Maliflower73/iStock via Getty Images

Value Investing Is At Its Core The Marriage Of A Contrarian Streak And A Calculator.

– Seth Klarman

I had recalled a quote about the market that I couldn’t quite place that said something to the effect of “Everyone has a calculator” suggesting being able to do basic math isn’t much of an advantage in markets. When I searched for the origin I found the above quote by Seth Klarman instead. As it turns out, I like that one a lot better because I’ve made an investing career out of applying basic common sense and a calculator to my decisions, and also because Seth Klarman is an investing legend. And for anyone who doesn’t know, I approach markets as a set of probabilities. I weigh the evidence I have and the probability of various events occurring and try to estimate what the impact will be on the share price. I’m rarely looking more than a year out, and for that, a calculator can be pretty handy, especially when playing in corners of the market with less competition.

The larger the company, of course, the less likely you are to make out well with just a calculator. Everyone else does have them too, and if none of the 25 analysts following a stock can see what you can see in your calculator, there is a decent chance you’re the one that’s wrong. Fortunately, the company I want to discuss today is a tiny company with barely a 100 million dollar market cap. My calculator and some basic analysis tell me there is a terrific opportunity here. It’s no guarantee, of course, nor is any other investing idea, but it’s one of the best risk/reward plays I see right now. I’m guessing nobody else has pulled out the calculator yet, but might be dusting it off by the time earnings are reported, presumably in March.

The company in question is Frequency Electronics (NASDAQ:FEIM).

Frequency Electronics is largely a defense contractor, selling overwhelmingly to prime contractors like Lockheed Martin, but also to the US government. In fact, US government sales either directly or indirectly account for roughly 95% of the company’s business.

Their products include precision timing equipment, specifically various forms of atomic clocks, as well as frequency generation devices. The company’s equipment has been used on the space shuttle as well as the voyager missions and has applications in satellites, secure communications, electronic weapons systems, UAVs, etc. Their business is divided largely into space/satellite and non-space government business, with each tending to run in the ballpark of 50% of sales, with some fluctuations around that range.

Getting out my calculator, I’m going to suggest why I think the stock is likely to re-rate from its current level over the next year.

Let’s start with revenue. I’ll go into more detail on some of this below, but I am assuming their base revenue near term based on their existing backlog should continue to be in the recent range of the last 9 months between $12 and $13.6 million. Backlog has been a fairly reliable indicator of revenue, as I’ll detail a bit below.

There is reason to believe revenues will actually be significantly higher. That’s because the company announced a series of contracts in November of $25 million, $19 million, and $9 million, equal to roughly their last 12 months’ revenue in a single month. The first two contracts, amounting to $44 million, have an aggressive delivery schedule and are slated to be delivered in the next 2 years. These contracts are not included in the backlog above. If those are delivered as intended, it would add $5.5 million in revenue per quarter over the contract’s lifetime. If one assumes a steady state of business of $12 million quarterly based on existing backlog, and adds the $5.5 million quarterly from recent contracts, quarterly revenue would average $17.5 million.

In addition, there was an important nugget embedded in the most recent conference call that suggests not only will revenue be ramping up substantially, but it will be doing so at much higher margins than the current 30%.

I think that we feel pretty strongly that our gross margin is going to continue an upward trend. Of course, that’s not going to go on indefinitely. But we’re targeting gross margin of around 50% and we think that we can get there within the next six months to a year.

-Thomas McClelland (CEO) 12/12/2023 Conference call

A 20% increase in margins on top of a nearly 50% increase in revenue would be game-changing. Especially in light of what the company expects would be rather nominal increases in overhead. Again from that same call.

So SG&A on a dollar value number is going to run fairly consistent. I mean, again, if we grow substantially, yes, there’ll be some more costs in there. But percent-wise, as you see, it went down for getting the percentage to dollars even as a formula of income is down. So we expect it to stay at that current level where it is now unless things substantially grow.

-Steve Bernstein (CFO) 12/12/2023 Conference call

We have a company expecting significant increases in revenue, significant increases in margins, and relatively flat overhead. It doesn’t take a rocket scientist to see what meeting these targets would mean for earnings. Since I am most assuredly not a rocket scientist let me take a stab at what I think quarterly numbers might look like sometime in the next year.

