tadamichi

Introduction

Investors seeking income over the past couple of decades have had a limited toolbox to work with. Dividend yields on U.S. equities have averaged less than 2% over the past 20 years, while yields on 10-year U.S. Treasuries have averaged less than 3%.

Two big levers that can be pulled in the search for higher yields are duration risk and credit risk. The greater the duration and/or credit risk an investor is willing to assume, the higher the yields should be.

Of course, since mid-2022 the yield curve has been inverted, resulting in a relatively unusual situation where increasing duration risk has resulted in lower yields.

But is extending duration and/or credit risk the optimum way to generate higher income? While there are market environments that indeed favor extending duration or taking on greater credit risk, there are drawbacks as well.

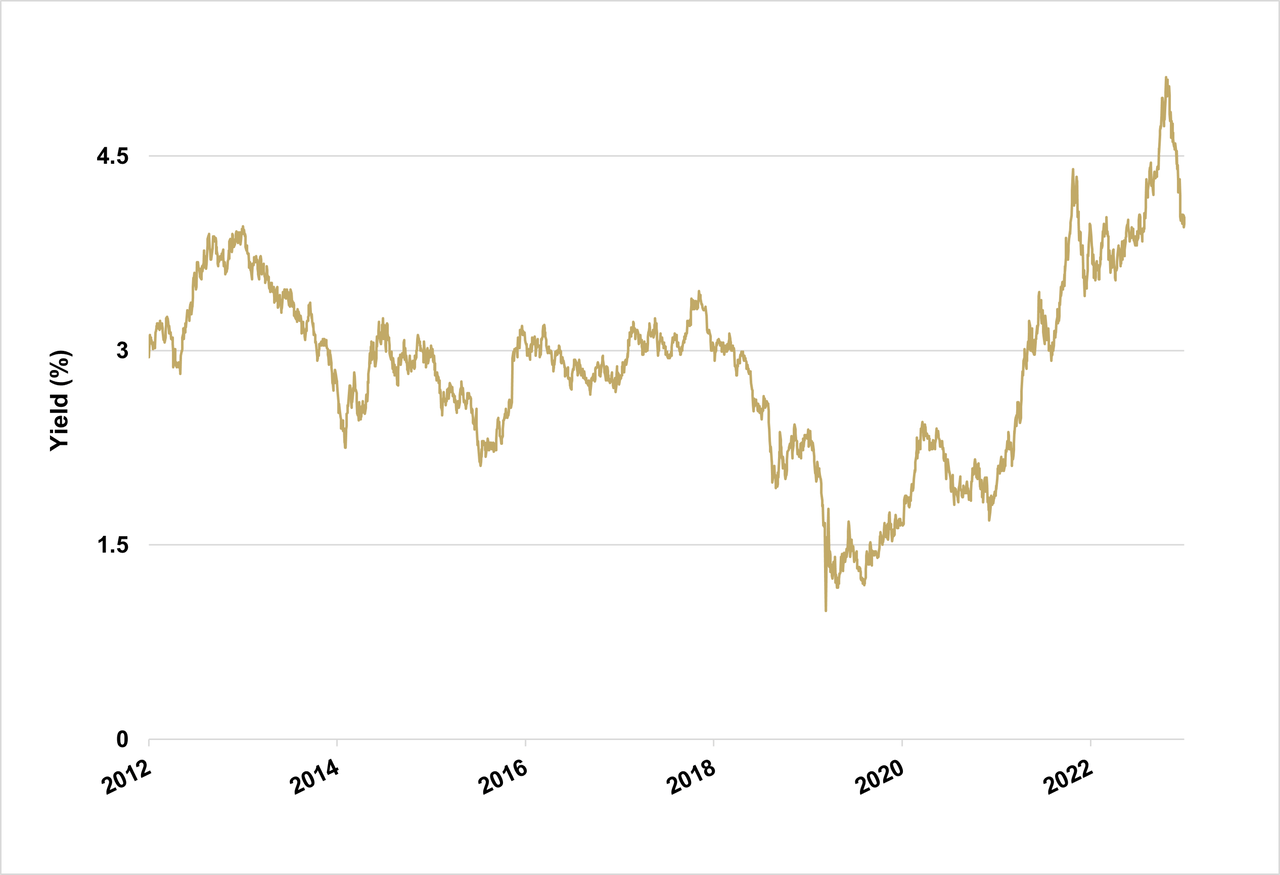

Let’s start with duration risk by looking at long duration (30-year) U.S. Treasury bonds. Figure 1 shows the yield on 30-year U.S. Treasury bonds for the 10 years ended 2023. As of January 2024, the yield is about 4%, and has averaged 2.87% for the full period.

