Joe Hendrickson

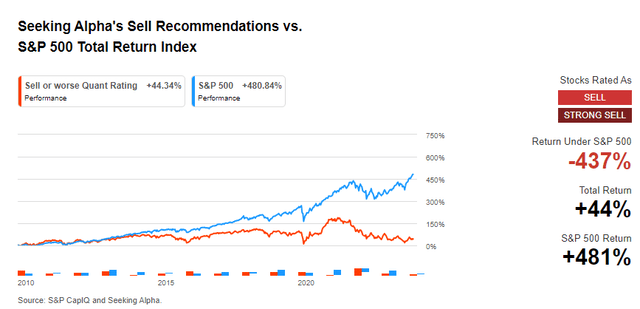

Cinemark Holdings, Inc. (NYSE:CNK) reported its Q4 and FY 2023 earnings results pre-market today (February 16th, 2024) as Seeking Alpha has covered here. My only previous coverage of Cinemark was back in April 2023, where I rated the stock a “Sell” on the back of its huge debt and Free Cash Flow [FCF] worries. Since then, the stock has gone up <1% while the market has gained nearly 22% in the same time period. Today’s earnings report offers the perfect opportunity to see how things have changed for Cinemark after almost a year.

Let’s review The Good, The Bad, and The Ugly from Cinemark’s Q4 report.

The Good

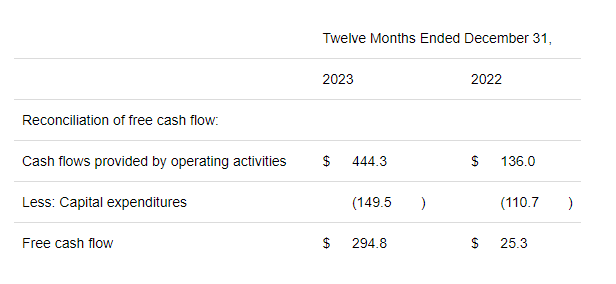

- In my previous review, I had mocked the company for its “Free of Cash Flow,” and it looks like the management made it a point to improve this in 2023. Cinemark now has recorded three consecutive quarters (including Q4) of positive FCF, with FY 2023 recording a total of $295 million. That’s almost a twelve-fold increase from the $25 million recorded in 2022.

CNK 2023 FCF (Seekingalpha.com)

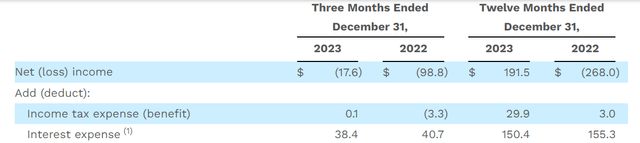

- Cinemark reported reducing its debt by $100 million in FY 2023, and it resulted in its interest expense reducing by $5 million. Although debt is largely a negative situation still for Cinemark (as covered below), I am highlighting this in the good because over the last five years, debt has increased by more than 30%, and it looks like the company has finally hit the brakes and turnaround in addressing debt.

Interest Expense (ir.cinemark.com)

- Cinemark once again beat revenue expectations, marking the 13th consecutive quarter where the company has done so. Sticking with revenue, Cinemark brought in about $3.1 billion for FY 2023, and that means the company is valued at a price-to-sales ratio of just about 0.65 based on current market capitalization of ~$2 billion. Undervalued, dare I say? Not so fast.

- Cinemark’s cash and equivalents balance went up to nearly $850 million at the end of Q4 and FY 2023. This continues the company’s strong trend on this metric where cash on hand has almost exactly doubled from the $426 million at the end of December 2018.

The Bad

- Cinemark’s management repeatedly called out the Hollywood strikes in the earnings call. This is clearly expected to hit the number of titles hitting the big screens (aka revenue and net income will take a hit) but the company stated it was not planning to cut down its capital expenditures. In other words, brace yourself for a likely operating loss in 2024 after just reversing the trend in 2023.

“That said, in 2024, we expect to prioritize more of our capital deployment towards long-term strategic opportunities, including new builds and other ROI-generating initiatives, mainly premium amenities.“

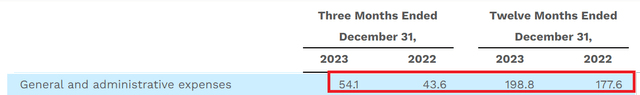

- Speaking of expenses, while Q4 revenue went up 6.50% YoY, general and administrative expenses went up 24% YoY. On an annual basis, admin expenses went up nearly 12%. A dollar saved is worth more than a dollar earned for any company and this is especially true for companies like Cinemark that are cyclical and have generally been under existential threat for a while.

CNK Expenses (ir.cinemark.com)

- Share-based compensation expenses went up 16% YoY in FY 2023 to reach $25 million. While this hasn’t led to much of a dilution yet, investors need to keep an eye on the total shares outstanding.

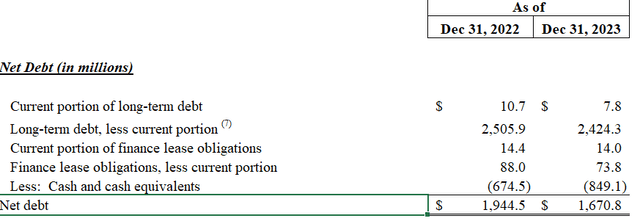

- Cinemark reported net debt of $1.67 billion at the end of FY 2023. While that represents a healthy 14% decline YoY, it is still substantial when you consider that Cinemark’s market capitalization is around $2 billion. Unless the company’s cash flow situation continues its recent upward trajectory and the company pays down its debt aggressively, I don’t see the stock turning around.

CNK Net debt (ir.cinemark.com)

Conclusion

While Cinemark Holdings, Inc. continues having pressing issues with its debt load and increasing expenses, the stock market in general is going strong, with new highs being the norm rather than the exception since 2024 began. When bearishness sets in, stocks of weaker companies tend to be the first ones to sell off, and Cinemark is a prime candidate for that. As Film volume grew to 110 wide releases in 2023, reaching 85% of the pre-pandemic levels, it is imperative to ask how much of a recovery we still have left. And yet, the stock is still up nearly 40% over the last year and is hanging closer to its 52-week highs than lows.

Overall, I agree with Seeking Alpha’s quant Sell rating on Cinemark stock, and I retain my own “Sell” rating on the stock despite mild improvements in its debt and FCF numbers.