Delta Air Lines will once again carry Team USA to the 2024 Olympics in Paris Nirian/iStock Unreleased via Getty Images

The year 2024 started out with a number of significant news items that impacted the global and U.S. aviation industry. As the New Year began, a fiery accident at Japan’s Tokyo Haneda airport involving two Japanese military and Japan Airlines aircraft shook an industry that has seen the rate of accidents drop as aviation becomes accessible to more and more of the world. Shortly after that, an Alaska Airlines (ALK) Boeing (BA) 737 MAX 9 jet lost one of its plugged emergency exits which further rattled the public’s perception of aviation safety, resulting in an admission by Boeing’s CEO that their production quality was lacking even if problems might exist elsewhere in their production system. The Alaska MAX accident resulted in an order from the FAA for Boeing to not increase production of its 737 jets as it intended to do, resulting in what is certain to be further delays in the certification of the MAX 7 and MAX 10 jets, the former of which is a significant new part of the generation aircraft order book for Southwest Airlines (LUV) and the latter of which forms a major piece of United’s (UAL) order book. Later in January, a federal judge sided with the U.S. Dept. of Justice that the proposed merger of JetBlue (JBLU) and Spirit Airlines (SAVE) was uncompetitive and should be blocked and the shock waves for the industry came at a rapid speed at the beginning of a year that looked promising for an industry that had survived the COVID-19 pandemic with no U.S. carriers failing.

Strong Earnings but Reduced Guidance

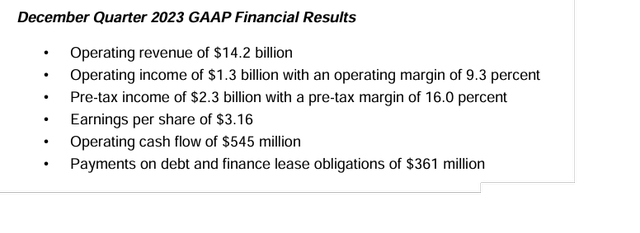

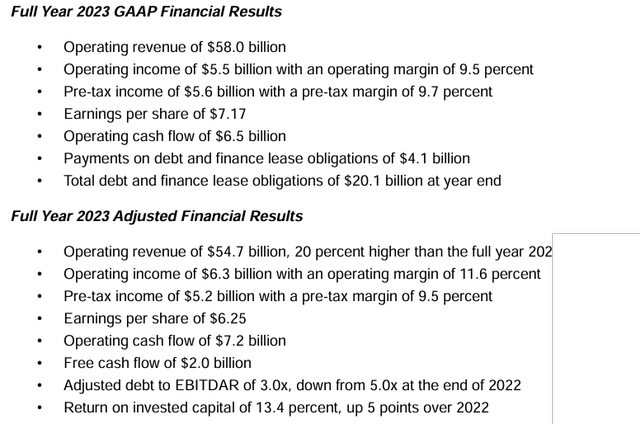

In the midst of all that news, Delta Air Lines (NYSE:DAL) reported its 4th quarter and full year 2023 results as the first U.S. airline and one of the earliest large companies to report its earnings, as it usually does. Delta’s investor guidance often carries as much significance to the financial community and the industry as its earnings do. In its most recent guidance, analysts and investors quickly responded to a softening of Delta’s bullishness in 2024, a year in which Delta expected a return to stronger business and international demand. While the U.S. domestic market came roaring back in the spring of 2022 and transatlantic demand began to reopen in that summer, many U.S. airlines were not properly staffed or had adequately prepared for an onslaught of strong demand and their operations suffered. Pushed by the U.S. DOT which was flooded by complaints of poor service, U.S. airlines aggressively hired over the 2022/2023 fall and winter periods, hoping to be ready for strong demand in the summer of 2023. Delta then led the big 4 (American, Delta, Southwest, and United) in settling a post-covid contract with its pilots in a rich deal that included almost $1 billion in retroactive pay and a healthy pay jump to offset the pilot staffing concerns that have plagued the industry for years. DAL offered pay increases to its flight attendants which included pay during boarding, a new concept for U.S. airlines, as well as for the remainder of its largely non-union workforce. All of those pay increases dented Delta’s financial performance in early 2023 but Delta appeared confident that its earnings would rebound with strong demand beginning in the summer of 2023 and that indeed began to happen. A summary of Delta’s 4th quarter and full year 2023 earnings follows.

