Francesco Carta fotografo/Moment via Getty Images

Momentum factor strategies aim to overweight securities with strong relative recent price performance based on the idea that in the near term, what is “up will go up.” The Vanguard U.S. Momentum Factor ETF (BATS:VFMO) is an ETF that targets U.S. large and mid-cap Momentum stocks.

VFMO is actively managed, and its benchmark is the Russell 3000. The fund currently holds just north of 500 stocks. It is hard to glean much more insight into VFMO’s methodology, since it is an actively managed ETF, and wants to keep the sauce a secret. Vanguard defines the Momentum factor as: “total returns from month T-12 to month T-1, total returns from month T-7 to month T-1, and the intercept from a 1-year regression of stock returns on their regional benchmark.” This composite definition is more comprehensive, including inputs based on the security’s performance over multiple time periods (both trailing 12-month and trailing 6-month returns). We tend to like factor definitions that include multiple inputs, as they are less vulnerable to one-offs that could directionally impact the score.

One interesting thing to note is that VFMO doesn’t specify rebalance frequency. Rebalance considerations are pretty important when it comes to momentum strategies because momentum strategies are susceptible to “factor decay.” Factor decay refers to the diminishing momentum characteristics in a given stock (which is based on recent price performance). This decay is attributed to a variety of things – mean reversion, investor “herding” behavior, and shifting markets – all of which can contribute to either inflated prices or price reversals. The fact sheet for VFMO does state that the fund experienced an 88.5% turnover rate for the most recent fiscal year ending in November, which is in line with what we might expect from a momentum strategy.

One benefit to VFMO being actively managed is that rebalances can occur in shorter intervals compared to an ETF that is simply tracking a momentum index, which typically rebalance on a quarterly or semi-annual basis (less than ideal for capturing recent momentum). More frequent rebalances can provide some confidence that a momentum strategy is doing its best to avoid factor decay. The drawback is that turnover contributes to transaction costs that can ultimately eat into whatever alpha your momentum strategy is providing.

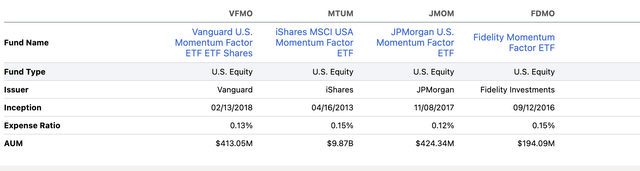

The good news on that front is that – true to Vanguard form – VFMO is fairly inexpensive for an actively managed ETF, with an expense ratio of 0.13% and has done a decent job of gathering $413 million in assets since its inception in 2018. This is on the cheaper side compared with other Momentum ETFs.

Seeking Alpha

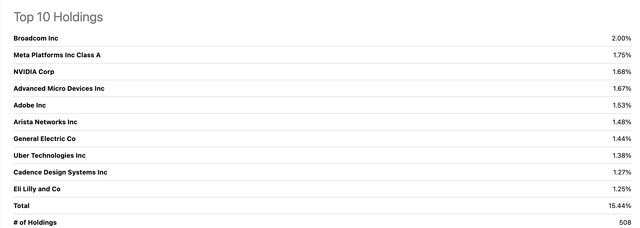

Another component to VFMO we like is the number of holdings. Competitor ETFs are fairly concentrated, both in total number of holdings, as well as the percentage of assets in the top 10 holdings. Typically, a focused ETF for more defensive factors such as Quality or Low Volatility might not deter us. But given the potential for price swings to impact the total performance of the portfolio, we prefer a broader subset of stocks for a Momentum ETF.

Seeking Alpha

Who has more juice: VFMO or SPY?

