Jeff Kravitz/FilmMagic, Inc via Getty Images

Investment Thesis

AMC Networks (NASDAQ:AMCX) has been facing secular headwinds as cable cord-cutting continues to pressure top-line growth. However, despite the continuing trend away from cable, AMC Networks continues to show strong free cash flow as they streamline operations and focus on niche quality content for select demographics. I believe the stock is undervalued as earnings and free cash are likely to continue as AMC Networks can leverage spin-off shows from their highly praised content. Furthermore, the company is seeing positive momentum in their streaming business, which could offset continued declines in cable.

Content Is King

AMC Networks is a global entertainment company that owns and operates cable television networks and streaming services. Their business model is based on distribution of their programming and advertising. According to their 2023 annual report, “In 2023, distribution revenues and advertising sales accounted for 74% and 26% of our consolidated revenues, net, respectively.” Distribution revenues refer to the “fees charged to distributors that carry our network brands and content; subscription fees paid for our streaming services; and revenue earned from the licensing of our original programming.” Advertising refers to “selling advertising time on our programming networks, on digital platforms we own and on an increasing number of AVOD and FAST platforms in the U.S. and the U.K.” Based on their business model, an investor should pay first and foremost to the quality and quantity of content AMC Networks produces because content drives a key role in how much distribution and advertising revenue they make. The better the content, the more attention and demand for their services.

Legacy Content Creates Potential For Future Hits

The company still boasts award-winning original series like “Better Call Saul” and “The Walking Dead”. However, many investors are concerned as these shows have come to their end with the final seasons.

However, management has still been able to use the built-in audience and strong brand recognition to create spin-off shows based on these iconic shows. I believe that AMC Networks can continue to produce original, high-quality content by leveraging its iconic intellectual property to create new shows that continue to generate revenue.

According to their Q4 press release, one of their operational highlights talks about new original content for 2024, “Kicking off 2024 with highly anticipated new original programming including:

- Monsieur Spade, starring Clive Owen, on AMC, AMC+ and Acorn TV, which premiered in January.

- The Walking Dead: The Ones Who Live, starring Andrew Lincoln and Danai Gurira as their iconic characters, Rick and Michonne, premiering February 25th.

- Parish, starring Giancarlo Esposito, which debuts on AMC and AMC+ in March.

- Orphan Black: Echoes, starring Krysten Ritter, set in the world of Orphan Black, to launch on AMC, AMC+ and BBC AMERICA.”

The Walking Dead franchise continues to stay alive and bring fans and attention back to AMC Networks. The universe is immense, and show after show can continue to spawn from out of the legacy show. There are still at least four versions of The Walking Dead spin-offs in some form of active status, with many more likely to come. Given the talent, focus, and brand loyalty this franchise commands, I highly doubt that the Walking Dead will actually fade away in peace. Therefore, the distribution revenue should be able to hold up and eventually stabilize in the future.

Furthermore, their offerings are seeing some remarkable success. According to the Q4 earnings call transcript,

“AMC+ and HIDIVE achieved their number one quarters ever in terms of viewership and Shudder and Acorn TV also showed significant strength close the year. Programming achievements included first season of The Walking Dead: Daryl Dixon, which is now the most watched season in the history of AMC+, and that includes the final season of The Walking Dead itself. VHS 85 is Shudder’s most watch film ever. The Eminence In Shadow Season 2 is HIDIVE’s the most watched season ever, and Toya & Reginae is All Blacks number one new series of all time in both viewership and customer acquisition. We had a lot of success with our shows and films last year, and the year ahead looks just says exciting.”

Despite this success, the net revenues are still down 12.4%, so this is still just a silver lining instead of a growth factor. Still, there is positive news among the thick clouds of cable cord-cutting decline. My belief is that the company can still successfully shift away from cable and more into producing original, high-quality content, and build a franchise that allows them to tap into continuously to create a stream of future hits. This rather unpopular view may hold some weight after all, as their original content continues to break record high views.

Streaming Growth May Offset Cord-Cutting

Investors have been eyeing streaming revenues as a potential offset to the continued cable business decline. For 2023, the Q4 2023 earnings call indicates “Full years streaming revenue increased 13% to $566 million. For the quarter, streaming revenue increased 4%.” Management continues to focus on and show optimism for streaming growth in 2024, “And we expect year-over-year streaming revenue growth in the high single-digit to low double-digit range driven by broader distribution of our offerings, selected price increases, as well as disciplined acquisition marketing efforts.”

AMC Networks announced an ad-supported version of their streaming service called AMC+. Showing positive momentum, management has several deals with other partners to spread their brand and streaming services across the globe:

- Recently completed a deal with Philo that adds AMC+ as part of Philo’s video offering.

- Strong results from their partnership with Max

- Continuation of strong partnership with Charter and Comcast as they roll out Xumo TV

Management’s aggressive focus on spreading their streaming services has shown positive results in the press release. CEO Kristin Dolan says, “I’m encouraged that this year we were able to grow streaming revenue and strengthen our subscriber base, expand our consolidated AOI margin to 25%, and meaningfully grow our free cash flow.” Despite the ugly revenue declines, a closer look at streaming shows exciting improvements. I believe investors should weight the streaming business as a potential growth driver that may offset the continued declines from cord-cutting.

