WWD/WWD via Getty Images

Introduction

On July 24, 2022, I published an analysis of Pandora A/S (OTCPK:PANDY)(OTCPK:PNDZF), evaluating the company as a good investment opportunity with an excellent risk/return ratio. Since the day the article was published, the stock price has increased by about +120%, and compared to my average purchase price, the performance has been about +150%. These performances were realized in a very short period of time, and with this article, I would like to analyze Pandora again, to see if it is time to sell and realize profits, or if it still represents a good investment opportunity.

The company has performed above my expectations, and compared to July 2022 it has improved. Anticipating what you will find in the following paragraphs in more detail, I can tell you that Pandora at current prices is obviously no longer the great bargain it was a year and a half ago, the risk/return ratio is no longer so advantageous but, according to my assessments, the company is not overvalued, and the future prospects are very promising. I have not sold my Pandora shares and have no intention of doing so, in the analysis below you can read the reasons why I made this decision.

Business Model

In the previous article, I already went into good detail about Pandora’s business model, so I will just summarize it briefly and focus more on what has changed and the development strategy. If you want more details, the analysis of the business model in the previous article is still valid.

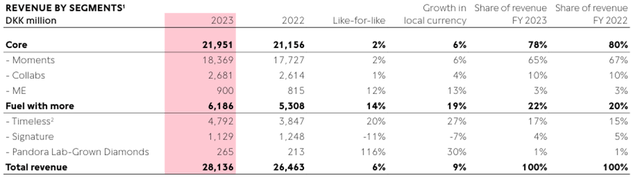

Pandora is a vertically integrated jewelry manufacturing company; in fact, it handles all processes involving product design, production, and marketing. The latter part is carried out through both owned and franchised stores. Pandora has been extremely successful with its customizable bracelets with many different charms. This business segment, referred to in reports as “Core,” still accounts for 78% of sales in 2023 (2022: 80%). The other macro-segment, “Fuel with more”, which includes within it the “Timeless” collections, “Pandora Lab-Grown Diamonds” and the “Signature” personalization service, accounts for the remaining 22% of sales (2022: 20%).

Management has been pursuing a brand repositioning strategy for a few years now, the goal being to make people feel that Pandora is no longer just the company that sells bracelets and charms, but an all-around jewelry company. The Core segment is their distinctive point, the one that differentiates them from all other jewelry companies, and it is now well understood in the minds of their customers. Especially with the Pandora Lab-Grown Diamonds collection, they are trying to attract customers other than the Core segment. In 2023, sales in the “Fuel with more” segment grew much more than in the “Core” segment (+19% vs. +6% in local currency), driven by the Timeless collection (+27%) and Pandora Lab-Grown Diamonds (+30%), for the latter in particular, ambitions are very high and management has the goal of having it reach more DKK 1 billion in sales by 2026, thanks to organic and geographic growth of the collection.

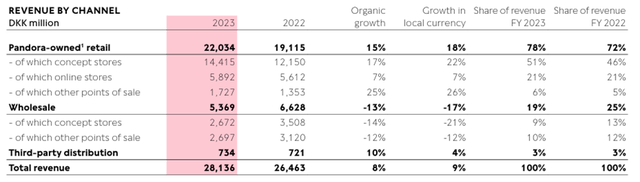

Regarding the management of different sales channels, Pandora during both 2022 and 2023 acquired several franchise stores, increasing the share of sales generated by company-owned stores from 72% in 2022 to 78% in 2023. Over the years, stores under the company’s direct control have performed better, so the desire to focus on this sales channel is understandable. In the growth strategy, chain store expansion is a very important point, in fact, 109 concept stores and 114 Pandora-owned shop-in-shops opened in 2023. They also expect to open 75-125 concept stores and 25-50 owned and operated other points of sale in 2024.

Underlying this expansion strategy are new concept stores called “Evoke 2.0,” from those that are already operating in several countries it has been noted that they manage to perform better than the old design. In the Annual Report 2022 it was stated that the opening of this new type of store allows for an increase in EBIT margin, moreover, the payback period for opening costs is very short. These data make this investment very profitable and also not very risky to make, as the payback period for the investment is extremely short.

