DANIEL ROLAND/AFP via Getty Images

Introduction

I previously covered Commerzbank (OTCPK:CRZBF) back in December 2023, highlighting Commerzbank’s strategic 2027 plan and its capital return potential relative to its largest peer, Deutsche Bank (DB). As expected, the bank is currently executing a 600 million EUR buyback as part of its 2023 capital return.

In today’s article, I will highlight the bank’s Q4 2023 earnings and compare Commerzbank with Deutsche Pfandbriefbank (OTCPK:PBBGF) which came into the headlines recently due to its exposure to U.S. real estate.

Operational Overview

Commerzbank results are available here. The bank reports results in two main segments, namely Private and Small-Business Customers (PSBC) accounting for 51% of 2023 revenue, and Corporate Clients (CC) accounting for 43% of revenue, with the rest of revenue recorded in “Others & Consolidation”.

Private and Small-Business Customers were clearly the weaker performing segment in Q4, with revenue down 18% Y/Y (2023: +2%). Impacted by provisions for Swiss mortgages at Polish subsidiary mBank, the segment recorded a loss in Q4, with operating return on tangible equity coming in -2.2% (2023: 14.5%). Operating return on tangible equity is a metric used by Commerzbank to evaluate segment performance and only takes into account operating profit in its numerator, without accounting for group overhead costs.

Corporate Clients’ performance was much more robust, delivering 12.5% Y/Y revenue growth in Q4 (2023: +17%). The cost of risk remained contained, with the segment delivering an operating return on tangible equity of 17.8% in Q4 (2023: +18.8%).

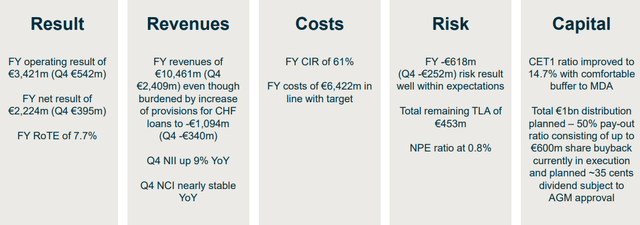

On a consolidated basis, revenue grew 1% Y/Y in Q4 (2023: +10%), the return on tangible equity (RoTE) was 5.2% in Q4 (2023: 7.7%), the cost/income ratio was 67.1% in Q4 (2023: 61.4%), cost of risk was 23 basis points in both Q4 and 2023, tangible book value per share was 21.45 EUR/share, flat Q/Q. I estimate that after the 600 million EUR buyback is completed in Q1 2024, tangible book value per share will grow by about 1 EUR/share to 22.45 EUR/share, taking into account expected Q1 profits.

Result Highlights (Commerzbank Analyst Presentation Q4 2023)

Capital Position

Commerzbank ended 2023 with a CET1 ratio of 14.7%, up 0.1% Q/Q, and comfortably above its current 10.3% requirement. In addition to the 600 million EUR buyback, the bank proposes a dividend of 0.35 EUR/share for 2023. In addition, the bank added color around its future payout policy, namely that it will apply for an additional share buyback after the H1 2024 results, which I estimate to be in the 600 million EUR range once again.

Looking further ahead, the bank targets a CET1 ratio of 13.5%, with a 2.5% buffer relative to regulatory requirements necessary for dividend payments, meaning that the bank will propose dividends as long as the CET1 ratio stands above 12.8%. Furthermore, a CET1 ratio of over 13.5% is necessary for share buybacks. The bank ended 2023 with a CET1 capital of 25.7 billion EUR, implying there is a circa 2.1 billion EUR capital surplus relative to the bank’s internal 13.5% buyback hurdle. As a result, I expect Commerzbank to execute at least three more 600 million EUR buybacks in 2024-2025, which at the current price of around 10.75 EUR/share can retire 167 million shares, or 13% of the 2023 year-end 1.24 billion shares.

