Dilok Klaisataporn

By Valuentum Analysts

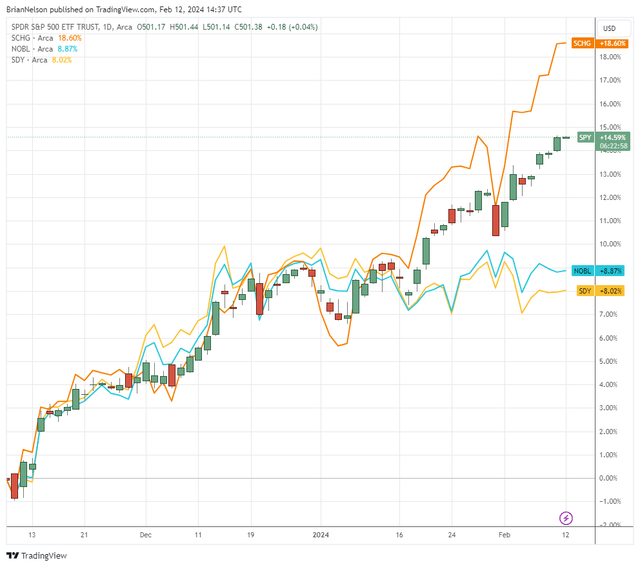

Back on November 8, 2023, a number of dynamics in the stock market started to come together for us to declare that a crash higher is coming. In that note, we mentioned the strong cash-based sources of intrinsic value for many companies in big cap tech and large cap growth including Microsoft (MSFT), Amazon (AMZN), and Meta Platforms (META), and these areas of the market continue to lead. Since November 8, the Schwab U.S. Large-Cap Growth ETF (SCHG) has advanced more than 18%, exceeding the return of the S&P 500 (SPY). However, it has become clear that dividend-paying stocks, as measured by dividend-growth oriented indices such as ProShares S&P 500 Dividend Aristocrats ETF (NOBL) and SPDR S&P Dividend ETF (SDY) haven’t done as well.

Large cap growth stocks continue to power the market higher. (Valuentum)

Don’t get us wrong — we like dividend-paying stocks, but we’ve worked tirelessly to educate readers that the dividend should be viewed as capital appreciation that otherwise would have been achieved had the dividend not been paid. This is why it is so important to add back dividends to a company’s capital appreciation in arriving at total return. When a company pays a dividend, its share price is adjusted downward by the dividend payment. Recklessly chasing dividend yields, in many respects, may be seeking to get paid with one’s own money because, as an investor, you already own the cash on the balance sheet that is used to pay the dividend. We understand how important dividends are to retirees, but understanding what the payout is and what it isn’t remains equally important.

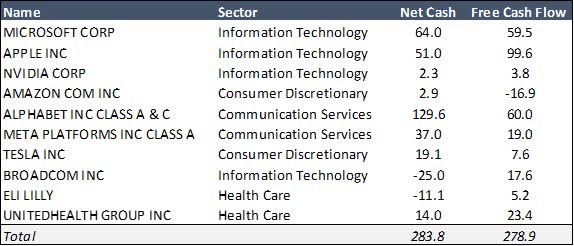

On the other hand, we think stock prices and returns are driven by the cash-based sources of intrinsic value: net cash on the balance sheet and future expectations of free cash flow. Within the discounted cash-flow process, a company’s net cash (total cash less total debt) is added to the present value of future expected free cash flows in arriving at a fair value estimate. If a company has a larger net cash position than another company, its intrinsic value should be larger, all else equal. If future expectations of free cash flow increase, a company’s share price should increase, and so should its stock price, all else equal. If future expectations of free cash flow decrease, a company’s share price should fall, all else equal.

The strong cash-based sources of intrinsic value of large cap growth. Net cash as of the company’s last fiscal year. Annual free cash flow as of the last fiscal year. Data retrieved January 2024. (Valuentum)

Though the past several months is way too short of a time period to make any sort of conclusion, we think that dividend-oriented investors will likely continue to be left behind in this new bull market. On the basis of their strong cash-based sources of intrinsic value, big cap tech and large cap growth may continue to lead the market higher, in our view. Unfortunately, for many dividend investors seeking outsize dividend yields, they may be left behind. We don’t expect a market correction anytime soon, but in the event markets pull back even just a little bit from when we penned that November article, most of the gains for dividend payers will become muted, unlike the burgeoning outperformance already had by the stylistic area of large cap growth.

