SOPA Images/LightRocket via Getty Images

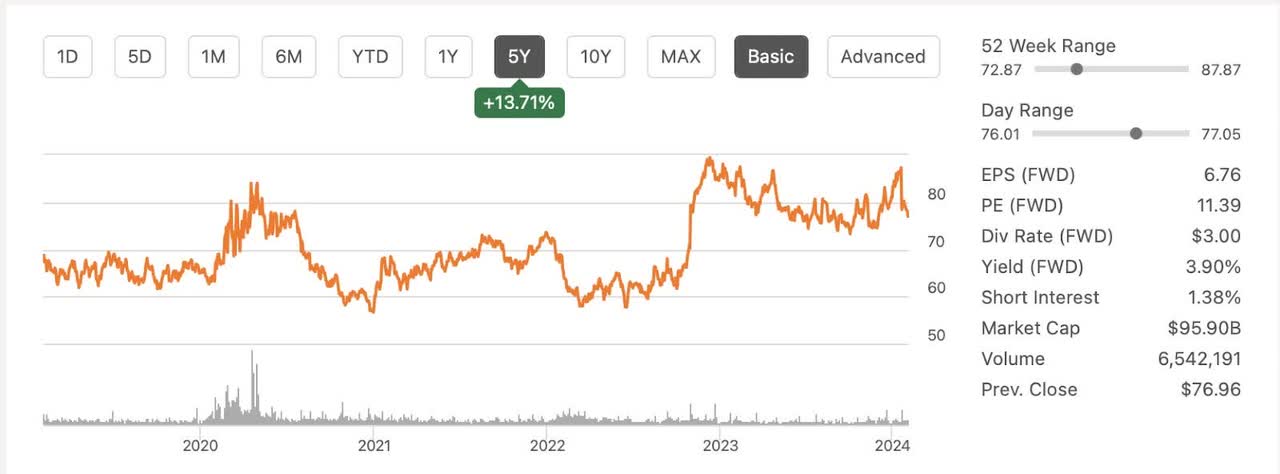

Gilead Sciences Incorporation’s (NASDAQ:GILD) stock price has not had a great week. As reported here on Seeking Alpha, the stock has traded in the red for the last seven days consecutively. Once the darling of the biotech world GILD, has seen better days. If we look back, we can see that the last five years haven’t been that great either.

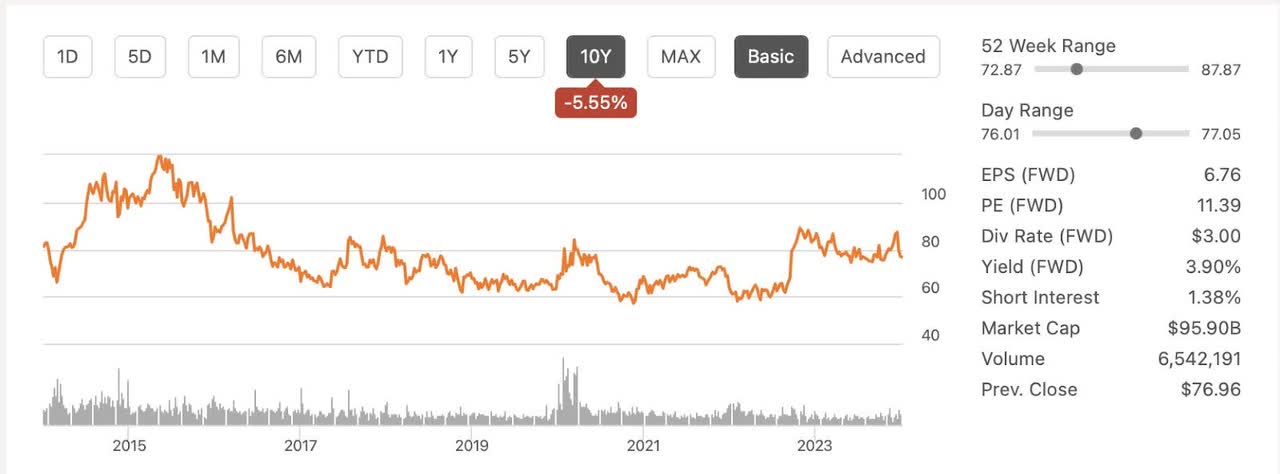

If we look back a little further we see that GILD stock has been dead money since 2015 when it traded over $100 a share.

