champpixs

After the bell on Thursday, we received fourth quarter results from streaming platform Roku, Inc. (NASDAQ:ROKU). While the company handily beat revenue estimates for Q4 and issued decent sales guidance for the current quarter, shares tumbled as investors worried about the company’s competition in the near term. At this point, Roku has certainly set itself up for success, so the plunge might make the name worth another look.

It’s been a while since I covered the name, as I went bearish during 2022 when the company’s growth tailed off after a coronavirus boom. When you include the post-earnings fall, shares have basically matched the S&P 500 since then, with markets soaring to new highs quite often these days. However, Roku is in a much different place now, as it is not the huge loss-leader it once was and has built a more solid foundation.

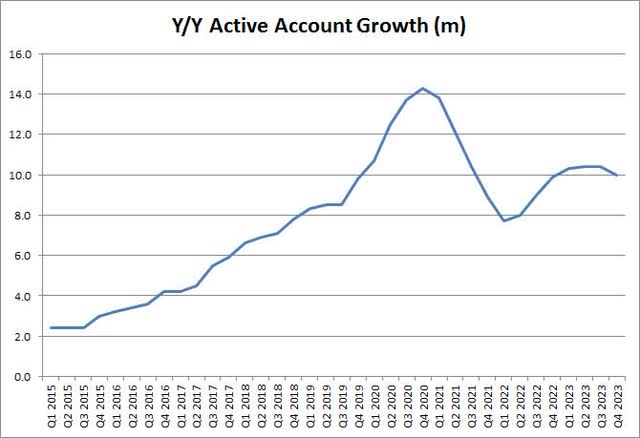

The COVID-19 panic helped to accelerate the transition from linear television and cable bundles to streaming services like Netflix, Inc. (NFLX) and Amazon.com, Inc. (AMZN) Prime. Consumers flocked to Roku-powered TVs as a way to access these subscriptions, and the company saw its account growth soar at one point to more than 14 million in a twelve-month period. As the chart below shows, growth rates naturally came back to earth, but the company has now announced four straight quarters where account growth was at least 10 million year over year.

Roku Account Growth (Company Earnings Reports)

For Q4, Roku announced revenues of more than $984 million. Not only was that up more than 13% year over year, but it beat street estimates by about $17 million. Streaming hours jumped by more than 20% year over year, and for the full year were up 180% since 2019. Revenues per user did decline a little as there have been some economic pressures on advertisers, but those headwinds are better than they were earlier in 2023. Guidance for the current quarter called for revenues of $850 million, which was a little more than $15 million ahead of the street. That’s good news, considering management has been a bit conservative with its sales forecasts in recent quarters.

There are two reasons why Roku is in a better place today. First, the company has worked to get its expense base in line. Net losses for 2023 were $353 million when excluding restructuring expenses, an improvement from the nearly $460 million seen in 2022. Further reductions in losses are expected over time as the company looks to GAAP profitability. Management has guided to a net loss of $90 million for Q1 2024, compared to a more than $193 million loss in the prior year period (that did contain $31 million in restructuring charges).

The second positive item today is that reduced losses have meant cash flow trends have significantly changed. A year ago, this was a company burning through $150 million in a year, but now it is reporting positive cash flow per year of more than that amount. Yes, a lot of this cash generation is really through the add-back of stock-based compensation, so there is some dilution over time, but that was a double hit in previous years when cash burn was resulting in equity raises. Roku finished last year with about $2 billion in cash and no debt, so the balance sheet is pretty healthy at the moment.

The reason investors are worried about Roku at the moment is that reports surfaced this week about Walmart Inc. (WMT) potentially buying VIZIO Holding Corp. (VZIO). A deal here, which has not even been formally announced yet, would likely pressure Roku’s short-term account growth, but Roku does have a lot more scale than Vizio. Roku also has an advertising partnership with Walmart, so it doesn’t appear that the retail giant would completely abandon the streaming device maker even if it goes through with the purchase.

In terms of valuation, Roku trades at a significant discount to a name like Netflix because of its lower revenue growth rate and lack of profitability. Netflix is also kicking off a bunch of cash right now, allowing for a stock buyback program. Roku currently fetches about three times its expected revenues for 2024, while Netflix goes for a little more than 6.5 times. Part of the reason why Roku shares have risen a bit since I last covered them is the substantial rally in Netflix shares, which have more than tripled since their 2022 lows.

Because of the improved profitability and cash flow situation, I am upgrading Roku shares to a hold today. Investors shouldn’t have to worry about large losses and significant dilution in the near term, but the uncertainty around the potential Walmart acquisition is what gives me pause from fully going to a buy rating today. If we get a bit more clarity on that situation that’s not too negative and Roku can put another couple of good quarters in the books, I think it could narrow the gap a bit in terms of the Netflix valuation, which I would think could mean a trade up to about 4 times revenues for Roku.

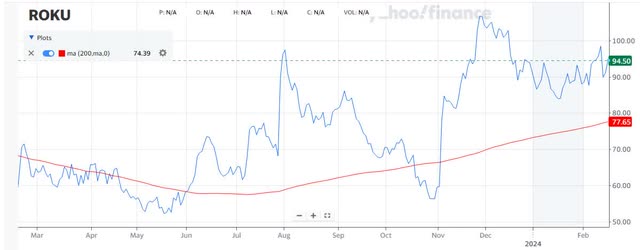

As the chart below shows, the time to buy Roku in the past year has been with shares below the 200-day moving average. That key technical level (the red line in the chart) is a little under $78 at the moment, so I also cannot recommend buying until that technical situation becomes a bit more favorable. That would mean another $5 to $10 of downside from the low $80s that Roku is trading at in Thursday’s after-hours session following the Q4 report.

Roku Last 12 Months (Yahoo! Finance)

In the end, Roku shares slumped despite a solid Q4 report, so investors could probably start looking at the name again. The company has continued to add millions of new accounts each quarter, and despite some advertising softness that continued throughout 2023, Q4 revenues handily beat street estimates. Management has worked to get net losses down and improve cash flow trends, setting the name up for future growth that hopefully comes with profits. The valuation may never equal that of the more profitable Netflix, but the gap could narrow if Roku can hit its targets. The only things stopping me from a buy recommendation today are the potential Walmart acquisition of Vizio hurting near-term growth, along with the stock still being a bit above its longer-term trend line.