Bloomberg/Bloomberg via Getty Images

In this article, I analyze B&M European Value Retail S.A. (OTCPK:BMRRY), a company that operates in the discount store industry and which, in my opinion, offers very interesting prospects in a sector that has grown significantly in recent years. In particular, I believe that B&M is an excellent investment at the moment thanks to 3 factors: macroeconomic factors are pushing Revenue and margins, the company has excellent growth capabilities and the valuation places B&M in the “value opportunity” category.

1. Adverse economic factors are driving B&M’s growth

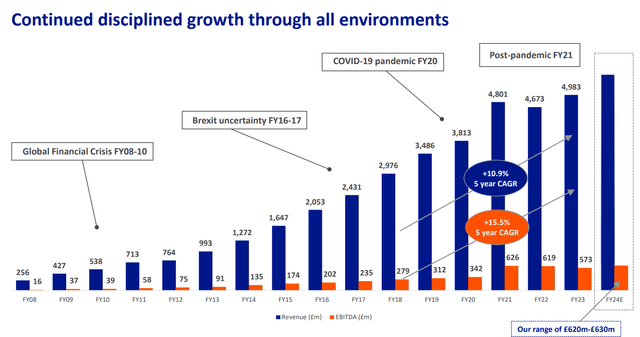

Contrary to what one might think, adverse macroeconomic conditions are favoring B&M which, unlike many traditional stores, has increased its margins and profits. Looking at the data, it can be seen how the company has been growing continuously for years, with a CAGR of +10.9% in the last 5 years (in my opinion, an impressive number). The other thing that amazes me is the EBITDA CAGR of +15.5%: this indicates that the company has not only grown but also improved efficiency over time.

By making a quick comparison with two competitors, such as Tesco and Sainsbury, you can notice a big difference in the main ratios: ROE of 43.42% versus 11.11% and 1.02% of the other two; looking instead at the Profit Margin, 6.80% versus 2.13% and 0.24% respectively.

The point I want to demonstrate is that, although Tesco PLC (OTCPK:TSCDF) and J Sainsbury plc (OTCQX:JSNSF) are very similar to B&M’s business (I chose to compare these two companies as they are both located in the UK and with similar consumer targets), the choice to operate in the Discount Stores industry is proving to be very profitable.

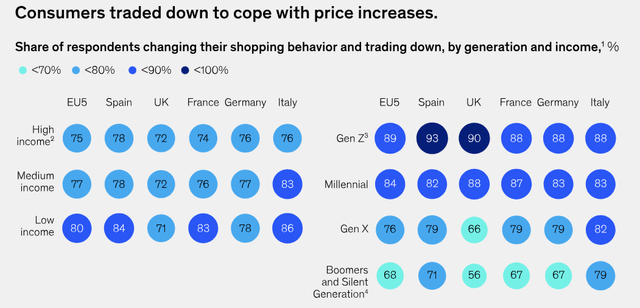

According to a recent study by McKinsey on European consumer sentiment, it is clear that the majority of consumers are trying to reduce their spending but maintain product quality.

Trading down remained prevalent. To cope with the pressure on household income, nearly eight out of 10 European consumers reported that they traded down.

Traditional trade-down behaviors include switching to less expensive products, shopping at cheaper retailers, or postponing purchases. Consumers across all income levels said they engaged in this behavior, and a higher rate of younger consumers reported trading down compared with older consumers.

(Source: McKinsey)

Consumers spending in EU (McKinsey)

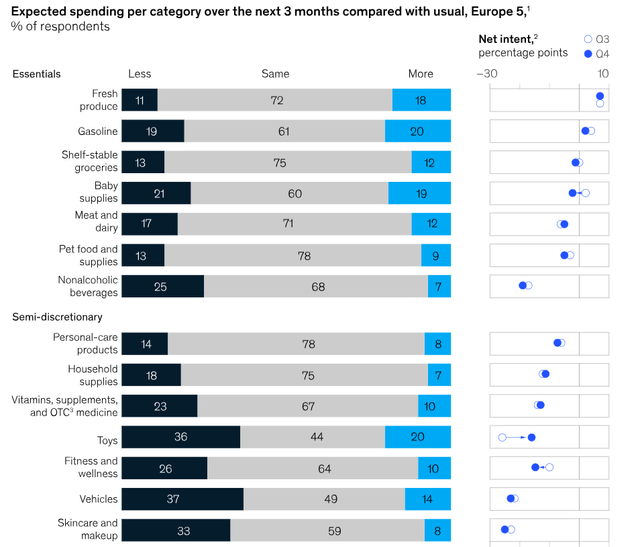

Another interesting graph regarding consumer spending behavior: in fact, the majority of consumers will not change their saving habits in the next quarter.

Consumer spending behavior EU (McKinsey)

In summary, by following consumer spending trends, B&M will attract more and more customers who intend to spend less, until the economic situation improves again.

