sreeyashlohiya/iStock Editorial via Getty Images

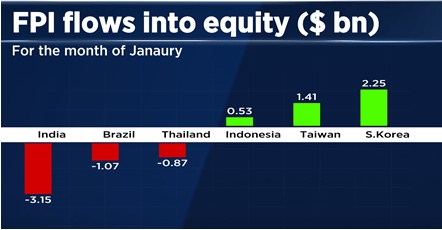

In contrast with the downbeat mood this time last year, India is quickly emerging as a consensus emerging market favorite. To some extent, re-rated P/E valuations reflect the improved sentiment. Yet, a lot of capital is still sitting on the sidelines (note Indian stocks saw the biggest monthly foreign outflow in a year last month). Market accessibility and expenses (visible and ‘invisible’) also continue to be major issues for foreign funds looking to invest directly in Indian listings.

CNBC

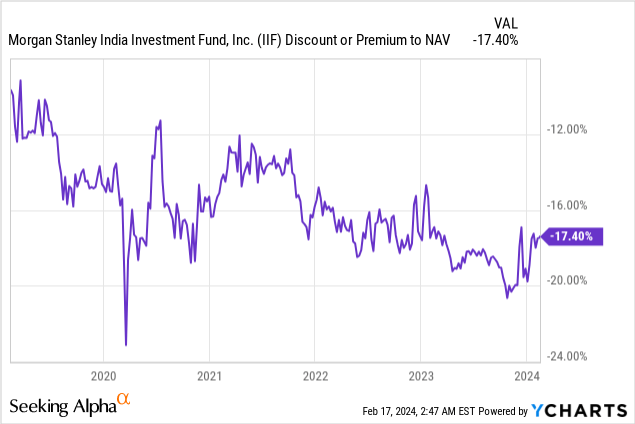

Given this context, active managers like the MS India Investment Fund (NYSE:IIF), a fund managed by Morgan Stanley (MS) Investment Management, remain an attractive vehicle to play India. Adding to its appeal is the fact that IIF is priced at a unfairly wide discount to net asset value (NAV) – despite a track record of outperformance both relative to its benchmark and passive ETF alternatives. And going forward, IIF’s portfolio exposure to the incumbent government’s infrastructure push also makes this an interesting bet ahead of general elections in the coming months.

Easing liquidity conditions are something to look out for as well, particularly in light of the recent Monetary Policy Committee voting shift (one vote for a 25bps rate cut). Also noteworthy was the central bank’s lowered consumer inflation forecast, in line with the decelerating core inflation trend we’ve been seeing lately. This clears the path to more dissent at April’s meeting, in my view, and potentially a sooner-than-expected liquidity pivot (currently a key overhang for banks, as I highlighted here). Amid relatively cautious rate expectations as well, there’s likely still room for equity valuations to re-rate should we see a pivot later this year.

Either way, IIF has the wind at its sails and should benefit from both a (likely) BJP election win and easing liquidity conditions. The high-teens % discount (slightly down from when I last covered IIF) and mid-single-digit % buyback run rate only add to investors’ margin of safety heading into a catalyst-rich next few months.

IIF Overview – As Concentrated as Ever; Slight Portfolio Changes Ahead of Election Season

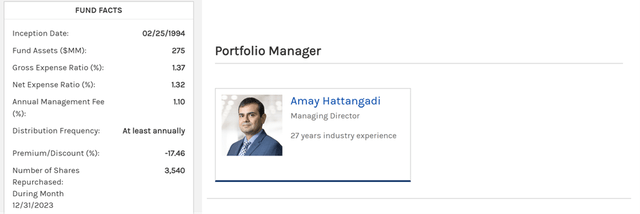

The actively managed India Investment Fund, which seeks to outperform its benchmark MSCI India index, has seen its headline assets decline to ~$275m since I last covered the name. This was, however, down to a big 2023 distribution (low teens % implied yield) rather than outflows. IIF’s expense ratio also remains very competitive at ~1.4% gross (~1.3% net of waivers), comprising a 1.1% management fee. For context, IIF’s actively managed peer, the abrdn-managed India fund (IFN) has a similar fee structure despite its larger asset base, while passive alternatives like iShares’ India 50 ETF (INDY) charge ~0.9% in fees. Crucially, the fund’s stock selection approach and lead manager, Amay Hattangadi, also remain unchanged.

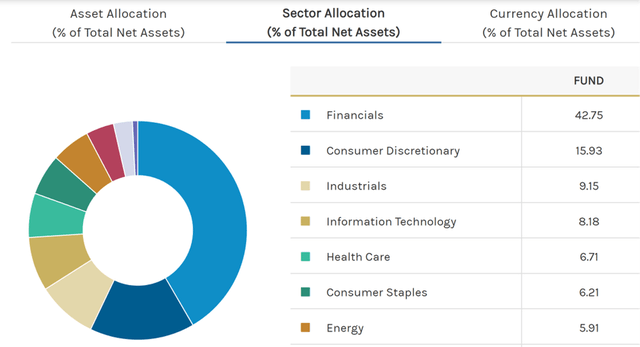

In the meantime, IIF has maintained a concentrated portfolio heading into the coming months’ elections. The two largest sector allocations, Financials Consumer Discretionary remain consistent with prior quarters, though they now comprise a larger % of the portfolio at 42.8% and 15.9%, respectively. Of note, Industrials is the big portfolio gainer at 9.2%, while Information Technology remains a key holding at 8.2% (broadly unchanged despite the sector’s recent post-earnings rally). All in all, the makeup and concentration of the top five sectors (now an even larger 82.7% of the portfolio) deviate quite significantly from IIF’s MSCI India benchmark, so investors looking for a ‘benchmark agnostic’ manager (vs ‘benchmark aware’ IFN) should find a lot to like here.

