shih-wei

Dear Investors (to myself as the single LP),

We welcome you to Vision Capital’s 2023 annual investor letter.

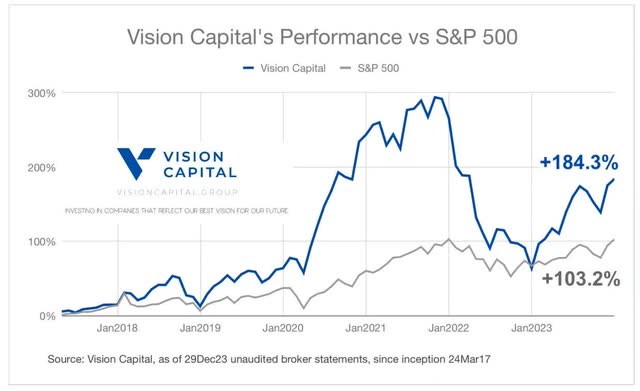

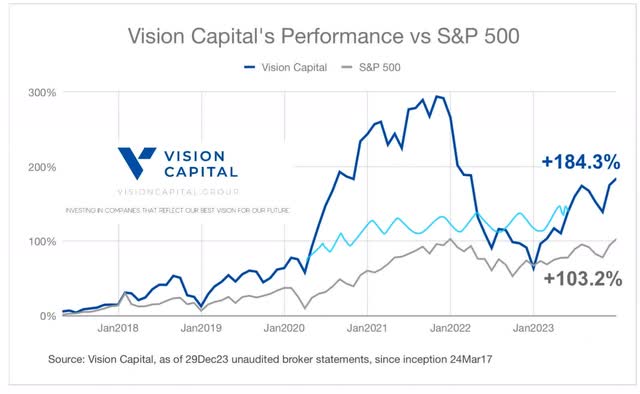

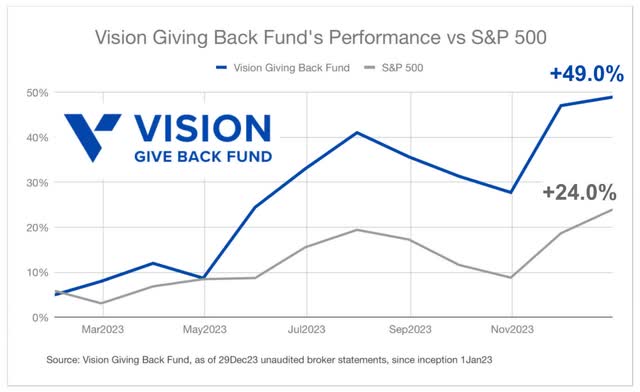

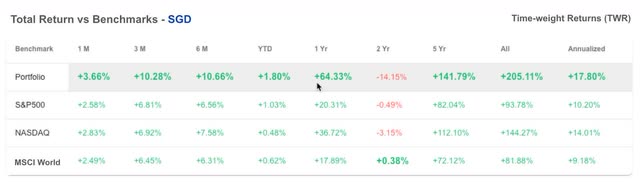

For 2023, Vision Capital returned +69.9% versus the S&P 500’s +24.0%. Since inception 24 March 2017, in TWR terms it has returned a cumulative +184.3% versus the S&P 500’s +103.2% and versus the MSCI World’s +71.7%.

The chart and table below details our performance thus far.

Inception 24 Mar 2017, as of 29 Dec 2023, updated monthly

Inception 24 Mar 2017, as of 29 Dec 2023, updated monthly

Reporting annualised returns going forward. Previously, annualised returns were not available in our broker, Saxo. We are excited to employ a new portfolio reporting tool, Portseido, and will be using it to calculate and report our annualised returns as well going forward.

Annualised Performance in SGD – 18% p.a. over almost 7 years. As of 12 January 2024, from 24 March 2017 inception, in SGD-denominated terms, our annualised time-weighted return (TWR) stands at 17.8% p.a. beating the S&P 500’s 10.2% p.a. by 7.6%, and the MSCI World’s 9.2% p.a by 8.6% (see table below).