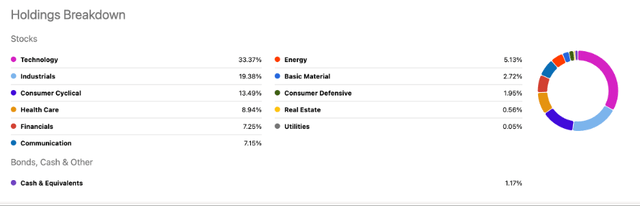

When looking under the hood, we see that VFMO has a large allocation to tech, which is unsurprising given that the sector has driven returns in the broader market. It also has large allocations to Industrials and Consumer Cyclicals which tend to be favored in periods of economic expansion, a prospect that could be on the horizon.

Seeking Alpha

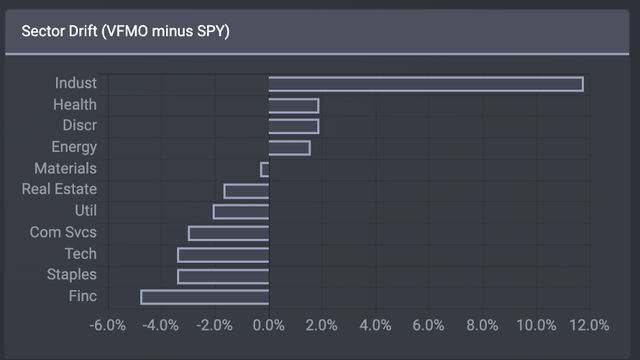

Interestingly, when we compare VFMO to SPY, to use as a proxy for the broader market, we see that VFMO is actually underweight tech relative to SPY, which is not particularly intuitive.

ETF Research Center

In terms of individual holdings, we see a similar pattern where VFMO is underweight some key constituents in SPY. Specifically, VFMO is underweight Meta, NVIDIA and Alphabet, all members of the Magnificent 7 and outperformers in 2023.

ETF Research Center

We don’t want to fall in the trap of putting too much emphasis on both the tech sector and the Magnificent 7 because they aren’t synonymous with the momentum factor. There are likely other components to Vanguard’s proprietary methodology that would justify these individual allocations. And folks who want to make momentum plays indirectly can just go to sector or thematic ETFs.

VFMO’s top 10 holdings include some names we might expect in a fund aiming to capture recent price performance, again Meta and NVIDIA have made a huge splash this year. Additionally, Eli Lilly holds a spot in the top 10 thanks in part to the explosive popularity of its weight loss drug Mounjaro. The top 10 holdings are well diversified across sectors, and the fund is not too concentrated in any single position, which is something we like.

Seeking Alpha

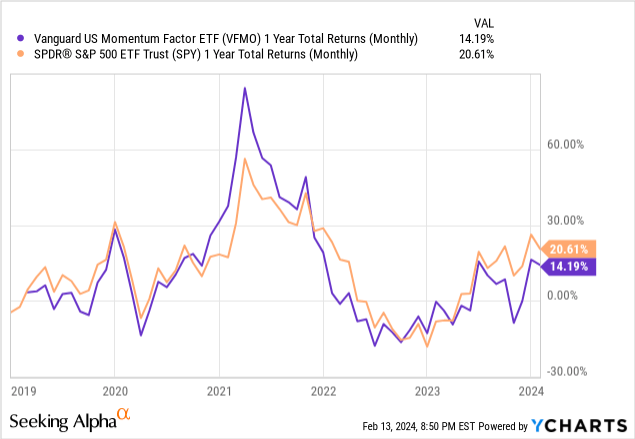

The chart above might be the best quick visual to capture the attractiveness of VFMO versus SPY. The 2 ETFs have traded alongside each other on a 1-year rolling basis, except for the post-pandemic period in 2021, when VFMO fly much higher. This does not make VFMO “better” than SPY for all time, but it does give a glimpse of just how much alpha a momentum strategy can add to the broad market index when market experiences periods like that.

It seems that the question that begs to be answered is if the current broad equity market needs to be complimented further with a momentum strategy, or if SPY is able to offer the momentum investor all it needs.

VFMO is gunning in 2024, but at what cost?

Looking at trailing 1-year historical performance, we see that VFMO has underperformed SPY, tending to diverge more when the market dips, while trending upwards as markets begin to bounce back.