DAL 4Q2023 Financial Highlights (ir.delta.com) DAL Full Year 2023 financial results (ir.delta.com)

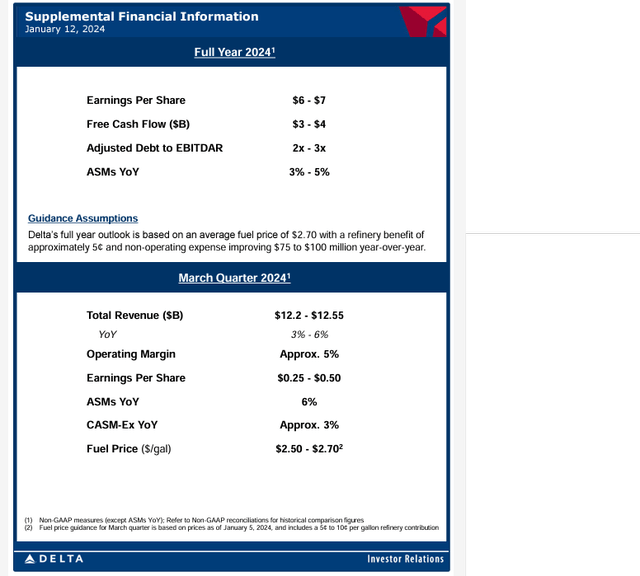

Its first quarter and full year 2024 guidance was perceived by investors and analysts as weak compared to previous Delta statements which led to a plunge in DAL stock.

DAL guidance as of 12 Jan 2024 (ir.delta.com)

As other airlines reported, their earnings were better received by Wall Street, partly a result of changed investor expectations and partly because they had not made statements regarding as high earnings expectations. In the month that has taken place since Delta reported its earnings and offered guidance, the stock has recovered but remains significantly below Wall Street price targets even though DAL’s market cap remains well above all other U.S. airlines, it earned much more than any other airline in the world, revealed a number of positive balance sheet and future strategies, and expects to remain the most profitable and highest revenue airline in the world.

DAL 1 month chart 14Feb2024 (Seeking Alpha)

A Strong Report & Industry Comparisons

A comparison of Delta’s performance on a number of key metrics provides insight into how well Delta did in 2023, followed by an examination of the potential Delta has to improve on its current performance.

First, on the bottom line, Delta significantly outperformed its U.S. competitors in absolute profit but also in net income margin.

Delta’s GAAP net income in 2023 was $4.609 billion compared to United’s $2.618B, American’s (AAL) $822 million, and Southwest’s $498M.

Each of the big 4 (as well as other airlines) offers a non-GAAP adjusted income which takes out non-recurring costs such as the pilot contract retro payments, which occurred in 2023 for much of the industry. Delta routinely removes its refinery operations – both revenue and costs – in order to provide investors with a basis for comparing actual airline operations, which include loyalty and credit card partnership programs which are common across the industry.

DAL’s adjusted non-GAAP profit for 2023 was $4.020B, UAL’s was $3.337B, AAL’s was $1.859B and LUV’s was $986 million.

DAL’s net income margin for 2023 was 7.9% while UAL’s was 4.9% and much of the industry was below 2% with several carriers reporting negative NI margins based on full-year losses, a stunning recognition that the industry is divided by the financially performing “haves and have nots.”

A breakdown of revenues and key cost numbers helps to identify where Delta finds its advantages and strengths.

Delta’s operating revenues totaled $58.048 billion compared to UAL’s $53.717B, AAL’s $52.788, and LUV’s $26.091B.

The big 3 generate considerably more revenue than LUV or other low and ultra-low cost carriers thanks, in part, to their global route systems and their higher fares which stem from their longer haul networks and their business model which includes premium cabins and lounges among other amenities which attract more business travelers. However, breaking down the revenues reveals interesting comparisons. Each of the big 3 gets nearly identical amounts of passenger revenue, with Delta just nudging American out for the most domestic passenger revenue, but both generated over $1 billion more domestic passenger revenue in the 4th quarter than United; United’s network is much more heavily skewed toward international travel. American nudges out Delta in cargo revenue, but United generated twice as much cargo revenue as Delta – or $750 million more for the year.

