onurdongel

EQT Corporation (NYSE:EQT) management began with a refrain heard throughout the industry lately that the market ignores its own peril. The market reflects “high storage levels”. But that is because investment in storage has not matched increasing demand levels. Combine that with “just in time deliveries” and you can set your alarm clock for a “sure to happen” crisis. One of the weaknesses of “just in time” deliveries is that those deliveries depend upon a constantly available supply. That is fine if supplies are adequate. But based upon days usage, they are low (or at least below average). Therefore, it is only a matter of time before something sends natural gas prices soaring, followed by “I told you so”. While timing is always uncertain in this low visibility industry, the longer this lack of new storage continues, the bigger the mess will be when it happens. EQT is moving to take advantage of the profits available when that time comes, while getting better prices in the meantime.

Storage

The news is all about the fact that storage levels are high, and the weather is mild. Surely, the investor can tell that prices will be dropping clearly through 2025 at this rate. But since when is a weather forecast good for more than two weeks at the most?

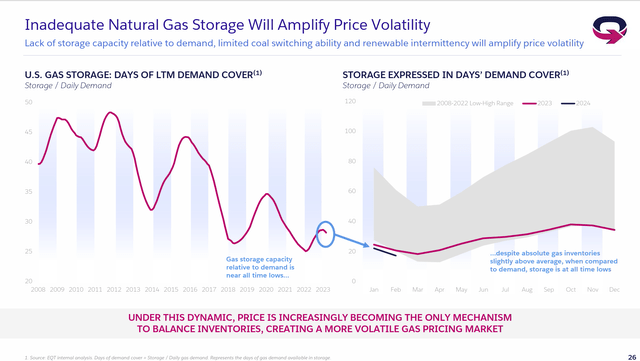

EQT Management Presentation Of Days Of Use For Natural Gas In Storage (EQT Corporate Presentation Fourth Quarter 2023, Earnings Conference Call Slides)

Interestingly, while the market does not think too much of the recent cold spell, that cold spell made a difference as shown above in days of usage (of natural gas) in storage. Clearly, the line went down into February. There is still plenty of time for another cold snap in February or March (or more than one cold snap for that matter). Many times, those cold snaps cannot be forecast more than a week or two ahead of time. They can also fizzle or become very significant on short notice. But you would not know that from all the forecasts of a natural gas surplus for the next year or two.

Furthermore, the days use of natural gas storage is at the low end as shown above as we (as a society) transition to more and more “just in time” delivery. A significant cold spell could wreak havoc with prices on short notice as a result.

Furthermore, as we see the current El Niño begin to fade, a La Niña (with its hot summers) is becoming a greater possibility in a few months. That throws still more uncertainty into the long-term forecast.

Demand Is Still Growing

Natural gas continues to displace other sources. A low selling price for natural gas generally accelerates the trend. The fact that it may materially increase pricing volatility without a proportionate growth in storage capacity is largely ignored.

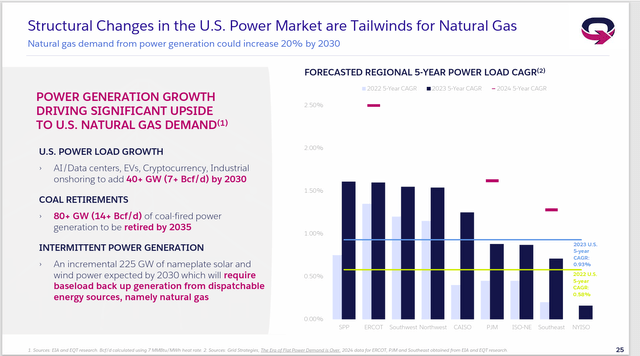

EQT Projection Of Electrical Generation Use Of Natural Gas Growth (EQT Corporation Corporate Earnings Presentation Fourth Quarter 2023)

One of the continuing large uses of natural gas is for electrical generation. That use continues to grow as shown above. If more days of use are not stored, and we hit an extended cold snap or heatwave, then it is very easy to see natural gas prices soaring to the extent that these natural gas companies will make years of profits all at one time.

In fact, if growth in storage does not occur, we, as a country, may get to the point where we will not need a cold spell or a heatwave to cause an issue. The disparity between storage levels (which the market assigns a priority to) and the days of use in storage keeps sending out “widening” different signals. Put this down as a weakness of the free market economy (and as an investor, “get in” and wait for the fallout).

