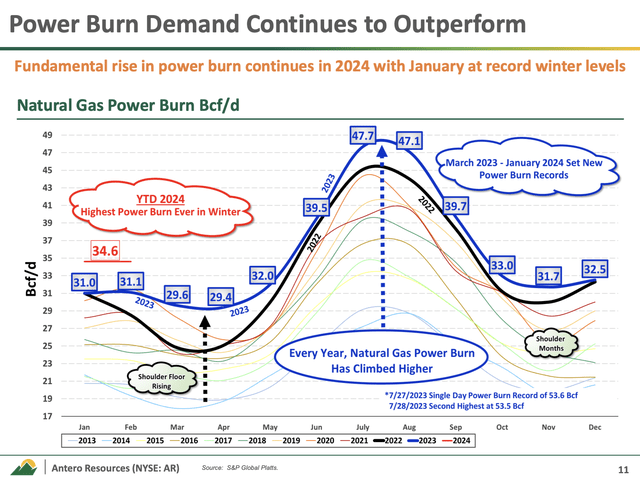

Adding to that, the company is witnessing another major trend, as it sees a structural shift towards reliable, clean, and affordable natural gas, leading to increasing natural gas power generation demand.

Despite forecasts projecting flat or lower power burn demand, 2024 demand is exceeding expectations, driven by coal-to-gas switching and higher electrification demand.

So, what does this mean for shareholders?

Valuation

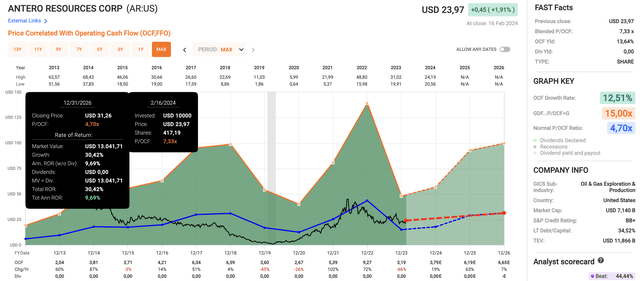

Antero Resources is trading at a blended P/OCF (operating cash flow) ratio of 7.33x. This is well above its long-term normalized ratio of 4.7x.

The reason for that is the 66% OCF decline in 2023.

However, using the data in the chart below, the company is expected to grow its OCF by 19% in 2024, potentially followed by 63% growth in 2025 and 7% growth in 2026.

If the company were to maintain a 4.7x long-term OCF multiple, it has a current fair price of $31.30, which is roughly 30% above the current price.

Needless to say, these numbers are highly dependent on NGL and natural gas prices, which is why I expect OCF growth expectations to rise significantly once fossil fuel prices gain upside momentum.

It’s also the reason why I haven’t sold AR.

I believe the company is in a fantastic spot to deliver long-term gains, as it has a very efficient business model, export opportunities, LNG pricing benefits, limited Henry Hub exposure, and a very attractive valuation.

However, please note that my AR position is small compared to long-term investments in Antero Midstream and other dividend-focused energy plays.

AR is extremely volatile, and it should not be bought by investors who mainly invest in dividend stocks and anyone using a low-volatility strategy.

So, please be aware of the risks that come with natural gas stocks!

Takeaway

Despite recent challenges in the natural gas market, my investment in Antero Resources remains grounded in its efficiency and strategic positioning.

Despite the current price weakness, the company’s operational improvements and favorable long-term outlook offer the potential for significant gains.

With a focus on maintaining flat production levels while optimizing costs, Antero anticipates positive free cash flow in the face of market pressures.

While volatility is inherent in natural gas investments, Antero’s strengths in operational efficiency, export opportunities, and favorable pricing dynamics present a compelling case for long-term investors willing to weather short-term fluctuations.

Pros & Cons

Pros:

- Efficiency: Antero Resources demonstrated impressive operational efficiency, as evidenced by its improvements in drilling and completion efficiencies, setting industry records.

- Cost advantage: With over 20 years’ worth of low-cost reserves, AR can sustain production even during periods of low natural gas prices, positioning it to benefit from future rebounds.

- Positive outlook: Despite current market challenges, Antero anticipates generating positive free cash flow, supported by capital savings and favorable pricing dynamics in LNG and NGL markets.

Cons:

- Volatility: AR’s stock price can be highly volatile due to fluctuations in natural gas prices, making it unsuitable for investors seeking stability or those with low-risk tolerance.

- Uncertain regulatory environment: Changes in government policies or regulations affecting natural gas production, export, or environmental standards could impact AR’s operations and financial performance.