Capacity in the airline industry is measured by available seat miles – one available seat mile is one seat flown one mile, while a seat with a paying passenger in it is counted in revenue passenger miles. The percentage of RPMs to ASMs forms the load factor. In 2023, United flew 291 billion ASMs, AAL flew 278 B, DAL flew 272 B, LUV flew 170 B ASMs. The big 3 all had load factors in the low 80s and within 2 points of each other. Given how close their passenger revenue is, it is obvious that Delta generates more revenue per seat mile. While United’s model of extensive international flying gives it the largest network as measured by capacity, it is the least efficient at generating revenue – and has implications on costs which we will discuss shortly.

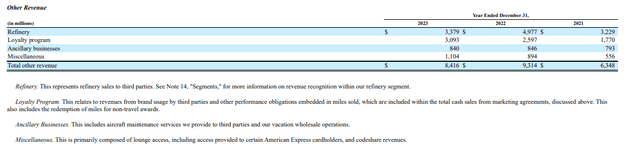

The “other revenue” category is where Delta’s financials are markedly different than the other two – topping $8.4 billion. Delta gets substantially more revenue from non-transportation sources (14% of its total revenues) than its peers for revenue that includes its loyalty (SkyMiles) and credit card (American Express – AXP) programs as well as its maintenance service operations for other airlines. Those three strategies are not only a key driver of Delta’s higher revenue and lower costs but all offer higher margin revenue streams than passenger revenue.

DAL other revenue YE2023 (ir.delta.com)

Delta Sets the Standard for Industry Costs

A quick comparison of cost items is equally enlightening.

In 2023, each of the big 3 spent a very similar amount on salary and benefits for their employees, as well as those of their wholly owned subsidiaries. American and Delta own regional airlines while United does not; each of the big 3 contract for regional carrier services with other airlines, as does Alaska. However, Delta’s profit sharing is listed as a separate expense and amounted to $1.4 billion in 2023, the richest of any airline in the world and one of the largest profit-sharing programs among U.S. corporations. DAL’s profit sharing was twice the size of UAL’s and more than 10 times the size of LUV’s; historically, Southwest has paid rich profit-sharing. Although Delta is the only one of the big 4 carriers that has increased pay for all workgroups since COVID-19, Delta pays its employees more than any other U.S. airline – and probably more than any airline in the world.

Putting Delta’s higher “other” revenue together with its higher labor expenses, it is clear that Delta’s much higher amount of “other revenues” essentially allows Delta to subsidize its richer salaries and benefits. Delta led the industry in raising pilot salaries and did so at eye-popping levels and then followed through with increases for its other employees, including adding boarding pay for its flight attendants; in order to enhance recruitment, Delta is also opening several smaller flight attendant bases to supplement its existing primary crew bases. DAL does not appear to be afraid of taking the lead in increasing labor costs, a strategy that is bearing fruit in an industry where skilled labor – for pilots and mechanics – is getting tighter and where aviation jobs are becoming harder to fill given the 24/7 and the work away from home natures of the industry. Airlines with less revenue generating capabilities are pressured by the upward march of labor costs which Delta initiated, but those higher costs appear to be an intentional strategy to ensure the company has an adequate supply of labor. Delta also consistently runs the most reliable operation and scores the highest among U.S. airlines in a composite of metrics that are tracked by the U.S. DOT. Running such a strong operation and generating fewer complaints than its peers helped Delta attract more corporate revenue than any other U.S. airline; Delta’s higher salaries translate into an ability to capture higher revenue. In essence, Delta’s non-transportation revenues allow the company to become better at running its core airline business and, thus, attract even more revenue.

The second-highest cost for U.S. airlines after labor is fuel and, once again, there are significant differences between the big 3. In 2023, United burned 4.2 billion gallons of jet fuel, Delta burned 3.9 B gallons and American burned 4.1 B gallons of jet fuel. United’s longer haul network burns more fuel to generate the same amount of revenue. However, AAL also has a fuel efficiency deficit to DAL. On an efficiency basis, DAL’s network is 7% more fuel efficient than UAL’s with a similar comparison to AAL. While AAL has the shortest average flight length of the big 3, fleet explains the differences in fuel efficiency and is discussed below.

