Founded in 2012, EXT is a next-generation investment company that provides direct access to over 50 markets. Aimed at experienced traders and investors, EXT offers a powerful trading platform and the ability to trade over a million financial instruments with a single, multi-currency account.

In this EXT broker review, we’lllook into the features of the Exante trading platform, its trading instruments, pros and cons, trading fees, and more.

Key takeaways

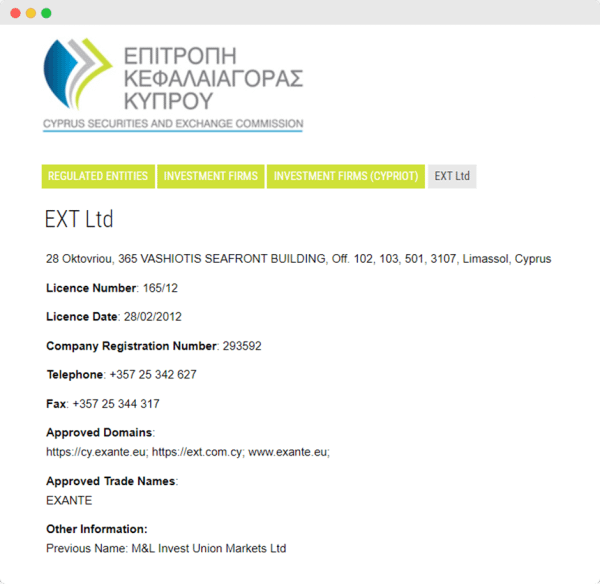

- In 2012 EXT LTD received a license from the Cyprus regulator.

- Exante offers access to more than one million financial instruments.

- The EXANTE brand is used as a trademark for several licensed investment firms around the world in the UK, Malta, Cyprus, and Hong Kong.

- Serves investors in more than 100 countries

- Ideal for experienced investors looking to trade across multiple asset classes

About EXT

EXT LTD is a European investment company registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC). EXT LTD falls under European Securities and Markets Authority (ESMA) regulation, ensuring the highest degree of investor protection.

The Exante trademark is owned and licensed by XNT LTD, which has granted EXT LTD the use of the trading name. The platform is available for traders on the web, desktop, and mobile.

Serving traders in over a hundred countries, Exante has over 1.6 billion AUM, with clients that include banks, wealth managers, and private investors. EXT offers the Exante platform to clients, with access to financial instruments like stocks and ETFs, bonds, futures, options, currencies, metals, and funds.

Pros and cons

Pros

- Trade more than one million financial instruments with a single account

- Trading instruments include stocks, ETFs, bonds, and more

- Competitive rates and a transparent fee structure

- Web, mobile, and desktop trading platforms available

Cons

- The minimum deposit amount may be high for smaller investors

- A fixed withdrawal fee of EUR 30

- No option for third-party indicators on the terminal at the moment

Trading instruments

Stocks and ETFs

With access to over 30,000 stocks across global exchanges on the Exante trading platform, traders can engage in equity markets with ease. The availability of ETFs adds another layer of diversification, allowing for broader market exposure.

With low commission fees starting from 0.01%, traders can capitalize on opportunities in the equity markets and build a diversified portfolio.

Bonds

Investors can also trade thousands of bonds through the Exante platform. With a custody fee of 0.3% per annum, traders can explore opportunities in the fixed-income markets and potentially earn steady returns. Traders get access to prime bonds with limited issue, and unlimited opportunities for portfolio diversification.

Futures

EXT offers 500 types of futures contracts on its trading platform, and traders can speculate on the future price movements of various commodities and financial instruments. Whether it’s currency, oil, or indices futures, Exante provides access to global markets such as HKEX, Eurex, and SGX. Exante offers traders access to global futures exchanges with 100% real-time prices and fast execution times.

Options

Options trading is a popular strategy for diversifying trading portfolios. The Exante platform gives traders access to thousands of options on futures, stocks, indices, and interest rates. Traders can use this to implement various investment strategies and capitalize on market movements.

Currencies

Exante offers access to 50+ currency pairs, with live market spreads starting at 0.2 pips. Traders can take advantage of the volatility in the forex market and potentially profit from rate fluctuations. Investors benefit from a safe forex trading experience, 100% reliability, and fast execution.

Metals

For investors who are interested in precious metals, the trading platform offers access to trading in metals such as gold, silver, and platinum. With low commission fees of 0.005% per trade, traders can take positions in these markets and diversify their portfolios.

Funds

The platform has over 200 funds available, with online access to hedge funds with the Hedge Fund Marketplace. Investors can monitor positions in real-time, and invest in funds with a single click.

