Brad Kathrins/iStock via Getty Images

Lakeland Industries (NASDAQ:LAKE) is a global manufacturer and seller of protective equipment for high-risk activities like firefighting, security, industrial, or healthcare.

I last wrote about Lakeland in March 2023, without recommending the company. The reason was that I considered the price excessive compared to the company’s long-term profitability metrics. I also feared the company would use its cash reserves to make revenue-expanding, profit-reducing acquisitions.

In this review, I find that the stock has appreciated almost 50% since my first article in September 2022. However, the company’s operating dynamics have not moved from what I expected in previous articles.

However, Lakeland is also undergoing significant changes. The company replaced its Chairman, COO, and CEO in the past year and a half. Also, Lakeland has made over $30 million in acquisitions during the same period, specifically in firefighting equipment companies. This leads me to believe that Lakeland could be different in the future, but that is yet to be seen.

Overall, I arrive at the same conclusion as before. Given its comparatively low operational profitability and lack of control over operating expenses, Lakeland does not represent an opportunity at current prices.

Back to the trend

In 2022 and 2023, Lakeland was still enjoying some of the benefits of the excess demand for PPE products during the pandemic. This made some people believe that the long-term trend of the business had changed and that the future presented a more profitable Lakeland.

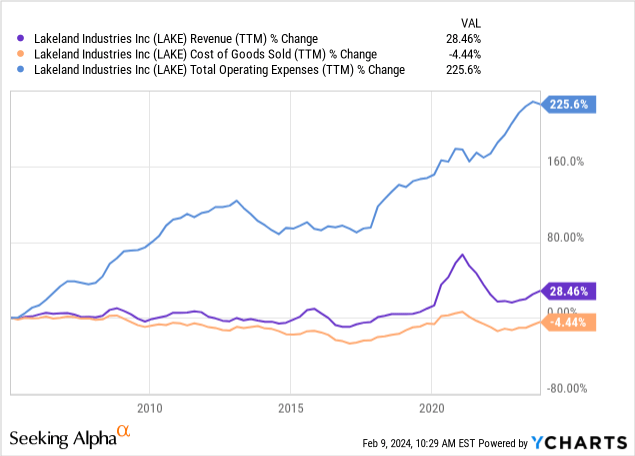

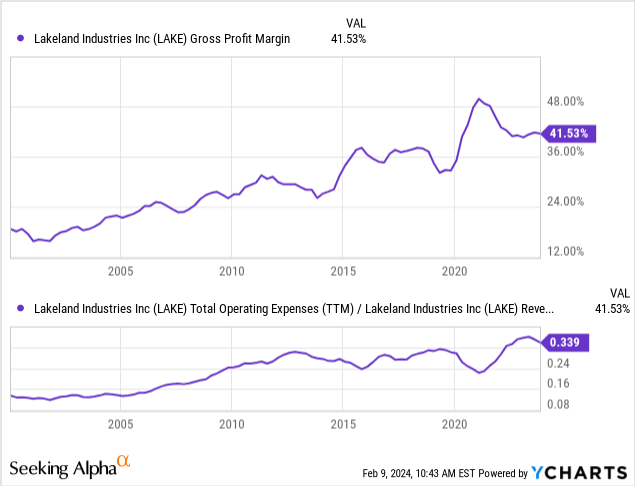

I believed that the future would look like the past, and recent figures show a return of revenues to the long-term trend they had before the pandemic. Further, two other critical characteristics of Lakeland’s operations are also back to trend. First, consistently expanding gross margins, and second, consistently expanding operating expenses.

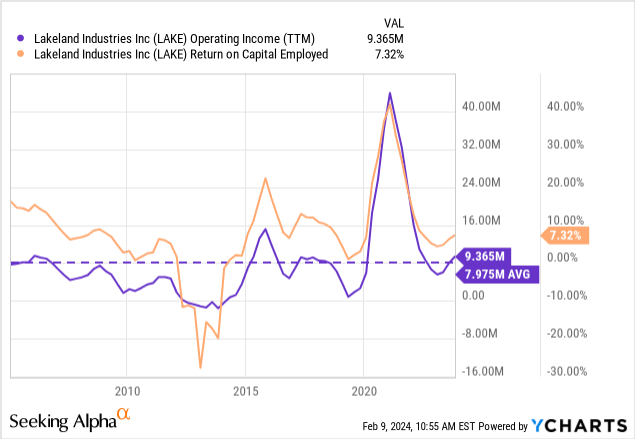

Although Lakeland has not grown much (30% revenue growth in the past 20 years, and most of that after the pandemic), it has consistently increased its gross margins. This was accompanied by an almost lockstep in operating expenses increases. The result was stable operating margins historically below 10%.

Although I am not entirely sure why Lakeland shows this dynamic, I believe the reason is mostly getting closer to the client, that is, moving downstream. The company launched sales efforts worldwide and decided not to use distributors and wholesaling as much. On its 10-K, the company mentions that foreign sales are a mix of direct sales and distributors, for example.

Unfortunately, Lakeland does not report which components go into CoGS vs OpEx. It does not report employees by function either. I hope they provide more information in the future.

