erlucho/iStock via Getty Images

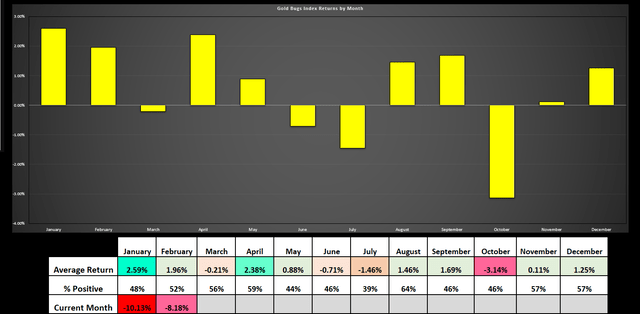

It’s been a volatile start to the year for the Gold Miners Index (GDX) which has declined 13% year-to-date, a nearly 20% underperformance vs. its seasonal average return in the first six weeks of the year of [+] 4%. This is even more disappointing for investors given that the gold price has held up relatively well since its December peak, down just 4% on a daily closing basis. So, what’s the culprit for this weakness?

Gold Bugs Index Returns by Month (1997-2023) – Author’s Data & Chart

While the gold price has risen sharply, some producers missed their FY2023 production guidance, resulting in them coming in higher on costs than planned. Second, sentiment remains in the gutter for the sector, so good news is ignored, mediocre news is sold, and bad news leads to waterfall declines. The good news is that this is an opportunity for those willing to be contrarian, and with Royal Gold (NASDAQ:RGLD), it’s uniquely positioned with above-average growth, inflation protection and superior diversification to the average company industry-wide.

In this update, we’ll dig into Royal Gold’s Q4/FY2023 results, recent developments, and what’s in store for 2024.

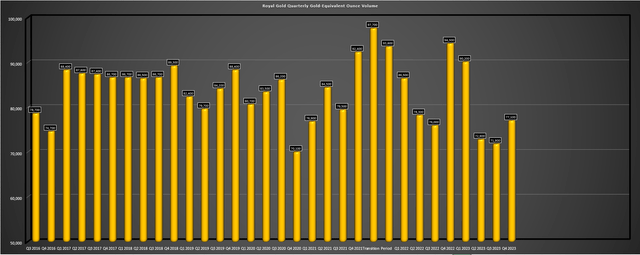

Q4 Production & Sales

Royal Gold released its Q4 and FY2023 results last week, reporting quarterly production of ~77,500 gold-equivalent ounces [GEOs], a significant decline from the year-ago period. Meanwhile, its annual GEO volume also saw a meaningful step-down to just ~312,100 gold-equivalent ounces, a miss vs. expectations of 320,000 to 345,000 GEOs and a nearly 7% decline year-over-year. While it’s easy to be disappointed with these results, it’s important to note that this was an abnormally tough year for Royal Gold’s partners, with several of the hiccups coming from key assets like Pueblo Viejo, Mount Milligan, and Penasquito. Let’s take a closer look below.

Royal Gold Quarterly GEO Volume – Company Filings, Author’s Chart

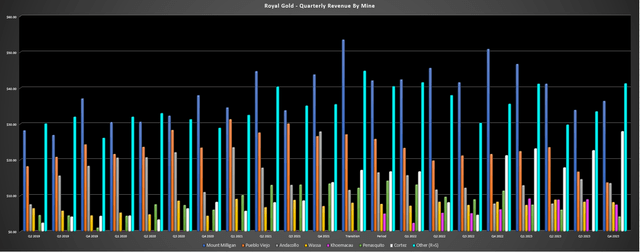

Looking at the chart below, we can see that Royal Gold saw growth in its ‘Other’ category with new contributions from assets like Bellevue which was running at planned throughput levels as of December after pouring first gold last year, as well as other assets like King of the Hills which poured its first gold in mid-2022 and has ramped up successfully since then. Other assets that contributed to the ‘Other’ category on the below chart were Xavantina in Brazil, which had a solid year with production from the new Matinha vein, production growth at Rainy River in Canada, and Khoemacau shown below also had a better year despite no help from silver prices.

