picture alliance/picture alliance via Getty Images

This analysis will focus on the competitive advantages related to Oracle (ORCL) Cloud Infrastructure, and it will show the long-term growth I expect to continue for the firm related to associated technologies despite balance sheet and valuation risks in the firm at present. My analyst rating for the stock is a Buy, but I am only considering allocating to the company at a small, defensive allocation.

Market Outlook & Key Drivers

Oracle Cloud Infrastructure is a full-scale cloud computing platform that offers computing, storage, networking, database, AI, machine learning, security, and marketplace services.

The cloud computing market is set for significant growth over the next 10 years. Fortune Business Insights highlights a cloud market value of $569.31 billion in 2022, forecasted to grow to $2,432.87 billion by 2030. That will mean the industry grows at a 20% CAGR over the period. This is a trend that will be driven by the adoption of autonomics, digital transformations in businesses and connected devices having higher capacities. While the public cloud segment will lead in market share, the hybrid cloud market, increasingly used by SMEs, will be the fastest growing based on the report.

Precedence Research also forecasts high growth in cloud computing. It estimates that the size of the market will reach approximately $1,614.1 billion by 2030, indicating a 17.43% CAGR between 2022 and 2030. The report outlines significant growth in the past few years, with the private cloud and SaaS segments largely dominating revenue share in 2021; North America had 40% of the cloud market revenue share that year.

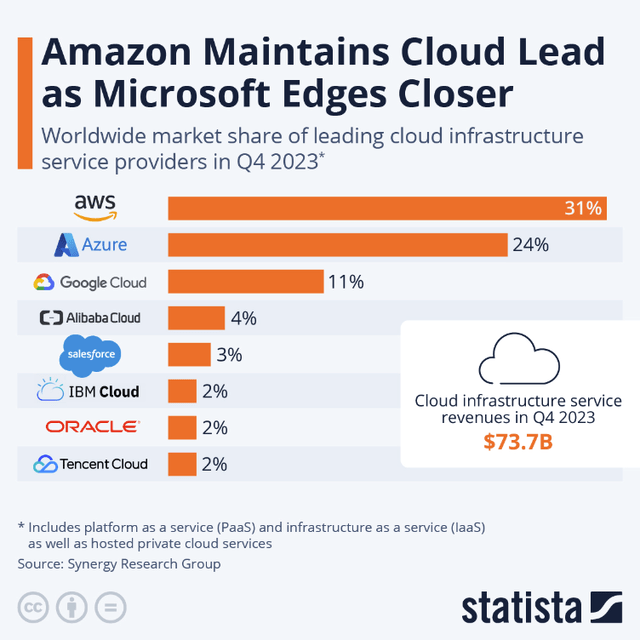

The cloud market is highly competitive, however, and Oracle will face significant pushback from Amazon (AMZN) Web Services, Microsoft (MSFT) Azure, Google (GOOGL) Cloud Platform, and IBM (IBM) Cloud.

Profitability & Financial Strengths

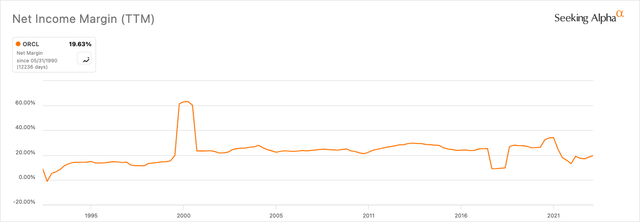

Oracle’s business has already proven itself to be highly profitable and relatively stable as such:

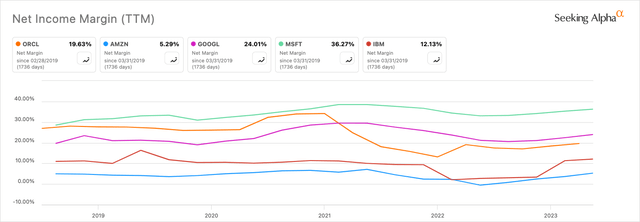

Based on net income margin, Oracle falls roughly in the middle of its high-value peer group also working in dominant cloud solutions:

Oracle’s net income margin of 19.63% is a 759.39% difference from the sector median of 2.28%.

McKinsey noted growth from the utilization of AI of between $2.6 trillion and $4.4 trillion in global corporate profits annually. It sees the boost in productivity coming from customer support interactions, creative content, and software coding. High-tech was seen as one of the major beneficiaries, which is of no doubt considering it is their field of competence to begin with. They estimate labor productivity to be boosted between 0.1% and 0.6% annually through 2024.