This completely undermines the fact that GILD is a major success story that has returned over 21,000% since 1994. Today GILD’s business is stronger than it has been in the last decade and is poised to return to growth in 2024. I recommend GILD as a strong buy based on its strong dividend and future prospects. It is my opinion that growth in the bottom line combined with drug approvals and possible dividend increases will be the catalyst to drive a higher multiple and higher price.

I pointed out the recent struggles above because it is important to note where a stock is in its lifecycle. Investors can easily lose interest in mature companies especially when the last decade has seen the stock price languishing. After all, there is always a new high flying company that can catch the eye of the hopeful investor and a decade is a long time in a human’s life.

The previous decade has heavily impacted the public sentiment regarding GILD which has in turn influenced the stock’s price quite heavily keeping it suppressed. I do not think the price was wrong. I think it was deserved, but I think things are about to change.

For those of my readers who enjoy analogies, I would point out that Microsoft experienced a similar lost decade where from 2000 to 2010 it went from over $50 to $25. This did not happen because Microsoft was a bad company. It happened because sentiment regarding the company cooled off after a previous run. Today, MSFT trades at over $400 a share and has a PE over 35. A sixteen bagger in 13 years. Not too bad. When I talked about investing in Microsoft in 2010, I was told it was dead money by many people.

I’m not saying that GILD will perform like Microsoft did in the past. I am not saying the two companies are all that similar, but I am saying that the sentiment in GILD now is similar to the sentiment in Microsoft in 2010. This is what interests me about GILD today.

For those that don’t know, I am primarily a sentiment trader/analyst. I think the numbers are important, but not as important as the sentiment for driving stock prices. I have spent the last few days researching a handful of stocks and the majority of them appear to be overvalued at first glance. This is not the impression that I get from Gilead.

I see a company with a large portfolio of products and a rich diverse pipeline. I see a company with enough cash and the necessary infrastructure and personnel to bring products through FDA approval and into the profitable sales cycle.

Catalysts

When looking for inflection points, it is important to consider possible catalysts that could possibly change the narrative. 2024 looks to have plenty of opportunities for Gilead to change sentiment.

The pipeline includes phase 3 drugs for emerging viruses, HIV, and HDV. There are four breast cancer drugs and five lung cancer drugs. Overall there are fourteen cancer drugs including two cell therapy drugs. Some of these drugs are going to drive success for the next decade.

Clinical Pipeline 2024 (Gilead)

Recent Acquisition

On February 12th, GILD agreed to buy Cymbal for $4.3 billion dollars. You can read about that here. Although this acquisition will not be accretive until 2026, it demonstrates the company’s commitment to long term planning and growth in the liver disease space. The truth is that buying companies with assets that are already approved is expensive. Valeant proved the potentially harmful impact that overpriced acquisitions can have on a company’s bottom line. Time will tell whether this was a good purchase or not and we will be watching.