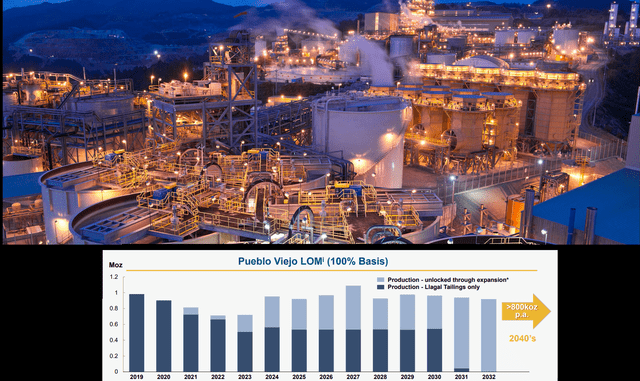

Unfortunately, this was offset by a strike at Penasquito, and a weaker year at Mount Milligan with lower than planned grades and recoveries in Q3 2022 through Q2 2023 (affected gold/copper stream deliveries in 2023 because of timing between production and deliveries). Meanwhile, Pueblo Viejo had a tough year with a delayed start to its expansion, which is ultimately expected to push production above 800,000 ounces per annum on a 100% basis (RGLD’s gold/silver stream applies to 60% of the asset). That said, these ounces are deferred and not lost, which is an important distinction to make as these are not setbacks caused by reserve deletions or major mine issues that would otherwise materially affect Royal Gold’s NAV, they’re simply delays getting to ore that will be mined a year later.

Royal Gold Quarterly Revenue by Mine – Company Filings, Author’s Chart

Since the setbacks, all three operations are back on track after what was a tough 2023, with Pueblo Viejo set to ramp up to full production by 2024 after reconstructing its feed conveyor (it saw a further impact from the failure of the gearboxes for the flotation cells). Given the setback at Pueblo Viejo, 2023 revenue to Royal Gold slid to ~$76.2 million vs. ~$85.9 million, with Q4 revenue sinking to just ~$13.6 million (Q4 2022: ~$21.6 million). And with the continued deferral of silver deliveries (~165,400 ounces deferred in Q4), total silver ounces deferred sits at ~854,000 ounces, with the timing of these deliveries uncertain which has continued to be a drag on Royal Gold’s results. On a positive note, stability and optimization of the flotation circuit should lead to better recoveries and allow Royal Gold to get back on track with its silver deliveries from this asset. That said, it’s nice to see gold production on track to rise materially on RGLD’s 7.5% stream under the 990,000 ounce delivery agreement (only 1/3 of these ounces delivered to date), with production of 520,000+ ounces in the 2025-2028 period (60% basis).

Pueblo Viejo Operations & LOM Production – Barrick Website

Moving to Penasquito, the strike has since ended at this massive mine, and while it will cost the operator a little more under the new agreement and the stronger Mexican Peso hasn’t helped matters, we should see a much better year of contributions to Royal Gold. As highlighted in Royal Gold’s Q4 results, revenue from Penasquito sunk from ~$43.2 million to ~$17.8 million because of the multi-month strike, a ~12,000 GEO impact which on this asset alone would have allowed Royal Gold to meet the bottom end of its guidance. Finally, Mount Milligan is out of the ore-waste transition zone and expects a much better 2024, which will help Royal Gold to bounce back this year from a tough 2023 with this being its most significant contributor ($158.2 million in revenue in 2023 vs. $180.5 million in 2022).

