spooh

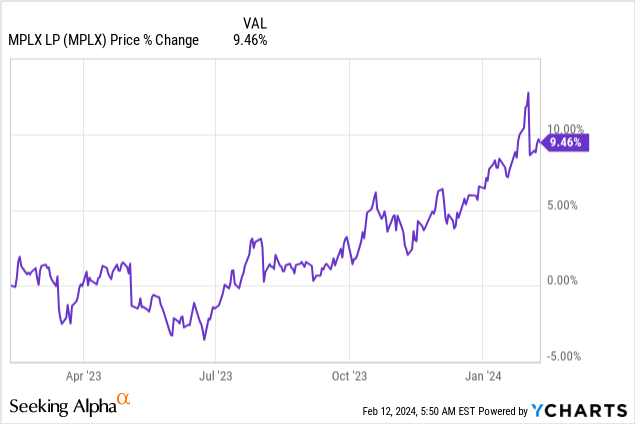

MPLX LP (NYSE:MPLX) is an attractive income and yield play for dividend investors in 2024. The midstream firm achieved record business results in FY 2023, strong distributable cash flow and managed to deliver an impressive distribution coverage ratio of 1.6X. I believe that MPLX can continue on its record run in FY 2024 and although the midstream firm does not have the size of a midstream firm like Enterprise Products Partners (EPD), MPLX is great value, in my opinion: MPLX delivered strong EBITDA growth and raised its distribution by 10% in Q4’23. I expect similar growth for the distribution this year and consider the 9% yield as well-supported and sustainable.

Previous rating

I last worked on the midstream firm in November 2023, and I recommended MPLX due to a favorable deleveraging trend. For FY 2024, I have high hopes for MPLX as well and believe that we could see another strong year in terms of business growth, potentially resulting in a sizable distribution increase. Since units of MPLX are still attractively valued, MPLX is one of my favorite high-yield master limited partnerships right now.

MPLX is a rapidly growing midstream

MPLX is organized as a master limited partnership and currently has a market cap of $37.8B. The company is diversified and operates both a logistics, storage and core midstream business which includes a network of crude oil and refined product pipelines as well as several natural gas gathering systems.

Other assets include marine terminals, loading racks and storage facilities for energy raw materials. MPLX essentially separates its business into two parts: Logistics/Storage and Gathering/Processing. The first part, Logistics and Storage, consolidates pretty much all of the company’s fuel distribution and storage services and generates MPLX’s fastest growth.

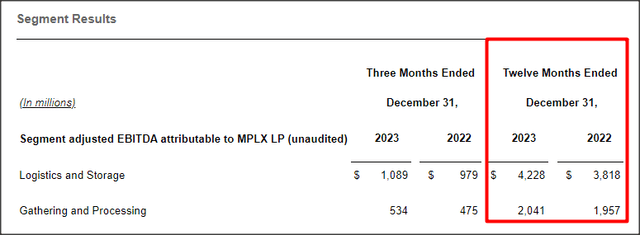

Logistics and Storage’s Q4’23 adjusted EBITDA in FY 2023 was $1,089M, showing 11% year-over-year growth while the second part of MPLX’s business, Gathering and Processing, which consolidates the firm’s natural gas activities, grew its adjusted EBITDA 12% year over year to $534M.

The totals for FY 2023 show that MPLX’s Logistics and Storage business generated 11% growth year over year, compared to just 4% growth in natural gas. The fast-growing L&S business accounted for two-thirds of MPLX’s consolidated adjusted EBITDA, and at no time in the company’s history did MPLX achieve a higher EBITDA than in FY 2023.

