Walmart (WMT 0.63%) is headed for Splitsville. No, the giant discount retailer isn’t about to break up into separate companies. It isn’t planning to sell off any of its units, either.

Instead, I’m referring to Walmart’s announcement roughly two weeks ago that it plans to conduct a 3-for-1 stock split on Feb. 26, 2024. CEO Doug McMillon explained that the company is splitting its stock because its founder, Sam Walton, felt that Walmart’s share price should be affordable for its associates. McMillion said, “Given our growth and our plans for the future, we felt it was a good time to split the stock and encourage our associates to participate in the years to come.”

Will Walmart stock jump after its upcoming stock split? Here’s what history shows.

Walmart’s stock split history

Before we get to that history, let’s first address why a stock split might provide a catalyst. The idea is that many retail investors are less likely to buy stocks with high share prices. Since splitting the stock lowers the share price, these investors could rush in to buy the stock at a lower price. This then creates buying pressure that pushes the share price up.

Does this theory work in the real world? Sometimes it does; sometimes it doesn’t.

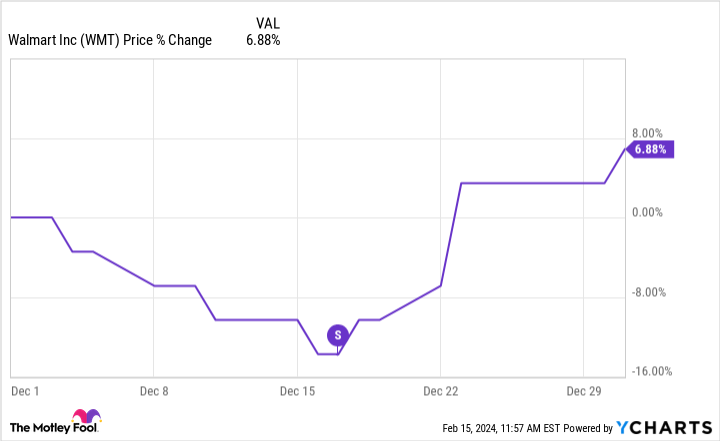

Walmart has conducted nine 2-for-1 stock splits through the years. The first one was on Aug. 25, 1975. There wasn’t a big move in share prices before or immediately after the split. It was a different story with the company’s next 2-for-1 stock split on Dec. 17, 1980, though. Walmart’s shares had been sliding lower before the split but rebounded nicely after the split.

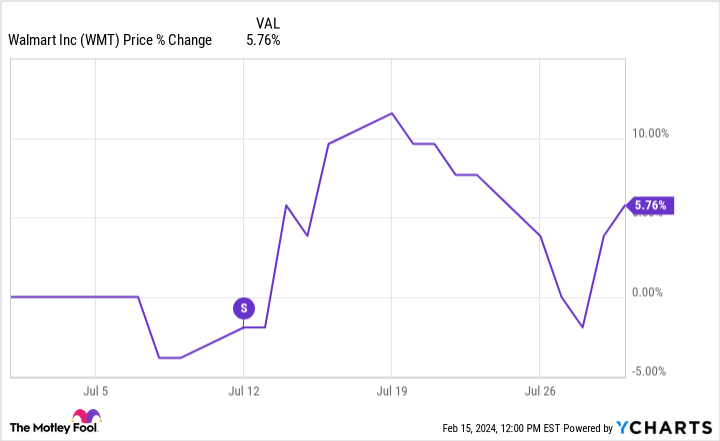

On July 12, 1982, Walmart conducted another stock split. Again, the split seemed to serve as a catalyst.

Almost exactly one year later, the discount retailer was at it again. Walmart conducted another 2-for-1 stock split on July 11, 1983. This time, there was a bump immediately after the split followed by a decline within a matter of days.

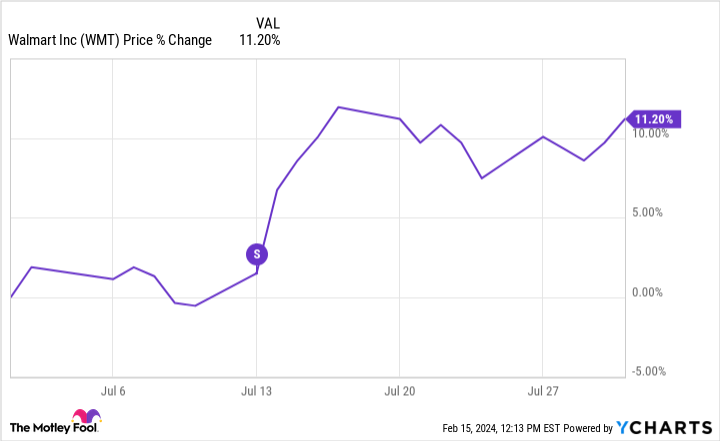

The next two splits for Walmart came in October 1985 and July 1987. Walmart’s share price jumped after each split, with the one on July 13, 1987, followed by an especially strong gain.