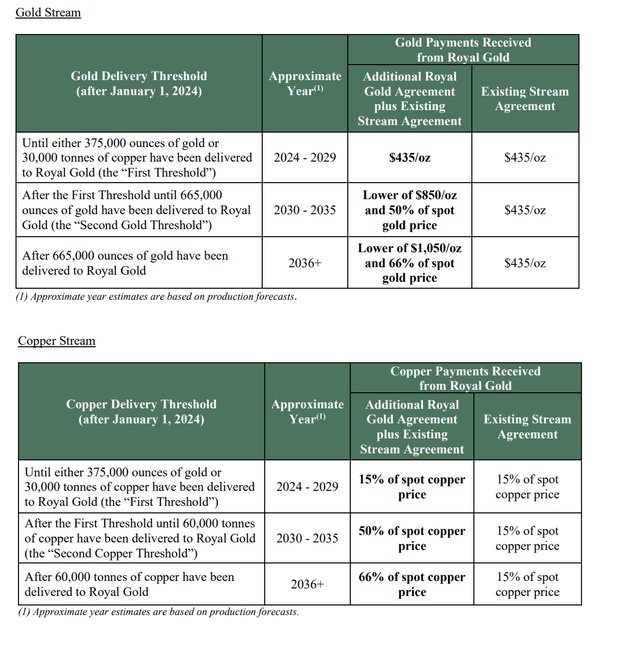

And on the topic of Mount Milligan, Royal Gold has put a new agreement in place with Centerra that will allow for an extension of the mine life to 2035 from 2033, with the potential for further mine life extensions. The mine life extension plans will be spearheaded with a PEA to look at incorporating inventory west of the existing pit, with other initiatives including exploration drilling and site optimization, with the latter having begun in Q4 2023. As part of the deal, Centerra will receive higher cash payments starting in approximately 2030, with gold payments being the lower of $850/oz and 50% of the spot gold price from 2030-2035 and the lower of $1,050/oz and 66% of the spot gold price from 2036 thereafter.

Mount Milligan Agreement – Centerra Website

The increased payments are significantly higher than Royal Gold’s current payments of $435/oz for gold ounces delivered and 15% of the spot copper price (as they will roughly double on gold payments and more than triple on copper payments), but the deal is mutually attractive. This is because Mount Milligan has a much better chance at extending its mine life with improved payment terms that are less cumbersome and, in exchange for the agreement, Royal Gold will receive:

- an upfront cash payment of $24.5 million

- the delivery of 50,000 ounces of gold (~67% related to ounces set to be delivered to Centerra as part of its sale of Greenstone)

- a 5% free cash flow interest starting in approximately 2030 at Mount Milligan, increasing to 10% after 2036

Royal Gold had the following to say about the deal:

“This is a good development for both Royal Gold and Centerra, as it should allow for further value to be realized through mine life extension. Royal Gold will benefit from getting further exposure to metal prices over an extended mine life, and we are pleased to provide support to Centerra as they review this potential.”

– Royal Gold, Q4 2023 Conference Call

Financial Results

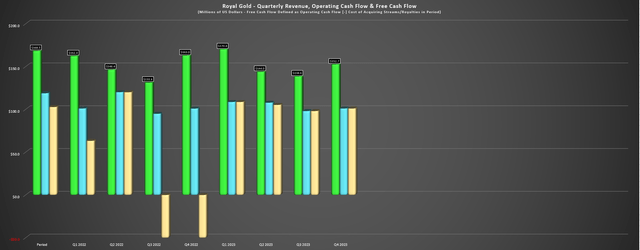

Moving to Royal Gold’s financial results, the company reported revenue of $152.7 million in Q4 (Q4 2022: $163.0 million), a ~6% decline year-over-year. This was related to the significant decline in contributions from assets discussed earlier, offset by a higher average realized gold price. Unfortunately, this led to roughly flat revenue year-over-year of $605.7 million, and a marginal decline in operating cash flow to $415.8 million vs. $417.3 million in 2022. That said, the annual results are not reflective of Royal Gold’s overall business and the near-term and long-term production profiles of its partner’s operations, given the multiple one-time headwinds and setbacks across the portfolio.