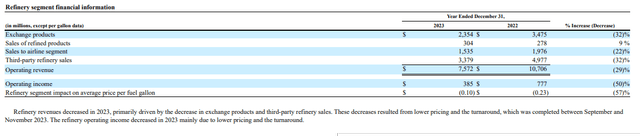

The price paid per gallon is just as important in total fuel costs; even a fraction of a cent matters when you consume as much fuel as the big US airlines burn per year. In 2023, Delta paid an average of $2.82/gallon of jet fuel, net of its refinery benefit. Southwest hedges fuel and paid $2.89/gallon. Neither American or United hedge or have a refinery benefit; American paid $2.96/gallon and United paid the highest of the big 4 at $3.01/gallon. In total fuel cost, AAL paid $12.251 billion, DAL paid $11.069B, and UAL paid $12.651 billion. Delta’s fuel cost is lowered by hundreds of millions of dollars per year just based on lower cost for each gallon because of the refinery which it owns near Philadelphia and is tuned to maximize jet fuel production and provide fuel directly to its major northeast U.S. airports. Non-jet fuel products are exchanged with petroleum companies to reduce Delta’s fuel costs in other parts of the U.S. The refinery has consistently reduced its fuel bill even though in some years the refinery itself has not made money; 2023 was one of the few years where Delta’s fuel strategy produced lower net fuel costs than Southwest’s hedging strategy. Combined with its higher fleet fuel efficiency, Delta spends $1.5 billion less on jet fuel than its two most direct global competitors. It is also worth noting that Delta’s profit sharing in the past year was nearly as large as its fuel cost advantage.

DAL refinery YE2023 (ir.delta.com)

Between its fuel cost and revenue generating advantages, it becomes apparent how Delta generates profits that are billions of dollars more than its peers. The question for investors is the sustainability of Delta’s revenue and cost advantages and whether they can be expanded relative to the industry.

A Global Network with Strong Growth Potential

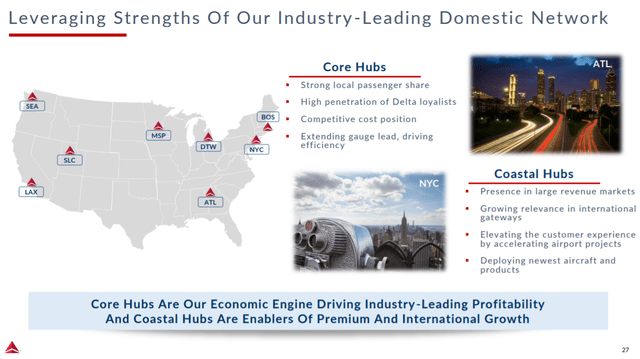

On the revenue side, Delta execs tout its network which they, like other airlines, tout as the industry’s best. A few characteristics of DAL’s network are unique and unmatched. Delta has what it calls its four core internal U.S. hubs at Atlanta (the world’s largest hub at the world’s busiest airport), Detroit, Minneapolis/St. Paul and Salt Lake City. Delta also has its four coastal hubs – New York City (hubs at both LaGuardia and JFK) making the Big Apple Delta’s #2 city by revenue, Boston, Los Angeles and Seattle. In all of its 8 hub cities except for Seattle, Delta is the largest carrier in passengers carried and also the largest carrier in domestic revenue.

Delta’s core four hubs have existed generally in their current form since at least the Delta/Northwest merger in 2009; some of those hubs pre-dated the merger. It is not likely that Delta will significantly grow any of its core 4 hubs other than to organically grow or to respond to industry demand changes. Delta says those 4 hubs drive its system profitability.

Delta’s New York City hub stems from its Pan Am asset purchase in 1991 as well as its slot swap with US Airways 10 years ago. Both LGA and JFK airports are slot-controlled and DAL is not expected to gain any more slots, although it is the largest slot holder at both airports. Thus, DAL’s growth will be by optimizing the use of its slots for higher revenue opportunities as well by increasing the size of aircraft used; Delta uses a significant number of regional jets at both LGA and JFK so there is a medium potential for revenue growth. The majority of Delta’s international flights from New York are to Europe and Africa, providing the potential for growth into Latin America and Asia.

Delta’s Boston hub is relatively new and has seen rapid growth over the past three years. Delta is reportedly talking to Massport, the government agency that operates Boston airport, about several options to increase the size of its facilities or to better connect existing gates at the airport for use as part of a larger hub operation. Delta has overtaken JetBlue as the largest carrier at BOS by number of flights as well as by revenue.