Vision Capital/Portseido (as of 12 Jan 2024), unaudited

Annualised Performance in USD (for reference) – 19% p.a. over almost 7 years. In USD-denominated terms (for reference), our annualised time-weighted return (TWR) stands at 18.7% p.a. beating the S&P 500’s 11.0% p.a. by 8.7%, and the MSCI World’s 10.0% p.a by 8.7% (see table below).

Vision Capital/Portseido (as of 12 Jan 2024), unaudited

No FX hedging. As a reminder, the portfolio is denominated in SGD, and many of our investments that we do are not denominated in SGD (~100%). We do not do any FX hedging. Thus, the SGD value can rise or fall purely on FX movements alone. While the USD-SGD FX rate has been range-bound over the past 10 years, depending on FX moves in any given year, our SGD returns can vary somewhat from the USD returns, though it should not differ too much. We expect the majority of our long-term returns to come from the long-term appreciation in stock prices, driven by the majority of long-term business performance, to a lesser extent FX.

Global Mandate. Vision Capital’s investment mandate continues to be global in nature. We can invest in any of the accessible publicly listed companies in the world. Since the majority of our holdings continue to be largely US-listed stocks (~91% as of 31 Dec 2023), it’s important that we compare our performance with a prominent US stock market index, the S&P 500 as our benchmark, rather than the MSCI World, a more global index.

2023 strong rebound. 2023’s +69.9% rebound was largely on the back of recovery of oversold valuation multiples, reversing 2022’s -54.3% decline. A large majority of our holdings were sold off indiscriminately in 2022, but had rebounded strongly in 2023 as the businesses continued to deliver profitable growth. As the market recognised this, the valuation multiples managed to recover back to more normalised levels.

Do not expect future returns of similar magnitudes. 2023’s strong returns were largely on the back of 2021/22 massive price declines. We do not expect returns of such high magnitudes to continuously persist going forward, and neither should you too. This is because the average Free Cash Flow (FCF) yield + revenue growth of the portfolio is around ~20-25%+, and without excessive valuation multiples, we do believe that 15-25%+ long-term annualised returns that reflect our portfolio holdings continue to remain reasonable long-term return targets that we can keep aiming towards as a north star.

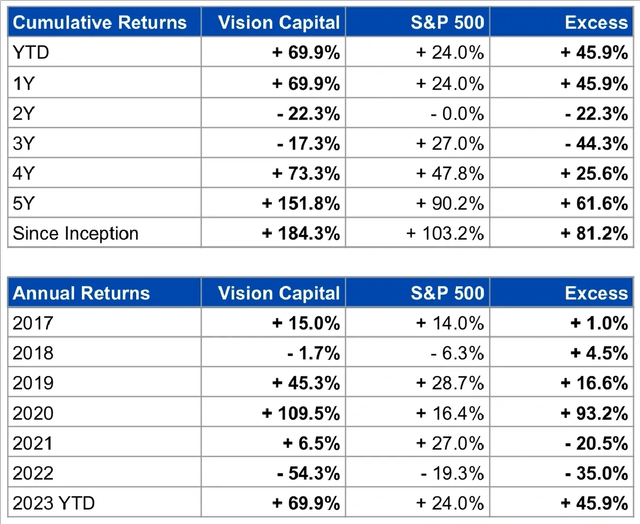

No control over the journey of our returns. The stock market is volatile, the returns of Vision Capital will not be smooth, and will be volatile from time to time. Stock investing is an infinite game with long feedback loops. One will only know after years and decades if one truly has skill. We know what the destination is going to be, and we can only control to a great degree what companies we own with the skill we think we have, but luck too will play some role as well. How well we will do will depend on the companies that we have chosen that can keep growing at strong rates over the long-run, turn out to be correct.

Source: Investing: Is it skill or luck? – Eugene Ng

Judging our performance. We continue to ask that we should be judged on a 3-5 year time frame at the minimum. It would be very disappointing if Vision Capital fails to beat our benchmarks over a longer time frame. We do believe that if we have a strong analytical and investment framework, a thoughtful philosophy to find growing durable compounders, coupled with a strong behavioural advantage with the willingness to hold and keep adding to them for years, which is more likely to lead us to market-beating returns.

