Andriy Onufriyenko/Moment via Getty Images

The KraneShares Electric Vehicles and Future Mobility Index ETF (NYSEARCA:KARS) invests in companies whose businesses involve the production of electric vehicles and/or components parts of those vehicles. This includes a wide variety of stocks, from vehicle production, autonomous driving, lithium, copper, and battery production, and electric vehicle infrastructure. The fund is passively managed and tracks the Bloomberg Electric Vehicles Index.

Due to its superior forecasted earnings and cash flow growth versus competitors, as well as its unique set of holdings and sector allocation, KARS is an EV ETF we like. However, our near-term outlook for the EV industry is pessimistic, giving us a hold rating on KARS for now.

Why invest in Electric Vehicles?

Rapidly Growing Market

Electric Vehicles are growing rapidly in their sales as well as in their share of the overall car market. In 2021, sales of new electric vehicles grew by 108% compared to 2020. In 2022, 10 million electric cars will be sold worldwide. When it comes to market share, there has been rapid growth as well in the last few years up until 2023. The electric vehicle’s share of the overall vehicle market moved from 4% in 2020 to, 9% in 2021, up to 14% in 2022, before retreating to 12% in 2023. Additionally, governments are increasingly passing laws that favor EV consumption over the long term, California and Washington State’s recent regulations outlawing the purchase of gas-powered vehicles by the year 2035 are good examples.

Why Now is Not the Right Time for EVs

The drawback in demand experienced in 2023 can be attributed to many reasons. Concerns about EV travel range, limited charging networks, and their reduction in performance in colder temperatures are all culprits. However, what we see as the biggest issues for EV demand in the near term include early adopters being fulfilled in their demand, high prices & poor economic sentiment, and high interest rates.

Early adopters of new technologies are typically people referred to as “innovators” – technology geeks that not only have an inherent interest in the new advancements but also tend to have higher disposable income which they can use to purchase these items out of the gate when prices are highest. These consumers were largely responsible for the rapid growth in market share EVs were able to attain over the last several years, but the dip in that market share in 2023 is good evidence that demand from that segment has been satisfied.

For EVs to continue increasing their share of the overall market, they will have to start being adopted by more mainstream consumers. Evidence shows that these consumers are interested in purchasing EVs. According to a study conducted by JD Power in June 2023, 61% of consumers are considering EVs for their next vehicle purchase. However, JD Power also found that 78% of EVs sold are in what they consider the “premium segment” of the vehicle market, which comes with a higher price tag.

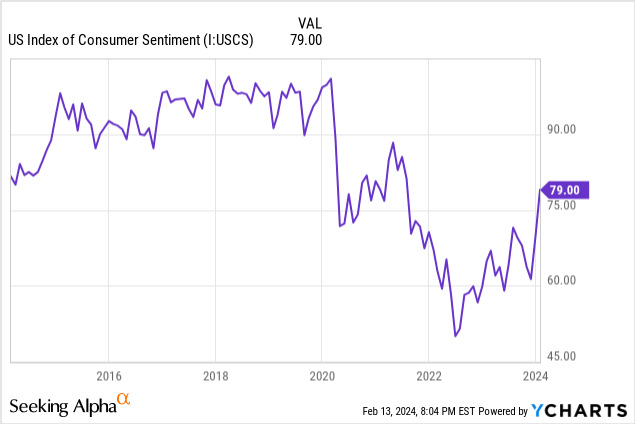

Elon Musk, the CEO of Tesla, has even suggested that “There are lots of people who want to buy our cars. They just can’t afford it“. Low consumer sentiment about the economy generally is one current explanation for this. The University of Michigan Consumer Sentiment Index, a measure that has been used as a monthly gauge of consumer confidence in the U.S. economy since 1978, hit an all-time low in June 2022. The index has been on a steady increase since then but is still 6.7% below its average of 84.3 over the last 10 years, currently sitting at 79.0. Getting this measure back above its average, and Americans feeling optimistic about the economy is an important metric to watch when it comes to demand for not only high prices but unfamiliar purchases such as EVs.