CapEx in the last two years has been increasing, in 2021 they accounted for 2.7% of revenues, in 2022 4.9%, in 2023 5.8%, and for 2024 they are expected to be between 6-7%. Usually, increasing CapEx year after year is bad news as far as FCF growth is concerned, but these expenses are being allocated mainly in the expansion of crafting facilities and expansion of the store network. If Pandora can maintain its high ROI (47% in 2023), long-term shareholders could not be happier with this increase in CapEx. Of course, FCF might be hurt in the short term, but it would benefit in the long term since these investments are used to finance the company’s organic growth and can offer very high returns.

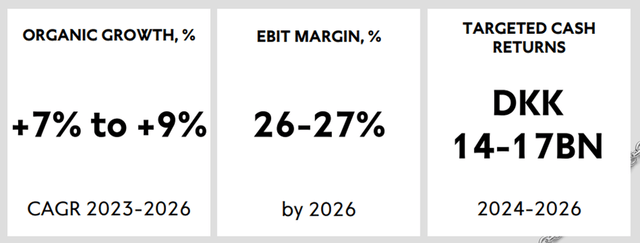

The revenue growth target for 2026 is a CAGR between 7-9% and an EBIT margin by 2026 between 26-27%. For 2024, the guidance is for sales growth between 6-9% and an EBIT margin of 25%, in line with 2023.

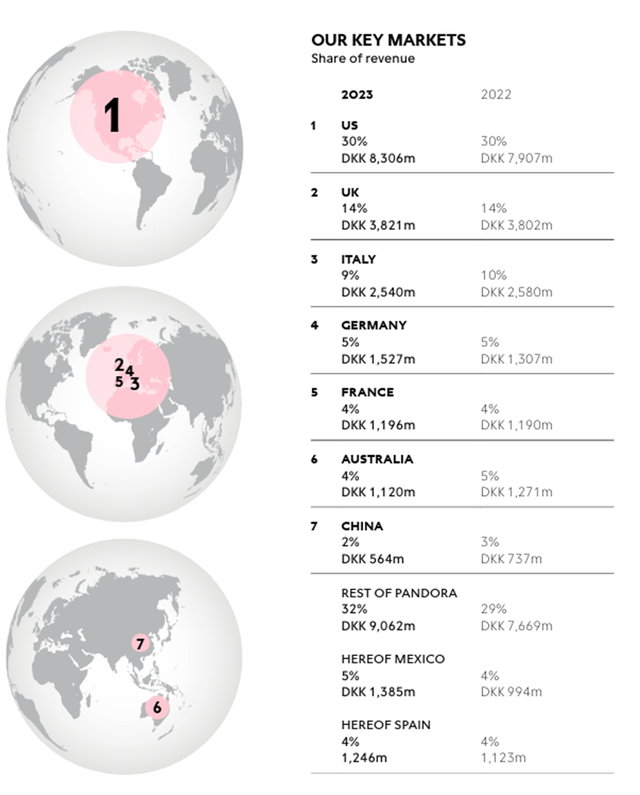

Geographic diversification is very broad, with the U.S. accounting for the largest slice of sales (30%), and although like-for-like growth in 2023 was only 2%, it remains one of the main markets underpinning their expansion strategy; in fact, they purchased 35 stores and added 27 net concept stores. Europe posted like-for-like growth of 3%, slightly higher than the U.S., but was severely penalized by Italy and the U.K., which posted no growth. In Germany, on the other hand, Pandora achieved double-digit growth every quarter and yoy like-for-like growth was +26%.

Australia and China performed poorly, with sales declining by -6% and -9% respectively. The situation in China has been difficult for several years now because of the macroeconomic difficulties with which we are all familiar. In fact, the company had decided to stop investment in China until the situation improved. In July, they started the brand relaunch in China, focusing mainly on Shanghai, to see the first effects we should probably wait a while. China is another market where Pandora wants to expand a lot and can clearly offer the opportunity to increase sales significantly. According to the “Phoenix Strategy“, their goal is to triple the turnover of 2019, where revenue was DKK 2 billion, this means that management believes they can reach DKK 6 billion turnover in the long term (probably beyond 2026), thanks to the strategy they have adopted to return to growth in the other markets. In 2023 Pandora in China had sales of only DKK 564 million, the target of 6 billion seems very far away, but I believe they will be able to grow and develop a network of stores very quickly, in case the macroeconomic situation improves.

“Rest Of Pandora” is the company’s highest-growth segment, accounting for 32% of sales (FY22: 29%) and achieving like-for-like growth of 16%. Within this segment, the largest markets are Mexico and Spain with 5% and 4% of sales, respectively.