Royal Gold Quarterly Revenue, Operating Cash Flow & Free Cash Flow – Company Filings, Author’s Chart

Despite the weaker Q4 and FY2023 results, Royal Gold ended the year with ~$104 million in cash and net debt of just ~$150 million and generated over $410 million in free cash flow. This allowed the company to increase its total liquidity to ~$850 million, repay $325 million on its revolving credit facility, and reduce its balance to just $250 million, which gives it lots of firepower to transact in what continues to be a very favorable environment for potential new royalties/streams. In addition, Royal Gold increased its dividend for the 23rd consecutive year to $1.60 per share (+7% year-over-year), placing it very rare air among all sectors next to names like Caterpillar (CAT), Target (TGT), McDonald’s (MCD), with it set to become a (*) Dividend Aristocrat (*) if it can continue this streak for another two years, an incredible feat for a company in a cyclical sector.

(*) Dividend Aristocrats are those companies that increase their dividends for 25 consecutive years (*).

Recent Developments

Great Bear

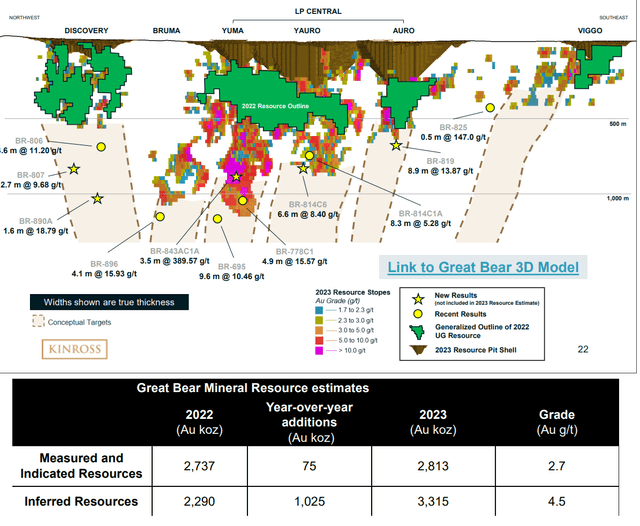

As for recent developments, there were several that were noteworthy, with considerable progress made at its partners’ assets in the early-stage, advanced, and construction phases, and at brownfield sites. For starters, the Great Bear Royalties’ purchase is becoming vindicated with further growth in the resource base to ~6.1 million ounces vs. ~5.0 million ounces of gold previously. It’s important to note that the grades here are miles above the industry average for a primarily open-pittable future operation, and ~380,000 ounces per annum over 15+ years (peak years above 420,000 ounces) is looking like a very real possibility even at the modest proposed 10,000 tonne per day throughput rate.

Great Bear Project & Resource Update – Kinross Website

Using Royal Gold’s 2.0% NSR and a $2,000/oz gold price assumption, this would translate to annual revenue of $16+ million in the early years of the mine life which could start as early as H2 2029, with upside to $19 million at a $2,250/oz gold price which doesn’t seem farfetched at all looking out to the 2030-2034 period (estimated peak production years). It’s also worth noting that the underground potential here continues to surprise to the upside, with highlight intercepts that included:

- 3.5 meters at 389.6 grams per tonne of gold at the Yuma Zone (900 meter vertical depth)

- 1.6 meters at 18.8 grams per tonne of gold in the Discovery Zone (1,070 meter vertical depth)

- 8.9 meters at 13.9 grams per tonne of gold in the Auro Zone (700 meter vertical depth)

As discussed by Kinross (KGC), these intercepts are well outside of the current resource pit shells and did not make into the recent resource, but certainly suggest the potential for further resource growth.

Cote & Goose

Staying with Canada, the Cote and Goose Projects in Ontario and Nunavut continue to see solid progress on construction, with Cote set to pour its first gold in Q2. This will be a nice little contributor to Royal Gold’s future results, based on its 1.0% NSR that covers roughly ~70% of gold reserves. Meanwhile, the Back River Project remains on track for first gold pour in Q1 2025 and B2Gold (BTG) taking over the project will mean a higher for longer production profile, with B2Gold aiming to maintain a ~300,000 ounce production profile for the first five years vs. peak production near this level previously. And while this royalty won’t kick in immediately as it has a 400,000 ounce threshold, the 1.95% GSR at Goose (with further long-term upside at George with a 2.35% GSR) should translate to upwards of $11 million in attributable revenue per annum starting in H2 2026.