Occasional underperformance. We know that as much as we like to keep beating the market each year and throughout, underperformance and negative returns are never welcome, but it is nonetheless inevitable. We are not aware of any investment strategy that will consistently outperform every year, and under every type of market condition. As much as we like, there will be some occassional periods of short-term underperformance, and we are okay with that, and I know you are too.

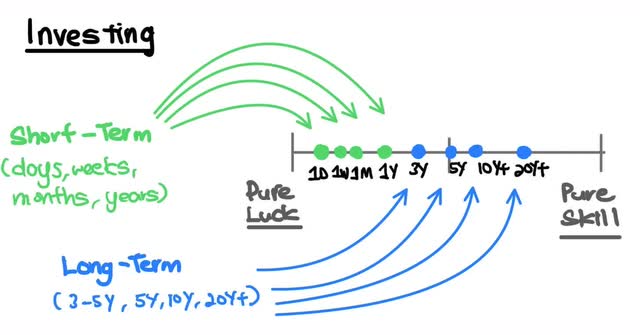

Investing is going to be one of zigs and zags. Investing is never going to be a one-straight line. When asked about how we think we will do through market cycles, we think our investment strategy is probably going to be even more volatile than the index.

How we think about our alpha generation to outperform the market. When markets fall over shorter periods, we will tend to fall more and faster than the market, but when markets rise over longer periods, we will tend to rise by much more.

Go down more, but go up a lot more. The illustration below conveys this best, versus how we think we will do over long periods of time, against a strategy of Index ETF indexing, a 60/40 stock bond portfolio, and a fixed deposit strategy with a fixed interest rate assumption. In short, you need to be very comfortable that Mr. Market will occasionally throw tantrums, or get very excited, but your returns are anchored by solid growing businesses that we continue to think are best placed to do well in the foreseeable future.

Price volatility is not risk, permanent loss of capital is. Thus, we rather optimise our psychology to be less emotional to temporary price declines, than to optimise our returns to be smoother with less price volatility to make us feel better. We choose to keep focusing on being investors and part-owners of businesses, and a disguised trader of one. Remember that by investing through us, you and I together we are part-owners of businesses, not just some stock ticker symbols, and we want to own the best businesses that can give us the best available long-term returns.

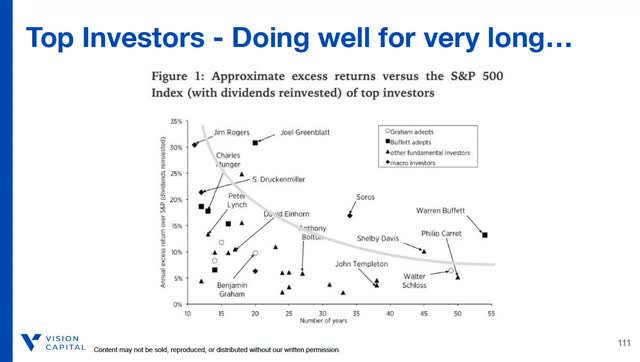

Investing is a tough sport. ~ 90% of actively managed US equity mutual funds over 30 years have collectively underperformed the S&P 500. And for those who survived and outperformed, they were in the top 10%. As a reminder, we don’t aim to be in the top 10% every year (and I know you don’t expect that of us as well), we only aim to be in the top 10% after decades. Great investing is difficult, if one is built right to survive and outperform over the long-run, eventually one does get to become one of the best.