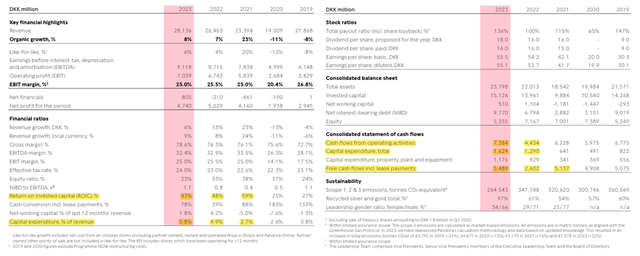

Financial Performance

In 2023, sales increased by about 6 percent to DKK 28.1 billion. While gross margin increased to 78.6% (FY22: 76.3%), EBIT margin decreased slightly to 25% from 25.5% in 2022. ROIC, although with higher expenses in CapEx was 47% (FY22: 48%), a return on investment that truly few companies worldwide can boast of having. Net income was DKK 4.74 billion, down from DKK 5 billion in 2022, due to a higher income tax of 24% (for 2024 it is expected to be between 24-25%) and higher interest due to higher interest rates and increased debt to support investments. Total financial expenses for 2024 are expected to be between DKK 950-1,000 million and the leverage ratio target is approximately 1.2x NIBD to EBITDA by the end of 2024.

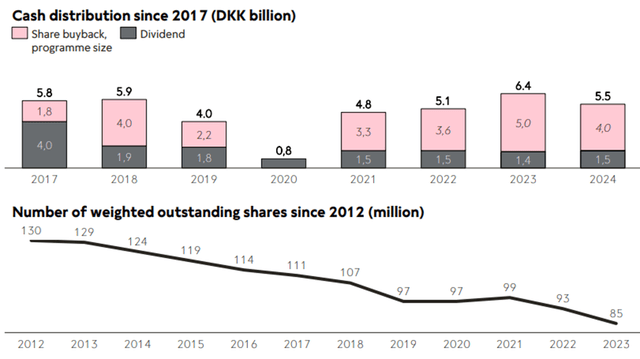

The increase in debt during this period of high rates is perhaps the most negative aspect of these results. Pandora from 2021 to 2023 distributed through share buybacks and dividends a total of DKK 16.3 billion. The share buybacks during 2022 and 2023 were created a lot of value for shareholders, as the share price was below the intrinsic value of the company. However, having used this cash to remunerate shareholders, management had to use debt to finance its projects, resulting in higher borrowing costs.

Although this represents a small downside, increased debt is not a problem at all; the company is a cash machine and is able to repay its debts. Moreover, even if the interest on the debt is higher, Pandora manages to generate a very high ROIC and consequently, there is no risk of destroying shareholder value. Management has also made it known that it intends to distribute between DKK 14-17 billion between 2024 and 2026, either through dividends or buybacks.

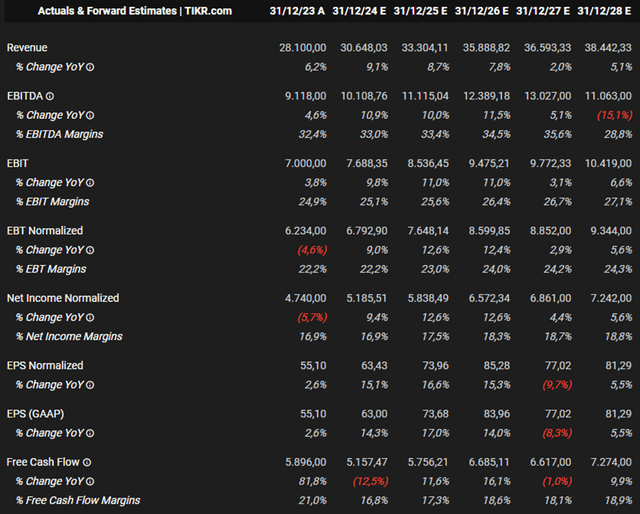

Annual Report FY23 Q3 FY23 Presentation TIKR

Analysts’ forecasts take into consideration the increase in financial expenses and the increase in investments. In fact, FCF from 2024 is expected to decrease from 2023 but still above DKK 5 billion. In the next paragraph you will find three different estimates of intrinsic value, from the most bearish to the most bullish, and I can anticipate that I believe Pandora will be able to achieve a higher FCF margin than analysts predict (around 18%) and more in line with its past performance (between 21-24%). I believe this is because, over time, the investments it is making now (both for crating facilities and store expansion) will start to generate cash and pay back the investments made, at the same time I believe the weight of CapEx on sales will decrease, after the phase of strong expansion of the store network slows down.

