PUGUN SJ

As many of my followers already know, I am bullish on the overall BDC space, but when it comes to VC-focused BDC names my stance is different.

In general, by allocating into BDCs, investors can access yields at a 9-13% level, which should be totally sufficient and attractive enough to not assume additional risk just for the sake of incremental 100 – 300 basis points in yield.

This is what BDCs, which lend and invest in VC businesses offer – a slightly higher yield with a higher risk profile. The enhanced yield-attractiveness among VC-focused BDCs mostly stems from higher credit risk premiums that are assigned to the relevant loans because of the usually loss-making businesses and speculative nature that depends on the success of early stage product and/or ability to find new strategic or financial equity owner.

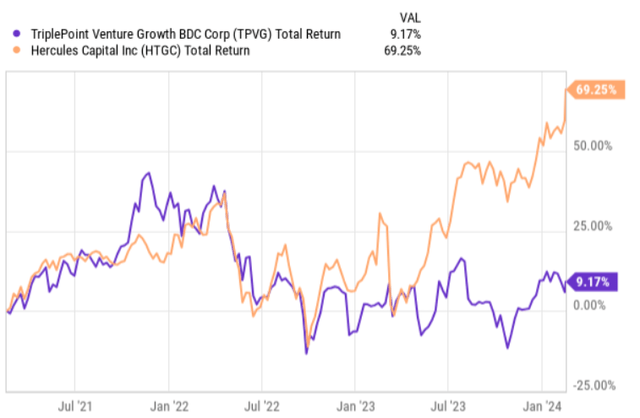

Granted, there are exceptions like Hercules Capital, Inc. (NYSE:HTGC) (see my article on it here), which have integrated quite tight underwriting standards and cherry-pick investments in a very prudent manner. Yet, in such cases, the yields are more balanced accordingly.

However, in TriplePoint Venture Growth (NYSE:NYSE:TPVG) case, I do not see this exception taking place. The BDC currently yields ~15% and carries several red flags, which render the seemingly attractive yield not sufficient on a risk-adjusted basis.

Let me now explain to you why I think that most prudent and risk-cognizant investors should avoid this stock. The list of these reasons is very long, so I will just focus on the one that is most critical in my opinion.

Thesis on staying away from TPVG

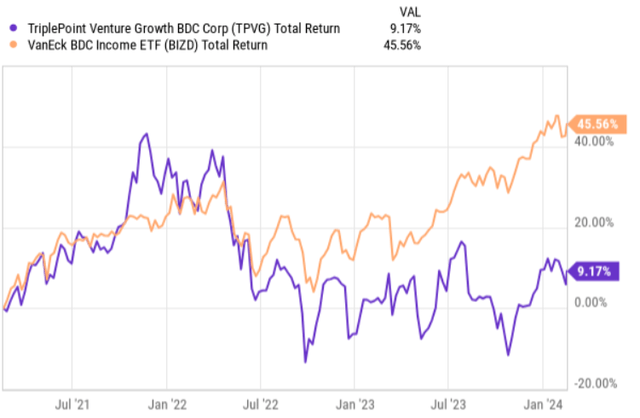

If we look at the total return chart below, which compared the results of TPVG to the broader BDC market, it is clear that TPVG has significantly lagged behind the index during an environment, which has been (and still is) extremely favorable for the sector.

The reason behind this gap lies in a combination of market-driven and idiosyncratic aspects. The former is explained by an overall slowdown in the M&A and IPO activity, which creates a drag on the VC businesses that are inherently reliant on “risk-on” financings. The latter is attributable to subpar structure and deteriorating quality at the TPVG end.

However, the major factor behind the negative alpha performance of TPVG has been the worsening situation in the idiosyncratic / BDC-specific profile.

The chart below captures this point very well, where we see how the previously mentioned peer HTGC has registered rich returns, even outperforming the market.

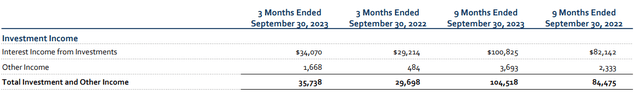

So, the simple explanation of this is the negative trajectory in the investment income component, which is a key measure for BDCs (e.g., it reflects the cash income that is adjusted for volatility in the paper gains or losses).

As we can see in the table above, the decline in investment income compared to previous periods has been massive, while for most of the BDC players, the corresponding figure has actually gone up due to a favorable interest rate environment and healthy portfolio qualities.

Now, there are 3 aspects that we have to consider which together account for most of the essence behind the aforementioned drop in TPVG’s top-line measure.

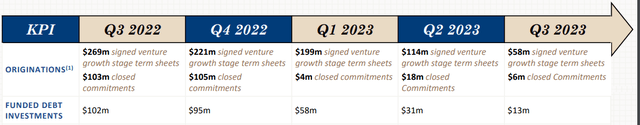

First, the origination volumes have suffered a lot, declining to as low as ~$13 million in the most recent quarter, which is totally insufficient to maintain the existing AuM base after organic and early repayments.

What this means is that the total base from which TPVG can generate value and capture spreads between its cost of financing and portfolio yields shrinks, thereby quite naturally introducing headwinds on investment income generation in absolute terms.

Theoretically, once this changes and markets become more active, TPVG should benefit accordingly and get back the portfolio at an optimal level.

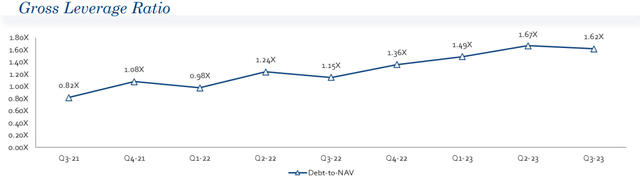

Nevertheless, if we take a look at the chart below, there is a notable reason to be skeptical about this. And this brings us to the second aspect – i.e., overly aggressive leverage structure.

Currently, TPVG’s leverage profile is aggressively high. It has the fourth most debt-saturated balance sheet in the BDC sector. Plus, the trend in the gross leverage ratio is unpleasant even though the net investment volumes have dropped.

It is only logical that the market has punished TPVG for having this high leverage as a VC-biased BDC, while the investment income has been worsening or taking the opposite direction as the BDC’s leverage.

The third aspect in these equations is the situation on the non-accrual front. As of now, TPVG has 11% of its cost value placed under the non-accrual status. This is a very high number both in absolute and relative terms if compared to the BDC average, which typically lies between 2-5%.

In fact, an increased non-accrual base has been one of the stimulants for TPVG’s leverage going up as the Management was forced to write down several assets, which reduced the underlying equity portion and grew the debt chunk accordingly (on a relative basis).

The bottom line

TPVG is a BDC, which embodies not only unfavorable characteristics at a structural level, but also negative dynamics at its underlying portfolio level.

It invests in VC businesses, which inherently elevates the risk profile due to exposure to companies that are not fully financially self-sufficient. TPVG’s leverage profile is astronomically high (one of the highest in the sector), which coupled with tiny investment volumes and excessive non-accrual investments, introduces huge pressure on the BDC’s ability to preserve value going forward.

Given the aforementioned dynamics, the current yield of ~15% is not sufficient to justify the risk.

With that being said, TPVG could very likely continue to trade sideways or even experience a slight uptick in its share price. As we saw in the very first chart at the beginning of the article, TPVG has actually registered positive total return performance despite its issues at the portfolio-level. It might be so that the market tailwinds support TPVG’s valuation going forward, making it a too risky short.

In a nutshell, I would avoid TPVG and consider other BDC opportunities.