Free Cash Flow Remains Strong

I believe that management has run a very tight ship and their efficiency in streamlining the business has paid off. Namely, “Our 2023 results, including a healthy 34% normalized free cash flow conversion ratio, and a reduction of gross debt of approximately $460 million, a reflection of these priorities which we’re carrying into 2024.”

If content is king, then cash is queen and the business is seeing plenty come in. According to management, they expect cash to continue to roll in, “And over the next two years, we expect to generate cumulative free cash flow of approximately $0.5 billion.” This adds up to almost ~80% of the current market cap, a significant amount.

Much of this cash could be used to reduce debt, as the company has already repurchased their senior notes. With the current free cash flow continuing, the company is actually pretty financially healthy and solvent.

Adjusted Operating Income margins (AOI Margin) continues to see strength despite declines in revenue, “Despite the revenue headwinds, in 2023, we actually increased our AOI margin to 25%, the first year-over-year increase in margins since 2017.” While everyone is laser focused on the top-line declines, management continues to show optimism in managing their margins and free cash flow to drive shareholder value.

While continued revenue declines are expected, I believe the margins and free cash flow will continue to remain strong.

Valuation – Shares Are Worth $20

Starting with TTM Revenues of $2.7 billion, I believe revenues will decline 10% year over year for 3 years and eventually stabilize. Continued cord-cutting plus a weak macro environment will likely continue to cause revenue to decline. However, streaming will likely begin to offset declines from traditional cable viewership. I think AMC Networks may be able to shrink itself into strong profitability, and management has proven they can generate cash and maintain margins despite declining revenue. Thus, at around $2 billion in revenue, I forecast net margins of 7%, roughly around the 5-year average. That leaves profits of $140 million, and divide that by 44 million shares outstanding, is around ~$3 EPS.

Going forward, the $3 EPS is likely sustainable as management continues to streamline their business and focus on being a niche streaming provider of unique content. My $3 EPS forecast is significantly lower than sell-side estimates of $5+ EPS, so I believe my assumptions are incredibly conservative.

Then, applying a 7x multiple on $3 of EPS gets me to around $20, rounded down. My assumptions are incredibly conservative given the uncertain nature of the business. Even with the declines in revenue, I still believe the stock is undervalued due to its strong free cash flow and high margins.

Potential Risks

The biggest risk remains the gradual shift away from cable and into streaming, which hurts AMC Networks because of declining viewership and ad revenue for AMC’s linear channels. The trend continues, as more and more people don’t see the value in cable anymore.

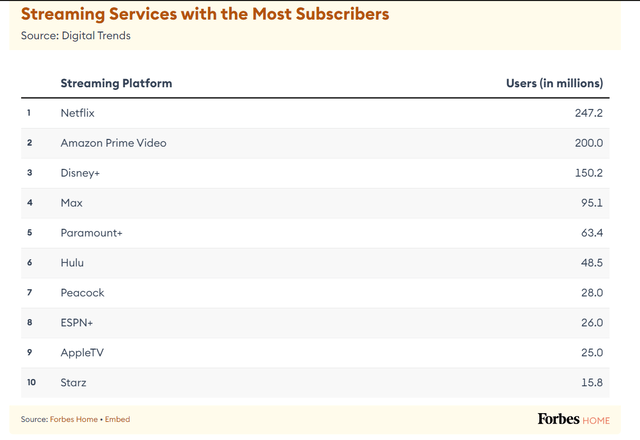

Furthermore, the competition in streaming is rather fierce, and other platforms have more money and resources to purchase and nurture content. Specifically, Netflix (NFLX) and Disney (DIS) are two larger players that have shown some dominance and stronger numbers than AMC Networks.

Sad to say, but AMC doesn’t even make the list for top 10 streaming services with the most subscribers. Because of this smaller scale, the business may suffer from higher costs per content because they lack the scale economies to spread fixed costs over a larger subscriber base.

It was last reported in the press release that AMC Networks had 11.4 million subscribers across all their platforms, which is 5% of Netflix’s subscribers. Which means any amount of fixed content purchase per subscriber would cost AMC Networks ~20x more as they spread that purchase over a much smaller base of subscribers. That’s a huge difference, so the bigger players continue to enjoy some cost advantages that stem from scale economies.

Ad revenues may continue to be under pressure as macroeconomic challenges still persist across the globe, although this is for all industry players, not just AMC Networks. Because of continued cord-cutting, ad revenue will likely continue to decline and continue to pressure the top-line.

And finally, their strategy of targeting niche audiences that want very unique content may not work as the larger players are entering those markets. Netflix has already delved deep into areas that AMC Networks has a stake in, such as anime and comic book adaptations. It may be tough for AMC Networks to continue to differentiate because if they can do it, the larger players can do it as well with larger pocketbooks.

Buy AMC Networks

The bull case for AMC networks seems rather tough, as the market is extremely pessimistic over the company’s future. Despite the obvious headwinds, the company still generates remarkable free cash flow and significant AOI margins. Assuming very conservative estimates, a $20 share price target is rather reasonable, as it already discounts all the cord-cutting and ad-revenue declines. Management has shown great prudence in running a tight ship and focusing on free cash flow. They focus on reducing unnecessary expense and creating high-quality content that is unique for a specific audience. Given the promising streaming revenue growth, I believe shares are undervalued and are a buy.