Trading platform

Web

Exante’s web-based trading platform, provided by EXT, has a modular design that allows for plenty of customization. The platform allows clients to trade from any web browser, without the need to download any software and it doesn’t rely on your browser and HTTP protocol.

The Basket Trader is a tool that enables you to handle a portfolio of assets all at once. You can buy or sell a group of financial instruments simultaneously and specify the number of units for each instrument. Also, you can select the side of the trade, whether it is buying or selling.

It has a powerful feature called the Bond Screener, which can help you find bonds and filter them by multiple criteria simultaneously. You can personalize your search results, and add or remove columns to filter the most important information.The platform has rigorous security features built-in, with data encryption and secure login procedures ensuring the protection of clients’s data and transactions.

One drawback worth mentioning is that the platform doesn’t currently support third-party or custom indicators, which could potentially be a limitation for some traders.

Desktop

Traders who prefer a comprehensive trading experience can use Exante’s desktop trading platform, which offers various trading tools and features. The platform has advanced charting capabilities, and an extensive range of technical indicators, and enables traders to analyze market trends accurately.

It supports multiple chart types and time frames, catering to various trading styles and strategies. The platform is highly reliable, with minimal downtime and rapid execution speeds. Experienced traders can create and save multiple workspace layouts, making it easier to switch between different setups.

The platform also offers a quick search function, drag-and-drop features, and a wide range of charting tools. Security is also a top priority for Exante, and the desktop trading platform offers advanced encryption protocols and secure login processes to safeguard transactions and user data.

Mobile

The mobile trading platform is compatible with Android and iOS devices. Once downloaded, the app is ready to use with a user-friendly interface and the ability to work on multiple screens.

You can access all financial products from a single account, with a large selection of personal settings available. The mobile app is very easy to navigate, providing real-time market data, portfolio management, and the ability to execute trades with just a few taps. Despite being a mobile version of the platform, the trading app doesn’t compromise on performance. It has robust charting capabilities, including a variety of time frames and technical indicators for traders to use.

Just like the web and desktop platforms, security is a top priority. Exante’s mobile app has strict security measures in place to safeguard user data and transactions. This includes two-factor authentication and automatic logouts to protect sensitive information.

Fees

Exante’s fees are structured in a way that they only apply to actual trading and the size of the minimum trading unit will depend on each instrument. Their fees are transparent and can be found on the EXANTE website.

For futures and options, trading fees differ based on the exchange. For US exchanges, fees range from USD 1.5 per instrument. European exchanges, on the other hand, charge a flat EUR 1.5 fee per instrument. Other exchanges like OSE, ASX, HKEX, DGEX, and SGX have their own fee structures.

The fees involved in trading stocks and ETFs vary depending on the exchange. For example, on major US exchanges, the maximum rate per share is USD 0.02. European exchanges have varying fees ranging from 0.02% to a maximum of 0.18%. Similarly, Asian exchanges also have their own fee structures, with rates ranging from 0.1% to 0.1927%. The current fees are as of December 2023.

There is a cash conversion fee of 0.25% for all major currency pairs, except for EUR/USD, where the fee is zero. For all other pairs, the rate is 0.4%.

Note that for short positions and FX, overnight fees are applicable, and these are constantly changing based on market conditions. Clients can find updated overnight fees in the Client Area.

Some other fees that may apply include:

- Margin trading fees: None as long as the margin utilization is below 100%.

- Manual execution: EUR 90 for voice trading if you place phone/email orders.

- Custody fee: 0.3% annually (applies to bonds)

- Shorting stocks: Approximately 12% of the transaction as an annual rate

How to open an EXT broker account

Opening an account with Exante is a hassle-free process that is easy to follow. To get started, simply sign up on the website. You can choose to begin with a demo account to see how the platform works, before opening a live account.

To tailor your account to your needs, you will be required to fill out a questionnaire indicating your experience in trading as well as your interests. Next, you will need to verify your identity for your individual or corporate account. To do this, you must upload verification documents which will take around one business day to be verified.

For individual accounts, you will need to provide proof of identity and proof of residence. Once approved, you can start by depositing money into your account – which will either be EUR 10,000 for an individual account or EUR 50,000 for a corporate account. You’ll now have access to the live trading platform that you can also download for desktop or mobile.

Summary

Exante is ideal for experienced traders, as well as wealth managers and private investors. There are both individual and corporate accounts available and the platform offers direct market access to more than one million financial instruments.

Compared to other brokerages, the number of markets you can trade with Exante is considerably higher, and the tools and features are more complex and designed with professional traders in mind.

The above information does not constitute any form of advice or recommendation by London Loves Business and is not intended to be relied upon by users in making (or refraining from making) any finance decisions. Appropriate independent advice should be obtained before making any such decision. London Loves Business bears no responsibility for any gains or losses.