Figure 1

Despite the large increase in yields over the past two years, the 30-year Treasury yield still only hovers around 4%. That’s a quite modest reward when considering the amount of duration risk the investor must assume.

The ICE U.S. Treasury 20+ Years Bond Index has a duration of about 17 years, meaning that a 1% move in interest rates implies a 17% change in price. In fact, over the past decade, long-term U.S. Treasury bonds have been nearly as volatile as the S&P 500 Index with a larger maximum drawdown of nearly 50%.

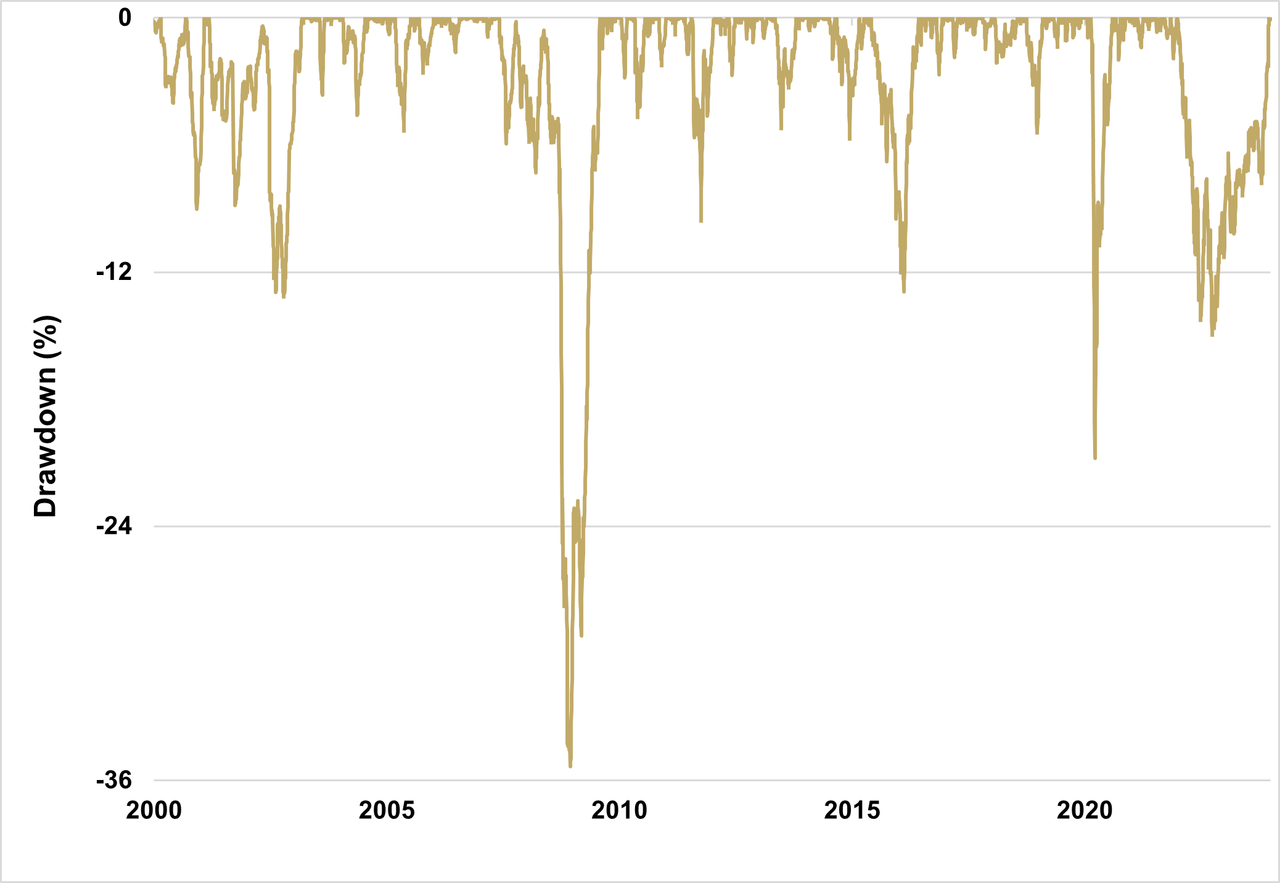

Turning to credit, corporate bonds with credit ratings below investment grade (high yield bonds), enjoy higher yields than long duration treasuries. But the credit risk associated with high yield bonds can rear its ugly head in dramatic fashion, particularly during recessionary periods.