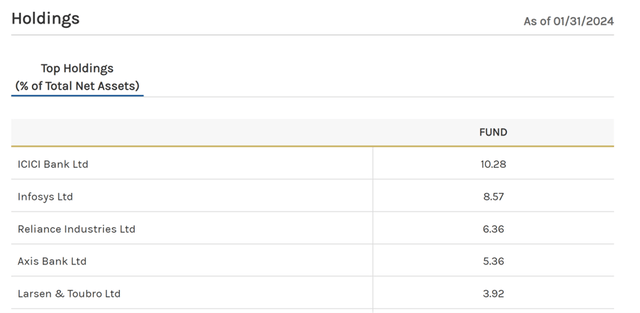

IIF’s single-stock holdings haven’t been altered too much since last quarter but concentration levels have increased. The top holding remains ICICI Bank (IBN) at a slightly larger 10.3%, while the absence of HDFC Bank (HDB), in contrast with its presence in the MSCI India Index and virtually all other Indian active and passive funds, continues to be notable. The relative overweights on infrastructure plays like Larsen & Toubro (3.9%) and state-linked entities like State Bank of India (3.6%) are also key differentiators. Finally, the >100% equity exposure (cash position now at -2.8% vs. ~4% previously), indicates IIF is now geared slightly – timely as an election catalyst looms large.

IIF Performance – More Outperformance; NAV Discount Adds Cushion

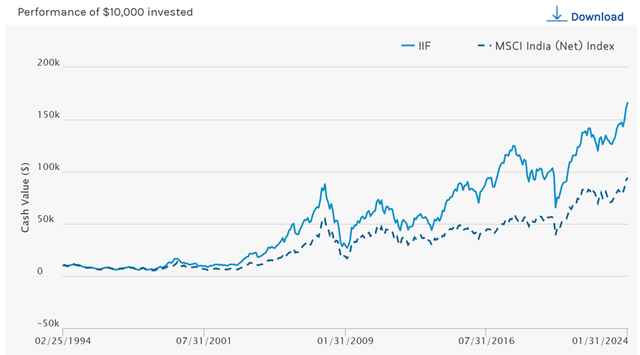

IIF ended 2023 on a particularly strong note at +23.4% in NAV terms. This was well ahead of MSCI India (+20.8%) and the largest and most liquid passive MSCI India tracker, INDA (+17.5%). With the fund extending last year’s positive returns into early 2024 as well, the fund has now compounded further ahead of its benchmark at an impressive +9.8% in NAV terms (vs. +7.7% for MSCI India) since inception. Actively managed comparable, IFN hasn’t outperformed by quite as much, though it does track MSCI India a lot more closely by virtue of its lower-risk stock selection approach.

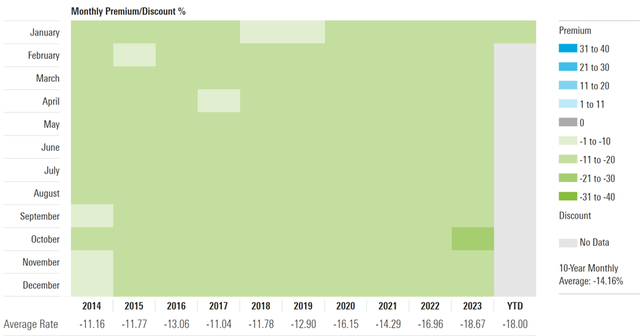

As for IIF’s NAV discount, it has narrowed somewhat over the last quarter but remains at a rather wide high teens %. The fund maintains healthy distributions ($3.14/share from capital gains), though, along with a sizeable buyback program (mid-single-digit % of shares outstanding), so there is a path to narrowing the discount over time. In any case, history points to a ‘fair’ NAV discount in the low to mid-teens %, so patient investors get additional safety margin at current levels. Also worth noting is the optionality in IIF (vs IFN, which trades at a premium to NAV) should the manager implement a similarly investor-friendly playbook down the line.

Active Indian Fund Poised To Ride a Catalyst-Rich 2024

Ahead of India’s general elections, traditionally a major positive catalyst for markets, IIF is as good a fund as any to capitalize, in my view. Not only is this an active manager with a proven track record of navigating the cycles, but its portfolio selection indicates the fund has a larger exposure to election beneficiaries than US-listed comparables. Thus, investors willing to underwrite a high-probability BJP government win will find a more attractive risk/reward equation here than say a passive MSCI India tracker or ‘closet indexer’ type fund like IFN.

Election or no election, it’s worth noting that fundamentally, Indian large-cap earnings are trending in the right direction. Alongside the improving prospect of monetary easing later this year, IIF’s high-quality portfolio should float on the rising tide. A historically wide high teens % discount to NAV and ongoing buybacks only further tip the scales in investors’ favor and thus, I continue to favor IIF for India exposure.