Delta’s west coast hub in Los Angeles has seen steady growth as Delta has seized the opportunity to overtake American, which was the largest airline at LAX for years but which has reduced the size of its operations in recent years. Delta recently opened an expanded and renovated terminal complex and has access to the airport’s international terminal, which continually seeks to grow the number of international flights, an offer that Delta is certain to continue to accept.

DAL’s hub in the Pacific Northwest is in Seattle, where it built a relatively new hub to replace its transpacific hub at Tokyo Narita. Although the Seattle airport is nearing capacity between its hometown Alaska and Delta’s hubs, Delta is adding new services to Taipei in the summer and is adding new and expanded facilities. Delta’s revenue growth potential from its west coast hubs is likely high.

DAL Global Network (ir.delta.com)

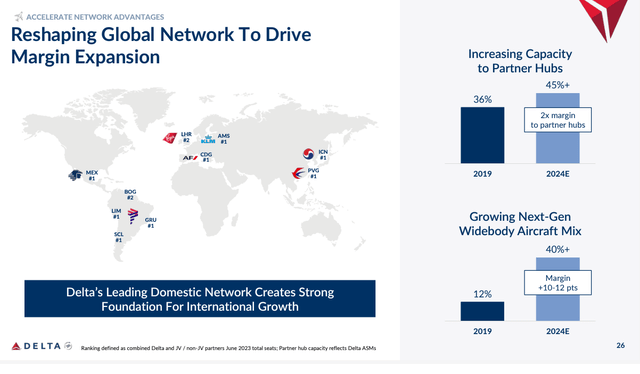

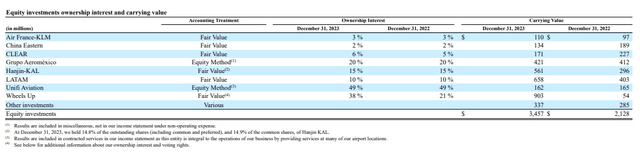

Delta says its foreign airline partnerships allow it to generate margins twice as high on flights to its partner hubs than to other destinations. In Europe, Air France (OTCPK:AFLYY) has bought a minority stake in Scandinavian Airlines – SAS – and will admit the airline to the current four carrier transatlantic joint venture, of which Delta is the largest partner. SAS was previously a part of the United/Lufthansa Group alliance, but was not a part of their joint venture. SAS’ hubs including Copenhagen will help Delta and its JV partners to grow in Northern Europe and to take pressure off its Amsterdam JV hub with KLM, where the Dutch continue to try to reduce that airport’s capacity.

In Latin America, Delta will lose its joint venture but be able to retain its partnership with Aeromexico as a result of the Mexican government’s processes to allocate slots at Mexico City. Further south, Delta’s joint venture with Latam has led Delta to fly its largest schedule ever to S. America, where it has high potential to grow further. Along with Latam, Delta has become the largest carrier from both JFK and LAX to Latin America.

Delta’s greatest potential for international growth is in Asia. Delta acquired a hub at Tokyo Narita from Northwest, but that hub swung frequently to being unprofitable. About the time of the Delta/Northwest merger, the Japanese government reopened Tokyo’s Haneda airport to transpacific flights. Delta attempted to move its Narita hub to Haneda but was denied. Prior to COVID-19, Delta completed the withdrawal of all flights beyond Tokyo to other points in Asia and began to develop a stronger relationship with Korean Airlines, with whom it has a transpacific joint venture. Delta is the largest foreign airline at Haneda, but travel from Japan is weak due to a currently poor JPY/USD relationship.

Delta’s growth to Korea’s Seoul hub has been strong but is stalled as Korean awaits approval for its merger with cross-airport money-losing rival Asiana; the Korean development bank facilitated a merger between the two, but the merger will significantly concentrate airline service in S. Korea, raising significant international concerns. The Korean/Asiana merger just received approval, with conditions, from the European Union, leaving the U.S. as the largest remaining government that needs to sign off on the deal. Since S. Korea and the U.S. have long had an Open Skies agreement which facilitates competition, it is likely that a deal with the U.S. can also be made, resulting in aggressive Delta growth to Seoul. In addition, Delta seems keen to return to India – which it once flew from Atlanta and New York – as well as rebuild its presence in Southeast Asia.