Valuation

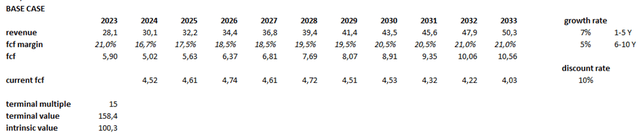

To evaluate Pandora, I will use a DCF based on three scenarios with different growth rates, margins, and multiples. The discount rate used is 10 percent, and I assume that Pandora distributes 90 percent of the FCF it generates.

Here I was a little more conservative than both management and analysts in estimating revenue growth over the next five years. I also slightly underestimated the cash that the company will distribute to shareholders, for 2024 in fact they plan to distribute DKK 5.5 billion, while I assumed DKK 4.52 billion, to remain more conservative.

The gradual increase in the FCF margin reflects what I mentioned in the previous paragraph. In fact, I think that over time, the weight of CapEx on sales will decrease, causing the margin to increase accordingly. As a final multiple, I thought it’s appropriate to use a P/FCF of 15, which is equal to the average of the last ten years. Using these assumptions, the intrinsic value of Pandora is DKK 100 billion, in line with the current capitalization around DKK 96 billion.

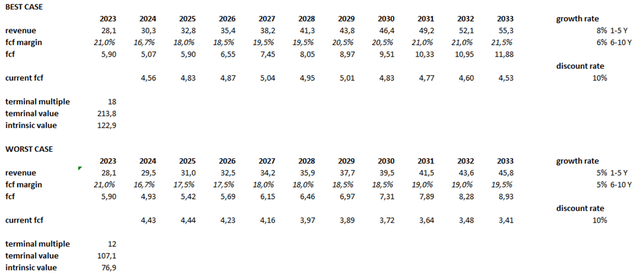

In the image above you can see the variables I have used for the best and worst cases, in both cases I have tried to remain more conservative with respect to what I believe Pandora’s potential could be, especially with respect to margins. I would like to focus on the worst case, for which I assumed constant growth of 5 percent per year, fueled mainly by growth in the number of stores but slowed by weaker organic growth. In this scenario, CapEx decreases more slowly and continues to remain an important part of sales, thus leading to lower margins than in the past. To conclude, I used a P/FCF multiple of only 12, which in my opinion is fair for a mature company with low growth rates. The intrinsic value in this case is DKK 77 billion, about 20% less than the current market capitalization.

Risks

The growth assumptions I used for the evaluations in the previous paragraph take into account a recovery in China. Given management’s track record in relaunching the brand in other countries, I believe there is a good chance of success in China as well, but in the event that this does not happen, perhaps due to unfavorable macroeconomic conditions, growth may be slower and as a result Pandora’s intrinsic value may be lower than indicated. Personally, in 2024, I would like to see the China segment return to growth, it should not be difficult given the poor performance of the last year, I would be concerned in case this doesn’t happen.

Another risk factor is due to valuation. Although according to my calculations, the company appears correctly valued, the absence of a large enough margin of safety increases the risk of the investment. It has been more than a year since Pandora’s stock price has done nothing but rise, in the near future there could easily be a retracement, and in the event that the market capitalization approaches the lower intrinsic value estimate, the risk/return ratio would certainly be better and there would be a greater margin of safety.

I think Pandora has a significant competitive advantage due to economies of scale and brand desirability, so I don’t see the risk of increased competition, but in the event that it fails to maintain the current brand positioning, performance could be hurt and management may have to spend more than expected on marketing to try to revive the company.

Conclusion

In the introduction, I asked myself whether I should sell my shares in Pandora after this rally and realize the profits made; based on the latest results, future prospects, and the current price of the company, the answer is no. I consider Pandora to be correctly valued at the moment and considering the high quality of the business and management, I do not believe that selling the shares just because the price has risen very quickly is a correct decision.

CEO Alexander Lacik and the rest of the management team have done a great job over the past few years, reviving what seemed to be a decadent brand and starting a new phase of growth. The current Pandora is a better company than it was five years ago, and I think that under the leadership of the current management team this can be true for the next five years and beyond. Besides brand and production efficiency, management is Pandora’s third major competitive advantage.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.