bjdlzx

Article Thesis

Energy Transfer LP (NYSE:ET) has reported compelling quarterly and annual results and guides for ongoing growth during the current fiscal year. Add an undemanding valuation and a high and growing dividend and the midstream giant has compelling total return potential going forward.

Past Coverage

I have covered Energy Transfer LP here on Seeking Alpha in the past, most recently on October 30 in this article. I gave Energy Transfer a buy rating back then, with that thesis having worked out well so far, as shares are up 9% and have returned more than 11% in a couple of months when we account for dividend payments. In this article, I’ll take a look at what has changed since then — this includes the strong Q4 results, M&A, and the excellent outlook for the current year.

What Happened?

Energy Transfer LP reported its most recent quarterly earnings results, for its fiscal Q4, on Wednesday afternoon. Seeking Alpha reported the headline numbers here:

While revenues were almost flat compared to the previous year’s quarter, that’s not too important — for Energy Transfer, commodity prices are a pass-through item to a large degree. That means that when energy commodity prices move upwards, so do sales and costs, while both revenues and expenses head lower when commodity prices pull back. The revenue number is thus not too important for Energy Transfer. Instead, cash flows and EBITDA (earnings before interest, taxes, depreciation, and amortization) are more relevant metrics for investors.

Energy Transfer beat earnings per share estimates easily, but that is also a not-overly-relevant metric for the company. Due to high non-cash depreciation charges, net profits are considerably lower compared to the company’s cash flows. Net profits are thus not the best metric to evaluate the safety of the dividend, capacity for dividend increases, and so on.

Energy Transfer: Excellent Performance And Outlook

Energy Transfer has been unloved for some time due to its management being too occupied with empire building and M&A. However the company has changed in recent years, and its operational performance has gotten stronger while the capital allocation strategy has also changed: Energy Transfer now only engages in M&A when it is accretive for shareholders (on a per-share basis). Spending on M&A for the sake of growing the company at any cost luckily is a thing of the past.

With energy production in North America rising in recent years, and with the US becoming a key supplier of energy to countries in Europe that had to replace supplies from Russia, the macro environment is positive for North American midstream players like Energy Transfer. After all, all the oil and natural gas that is being produced needs to be moved to end markets or export facilities on the coast.

During the most recent quarter, Energy Transfer has set several new records when it comes to its operations. The company hit new record levels for natural gas fractionation volumes, natural gas transportation volumes, crude oil transportation volumes, and several more. Results in these areas improved markedly versus the previous year’s fourth quarter, with crude oil transportation volumes growing by a hefty 39% year over year. Natural gas fractionation and transportation volumes were up by double-digits as well.

This drove nice growth in the company’s financial metrics as well, as EBITDA rose by 5% year over year, with that number hitting $3.6 billion, or more than $14 billion annualized. Q1 and Q4 usually are a bit stronger than the company’s Q2 and Q3, but even when we account for seasonality, Q4 was strong and ahead of estimates (and ET’s guidance).

Even better, the company’s outlook for the current year is great as well. Since the market is usually forward-looking, this could be a deciding factor when it comes to Energy Transfer’s share price performance over the coming months, as a positive outlook could attract additional investors that want exposure to high-yielding investments and/or the growing North American energy transportation sector.

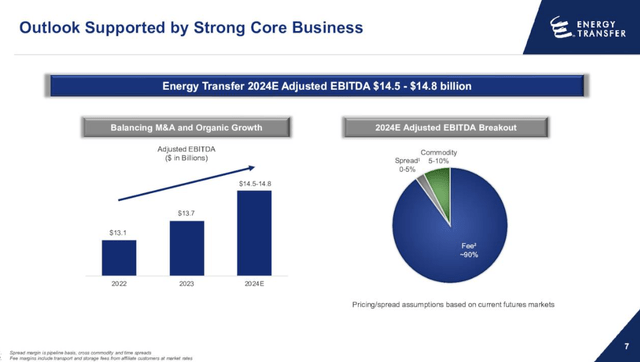

Energy Transfer LP’s guidance for the current year looks like this:

The company sees EBITDA growing to around $14.7 billion this year, which represents growth of a little more than 7% compared to the previous year. On a two-year basis, cumulative growth will be in the 12% range, or around 6% annualized. The expected growth in Energy Transfer’s EBITDA will be driven by several contributing factors. The first of these is growth in existing assets, e.g. via rising volumes (where possible) or via rate increases. The company’s organic investments in new assets will also play a role. While Energy Transfer’s growth spending has been somewhat lower in recent years compared to pre-pandemic levels, the company still spends money on upgrades, expansions, and so on. Over time, the additional profits and cash flows that these investments generate add up. Last but not least, acquisitions also impact Energy Transfer’s results. While the company has slowed down its M&A pace, it still does pursue deals where it makes sense to do so. Late last year, Energy Transfer closed the takeover of Crestwood Equity Partners, which will contribute to this year’s profits and cash flows. Since this takeover was done at an inexpensive valuation, it will be accretive, even on a per-share basis — under these conditions, and as long as leverage doesn’t increase, takeovers can be useful to grow shareholder value.

Looking at the leverage I just mentioned, Energy Transfer has progressed nicely. The company’s leverage has come down from around 4.5x EBITDA in recent years. In the earnings presentation, Energy Transfer notes that its leverage ratio (net debt to EBITDA) has, accounting for a full year of the Crestwood Equity Partners acquisition, come down “to the lower half of the 4.0x to 4.5x target range”. So with the full effect of the takeover factored in, leverage is around 4.1x or 4.2x EBITDA, which is, I believe, very reasonable. Energy Transfer is a company with high cash flows that are both stable and recession-resilient, thus even a leverage ratio of 4.5x would not be unreasonably high.

Energy Transfer should be able to generate distributable cash flows of around $8.0 billion to $8.5 billion in 2024 (2023: $7.6 billion). The company guides for growth capital expenditures of around $2.5 billion, while maintenance capital expenditures are already accounted for in distributable cash flows. This leaves around $5.5 billion to $6.0 billion of cash that is left over for buybacks, dividends, M&A, and debt reduction. It’s possible that Energy Transfer will pursue M&A this year as well, but they could go for an all-stock deal again, like with the Crestwood takeover. Dividends will cost the company around $4.2 billion this year, thus around $1.5 billion would be left over for debt reduction or letting cash pile up on the balance sheet (which would reduce net debt, too). The company has redeemed some of its preferred stock in February (series C & D), while Energy Transfer has also announced that it would redeem its series E preferred shares in May. This will require some cash outlay, but the company will not necessarily finance this via its cash flows, as Energy Transfer also took on debt in January at attractive rates, including 10-year debt at 5.5%. I would like to see Energy Transfer pursue buybacks as these would be highly accretive due to the low valuation, but it is unsure whether the company will buy back shares at a meaningful pace this year.

Energy Transfer: Significant Upside

Energy Transfer’s operational performance is strong, the company regularly beats its guidance, and pursuing acquisitions only when it is accretive to do so is a good idea as well.

On top of that, Energy Transfer also offers a nice yield of 8.9%, and shares are pretty inexpensive. Based on my distributable cash flow estimate for the current year, Energy Transfer is trading at a DCF yield in the high teens, which makes for a DCF multiple of less than 6. While Energy Transfer is more aggressive than Enterprise Products Partners (EPD), which has less debt and which thus deserves a premium valuation, Energy Transfer could see its valuation expand meaningfully in the long run. An 8x DCF multiple for ET wouldn’t be aggressive at all, and while I do not see any major catalyst for that in the near term, it could add nicely to the company’s total returns in the long run.

While Energy Transfer has performed nicely over the last year in terms of stock price gains, shares are not expensive and have more upside potential in the long run, especially if Energy Transfer continues to perform well operationally.