We understand that a meaningful dividend payment is important to many a dividend investor, but if the past few months have provided any indication, to truly participate in any huge market rally, which we think may still be ahead of us, an adjustment to seeking only elevated yields may be warranted. Warren Buffett has said in the past that investors can make their own dividend by selling a portion of their shares, but this statement is one made in the context of intrinsic value and doesn’t take into consideration the importance of financial planning or tax implications, which are different for every investor. Still, we think investors can participate in the strength of large cap growth, while reaping a dividend, albeit a small one, along the way. Here are two aggressive growth stocks with strong dividends to consider.

Visa (V)

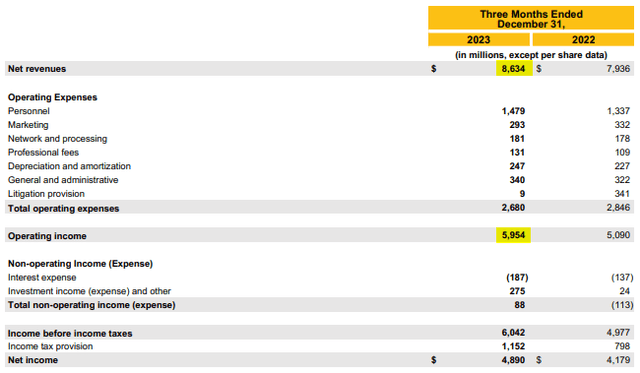

Visa’s operating margins are phenomenal. (Visa)

Visa is not a hidden stock by any stretch of the imagination, but the company has a lot of things going for it that we like quite a bit. For starters, the company doesn’t take on credit risk like American Express (AXP) or Discover Financial (DFS), and instead reaps a fee every time one of its cards is used. What a business model, right?

The credit card giant issued strong first-quarter fiscal 2024 results on January 25 that exceeded consensus estimates on both the top and bottom lines. Visa’s net revenues leapt 9% in the quarter from the same period a year-ago, and it drove non-GAAP net income and non-GAAP earnings per share 8% and 11% higher, respectively.

In the company’s most recently-reported quarter, it experienced strong growth rates in payments volume, cross-border volume, and processed transactions. Visa’s operating margin remains stellar, too, as it registered an impressive 69% mark in the quarter, while it generated ~$3.35 billion in free cash flow, which equates to nearly 39% of sales.

When looking at its balance sheet, the company ended 2023 with $20.2 billion in cash, cash equivalents, and investments, which was modestly lower than its long-term debt load of $20.7 billion. The executive team said in the press release that it continues to witness “stable growth in overall payments volume and processed transactions” and that “consumer spending remained resilient,” which we take as yet another strong data point for the economy.

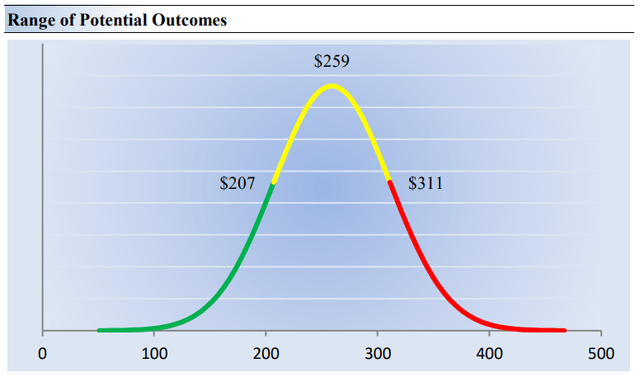

Our fair value estimate range of Visa. (Valuentum)

Visa’s operating and free cash flow margins make it one of our favorite stocks to consider, and the firm is heavily tied to secular growth prospects as the world moves to a cashless society and as e-commerce continues to proliferate. We expect the strong labor market, as evidenced by low unemployment rates and strong wage gains the past few years, to continue to propel credit card spending higher, and Visa is primed to benefit.