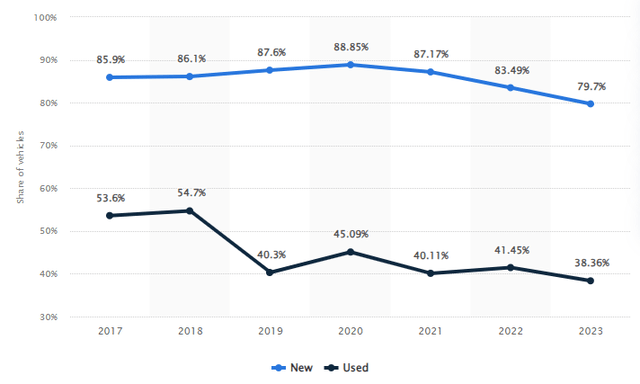

Lastly, higher interest rates have slowed demand in the car market generally. With 79% of new vehicles sold requiring some kind of financing, higher interest rates cause car payments to be higher, making consumers less likely to make those purchases. Seeing interest rates come down will make us more optimistic about the auto market generally.

Percentage of Vehicles Requiring Financing (Statista)

Comparison of EV ETFs

The table below (data from Seeking Alpha) compares KARS, to two other EV ETFs, DRIV, the Global X Autonomous And Electric Vehicles ETF, and CARZ, the First Trust S-Network Future Vehicles & Tech ETF.

| Ticker | Total Assets Under Management | Weighted Average Market Cap | Forecasted 5-Year Earnings Growth | Forecasted Cash Flow Growth | 5-Year Total Returns (Daily) | Net Expense Ratio |

| KARS | $114,134,130 | $18,808 | 19.3% | 21.0% | 44.3% | 0.72% |

| CARZ | $38,716,583 | $106,096 | 13.0% | -0.4% | 79.1% | 0.70% |

| DRIV | $639,090,634 | $32,867 | 12.6% | 0.1% | 96.5% | 0.68% |

A couple of things stick out off the bat. DRIV has by far the most assets, likely due to its outperformance over the last 5 years. DRIV and KARS are invested in much smaller companies on average, and the fees on these funds are all within 4 basis points of each other. One big advantage for KARS is its much higher forecasted 5-year earnings growth, which makes sense due to the fund’s relatively lower average market capitalization. We view this positively as at some point the higher earnings growth of the KARS portfolio should be reflected in its returns.

The big reason we prefer KARS to DRIV and CARZ is due to its sector and country allocations. The 33% weighting to China is reflective of reality, in 2022 the country accounted for 59% of EVs sold worldwide. This is a large contrast from the 4.3% and 4.4% weightings to China in CARZ and DRIV, respectively. Additionally, we see that KARS has a much higher weighting to Basic Materials and Industrials compared to the other two funds, with a large underweight to technology.

| Ticker | Basic Materials Exposure | Communication Services Exposure | Consumer Cyclical Exposure | Financial Services Exposure | Industrials Exposure | Technology Exposure |

| KARS | 24.8% | 0.0% | 40.6% | 1.5% | 22.7% | 10.4% |

| CARZ | 5.2% | 5.0% | 23.5% | 0.0% | 6.7% | 59.6% |

| DRIV | 10.7% | 5.2% | 35.3% | 0.7% | 17.7% | 30.4% |

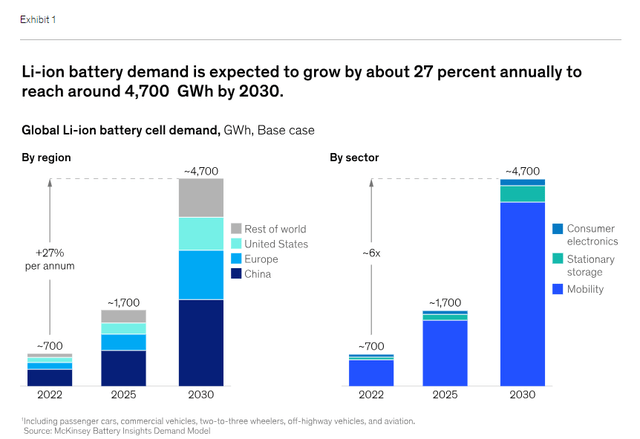

We like this, as battery manufacturers, rare earth miners, and component producers are key parts of the electric vehicle industry that are forecasted to see intense growth. For example, lithium-ion battery cell demand is expected to grow 27% per year until 2030, with the vast majority of that growth coming from transportation.

Two KARS holdings playing into this trend are Pilbara Minerals Limited (OTCPK:PILBF), which owns the world’s largest hard rock lithium operation, and Albemarle Corporation (ALB), the world’s largest provider of lithium for electric vehicle batteries in the world.