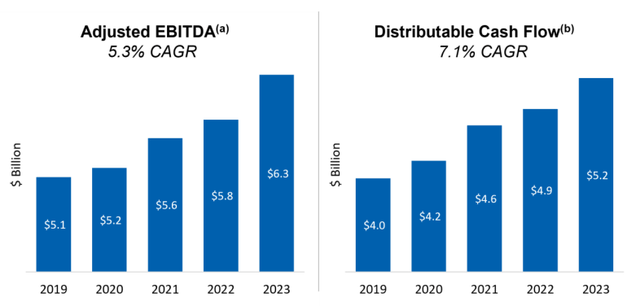

Growth in adjusted EBITDA as well as distributable cash flow has been due to investments in key growth areas in recent years. MPLX invests in the growth of its gathering systems especially in the Permian and the Bakken Basins which are two of the most promising production growth plays in the U.S. shale industry.

These basins have been the core focus of producers in the last decade, and midstream companies like MPLX have unique opportunities here in connecting these shale basins to energy/export hubs that allow for the transportation of energy raw materials to consumer end markets. MPLX is investing heavily in the Permian in a bid to improve its appeal to producers: the midstream firm is constructing the Agua Dulce Corpus Christi pipeline, as an example, which is expected to go into service in Q4’2024 and the MPL is building a sixth natural gas processing plant in the Permian as well… which is projected to come online in Q2’24.

Growth in MPLX’s EBITDA is therefore related to a number of factors, including a growing pipeline footprint, higher pipeline rates as well as higher throughput volumes. New expansion projects in the Delaware basin, which is where the company is also building new natural gas processing plants, would boost the company’s processing capacity and allow for organic adjusted EBITDA growth as well.

MPLX’s EBITDA grew 9% in FY 2023 to a record $6.3B on broad-based business momentum, while its distributable cash flow increased 6% year over year to $5.2B.

Distribution coverage

In the past, I mentioned that MPLX had good distribution coverage, which didn’t change much in FY 2023. The master limited partnership exhibited a distribution coverage ratio of 1.6X in Q4’23 which was the same ratio as in Q4’22, FY 2022, and FY 2023. For context, Enterprise Products Partners had a distribution coverage ratio of 1.7X in FY 2023, so this extremely well-run MLP had only slightly better coverage than MPLX.

MPLX has a history of good distribution coverage, which is the primary reason why I believe that the midstream will continue to return more cash to shareholders in FY 2024. Given MPLX’s excess coverage and uptrend in distributable cash flow, the midstream firm has more than enough cash coming in on a recurring basis to afford another distribution increase later this year.

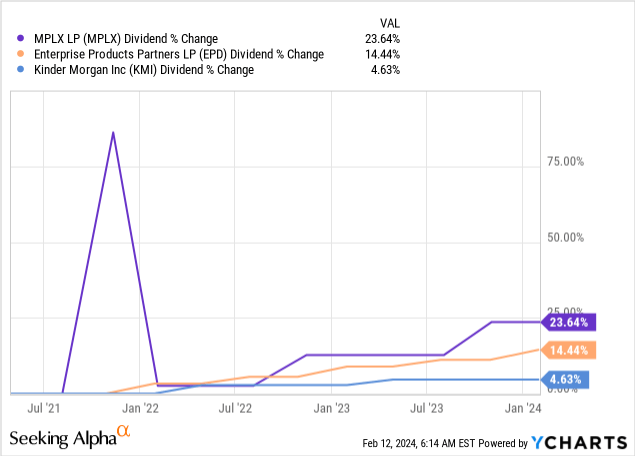

MPLX outperformed EPD in terms of distribution growth in the last three years

The yield of a midstream firm is obviously a key decision parameter for dividend investors, but so is the rate of distribution growth. MPLX raised its distribution by a solid 10% in November 2023 to a new quarterly rate of $0.85 per unit. The new annualized distribution is therefore $3.40 per unit, which calculates to 9.0% forward dividend yield. Importantly, if MPLX keeps up its rate of adjusted EBITDA and distributable cash flow growth in FY 2024, which I believe is likely, the midstream firm could raise its distribution ~10% in FY 2024 as well… without materially affecting its distribution coverage ratio.

Considering that MPLX also offers a higher distribution yield and faster distribution growth than EPD or Kinder Morgan (KMI), MPLX is my favorite midstream to own for income in FY 2024.