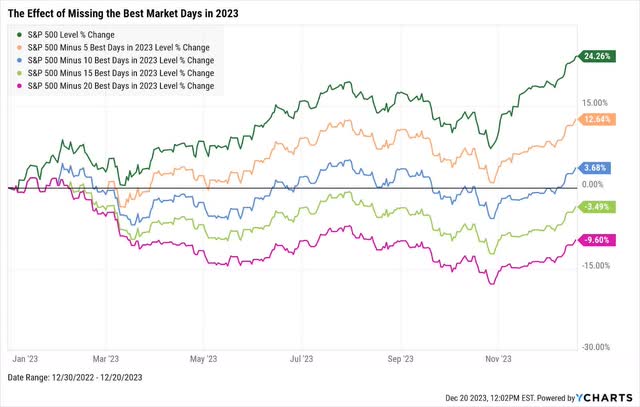

Staying in the game and time in the market. If one decided to trade and missed the best months of January, May-July, and Nov-Dec in 2023, one’s returns would have been horrible. We only do buy-and-hold investing in strong, durable, profitable growing businesses. We are investors at heart, not traders. In a market that rises over the long-time, missing the best days is what we seek not to miss, not missing the worst days. If one missed the 5, 10, 15, 20 best days in the S&P 500, instead of 24%, they would have significantly lower returns of 13%, 4%, -3% and -10% respectively. Investing is time in the market (for the long term), not timing the market (for the short term).

Buying more in 2022, and less in 2023. In 2022, we had significantly lower prices, and that presented the opportunity for higher prospective returns with lower downside risk. We had asked you of our LPs for heavier capital contributions during 2022, and you delivered. That allowed us to deploy nearly 3X the amount of new capital in 2022 versus that in 2023 at very attractive prices. We are happy to keep dollar cost averaging into our businesses. But we especially like to be contrarian in nature, buying much more when many are pessimistic and fearful, and buying much less, when others are pounding their chests and signs of greed and confidence are all around. That said, we are happy to be continuously dollar cost averaging through time, perfect timing gets you a little better, but miss it, and you end up doing much worse.

Normalised Performance. We are still down from all-time highs, but arguably in hindsight our portfolio should have not risen so fast so quickly. Using my favourite mental model of parallel universes. What happened if COVID didn’t occur in 99 of 100 parallel universes?

What if our average performance in 99 of them looked somewhat like the path in light blue instead? Would we then become a better investor instead? But we have no control over COVID happening, but we can control how we think about what could happen. We still have full confidence in our investment strategy and our ability to outperform longer term, without such large volatility, and we thank you for keeping the faith in us, especially through 2021/2022.

Stocks are not lottery tickets, there is a company behind every stock. When the company does well (grow revenues, profits and cash flows and returns capital), the stock does well. It is not complicated. Our underlying companies in the portfolio are growing TTM revenues at 30% with 25% FCF margins on a weighted-average basis. Thus, 2024 returns are most likely going to be lower in magnitude, and we would be perfectly okay as returns normalise towards lower levels. We will do very well if we can achieve ~15-25% CAGR for the next 30-40 years.

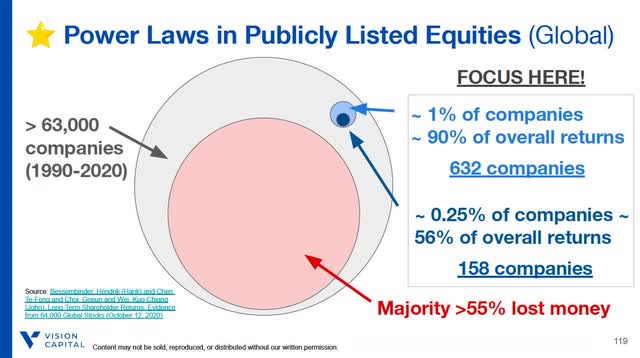

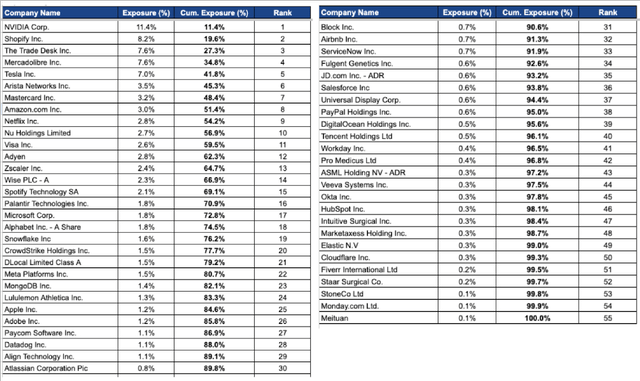

Power Laws exist in publicly listed stocks. ~1% of companies (i.e. 632 companies) accounted for ~90% of overall returns, and ~0.25% (i.e. 158 companies) accounted for ~56% of overall returns, whilst the majority >55% lost money. The majority of companies are not where we seek to invest, and we are really only seeking to be fishing in a very small pond of companies that truly matter. We think that there are probably at best less than 100+ companies currently worldwide that would meet our investing criteria. We have been selective, learned to be even more selective, and will continue to be even more so in the coming years and decades with our investments. We think investing in publicly listed companies too is very similar to venture capital, that power laws prevail and is going to be even more so in the information technology era.