The high end of our discounted cash-flow derived fair value estimate of Visa stands at $311, well above where shares are currently trading. The company currently has a dividend yield of ~0.75%, which won’t turn many heads, but it meets our definition of an aggressive growth stock that also pays a dividend. We think it is worthy of consideration, especially in the current market environment.

Meta Platforms

Meta Platforms is a company that we once loved. We had been so excited about its long-term prospects, “Meta Platforms’ Shares Offer the Bargain of the Century,” and then late 2022 happened, where free cash flow dipped so low that we grew concerned about the company’s long-term profitability. We were shaken from our bullish thesis on the name in late 2022, but the company has come a long way from the struggles of a couple years ago.

The social media giant has put a lot of the problems that weighed on the stock behind it, with the company 1) addressing challenges that came about from running effective advertising campaigns due to Apple’s iOS changes, 2) launching Reels to meet head-on competitive issues over the rise of TikTok in short-form video 3) putting to bed concerns that Facebook may turn into the next social media dinosaur (its daily [DAUs] and monthly active users [MAUs] continue to increase at a respectable pace), and 4) better managing costs and capital spending, particularly on the metaverse.

Meta Platforms has registered highly on our rating scale several times in the past, showcasing the company’s attractive investment attributes during the past several years, but we didn’t play the idea as well as we could have. Meta Platforms nevertheless is included as a top weighting in many large cap growth indices, and the company’s recently-released fourth-quarter results, which showed a strong beat on both the top and bottom lines, should help to propel higher this stylistic area of the market that is overflowing with net-cash-rich and free-cash-flow generating powerhouses.

It’s important to note that Meta Platforms fits right in with this stylistic area, as it, too, has a huge net cash position, while it hauls in tens of billions in annual free cash flow (~$43 billion in 2023, for example). Importantly for the dividend investing crowd, the company has now initiated a quarterly dividend of $0.50 per share, which we think has a long runway of future growth on the basis of its net-cash-rich balance sheet and strong free cash flow generation while the dividend, itself, signals to investors that the company will likely be a more disciplined capital spender going forward, in our view.

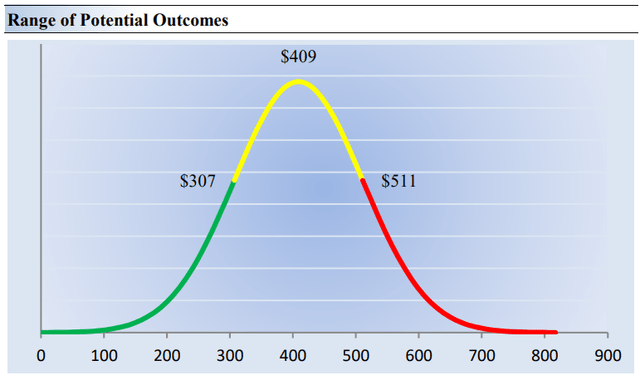

Our fair value estimate range for Meta Platforms. (Valuentum)

The high end of our fair value estimate range of Meta Platforms, which we derive from the discounted cash-flow method, stands at $511 per share, well above where shares are currently trading. The company has navigated through a very difficult period, where it seemed like everything was going wrong. Reduced effectiveness of ad campaigns, rampant spending, increased competitive pressures, and general negativity surrounding its platforms punished shares, but the stock has come roaring back. Meta Platforms yields a paltry ~0.43% at this time, but the company is, in our view, an attractive aggressive growth stock that is just beginning to rev its engines with respect to potential long-term dividend growth. We think it is worthy of consideration.

Concluding Thoughts

There’s nothing wrong with dividend growth stocks or high yield stocks, per say, save for perhaps that many hold large net debt positions and pay out most of their free cash flow as dividends, but we think the next 12-18 months may look a lot like the past several months, where big cap tech and large cap growth outperform the S&P 500 and where many dividend-oriented indices struggle to keep pace with the average S&P 500 company. To that end, we’ve identified two large cap growth entities that pay a very solid dividend. Though their yields won’t turn many heads, Visa and Meta Platforms, in our view, offer dividend-oriented investors a couple choices for long-term aggressive growth exposure with a dividend to boot.