Either for the reason I am mentioning or another, Lakeland has been unable to consistently grow its operating profitability despite top line and assets growth. This has also resulted in stagnant returns on capital like ROCE.

Recent changes and outlook

If the early post-pandemic thesis was that Lakeland had emerged as a new company with more robust profitability, the recent figures show that is untrue.

However, there have been other changes in Lakeland after the pandemic that may indicate a different trend in the future.

First, the company’s management has changed. The first to leave was the company’s Chairman, who was replaced by the then vice-chairman, James Jenkins. The new Chairman comes from the M&A and business development world.

The company has also changed its CEO (October 2023), CFO (February 2023), and COO (April 2023) since. The CFO and COO have been replaced, whereas Jenkins temporarily occupies the CEO position until a new candidate is chosen.

Can the new management team transform the company? It could be. For now, although they have been in their positions for less than a year, the results show no changes.

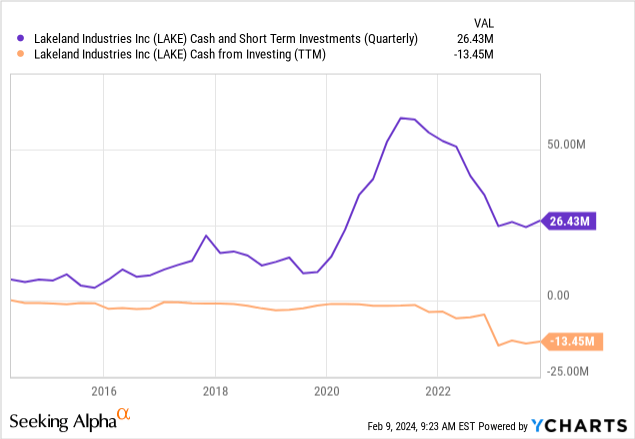

The second significant change in strategy is the company has used most of its cash for acquisitions. The figures below still lack two of the most recent acquisitions for almost $18 million in cash, bringing the total to more than $30 million in acquisitions in a year and a half.

The company’s acquisitions have been almost exclusively directed to firefighting protective equipment companies, Eagle Technical in the UK, Pacific Helmets in New Zealand, and Jolly Scarpe in Italy/Romania. The company also put $3 million in a minority position (11%) in a startup called Bodytrak that provides remote monitoring equipment for health and hazard departments in industrial settings.

As of the latest report, we have no information on the actual cost of acquiring Pacific and Jolly. We know the transaction price, but the actual cost needs to include the working capital and debts acquired with the company.

The company’s management expects these two companies to generate $8 and $15 million in sales in their first year, respectively, as mentioned in the acquisition press releases (Pacific Helmets and Jolly Scarpe). I did some channel research, and these companies seem to position themselves in the differentiation area of their markets with high-quality products. Both companies have their own manufacturing facilities (in New Zealand and Romania, respectively).

The company’s strategy is to continue moving into higher-margin categories, like firefighting equipment. The acquisitions might provide cross-selling opportunities and access to better manufacturing practices and know-how.

Valuation and conclusions

So, the company is changing via management movements and acquisitions.

I prefer a bird in my hand than two in the bush. Therefore, I prefer to see the results of these changes playing out before paying for them.

If we evaluate Lakeland from its historical performance, we can use an operating margin of about 7.5%, a little above its 20-year average of 7%.

Further, we can give management some confidence and assume that the two newly acquired companies will indeed generate close to $25 million in revenues this year.

That would leave Lakeland generating close to $150 million in revenues by the end of calendar 2024 (Lake’s fiscal year ends in January; therefore, calendar 2024 is mostly fiscal 2025).

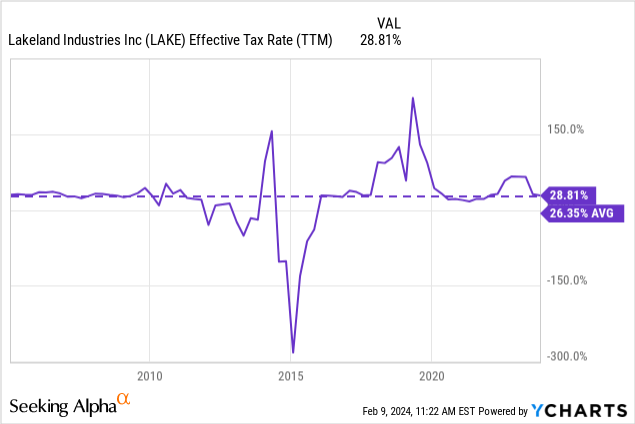

At historical margins, that represents $11 million in operating profits. Without any debt, the company pays no interest expenses, and after applying an average 26% effective tax rate, we arrive at about $8.3 million in net income.

Against this perspective, Lakeland sells for a market cap of $130 million or a P/E multiple of 15x. In my opinion, such a multiple can only be justified for companies with a proven track record of growing profitability and high returns on employed capital. That is not the case for Lakeland, at least not yet.

Therefore, I prefer to pass on Lakeland but continue observing its developments. Hopefully, the new managerial team can change the company’s long-term trend, and we can consider the investment at lower entry points.