Source: Vision Investing Cohort 2 Presentation Slides

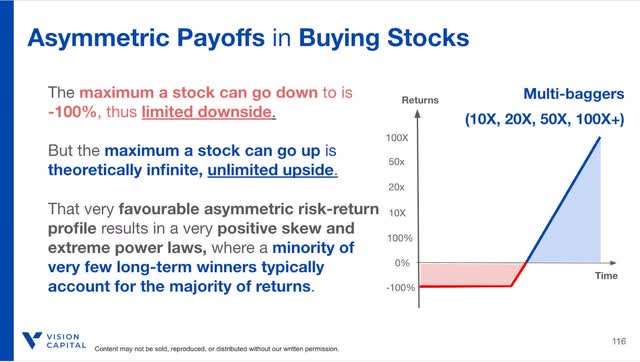

Investing is thinking in probabilities and payoffs. When you buy a stock, the maximum downside is -100%, but the maximum upside is theoretically unlimited with multibaggers (5X, 10X, 20X, 50X, 100X+). We are only seeking to do two things, increase our probability of success in finding winners, and increasing our payoffs from our winners with multibaggers, while eliminating any unlimited downside scenarios. This portfolio asymmetry causes our portfolio to effectively become a portfolio of very long-dated call options and drives power laws returns.

Portfolio Update

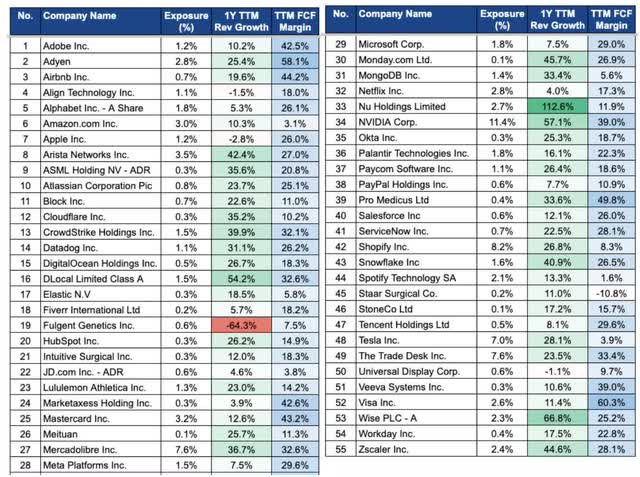

Continue to express thematic concentration driven by top dogs supported by long-term tailwinds. For example, in E-Commerce (~20%), we own Amazon (AMZN), MercadoLibre (MELI), Shopify (SHOP), JD.com (JD), Fiverr (FVRR), Airbnb (ABNB), & Meituan (MEIT). In Payments (~16%), we own Visa (V), Mastercard (MA), PayPal (PYPL), Block (SQ), Adyen (OTCPK:ADYEY), Wise, DLocal (DLO), Nu Holdings (NU), StoneCo (STNE). In SaaS/Software (~21%), we have Adobe (ADBE), Atlassian (TEAM), Datadog (DDOG), Elastic (ESTC), Hubspot (HUBS), Salesforce (CRM), Microsoft (MSFT), Monday.com (MNDY), MongoDB (MDB), Okta (OKTA), Palantir (PLTR), Paycom (PAYC), ServiceNow (NOW), Veeva (VEEV), Workday (WDAY). In Advertising (~11%), we have The Trade Desk (TTD), Alphabet (GOOG) (GOOGL), Meta (META), and Tencent (OTCPK:TCEHY). In SaaS/Cybersecurity (~4%), we have Zscaler (ZS), CrowdStrike (CRWD), CloudFlare (NET).