2024 Outlook

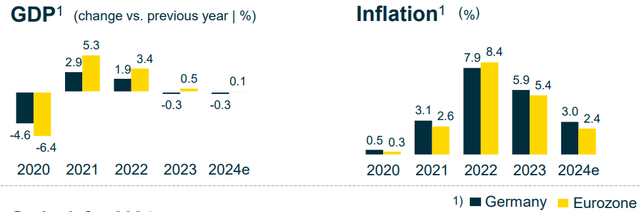

Commerzbank expects the German economy to underperform the Eurozone in 2024, contracting by 0.3% as opposed to 0.1% growth in the Euro area:

Macro outlook 2024 (Commerzbank Q4 2023 Analyst Presentation)

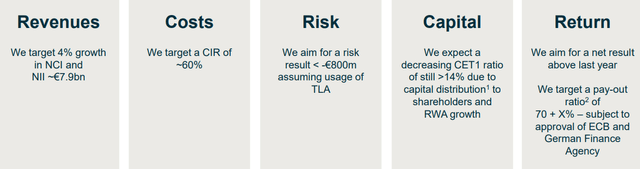

Turning back to Commerzbank, the bank expects net interest income (NII) to be 6% lower in 2024, partially offset by 4% higher net commission income (NCI), with a cost of risk below 800 million EUR (2023: 618 million), helped by the release of 453 million EUR of top-level adjustments. These adjustments are provisions for credit losses made by management in excess of what is prescribed by credit models.

2024 Targets (Commerzbank Q4 2023 Analyst Presentation)

Commercial real estate exposure

Commerzbank’s commercial real estate exposure (CRE) stood at 9 billion EUR at the end of 2023, of which 0.3 billion EUR, or 4%, is non-performing. Offices and residential account for 6.4 billion EUR, or 71% of all CRE exposure. 99% of the real estate portfolio is located in Germany, with an average loan-to-value of 51%.

While it is true that the proportion of non-performing loans, at 4%, is much higher than the bank average of just 0.8%, I expect stress in the sector to materially diminish as the ECB cuts rates in 2024-2025. Furthermore, the 9 billion EUR commercial real estate portfolio represents just 1.9% of Commerzbank’s total assets.

Comparison with Deutsche Pfandbriefbank

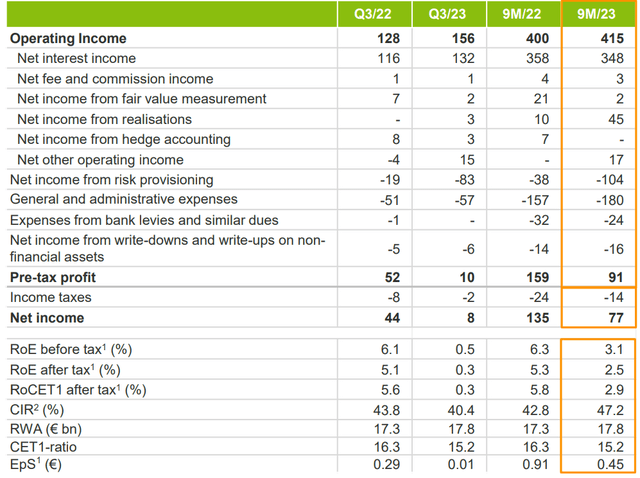

Deutsche Pfandbriefbank (pbb for short) whose presentations are available here, came into the headlines recently due to its exposure to the U.S. office market. The bank is significantly smaller than Commerzbank, with 48 billion EUR of total assets, 32 billion EUR of which are in real estate. Despite elevated loan-loss provisions, pbb boasts a strong CET1 capital ratio of 15.2%, some 0.5% higher than Commerzbank:

Income statement highlights (Deutsche Pfandbriefbank 14.02.2024 Company Presentation)

While pbb is actively trying to diversify its business, it remains squarely focused on real estate finance and is thus by no means as diversified as Commerzbank. As of the time of writing, pbb trades at a price-to-tangible-book ratio of just 0.18, well below Commerzbank’s 0.50.

All in all, I reckon that Commerzbank will mitigate the current commercial real estate panic with relative ease, given its robust capital position and diversified loan book.

Conclusion and valuation

Since my previous article, Commerzbank has outperformed German peers such as Deutsche Bank, which currently trades at a price-to-tangible book of 0.41. I expect both banks to deliver a RoTE of about 8% in 2024, with incremental increases in the coming years. Even if we account for the upcoming capital distributions, I reckon Commerzbank shares will consolidate at current levels, creating an excellent opportunity to generate options income. Longer-term the shares are not prohibitively expensive, and I expect Commerzbank to reach a tangible book value of around 26 EUR/share at the end of 2025 once capital has been returned to shareholders.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.