Ruby Hill

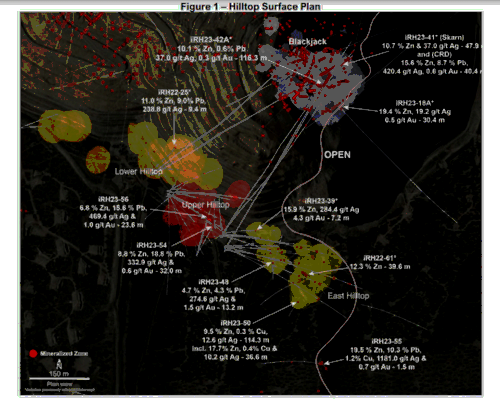

If we move south to Nevada, we’ve seen several positive developments, with one of these being the continued exploration success at Ruby Hill and the announcement that i-80 (IAUX) is working on an agreement with a potential joint-venture partner. For those unfamiliar with the asset, Ruby Hill is home to nearly 9 million ounces of gold and ~180 million ounces of silver, but i-80’s focus is on the polymetallic potential and high-grade subset of the future Ruby Hill resource base (Ruby Deeps, Hilltop zones, FAD, Blackjack). And while this asset may not be contributing yet with resources set to be declared this year, this could be a ~200,000+ ounce per annum asset on a GEO basis assuming a 3,000 ton per day throughput rate later this decade, with an additional 70,000+ ounces from Ruby Deeps as the #3 spoke for its planned Hub & Spoke model (autoclave + three high-grade mines delivering sulfide material).

Ruby Hill Drilling – i-80 Gold Presentation

Based on Royal Gold’s 3.0% NSR on all metals, this is an asset that could contribute upwards of 8,000 GEOs per annum and a similar revenue contribution to Great Bear ($16+ million), and the path to first production would be accelerated and de-risked if a joint-venture partner agrees to a deal which would mean shared capex and a higher exploration budget. And while there are no guarantees that a JV deal is struck, the pace of new discoveries and high-grade nature of this ore body combined with relatively low capex (brownfields site with potential to convert CIL mill to flotation) makes this a very attractive asset for a partner, with highlight drill results shown below. Finally, it’s worth highlighting that Royal Gold picked up this royalty off International Minerals Corporation for just $38 million in 2012, and if i-80 and any future partner execute successfully, this royalty could generate upwards of $150 million in revenue to Royal Gold ($15+ million per annum over 10 years).

Highlight intercepts at Ruby Hill include:

- 116.3 meters at 10.4% zinc/lead, 37 grams per ton of silver, and 0.30 grams per ton of gold (Blackjack)

- 40.4 meters at 24.3% zinc, 420 grams per ton of silver and 0.6 grams per ton of gold (Blackjack)

- 114.3 meters at 9.5% zinc, 0.3% copper, 12.6 grams per ton of silver (East Hilltop)

- 10.0 meters at 15.7% lead, 60.2 grams per ton of gold and 909 grams per ton of silver (Upper Hilltop)

- 28.3 meters at 39.4% lead/zinc, 525 grams per ton of silver and 0.9 grams per ton of gold (Upper Hilltop)

- 33.2 meters at 19.8 grams per ton of gold (Ruby Deeps)