By thinking in blocks/mini-portfolios, because of the somewhat higher correlation between a number of these companies, we are actually quite highly concentrated on an industry level (11-21% across 4 largest sectors), but less so at an individual company level (largest positions being 8%+, <10%).

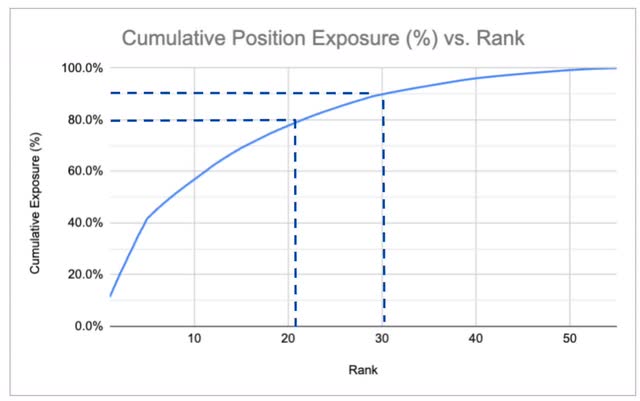

Seemingly very diversified but still fairly concentrated. Despite having a seemingly large number of 55 holdings, Pareto Principles (80/20 rule) do continue to largely apply for us as well. Our top 22 and 31 positions account for ~80% and ~90% of the overall portfolio (vs 25 and 35 in 2022 and 30 and 40 in 2021). We expect the continued increase in portfolio concentration to likely continue in a zigzag fashion in the years to come as the winners become larger and even more outsized positions in the portfolio. Winners win, we continue to let them run, water our flowers, not our weeds.

Current Portfolio Positions and Allocations. It is the first time we are sharing publicly our portfolio and the allocations, and we only seek to do so to illustrate the high quality of the companies that best reflect our mission and our vision of the future that can change and shape the world for the better, and that we believe can continue to outperform and beat the market over the long term, which is the only term that counts.

High quality portfolio of profitable growth. Below table is our current portfolio by name in ascending order, and the weighted-average trailing 12 month (TTM) revenue growth is 25.4% and TTM FCF margin is 30.0%, versus the simple average of 22.0% and 22.9% respectively. This reflects our higher allocation to faster growing and higher FCF margin companies that we prefer to keep compounding with for long periods of time.

Block uses FCF/gross profits (Koyfin as of 31 Dec. 23, selected figures corrected)

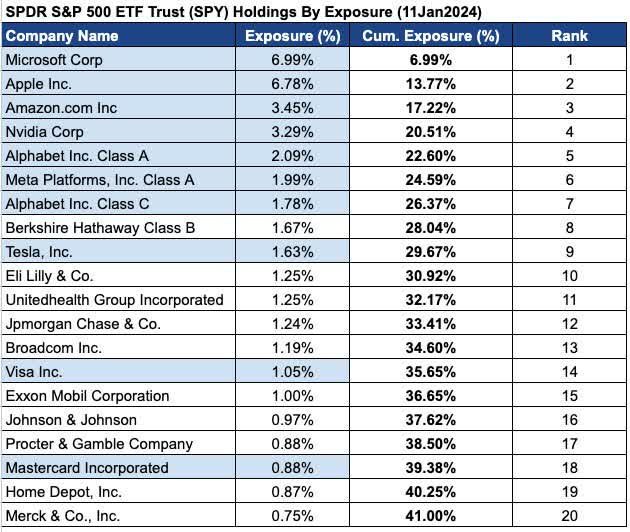

We remain comfortable with our existing portfolio allocations. The maximum 20% single position limit continues to apply. In addition, you can see from our existing portfolio allocations (earlier tables versus below), that we are clearly not closet indexers. Our portfolio looks nothing like the S&P 500 Index. Highlighted in blue amongst the top 20 S&P 500 positions, below are the positions we have in common.