Exporting

Recent headlines to the contrary, so far, a pause has been announced. But a pause is not permanent. It also does not affect those projects underway with all the permits needed to build export facilities and related infrastructure. There are plenty of those projects underway.

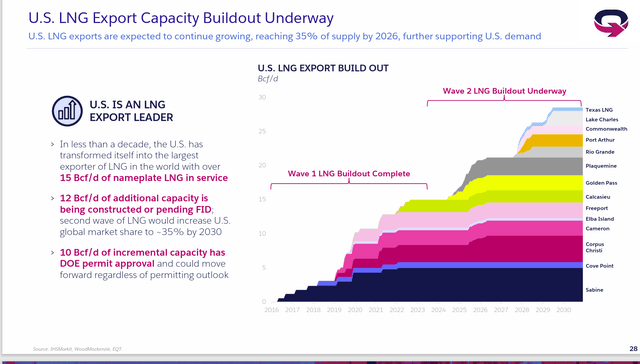

EQT Description Of Export Capacity Under Construction Or Projects With All The Necessary Permits (EQT Earnings Conference Call Slides Fourth Quarter 2023)

The current administration actually has allowed quite a few projects to continue or get started (probably in the near future) with permits already issued. Management nicely summarizes the situation in the slide above.

The key idea here is that there is plenty of exporting capacity coming online regardless of what happens with the pause. The downside for consumers is that the United States and Canada will likely join the (usually) much stronger world market pricing in the future as this capacity comes online. That may prove a shock to consumers who have gotten used to lower natural gas prices due to the oversupply of North American natural gas for much of the last decade (give or take).

Summary

Natural gas still has a bright future. The time to invest in natural gas upstream companies is when the industry is left for dead because “natural gas prices are going lower through 2025 from the oversupply”. No matter how many times something like this goes haywire and prices unexpectedly move up, the market loves the certainty of a long-range forecast, no matter how tenuous or even impossible it may be.

In the meantime, if the weather does not do it, then climbing usage should do the job. Natural gas is lower polluting than some alternatives and should continue to replace the use of those alternatives (especially when the price of natural gas is low).

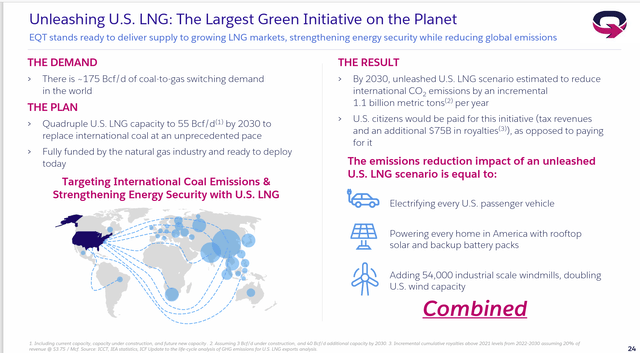

EQT Management Vision Of The Future Of Natural Gas Overview (EQT Earnings Conference Call Slides Fourth Quarter 2023)

The rosy industry scenario shown above can fall quite a bit short of those goals and still benefit shareholders. Right now, the tailwind of low natural gas prices is really aiding a bullish view of the future of natural gas usage.

The thing to watch is the days of natural gas usage in storage (not the absolute levels) because the amount in storage can disappear very quickly through actual daily use (as opposed to a heatwave or a cold snap).

The other thing to remember is that both in the latest cold snap and the one back in 2021, the news covered a decline in production at the time it was most needed. Some places like Canada and the Northern United States cannot do much about production if the weather is severe enough. As a result, those areas often go days without fixing a breakdown or needing repair because they cannot. A weather event can increase that issue considerably.

While fiscal year 2023 featured declining prices. Remember that few saw the prices of early 2022 all that much ahead of time. This company reported good results by hedging its production. But the market rarely values hedging results. Generally, both hedged and unhedged companies have similar pricing actions because the market tends to go to extremes with long-term forecasts.

This investment grade company remains a strong buy as one that will likely take advantage of the next natural gas shortage because management is constantly working on the flexibility needed to make that opportunity one that management can profit from. “Buy straw hats in January” applies here. One would think that right now there would never be a natural gas pricing recovery the way these stocks are priced. But that puts too much reliance on long-term forecasts that have no place in this very low visibility industry.