Revenue: $17.5 million

COGS: $8.8 million

SG&A/R&D: $4 million (assumes 15% growth from current levels)

That leaves me with pre-tax income of about $4.4 million dollars, or EPS of $0.47 per share. Note the company has substantial NOLs that should shield it from most taxes near term and there are no real interest expenses. So what is a company showing huge growth in revenues, margins, and sporting nearly $2 a share in annualized EPS worth? I’m not sure, but I think it’s quite a bit more than the current share price, hovering a bit under $11 per share.

All of that is, of course, based on a whole bunch of future assumptions derived from the statements of the current management team, and some recent data. That leaves the question of how likely is it that some or most of this comes to pass. I think there is good circumstantial evidence it will. Let me go through those item by item. I’m going to break this into 3 parts suggesting why the existing revenue run rate should be sustainable, why the new contracts will likely be additive as expected, and why those margin targets are plausible.

Base revenue

My base revenue assumptions for the next year, excluding the recently signed batch of contracts in November, is approximately 12 million dollars a quarter, which is below the low point of 12.4 million dollars over the last 9 months. The primary argument here is that backlog has been fairly predictive of 12-month revenues. This makes sense as this is a funded backlog where money has already been committed.

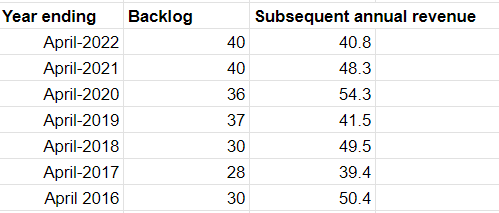

Going back to 2016, you can observe the year-ending backlog versus the revenue for the following year and see that revenues have consistently exceeded the end of year backlog. With backlog sitting at $49.7 at quarter end, a base rate of $12 million dollars quarterly would put them below every previous order conversion level going back to 2016.

Company filings

While no guarantee, orders do get canceled, things happen, I think expecting conversion rates slightly lower than historic levels is reasonable.

I would also point to what seems to be at least stable to growing demand in the space business. The U.S. Space Force requested a 13% budget increase for fiscal 2024 which is broadly supportive of federal investment in areas that would benefit the company.

On their fourth quarter conference call, Northrop Grumman, one of the company’s large customers, indicated they see mid-single digit growth looking forward in their space segment.

Space sales are now expected in the mid-to-high $14 billion range, with margins of approximately 9%. The mid-single digit growth rate in space reflects declines in a restricted program due to shifts in government priority, which are more than offset by growth in other parts of the space portfolio.

Overall, I think assuming the base relationship between order backlog, and revenues is sustainable, and reasonable near term especially in light of consistent messaging from major customers and priorities of the US government.

New contracts

The stated assumption here is that the company will achieve its stated revenue targets on the batch of large contracts announced in December, and that this will be additive to the base revenue levels described above. I’ll point to a couple of items here that suggest this is reasonably likely.

First, the company has indicated the work was long in coming, so they were well-prepared to start. Having been expected some time ago, the groundwork was laid, employees were hired etc. They also indicated as of the December earnings conference call that this work had already begun after a few million dollars of the funding was released.

They also describe this work as being on an aggressive timeline.

this is sort of a test to see if we and of course, our customer can deliver in this shortened period of time. Typically, a program like this would take roughly three years to do the same thing.

Ultimately, work has begun immediately on contracts with an intentionally unusually short time frame. This doesn’t guarantee that things will continue at the pace, but it does suggest the work is progressing as expected as of now and should move quickly. At least in terms of this contract, it seems to be the entire point of the work.

Gross margins

In the most recent conference call, management stated and reiterated they expect to arrive at 50% margins in the next 12 months. This is notably higher than their historic targets of 35% to 40%. So what has changed here? If you believe current management, there has been a philosophical shift in how they bid work.

Again from the December call.

I think that if we look historically, we’ve had a lot of difficulty with what we refer to as NRE programs, non-recurring engineering or a lot of new development activity. Historically, when those turn into later on into production, we’ve been able to do those very profitably, but we have been challenged with the development. And I think one thing that I’ve made a real effort to do differently, is we’re bidding these things differently. And I think to some extent, my experience here over many years, I have been involved in an awful lot of these development programs. And I know the pitfalls and the difficulties. And I think we’re pushing back really hard, and we’re making sure that we bid these in a way that we feel confident that we can be profitable. And so I think that’s one of the elements. I think then the rest is just kind of the devils in the details. I think if we look at the specific programs that have just come online in November, I think these have a smaller non-recurring engineering component to them. They are much more production and those historically, we have been very effective on.