About the Bloomberg Electric Vehicle Index

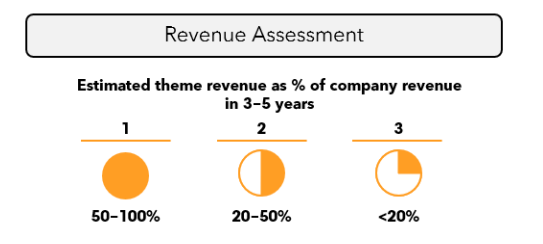

In order to be selected into the index, a security must rank within the “Gold Tier” of the Bloomberg Electric Vehicles ecosystem. Being ranked in the Gold Tier is predicated on a combination of revenue and thematic assessment. A firm must attain a score between 2-4 when adding the revenue and thematic scores. Below is an illustration of how the revenue assessment is made.

Bloomberg

The thematic score is more subjective, with Bloomberg Intelligence ranking firms across many data points to formulate a view on their ability to execute within a particular thematic & competitive landscape. These data points include the ability to ramp up production and meet demand, access to capital, customer relationships, and industry reputation. A thematic score of 1-3 is given, with 1 being the most relevant to the theme and 3 being the least relevant. In order to attain an overall score of 2-4, it can be seen that a firm must have some combination of high revenue expectations and low theme relevancy, high theme relevancy, and lower revenue expectations, or rank in the middle of both. Overall, we like this methodology as it places importance on revenue to drive returns and value creation while also balancing the importance of companies being strong players within the theme and ecosystem they operate in.

Holdings

See the table below for KARS’ top 15 holdings and their weights.

| KARS Holdings As of 2024-02-15 | |

| Company Name | % of Net Assets |

| APTIV PLC | 4.43 |

| NIDEC CORP | 4.4 |

| CONTEMPORARY A-A | 4.09 |

| PANASONIC HOLDINGS CORP | 3.93 |

| TESLA INC | 3.89 |

| SAMSUNG SDI CO LTD | 3.56 |

| BYD CO LTD -A | 3.48 |

| LI AUTO INC-CLASS A | 3.41 |

| RIVIAN AUTOMOTIVE INC-A | 2.92 |

| MAGNA INTERNATIONAL INC | 2.91 |

| ECOPRO BM CO LTD | 2.88 |

| PILBARA MINERALS LTD | 2.77 |

| ALBEMARLE CORP | 2.64 |

| POSCO FUTURE M CO LTD | 2.63 |

| DR ING HC F PORSCHE AG | 2.53 |

Aptiv PLC (APTV) is the fund’s top holding, weighted at 4.43%. Aptiv generates most of its revenue from its Signal and Power Solutions segment, which creates complete vehicle electrical systems including wiring and cable assemblies. It also has a much faster growing segment called Advanced Safety and User Experience which provides advanced software, computing, and sensing systems for vehicles. We like this segment combination as it provides a stable and more goods-based source of revenue while also investing in software-based solutions that will contribute increasingly to revenue growth.

Nidec Corporation (OTCPK:NJDCY) is the “world’s number one comprehensive motor manufacturer”, building motors on the largest and tiniest scales. Automotive parts are a substantial segment of their business and have the fastest expected average sales growth rate of any of their segments at 29% per year from 2020 to 2025.

Risks of Investing in KARS

Investing in a fund with a large allocation to China can be worrisome due to the uncertain political environment, and the government’s ability to influence winners in losers in the economy. However, China is very committed to transitioning their economy to run on electric vehicles, and we see them being overall supportive of the industry.

And, with a fund like KARS, its low exposure to technology will cause it to underperform when the sector does well, as we have seen recently. This is especially true when the fund’s allocation to Magnificent 7 companies is only 3.8%, compared to 15.8% for DRIV and 23.1% for CARZ.

We envision the returns of the fund will pick up once the consumer starts to feel better about the economy. A big sign of this will be CPI coming in lower than expected as inflation has done a lot of damage to the consumer. Also, lower inflation figures will allow the Fed to drop rates, lowering financing costs for vehicle purchasers. We will be watching the CPI and consumer sentiment figures as we continue to monitor this fund.

Conclusion

We like KARS as an EV ETF, due to its high forecasted earnings growth compared to peers and differentiated country and sector allocation that lines up with the reality of the EV market. However, near-term concerns about the economy and the EV market generally are reason for pause. Based on this, KARS is rated a hold for now.