During the Global Financial Crisis, the Bloomberg U.S. Corporate High Yield index endured a 36% drawdown (see Figure 2).

Figure 2

During recessionary periods, corporations with low credit ratings may struggle to service their debt or roll over their debt as it matures. This is especially true if recessionary periods are combined with higher interest rates.

It’s this financing stress which causes the yield spreads versus Treasuries to widen during recessions, resulting in drawdowns for high yield investors.

Today, income-seeking investors have more alternatives. With the modernization of the regulatory framework regarding derivatives such as options within ETFs, new tools can be applied to generate significant levels of income without taking on increased duration or credit risk.

Introducing the Simplify Enhanced Income ETF (HIGH)

HIGH is designed to provide a high level of monthly income without taking on significant duration or credit risk. It does this by combining short-term U.S. Treasury Bills with a risk-managed options selling strategy.

The HIGH Investment Process

The investment process begins by investing nearly all of HIGH’s assets in short-term U.S. Treasury Bills. The T-Bills provide safety, stability, and a base level of income.

As of January 2024, T-Bills are yielding over 5%. While T-Bills have no opportunity for capital appreciation, they currently yield 25% more than 30-year Treasury bonds, all while assuming zero interest rate risk.

Next, HIGH employs a risk-managed options selling strategy to provide additional income above that of T-Bills. This options strategy comes in the form of writing a diversified basket of credit spreads.

Credit Spread Basics

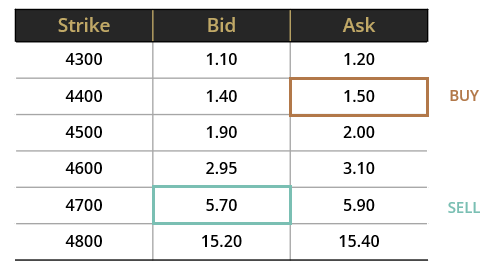

A credit spread is when the investor sells an out-of-the-money (OTM) option and then buys an even further OTM option. Both options are of identical quantities and have the same expiration date.

Figure 3 shows a hypothetical put option credit spread for an asset with a current price of about $4900. The investor might sell an OTM put option with a strike of 4700, which would result in proceeds of $5.70.

Next, the investor buys a put option even further OTM, say, at 4400, resulting in a cash outlay of $1.50. In this example, the net proceeds of these two trades are +$4.20, which is credited to the investor’s account – hence the name “credit spread”.

Figure 3

Why would the investor sell a credit spread instead of just selling the put option? Doesn’t buying the further OTM option reduce the profitability of the trade?

Buying the put option controls the risk of the trade. It sets a “floor” under which the investor is protected in the event the asset price drops below the strike price of the long option. Since the further OTM option is much cheaper than the option that’s being sold, it is an inexpensive form of insurance.

Ideally, the options all expire out-of-the-money. In that case, the entire net proceeds of the spread become the investor’s profit.

Managing Risk

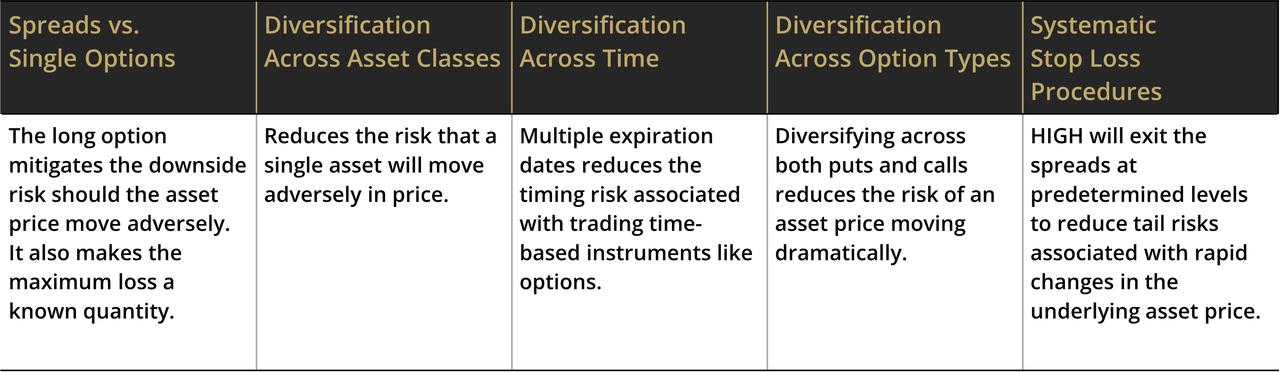

Aside from delivering attractive income, an additional goal of the fund is to maintain low levels of volatility and drawdowns. HIGH employs a number of strategies to manage risk, as shown in Figure 4.