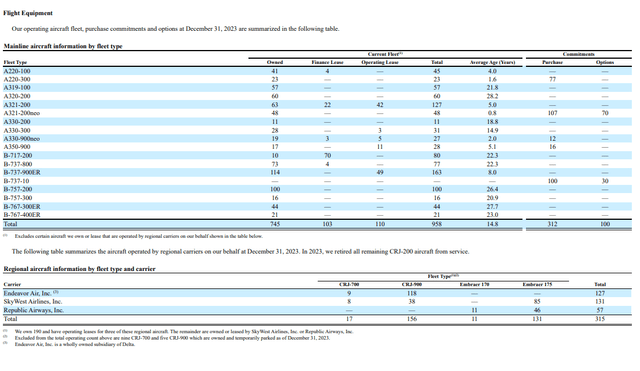

High-Efficiency Fleet Growth

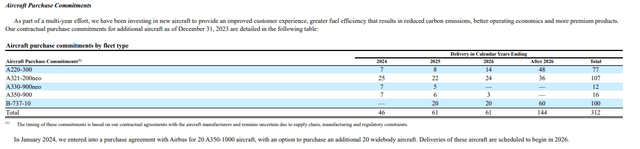

Delta’s international growth, esp. to Asia will be possible because of its fleet strategies. During the pandemic, Delta retired its fleet of 18 Boeing 777-200ERs and -LRs, the latter of which was the world’s longest range commercial aircraft at the time. However, the 777-200 family is the least fuel-efficient widebody in the U.S. airline fleet and Delta already was operating the Airbus (OTCPK:EADSY) A350-900 and had more on order. As I have noted in previous articles, Delta’s A350s were considerably less capable than the 777-200LRs, but much more fuel efficient. However, Delta is taking delivery this year of the newest and most capable versions of the A350-900, which can carry as many passengers over a further distance than the 777-200LR did but burning over 20% less fuel. Early in 2024, Delta ordered 20 A350-1000s, the largest and most capable new generation aircraft in service. Combined with Delta’s A330-900s, Delta has considerable long-range expansion potential with its new aircraft, which rival or exceed similar offerings from Boeing. Delta also took options on 20 other widebody aircraft from the Airbus product line.

DAL fleet 31Dec2023 (ir.delta.com) DAL fleet commitments 31Dec2023 (ir.delta.com)

Delta’s international strategy is tied to its equity investments in five partner airlines.

DAL equity investments 31Dec2023 (ir.delta.com)

Domestically, Delta will finalize activations of its used 737-900ERs which it acquired during the pandemic, in addition to continuing to receive new narrowbody aircraft from Airbus. Its latest 10K indicates that its domestic aircraft deliveries will be reduced from expectations last year, which might be indicative of supply chain problems that are delaying nearly all commercial aircraft deliveries. However, Delta might also see the need for fewer domestic aircraft and could be slowing its deliveries to reduce capex even as customers for the Boeing 737 MAX such as United are looking to Airbus to offset Boeing delivery delays. Delta is scheduled to receive 737 MAX 10 aircraft in 2025, but that model is still not certified and will likely be further delayed.

Delta’s capacity growth is expected to be significantly lower than in 2023 in line with reduced capacity growth expectations throughout the industry – which should result in a stronger pricing environment.

Financial Discipline Yields Balance Sheet Improvement

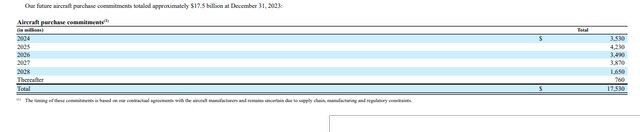

Delta’s capex remains between United’s very aggressive spending and American’s conservative fleet growth plan. UAL spent just under $8 billion on capex in 2023, DAL spent $5.3B, LUV spent $3.5B (a significant portion of which was for IT systems), and AAL spent $2.6 billion. Delta has relatively modest fleet replacement needs over the next five years but has more than sufficient orders and options to offset those retirements and still grow. In 2023, DAL matched UAL’s 17% system capacity growth, which was the most aggressive in the industry.

DAL aircraft capex 31Dec2023 (ir.delta.com)

In 2023, DAL spent $834 million on interest expense but reduced its debt, generating $2 billion in free cash. American spent $2.15 B on interest expense, a result of its aggressive fleet spending over the past 15 years that has left it with the youngest fleet among the big 4 but not necessarily the most fuel-efficient (as noted above). AAL’s fleet spending is expected to be lower than DAL, UAL or LUV over the next few years as AAL continues to pay down debt and also generates free cash. LUV is unique among U.S. airlines in having no net debt, so it made $324 million from its cash on hand in 2023. UAL was the outlier among the big 4 in burning cash through its aggressive fleet spending, which was by far the largest among U.S. airlines.