Source: Slickcharts (as of 11 Jan. 2024)

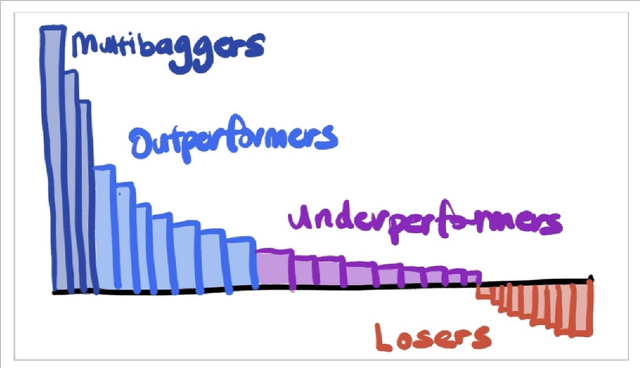

Diversification as a process, concentration as an outcome. Because of the highly asymmetric payoffs (limited downside, unlimited upside) of owning strong businesses resulting in multi-baggers that keep compounding over a long duration of time, the positive skew can result in power laws, where a few long-term outsized winners typically account for the majority of the portfolio’s returns. This continues to be the case for us, but the attribution varies significantly year to year, depending on how much the winners go up or down (especially in 2023). We believe that if we do it right, our portfolio should look like the chart below, and it should become even more pronounced in the many years and decades to come, albeit with the occasional compressions like in 2022. If it is going to be the next multibagger, a little is all we need, if not, a little is all we want.

Source: Vision Investing: How We Beat Wall Street & You Can, Too! (published in 2020)

The absolute gains (realised and unrealized) from our multibagger winners will more than outweigh all of the losses from all of our losers combined. This considers both unrealized and realised gains and losses. And this is how we generate alpha and outperformance. Currently, this is nearly ~4X, and we expect this to vary from year to year though albeit on an increasing trend if we keep doing it right. Specifically, the absolute gains from just our top 2 winners alone exceed the combined absolute losses from all our losers.

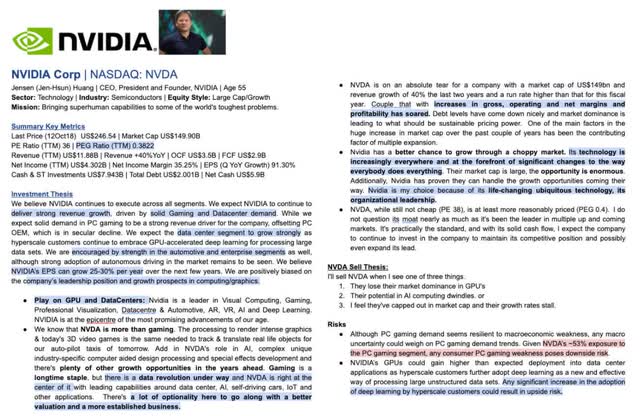

NVIDIA (NVDA) is the portfolio’s current largest position at 11.4% and a contributor to overall returns in 2023. NVIDIA was first purchased back in 2017, and is currently a near 10-bagger on that investment, with a large price rally in 2023. We are still overall comfortable with our position. NVIDIA is at the pivot of the longer term structural tailwind shift from general purpose computing to accelerated computing and generative AI with significantly stronger use cases than the previous Crypto/De-Fi/NFT hype. There is a strong visibility of multi-year long-term broad-based CAPEX demand that reflects the start of a potential longer-term shift. NVIDIA should continue to dominate with its strong architecture moat of CUDA, InfiniBand, Mellanox have built and strategically acquired over the years. That said, we are watching competition as AMD enters with their MI300X GPUs, and other emerging start-up competitors as well.

I wanted to share a screenshot of our written investment thesis back then so you get a sense that it was GPUs that were at the core of our thesis, but NVIDIA’s journey was far from smooth.

Portfolio Changes

Inaction is action. To be honest, we did not do much in 2023 at all. Much of 2023’s results were due to the action we did in 2022. We took advantage of opportunistic drawdowns during 2023, the usual monitoring of our part ownership stakes in our businesses during each quarterly earnings season which we share publicly on X (previously Twitter) every quarter without fail. Separately, we only added 1 new position (Lululemon (LULU)), doubled down on a number of companies (Adyen, Paycom Software, DLocal, Nu Holdings, Wise, Tesla, Workday, MercadoLibre, Alphabet, STAAR Surgical (STAA) and Digital Ocean), and exited 10 positions completely totalling ~1.7% of the portfolio.

