andreusK

Introduction

SiteOne Landscape Supply, Inc. (NYSE:SITE) is a supplier of landscape supplies, tools, and equipment. This includes everything from landscape accessories, blocks and stones, outdoor lighting products, ice melts, and irrigation suppliers and equipment. Over the last number of years, the company has put up an impressive growth rate, compounding sales at a 17% CAGR. In its most recent quarter announced on February 14, I believe there’s reasons to believe that the growth rate is slowing down, which is why I’m recommending a hold rating on the stock.

Company Background

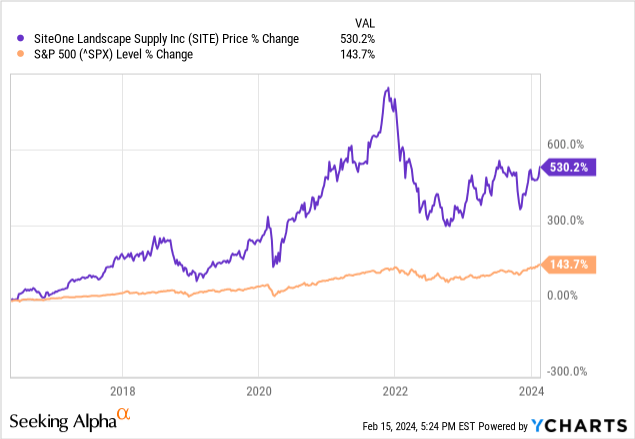

Over the last few years, SiteOne has performed exceptionally well in terms of total returns to shareholders. For example, over the last decade, the company has produced a total return of 530.2%, beating the S&P500 by a wide margin, with the index’s return at just 143.7%. Annualizing the ten-year period results in a 19.7% compounded annual return. Not bad for a company that sells soil and gardening equipment!

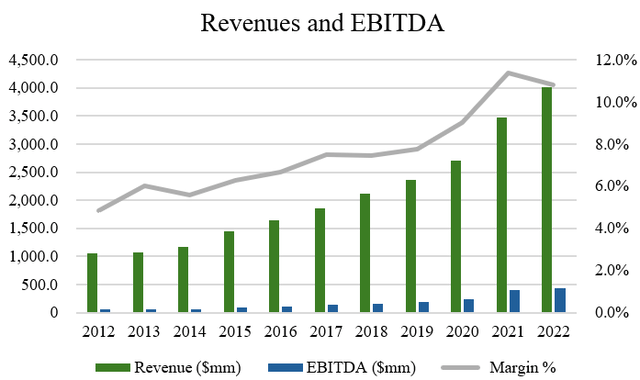

SiteOne’s impressive share price performance shows up in the financials of the company too. Over the last decade, the company has produced a CAGR of 14.2% in revenues and a CAGR of 23.8% in EBITDA. Over the last five years, the company has grown revenues and EBITDA at CAGRs of 16.6% and 25.5%, respectively (source: S&P Capital IQ). With EBITDA growth outpacing sales growth, this shows that SiteOne has expanded its margins over time as a result of better operating performance.

Author, based on data from S&P Capital IQ

All of this growth has been funded with fairly minimal dilution. Since its IPO, the share count has stayed roughly the same, increasing less than 1% per year on average. This shows that the management of SiteOne have a fairly disciplined approach to managing their per-share profitability metrics and don’t need to rely on equity financing to growth the business.

Recent Results

When looking at the recent results for the company, SiteOne reported a beat on both revenue and EPS with revenue clocking in at $965.0 million (beat of $22.8 million) and EPS of -$0.08 compared to the consensus estimate of -$0.22.

Overall, this was a relatively mediocre quarter for SiteOne. While revenues were up 8.4% year over year, this was almost completely driven by acquisitive growth. On the rest of the business, organic daily sales were down 1% compared to last year, particularly in the more commodity products that the company sells like grass seed and fertilizer.

The company also faced challenges from macro factors too. With a softer market and operating cost inflation, EBITDA would have actually been flat excluding the impact of the acquisition. The 11 acquisitions that made up the revenue bump contributed $320 million in one-year trailing revenue.

No question about it. SiteOne has proven itself to be a market leader in the industry, with a 17% market share that outrivals its closest peer three-fold. With a historical ~15% CAGR in revenues over the last decade, nearly doubling every 5 years, I think the growth rate is likely to decelerate going forward.

The U.S. landscaping industry is protected to grow at a 3% CAGR until 2029, so it would seem that with organic growth in the 3% range and 7% growth through acquisitions (full year net sales grew 7% in 2023 to $4.30 billion), SiteOne should be able to grow about 10% a year going forward. As such, I would expect the growth rate to slowdown over the next few years. For the full year 2024, management is expecting low single digit organic daily sales growth, further solidifying my thesis that the growth here is decelerating.

One of the trends that’s been upsetting to see from SiteOne is that margins are contracting. Pricing is one factor, but expense management is another. With gross margins down 200 basis points, I think it’ll be tougher for SiteOne to continue to raise pricing.

The company hasn’t exactly provided color on how they plan to increase gross margins and EBITDA margins, and a lot of it will be out of their control given the macroeconomic outlook and more commodity products in the mix. Thus, I’m not too optimistic on the company’s future. If we were able to see some meaningful margin expansion as a result of cost synergies from acquisitions that the company has already done, I’d be willing to change my views, but at present, I don’t see much to be exciting for here.

On the balance sheet front, SiteOne’s net debt was essentially unchanged from a year ago at $382.0 million with a Net Debt to EBITDA ratio of 0.9x (an improvement of 1-turn). So company’s balance sheet looks to be manageable, improving, and in good shape. The main risks, as I mentioned, are the deceleration in growth rate and precarious macroeconomic environment and how that might shape consumer spending going forward.

Valuation and Wrap-Up

Based on the 8 analysts who cover SiteOne’s stock, there are 2 ‘buy’ ratings, 4 ‘hold’ ratings, and 2 ‘sell’ ratings. The average price target is $162.25, with a high estimate of $204.00 and a low estimate of $120.00 (source: TD Securities). From the current price to the average price target one year out, this implies 2.8% downside, suggesting that analysts believe the company’s shares to be overvalued at the current price.

I would agree with analysts’ assessments here. When we look at the company’s EV/EBITDA multiple, it’s certainly crept up in the last little while, coming in at 20.8x EV/EBITDA. Above the historical multiple, I think this lends itself to the fact that the market is still valuing its growth prospects as not slowing down, despite evidence I discussed to suggest that it has. For these reasons, SiteOne should be trading at a lower multiple.

For a company that should grow in the high-single digits to low-teens, I think SiteOne should trade at the lower-end of its historical range closer to 15.0x.

Why 15.0x? Because comparing to peers like Watsco (WSO), MSC Industrial Direct (MSM), Pool Corp (POOL), Core & Main (CNM), and Beacon Roofing yield an average EV/EBITDA multiple of exactly 15.0x. These companies exhibit similar growth characteristics, business quality, and operate similar adjacent industries, so I think the comparisons are valid.

At 15.0x EV/EBITDA, this would imply a target of $119.40, which would imply downside of about 28% from my target price. Thus, I would rate shares as a sell base on today’s price.

If you are looking to buy shares, I’d wait for a pullback to that target price and multiple to enter a position. For long-term investors who may already own the stock, I’d consider selling covered calls against my position to generate a bit of premium on your equity position. The October 2024 $170 call contracts, for example, are selling for about $20.30, which equates to an annualized yield of about 18.8%, which is certainly quite attractive in my view.