Figure 4

The primary risk management tool is to sell spreads instead of single options. This limits the maximum potential loss for the trade in the event of an adverse move against the underlier.

Diversification is another key driver of HIGH’s risk management. HIGH will sell credit spreads on a variety of underlying instruments, including equity ETFs, fixed income ETFs, commodity ETFs, and even individual stocks. By diversifying across several underlying instruments, the overall risk of the strategy is reduced.

A second layer of diversification can be gained by engaging in both put spreads as well as call spreads. More often than not, on the equity side, HIGH will be biased towards put spreads for two reasons:

(1) for the same moneyness, put spreads usually result in a higher profit and (2) stocks go up slightly more often than they go down, making put spreads the higher percentage play.

On the fixed income side, HIGH will often engage in call spreads in addition to put spreads, and sometimes both at the same time.

The third level of diversification is diversifying across time. HIGH will typically sell 2-week spreads, but on a rolling 1-week basis. This will reduce some of the timing risk inherent in instruments that carry an expiration date.

Finally, downside risks are also managed via a stop-loss system that closes positions at preset underlier levels. This risk mitigation technique kicks in way before the long put or call are close to being at the money, substantially cutting the possible loss for the strategy.

Portfolio Implementation

Replacing existing fixed income holdings with HIGH will likely reduce duration, reduce credit risk, and increase income. It should not be used by investors who wish to extend duration or credit risk.

Investors who seek to maintain their duration and credit exposure, but wish to increase their yield, can consider replacing some of their cash exposure with HIGH. This will, however, raise their portfolio’s overall level of volatility.

Summary

The traditional playbook of extending duration or lowering credit quality in search of yield has its limitations. Not only does extending duration not add much yield, it comes with equity-like volatility and drawdown risk.

Similarly, high yield bonds offer more attractive yields, but at the expense of high drawdown risk, especially during economic contractions.

Recent regulatory clarity around derivatives has opened the door for options-based income strategies like HIGH. By following a risk-managed credit spread strategy, alongside investing in T-bills, HIGH has the potential to generate attractive yields while maintaining minimal exposure to duration and credit risk.

Glossary:

Duration: A measure of the sensitivity of an asset price to movements in yields.

Moneyness: Describes the intrinsic value of an option’s premium in the market. A contract is either “in the money”, “out of the money”, or “at the money”. A call option is said to be “in the money” when the future contract price is above the strike price. A call option is “out of the money” when the future contract price is below the strike price.

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price (“strike”) by a specific date (“expiry”). An “outright” is another name for a single option leg. A “spread” is when options are bought at one strike and an equal amount of options are sold at a different strike, all at the same expiry.

Out-of-the-Money: An option has no intrinsic value, only extrinsic or time value.

Investors should carefully consider the investment objectives, risks, charges, and expenses of Exchange Traded Funds (ETFs) before investing. To obtain an ETF’s prospectus containing this and other important information, please call (855) 772-8488, or visit SimplifyETFs.com. Please read the prospectus carefully before you invest.

An investment in the fund involves risk, including possible loss of principal.

The fund is actively-managed is subject to the risk that the strategy may not produce the intended results. The fund is new and has a limited operating history to evaluate. The Fund invests in ETFs (Exchange-Traded Funds) and entails higher expenses than if invested into the underlying ETF directly. The lower the credit quality, the more volatile performance will be. When junk bonds sell off, the lowest-rated bonds are typically hit hardest known as blow up risk. Likewise, the riskiest bonds typically rise fastest in a bull market however these investments that don’t have a credit rating are typically the most volatile, hard to price and the least liquid.

The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate, or index. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. The use of leverage by the Fund, such as borrowing money to purchase securities or the use of options, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. The Fund’s investment in fixed income securities is subject to credit risk (the debtor may default) and prepayment risk (an obligation paid early) which could cause its share price and total return to be reduced. Typically, as interest rates rise the value of bond prices will decline and the fund could lose value.

While the option overlay is intended to improve the Fund’s performance, there is no guarantee that it will do so. Utilizing an option overlay strategy involves the risk that as the buyer of a put or call option, the Fund risks losing the entire premium invested in the option if the Fund does not exercise the option. Also, securities and options traded in over-the-counter markets may trade less frequently and in limited volumes and thus exhibit more volatility and liquidity risk.

Diversification does not ensure a profit or guarantee against a loss.

Simplify ETFs are distributed by Foreside Financial Services, LLC. Simplify and Foreside are not related.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.