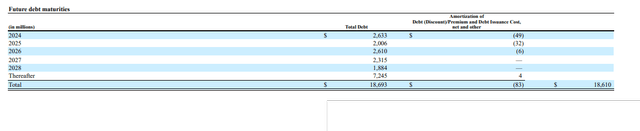

DAL’s debt maturities are modest in light of the cash it is generating.

DAL debt maturities 31Dec2023 (ir.delta.com)

Non-Transportation Revenues Will Fuel Revenue Growth

Delta’s revenue growth potential will be driven not just by passenger revenues but also through cargo as Delta expects to be able to carry more freight in the bellies of its passenger aircraft using more capable aircraft.

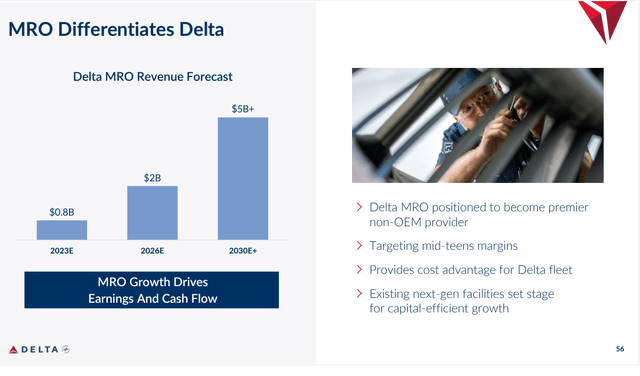

In addition, Delta’s contract maintenance service revenues are expected to grow. Delta has engine maintenance contracts for every engine type on every aircraft that Delta flies. Part of the reason for the delay in finalizing the A350-1000 order was Rolls-Royce’s resistance to granting Delta Tech Ops the overhaul rights for the engine that powers that aircraft, but Delta obtained those rights as part of the order. Delta expects to add billions of dollars in maintenance contract revenue over the next five years.

While Delta’s loyalty and credit card program revenues will continue to grow, those programs likely have less growth potential than their maintenance revenues, although Delta’s loyalty and credit card programs are already global industry-leading.

From a cost standpoint, Delta has already absorbed most of the large labor cost increases that the industry is likely to see. While there are no indications of changes to Delta’s refinery strategy, the company previously sought to sell part of its fuel procurement and exchange processes but retain the cost-savings benefits from the refinery. From a cash flow standpoint, its non-fleet capex is likely to fall as its largest airport terminal projects near completion. It used over $700 million in cash to fund its pilot contract retroactive payments in 2023.

A Stable and Reliable Industry Leader

Airline stocks remain subject to macroeconomic factors, which have included assessments of the strength of the general economy, driven in part by interest rates. The big 3 have demonstrated that they are less susceptible to macroeconomic factors than the low-cost carrier segment of the industry, and that distinction is likely to continue to help Delta.

Crude oil prices have recently nudged above the $75 level, which they found difficult to break for a number of recent months. Global instability, including around Middle East shipping routes, is offset by strong domestic production in keeping crude oil prices in check, which will be beneficial to Delta and other transportation companies.

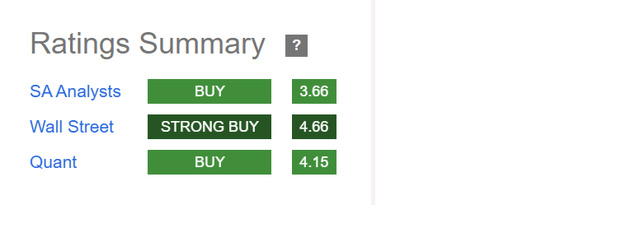

DAL stock remains a strong Wall Street and Seeking Alpha analyst favorite and is supported by strong SA quant ratings. Wall Street’s price target of $53 provides a 30% upside.

DAL summary ratings 14Feb2024 (Seeking Alpha)

DAL stock is a strong buy for a company that continues to be positioned at the top of its industry in both current performance and future prospects. In an industry known for instability, Delta is a predictably and reliably strong and stable company.