The Health of the Business

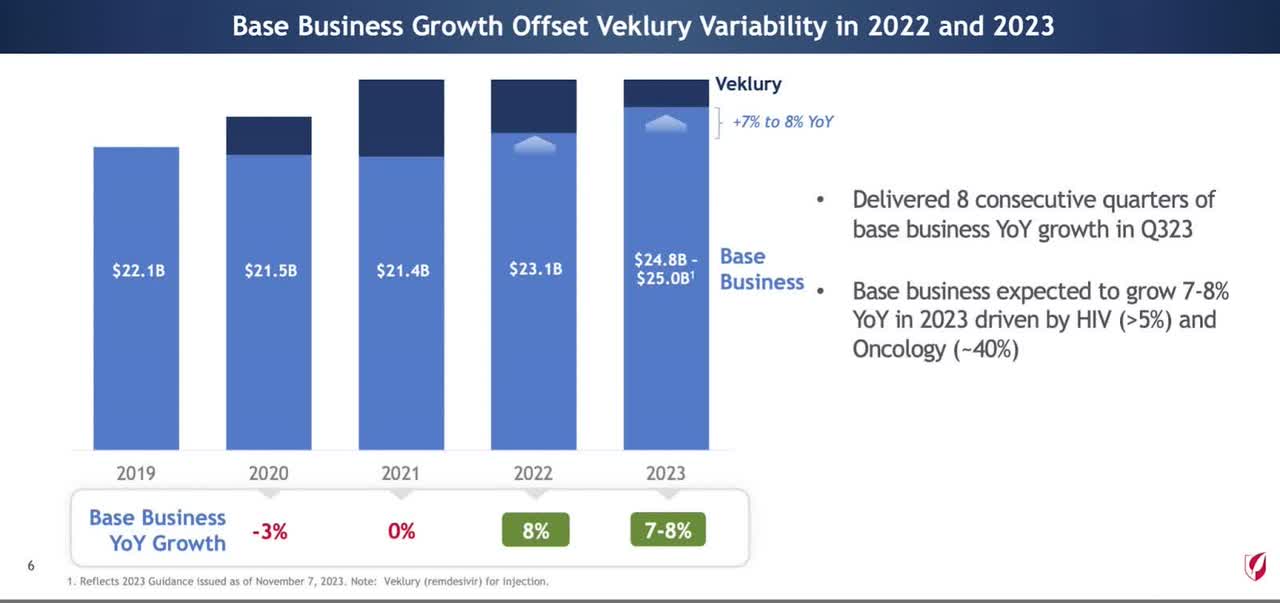

The company’s business prospects are already showing signs of improvement. While in 2020 the business shrank. Gilead has had twelve consecutive quarters of growth and their recent growth in 2023 shows that the ship might be turning around. Investors may not be impressed yet, but 2024 should be a year when people start to notice GILD again. This is a clear sign to me that sentiment could be ready to shift and it’s always better to buy before the moment of inflection than after it.

Valuation

It’s very difficult to value a company as large as GILD. There are a number of products/drugs that will heavily impact its future and the outcome is uncertain. If we look at the current PE ratio of 10.47, we notice that it is close to its yearly low. PE ratios are not really the best way to value a stock, but I do like to look at the historic PE ratios to understand the current sentiment. Earnings are predicted to increase slowly throughout the next decade which should have two effects on the stock price. Higher earnings will eventually earn a higher multiple. My back of the napkin estimates say GILD should earn over $8 a share by 2027. At this point I predict GILD will have a PE of over 16. Putting my price target for 2027 at over $128 a share. This is not including the possible surprises caused by FDA decisions.

If instead I did a rough DCF analysis with a 10% growth rate over the next ten years and included the negative tangible book value per share of ($9.65) it would give me a value of $85.63. This value seems to be rather low but still provides a 14% cushion to its current trading price of $73. Not really an impressive discount all things considered.

Final Thoughts

2020 was a bad year for GILD’s business and investors took note. The stock market does not like shrinking companies and often punishes them and shareholders in moments of contraction. However, the opposite is true when a company is growing. Multiples increase and stock prices rise.

GILD appears to be entering an inflection point where I think they will go from being punished to being celebrated. This change will likely take 1-3 years to come about so some amount of caution is necessary.

There is nothing more rewarding than picking a great company before a positive change in its fortunes. I would also argue that this is how you buy a great company at a fair price. A habit which has made many investors quite well off. Overall, I recommend Gild as a buy currently and think it has some value compared to most equities which appear to be overvalued. As always, please do your own due diligence prior to buying any equities and good luck investing. If you liked the article, please leave a comment. Thank you for reading.