Understanding that Oracle’s profitability is likely to only improve from here as a result of automation and artificial intelligence is foundational in understanding the long-term investment potential. Yet, there are specific areas where the company is less strong.

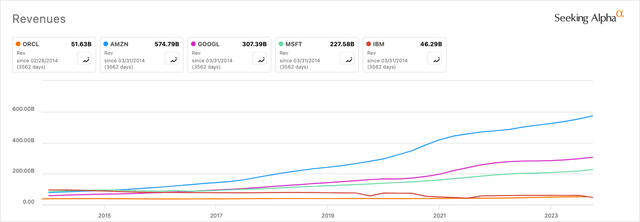

For example, let’s compare the company’s revenue growth against the set of high-tech peers I selected above for my profitability analysis. Oracle is, unfortunately, roughly in line with IBM:

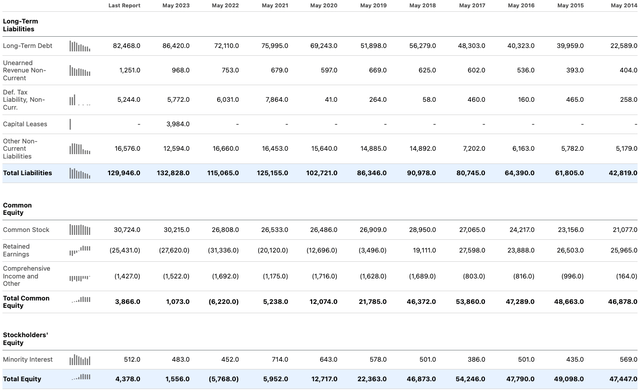

Significant Balance Sheet Risk

In addition to the long-term revenue growth plateau, Oracle also has a very weak balance sheet at the moment, and it is my largest risk when considering investing in the company at this time. Consider that the company has an equity-to-asset ratio of just 0.03:

Compare this to Amazon, which has an equity-to-asset ratio of 0.38, and Microsoft, which has an equity-to-asset ratio of 0.51.

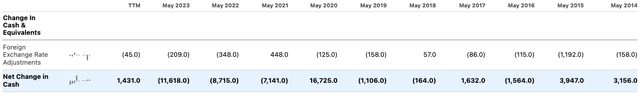

Weak liquidity is further evidenced in the firm’s consistently negative net change in cash:

Valuation

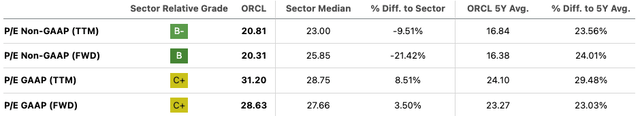

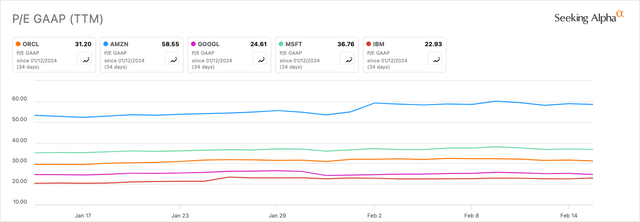

Additionally, let’s look at Oracle’s valuation, which proves that the company is valued higher than the sector median based on GAAP standards:

Compared to my set of high-tech peers, Oracle is roughly in the middle once again. My estimate is based on the firm’s high-growth potential in cloud services but severe weakness in the balance sheet, commanding lesser value than a firm like Amazon. As such, I think the stock deserves a multiple of almost half of AMZN, which it has. I consider the market to have priced Oracle at roughly fair value at this time.

Security Risk To Cloud Market Growth

While the cloud market is expected to grow significantly over the next decade, companies that operate within the domain are going to face a host of new problems, including constant threats from advanced cybercrime.

In 2023, Security Intelligence outlined four major cyber risks: the misconception of security by obscurity, supply chain attacks, collaboration among threat actors, and the outdated approach of reactive network defense. That year, The Guardian newspaper was cyber-attacked by a ransomware group, as was Toronto SickKids hospital. The Federal Aviation Administration also faced failures, causing widespread flight disruptions, likely the result of failed cybersecurity infrastructure.

While Oracle is working on implementing higher security measures in an effort to safeguard its customers from cybercrime, it will take significant investments in advanced tools and capabilities to remain competitive against malpractice. As such, Oracle’s need to protect itself rigorously from such threats is the number one risk I have to outsize market growth in its highly-anticipated cloud computing segment.

Conclusion

I consider Oracle a reasonable company to own. However, I would be cautious about allocating too much. While the stock should see considerable returns over the next decade due to its strong presence in advanced cloud technologies, I would not be surprised if there is some volatility or worse results than companies like Microsoft and Amazon.