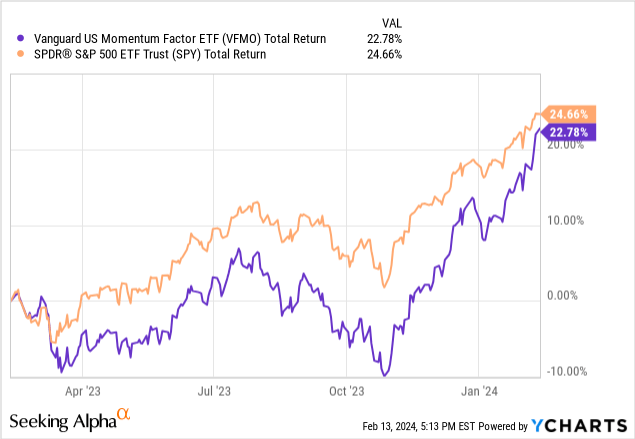

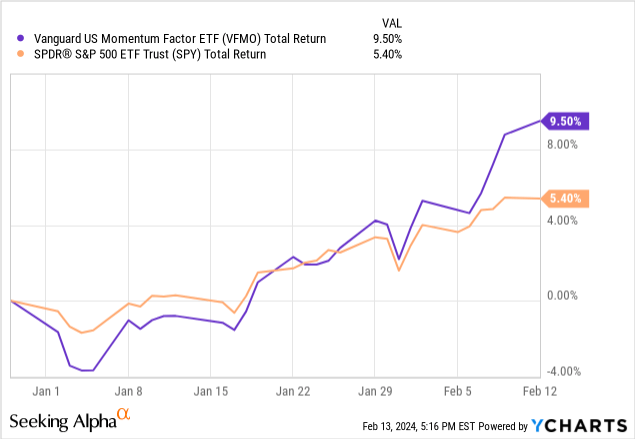

However, when we look at the most recent period, which includes at least 2 instances of the S&P 500 reaching all-time highs, we see that VFMO has outperformed notably, delivering +4.1% return above the market since the start of 2024.

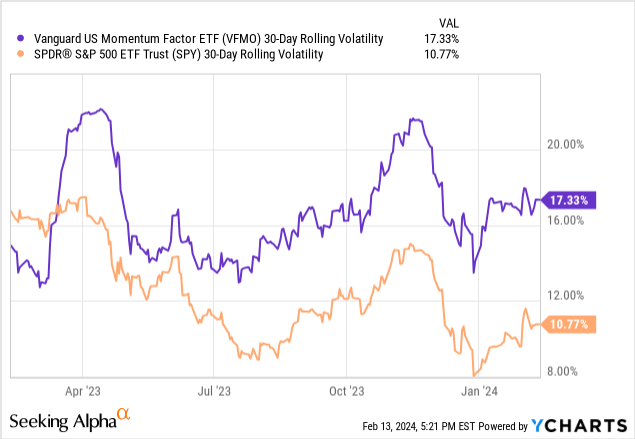

Given that momentum tends to build on itself, this could be seen as a positive indicator. But when looking at the other side of the coin, we see that in previous trailing 1-year period, VFMO takes on considerably higher volatility for lower returns than SPY.

Conclusion

VFMO is one way to capitalize on current market exuberance. It has succeeded in the recent period of providing above market returns. While the current market is favoring risk-on sentiment, we are not confident that it is worth piling on additional risk for more momentum. At least not at this stage of the market cycle, with recent stock market leaders increasingly looking like they are running out of gas.

For those that already have a momentum allocation, it might be worth it to ride the wave for at least a little while, but knowing when to take gains before the whiplash hits is also something to think about.

Our bottom line: VFMO is a hold, but we’d have a quick exit ramp if the momentum trade suddenly reverses course. Because if and when it does, it will likely be a swift transition to a period of underperformance for VFMO, if not decidedly negative returns.