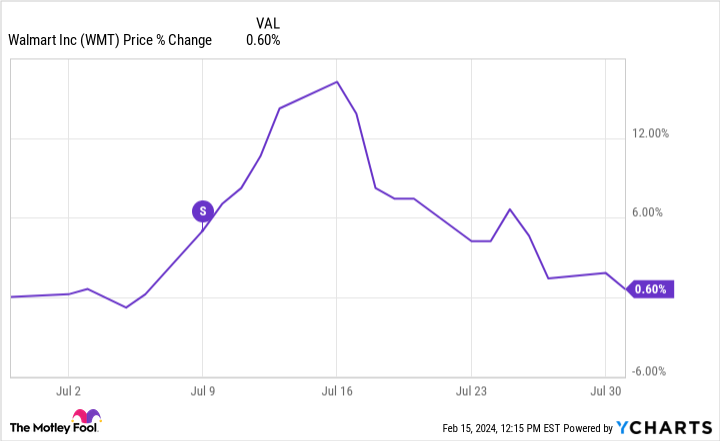

However, this pattern wasn’t always replicated. For example, it isn’t clear that the stock split conducted on July 9, 1990, caused Walmart’s shares to rise since an uptrend was already underway.

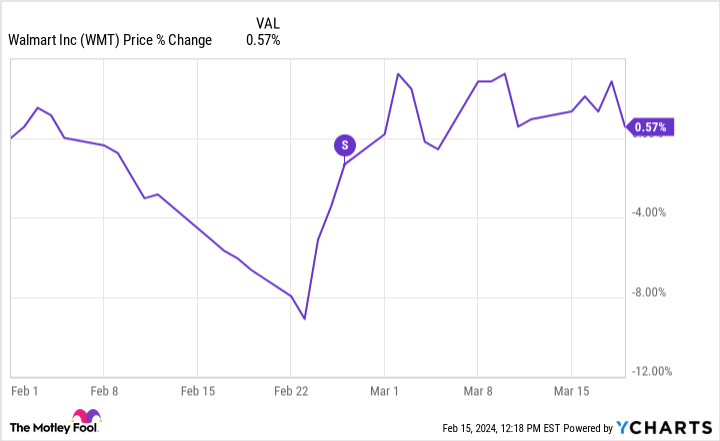

It’s also hard to tell if Walmart’s next stock split on Feb. 26, 1993, affected the stock’s performance. Shares were already rising before the split and continued to do so for a few days afterward.

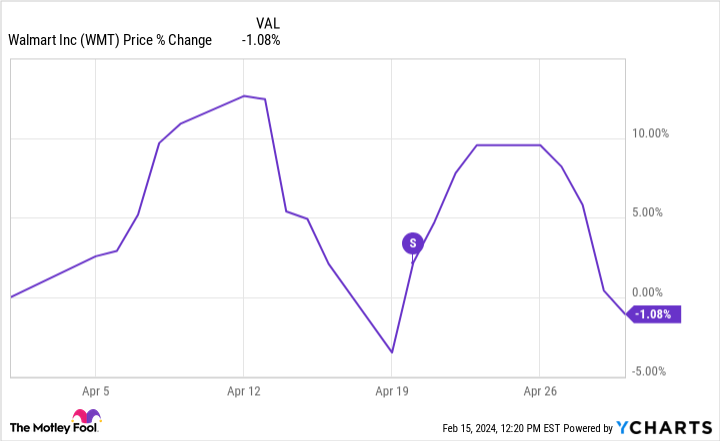

Walmart’s most recent stock split occurred on April 20, 1999. Again, whether or not the split served as a catalyst is debatable. The stock was already rebounding before the split. Walmart’s shares kept rising briefly after the split. However, all of the gains soon evaporated.

The key lesson from Walmart’s stock split history

I think there’s one key lesson from Walmart’s stock split history: There’s no way to know what the stock will do after a split. Investors will be better off focusing on the company’s underlying business, growth prospects, and valuation.

Walmart’s underlying business is exceptionally strong. Wall Street expects the company to generate fiscal 2024 revenue of around $645 billion. Walmart continues to generate solid profits and free cash flow.

Granted, Walmart doesn’t have the tremendous growth prospects now that it’s a retail giant with a market cap topping $450 billion than it did years ago. However, the company’s e-commerce and advertising businesses stand out as two important growth drivers for the future.

My biggest concern with Walmart is its valuation. The stock trades at a forward price-to-earnings multiple of 23.8x. That’s not an absurdly high premium, but it’s not cheap, either. I still like Walmart as a long-term pick. Waiting for a pullback to buy could be investors’ smartest move, though.

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walmart. The Motley Fool has a disclosure policy.