Fourmile

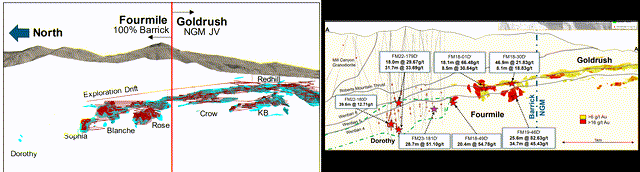

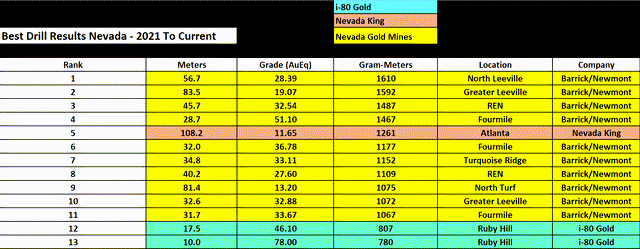

While Ruby Hill has turned from an intriguing asset to one with considerable potential and the possibility of a 250,000+ ounce production profile from a GEO standpoint and the best new discovery for any sub $5.0 billion company in the United States, the real monster in Nevada is owned by Nevada Gold Mines LLC. This asset is Fourmile, and disclosure from the operator is that this could be an 8.0+ million ounce resource at 11+ grams per tonne of gold. This is based on the operator’s recent unveiled exploration target of 13 to 20 million tonnes at 13.3 to 20 grams per tonne of gold, pointing to a 15+ year mine life at up to 400,000 ounces per annum at industry-leading costs below $900/oz, and the deposit continues to grow with astonishing intercepts like 28.7 metres at 51.1 grams per tonne of gold (drilled last year), nearly matching other phenomenal intercepts at the time of its discovery like 25.6 meters at 82.63 grams per tonne of gold (2018 drilling). In fact, the recent hit was one of the top-15 intercepts drilled in Nevada since 2021.

Fourmile/Goldrush Drilling – Barrick Presentation

Best Drill Intercepts in Nevada (2021 to Current) – Company Filings, Author’s Table

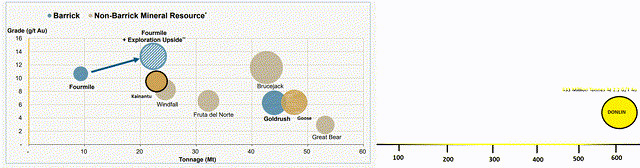

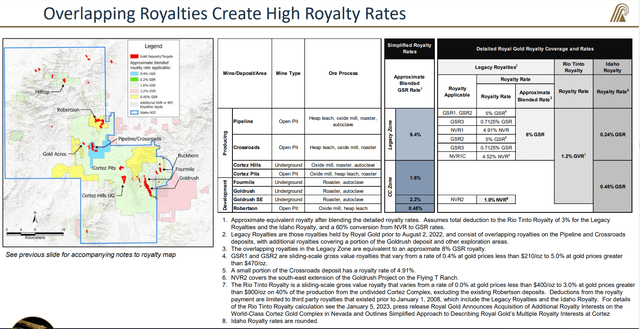

Looking at Fourmile vs. other assets, it is truly a world-class discovery in the exploration target case, with its grades and size expected to trump that of Windfall and other impressive projects/mines. And following Royal Gold’s increased exposure to the Cortez Complex, its royalty holdings now cover Robertson, Fourmile and Goldrush which is ramping up to 400,000 ounces per annum by 2028 following the receipt of its ROD with no step downs or caps that’s expected to be an important future source of high-grade feed for its Carlin processing facilities and oxide feed in the case of Robertson.

Fourmile, Fourmile Exploration Upside & Other Mines/Projects – Barrick Presentation, Author’s Notes/Drawings

Royal Gold Royalty Coverage – Company Presentation

2024 Outlook

While Royal Gold will get a boost from Bellevue, Mara Rosa, Cote, and Manh Choh next year and a more normal year for Penasquito, it will see a disproportionate negative impact from Cortez which is one of its largest contributors. This is because the operator has trimmed guidance at the Cortez Complex for 2024 due to a change in the Crossroads resource model with the company that will reduce oxide mill feed. The operator stated a large chunk of high-grade was faulted out, which stole some assume high-grade oxide ounces it previously expected to mine. That said, while this is disappointing and a drag on near-term attributable production for Royal Gold and the operator, I would argue that the exploration success at Fourmile (potential for 4.0+ million incremental ounces vs. the previous resource base) more than offsets any near-term cash flow impact here for Royal Gold.

So, what does this mean for 2024?