2. France and Heron Foods will drive growth in the coming years

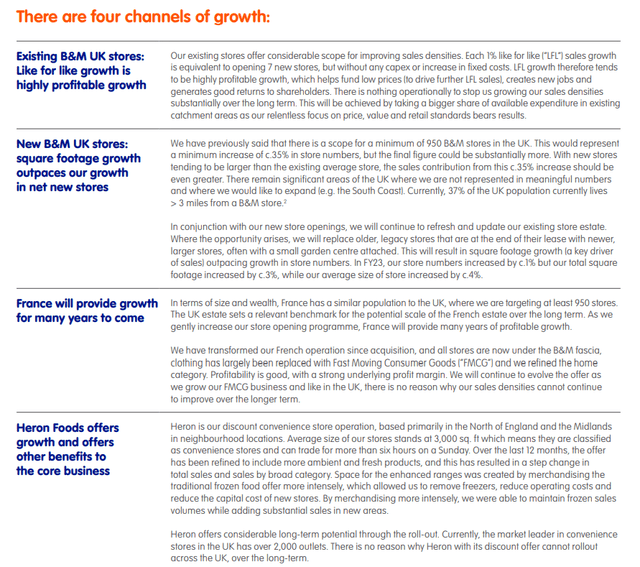

According to B&M’s latest annual report, there are 4 channels capable of ensuring the company’s future growth: New B&M stores, efficiency improvement of existing B&Ms, development in France, and growth of Heron Foods. However, I believe that it is precisely the last two that can become the drivers capable of continuing the company’s growth at a high rate.

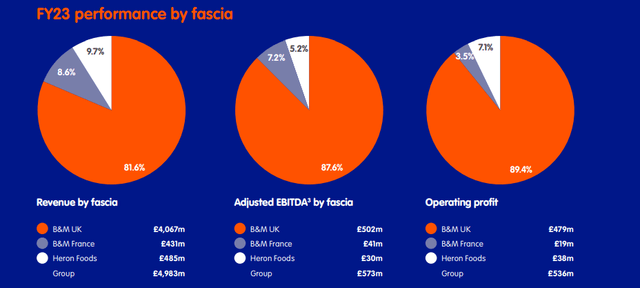

B&M Growth drivers (B&M IR) B&M Revenue Breakdown (B&M IR)

Looking at the revenue breakdown, B&M France and Heron Foods seem far from their potential. According to B&M:

In terms of size and wealth, France has a similar population to the UK, where we are targeting at least 950 stores. The UK estate sets a relevant benchmark for the potential scale of the French estate over the long term. As we gently increase our store opening program, France will provide many years of profitable growth.

(Source: B&M Presentation)

In summary, considering France and the UK as two similar markets, we can expect growth very similar to that reported by B&M in the last few years, and this would allow (at least in theory) to double the Revenue of the entire company in approximately 10 years. Furthermore, growth in France could also be pushed more than initially expected, also due to the dynamics that I explained in the chapter above.

As for Heron Foods, I believe there are very few alternatives in the industry at the moment and this gives the brand more room to grow:

Heron offers considerable long-term potential through the roll-out. Currently, the market leader in convenience stores in the UK has over 2,000 outlets. There is no reason why Heron with its discount offer cannot roll out across the UK, over the long term.

(Source: B&M Presentation)

3. The valuation is really cheap

Finally, as regards the valuation, I referred to the historical multiples of the company and the market in which it operates in general.

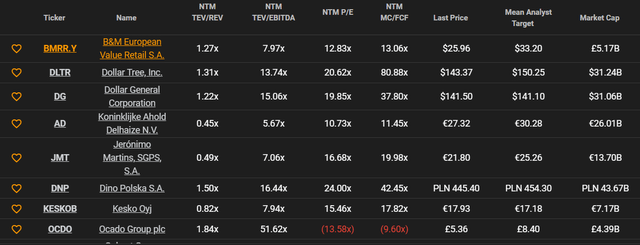

Starting by taking a look at the competitors, the average in the sector for NTM EV/EBITDA is around x15 (I took the data from both competitors in the UK and in the rest of the world, to get a more precise general idea of the market); considering that B&M has a ratio of x7.97, the company would appear to be very undervalued. Looking at the historical ratio of x9.9, the company still appears to be undervalued, however much less compared to the market (about 25%). Regarding P/E and P/S, x12.66 and x0.90 respectively, B&M always seems undervalued by a range of 20-30%.

A focus on the risks

In the first part of the analysis, I explained the almost inverse correlation of B&M towards adversities in the market: if macroeconomic conditions are bad, B&M attracts more customers. However, it is good to remember that very often, especially in the case of stock investments, companies are linked to the more general trend of the entire market. In fact, in the event of a market drawdown, following a worsening of economic conditions, B&M, although it may benefit from it, could be involved in a price decrease. Personally, I doubt that this is a concrete possibility; however, it is important to underline these market dynamics which could push B&M’s price down.

Another note regards the balance sheet situation. At first glance, there are some numbers that could give the investor some doubts: I am referring above all to the Total Debt/Equity ratio of 280.00% and the Total Cash, currently at £224 million, a low number compared to the company’s debt. However, from my point of view, these are not worrying numbers. First of all, the Current Ratio in recent years has remained considerably above 1x (currently at 1.37x) and this indicates that the company is healthy in the short term; furthermore, by comparing the debt and other balance sheet ratios with its competitors, it is clear that B&M it is not at all among the worst, but rather, it is average. Finally, it should be remembered that B&M uses debt to grow, and given the pace at which the company is growing (CAGR +10.5%), I believe that the situation is totally under control and not at all worrying.

Conclusions

So it is easy to come to the conclusion that at this moment the company, in addition to being favored by the macroeconomic environment and having excellent growth prospects, is also undervalued by around 25%. Given the current price of $25.96 (under the ticker BMRRY), I think the company’s price target could be around $32.50 per share, therefore making B&M an excellent value opportunity. For all these reasons the company is a “Strong Buy”, with great upside potential.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.