Continual deleveraging

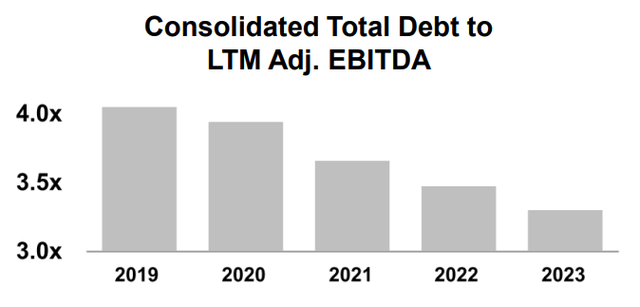

Another lever that MPLX can pull to grow the distribution is represented by the MLP’s successful deleveraging. The company has made massive progress by bringing down its leverage ratio, from 4.1X in FY 2019 to 3.3X in FY 2023, showing a total decline of 20% in the last four years. The decline in leverage is freeing up cash for the MLP to invest in its Permian-based growth strategy, as well as in a growing distribution.

Valuation of MPLX compared against other midstream firms

MPLX trades at a higher enterprise-value-to-EBITDA ratio than its larger rival, EPD. I use an EBITDA-based valuation ratio to value MPLX because MPLs have large capital expenditures that skew earnings.

MPLX is currently expected to generate $6.6B in EBITDA next year, compared to a consensus EBITDA projection of $10.1B for EPD. Enterprise Products Partners is therefore 1.53X the size of MPLX in terms of EBITDA and 1.48X the size of MPLX in terms of enterprise value. MPLX’s estimated EBITDA growth rate is below the company’s 5-year CAGR rate of 5.3%, so I believe the market may be conservative with its assumption.

While EPD is expected to grow its EBITDA slightly faster than Enterprise Products Partners, MPLX is more expensive than EPD on an Enterprise-Value-to-EBITDA basis: the ratios are 8.9X for MPLX and 8.6X for EPD. I attribute the slightly higher multiplier factor to the fact that MPLX outperformed EPD in the last three years in terms of distribution growth. EPD, however, has earned a reputation as a liable dividend payer over time and is a top income play as well.

| in $B | MPLX | EPD |

| Market Cap | $37.8 | $57.0 |

| Enterprise Value | $59.0 | $87.3 |

| Est. EBITDA FY 2024 | $6.5 | $9.8 |

| Est. EBITDA FY 2025 | $6.6 | $10.1 |

| Y/Y EBITDA Growth | 1.54% | 3.38% |

| EV-to-EBITDA Ratio (2025) | 8.9X | 8.6X |

(Source: Author)

Risks with MPLX

The biggest commercial risk with MPLX is that fossil fuel-oriented midstream businesses may be at the receiving end of adverse environmental regulation that could stifle the industry’s overall growth prospects when it comes to the expansion of pipeline networks. MPLX is a pipeline-focused enterprise and as such could see slowing EBITDA, DCF and distribution growth going forward. What would change my mind about MPLX is if the midstream saw a steep decline in its distribution coverage ratio or if its distribution growth slowed.

Final thoughts

MPLX is a top income play for me in FY 2024 and beyond: few midstream giants offer investors a 9% yield while at the same time growing distributions by 10% annually. MPLX does, however. The midstream firm saw record results in FY 2023, and it is likely that MPLX will end the fiscal year with record adjusted EBITDA as well as it executes its Permian-driven growth strategy.

While the business itself seems to be on a good track, due to past investments in pipelines connecting important shale regions to end consumers, especially in the Permian, I believe the well-supported 9.0% dividend yield and very solid distribution coverage of 1.6X suggest that dividend investors will continue to see a rapid increase in their distribution in FY 2024 and beyond. Since MPLX has grown its distribution by approximately 10% in FY 2022 and FY 2023 and units are only slightly more expensive than those of highly-regarded Enterprise Products Partners, I believe the risk profile remains highly favorable for MPLX!