While the Cortez Complex will be a drag due to its overlapping royalty, I would still expect to see at least 345,000 GEOs of attributable volume in FY2024 which would mark a new record for the company and translate to record cash flow per share ($7.30+). This is because of contributions from new assets coming online and ramping up, and a much better year from two of its larger contributors, Mount Milligan and Penasquito. And if we look out to 2025/2026, I would expect to see more records set with a full year of production from Manh Choh and Cote, increased production from Goldrush, a stronger year from Pueblo Viejo and hopefully catch-up on deferred ounces, initial contributions from Back River, and the potential for initial contributions from Ruby Hill. Hence, this temporary slowdown in growth that’s left the share price in a range should create buying opportunities for patient investors if we see further weakness.

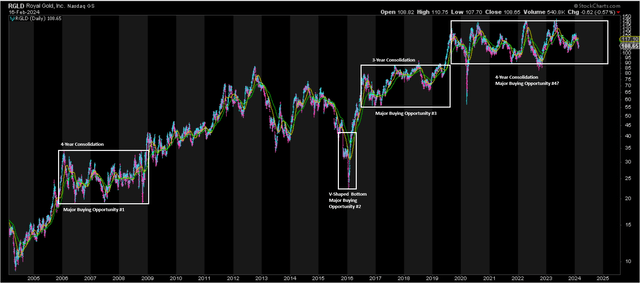

Royal Gold 20 Year Chart – StockCharts.com

Valuation

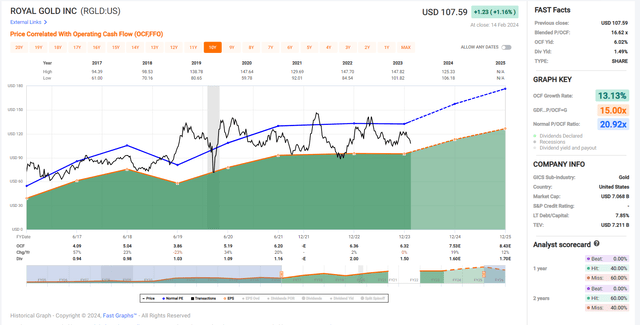

Based on ~65.7 million shares and a share price of $108.00, Royal Gold trades at a market cap of ~$7.1 billion and an enterprise value of ~$7.25 billion. This is a significant departure from its peak market cap of ~$9.68 billion in May 2023 and this is although gold prices are sitting at higher levels, with a record 13 consecutive weekly closes above the $2,000/oz level. Meanwhile, the stock is trading at just ~14.6x FY2024 cash flow per share estimates, a significant discount to its long-term average of ~25.0x cash flow. And even if we use more conservative multiples of 22.5x FY2024 cash flow per share estimates (10% discount to long-term average) and 1.80x P/NAV and a 65/35 weighting (P/NAV vs. P/CF), I see a fair value for the stock of $151.00. However, if we roll forward to FY2025 cash flow as FY2024 will be weaker for cash flow, fair value increases on the same assumptions to ~$156.00.

Royal Gold Historical Cash Flow Multiple & Current Valuation – FASTGraphs

Typically, I am looking for a minimum 30% discount to fair value for royalty/streaming names to ensure a margin of safety, and measuring from the midpoint of 2024 and 2025 fair value estimates, this translates to a low-risk buy zone of $107.50 or lower. Hence, if I wanted to add exposure to gold with additional leverage, discovery optionality on some of the best assets in the safest jurisdictions all while collecting a future 2.0%+ yield on cost given RGLD’s growing dividend, I would expect any further weakness in the stock to provide a buying opportunity.

Summary

Royal Gold had a tough year in 2023 at no fault of its own, with hiccups at several of its partners’ assets that impacted its royalty/streaming sales and offset the benefit of a higher gold price. Unfortunately, another of its key assets is set to sting it again in 2024 with lower production expected from the Cortez Complex in Nevada, but its diversified portfolio with multiple development assets inching towards production will help to offset this impact, with more attributable production (and financial records) expected in 2024 if the gold price cooperates. So, with Royal Gold being a low-risk business with a more attractive yield than gold and a favorable environment that suggests the possibility to get more meaningful transactions done in 2024 with minimal if any share dilution, I see it a superior alternative to gold, and one of the better buy-the-dip candidates sector-wide below US$107.50.