The claim here is twofold. First, they are not bidding on contracts without adequate margin. Second, is that it is development and engineering contracts that have been problematic, while the recent batch of work is more manufacturing work. The implication there is both more discipline in how contracts are bid, and an order book that tends to reflect higher margin production work over lower margin engineering work.

At this stage, we are relying on comments from management more than anything else that those margin targets are achievable, which leads to management credibility as a key factor in evaluating the likelihood that they can achieve those rather ambitious goals.

This seems like a good time to delve into company history and take my best stab at the credibility of current management.

The current CEO is Thomas McClelland, who has been the company’s chief scientist for decades. He holds a PhD in physics from Columbia. He was named interim CEO in July 2022, replacing Stanton Sloane who took over in May 2018. The previous CEO’s tenure can only be fairly described as an utter disaster, racking up over 20 million dollars in operating losses between 2019 and 2022. Operating margins collapsed to -17% in his final full year at the helm.

There are two things I would observe about this change. First, the new CEO has been much more credible in his commentary, and second, he seems to have turned the ship around.

Since taking over in July 2022, revenues have increased from $8.2 million dollars in the quarter ending July 2022 to $13.6 million dollars or 65% in the quarter ending October 2023. In that same time, operating income has gone from a $3.1 million dollar quarterly loss to a $0.8 million quarterly profit. Gross margins have expanded from -0.06% to a positive 31.9%, tracking towards that 50% target. Backlog has increased from $40 million to $50 million or 20% excluding the recently announced contracts. To date, the operations speak to the competence and credibility of current management.

Getting to actual commentary, I went back through the conference call transcripts going back to July 2022 to evaluate the credibility of previous statements on the company outlook. As a relatively new CEO, there isn’t a ton to evaluate, but credibility to date looks good.

Here’s the rundown.

At this time, we anticipate the imminent award of several significant contracts.

In this case, I suspect he was referring to the batch of work reported this November. I would describe this as accurate but slower than expected.

There were two separate statements about profitability in fiscal 2023, first in Q1.

we’re working hard to get profitable as quickly as possible. Our goal is to break even at least, if not be profitable by the end of the fiscal year.

And again in Q2

Well, I wouldn’t say as likely that this fiscal year will be break-even. But I think the last quarter and going forward after that we do anticipate being break-even or perhaps a little bit better.

By the fourth quarter of 2023 the company hit exactly what was described in the first quarter of 2023, and reiterated in Q2, generating $13 million dollars in revenue and $0.2 million dollars in net income. This was right on the money.

My net take here is that given the recent changes in operations, and their predicted course, I’m skating to where the puck is likely to be. The company has indicated what should be a rapid ramp in revenue and earnings from a CEO who has performed superbly over less than 2 years while being fairly accurate in his forward-looking assessments. At the same time, they operate in a niche related to space and defense that is both sexy from an investor standpoint, and is an important focus of federal spending. It’s plausible they could re-rate on both earnings and multiple. The risk reward here is compelling.

The downside is protected by a solid balance sheet with no debt and almost a dollar a share in cash. There have been no recent insider sells and a flurry of small buys in 2022 and 2023 although at lower prices.

I think the ultimate tell here on whether my thesis is going to be correct is near term gross margins. Management has clearly stated they have changed their bidding philosophy to ensure profit margins. At this point, most of the backlog acquired under previous senior management should be working off the books. If they are correct here, we should start seeing gross margins and profits start to lift towards that target in the upcoming quarter. Even if they don’t reach my hypothetical numbers, moves in that direction should result in upside for the price of the underlying equity.

There are risks, of course.

-

Federal spending schedules are notorious for changes and delays. That could, of course, happen here and derail the forward outlook.

-

They have significant customer concentration, with almost all of their work deriving from federal spending and 4 customers accounting for more than 10% of revenue.

-

Engineering and project problems are always a risk, and can result in low or even negative margins. The characterization of their current batch of contracts being more production and less development oriented does mitigate that risk.

- Upcoming budget negotiations and the possibility of a government shutdown could weigh on delivery schedules.

I am trying to arrange a discussion with management to get a stronger feel for the business. I may do a follow-up post once that discussion is arranged. In the meantime, the risk/reward looks excellent here. We should get a better feel for whether I am right or whether this will blow up in my face when earnings are released again sometime in March.