Lululemon. It is a new position added for us in 2023. See below on our notes:

✅ Lululemon is a specialty technical athletic apparel, accessories and footwear brand that has a global reach that focuses on the premium athleisure segment. They did over US$8bn of revenues in FY22, with $1.2bn of Net Income (adjusted for one-off Mirror acquisition impairment).

✅ Lululemon designs and sources all their own materials through suppliers, and subsequent does all the manufacturing via contract manufacturers, with marketing and sells it, similar to the other sporting brands like Nike, Adidas, Under Armour, Puma, etc.

✅ Where Lululemon differs from the rest, instead of being largely selling through B2B distributors, having more scale, lower margins, heavy discounting, huge working capital requirements, it sells through largely their two main own B2C channels (~91%) to its own customers, which are roughly split 50-50, amongst their own 655 physical stores worldwide (mostly in US, Canada, China) (~45%) and via DTC / e-commerce (~46%).

✅ Lululemon’s largely B2C distribution strategy allows it to capture higher profit margins of > 1000bps more versus its competitors. In gross profit margins, Lululemon has 56% GPM vs. 43-46% for competitors), and EBIT margins of 22% vs. Nike 11% and much lower for others.

✅ In addition, Lululemon also has better working capital terms, it has significantly lower days receivables cycle (<5 days) vs competitors (30-45 days), as customers pay upfront immediately, versus extending credit payment terms to its B2B distributors. Lululemon’s inventory days is also comparable to best-in-class Nike and has been rising due to its DTC strategy.

✅ DTC has been growing faster than physical store revenues, growing share of revenues from 20% in 2015 to 46%, as the dominant model is to drive customers to order via DTC/online instead. DTC is also a much more profitable business with higher EBIT margins (42%) vs that of the physical store business (27%). The faster DTC grows, the more profitable Lululemon becomes.

✅ Lululemon does have a smaller wholesale B2B channel (~9%) that is sold largely through yoga studios, high-end fitness studios, and through department stores occasionally, but done largely for brand awareness, but that is not the dominant customer distribution strategy.

✅ Lululemon is currently majority women’s apparel (~65%), and men’s apparel (~24%), the reverse of the others which is largely men’s. Men’s is a very large segment, and Lululemon’s unaided brand awareness still remains very low with lots of room to grow from here (US 25% ROW low single digits) as more customers come to know the brand. It is focused on growing Men’s (shoes to come in 2024), International namely China, Accessories (Bags), and higher profit margin DTC which is overall profit margin accretive.

✅ Geographically wise, it is majority 84% North America (70% US, 14% Canada) with only about 16% of the business being outside the US. The international business has been growing much faster than the North American business. Lululemon is focused on growing in China and expects to double the existing 100 stores to 200, in comparison, Nike has 1,000+ stores.

✅ There are other optionalities for Lululemon to expand to various sport segments, hiking, golf, tennis, men’s, etc, and it’s still low unaided brand awareness shows great strength in what potentially Lululemon can become. Its Power of Three x 2 focuses on 15% net revenue CAGR growth, with Men’s +20% CAGR, Women’s LDD CAGR, Accessories Low Teens CAGR, Ecomm and Stores +15% CAGR, and International 30%+ CAGR vs. North America with LDD CAGR.

✅ Lululemon is about its strong customer brand loyalty (fanatic customers, speak to Tai Tais), the subtle logo placement (not big ostentatious logos), its versatility allowing the repeated wearing of their clothing and apparel across multiple occasions. It is also their lesser focus on fashion and their strong focus on technical fabric, production innovation, and on the premium segment.

✅ Overall, Lululemon is structurally advantaged versus other sports apparel brands with higher profit margins with its largely premium full-priced B2C business and DTC, rather than the traditional B2B business that its competitors focus on. Resulting in higher profit margins and better working capital dynamics, and having full control of future products for sale and the avoidance of discounting by B2B distributors.

✅ Lululemon is also marketing advantaged with its strong focus on community-based marketing and influencers that have strong influences than sponsoring big name athletes that require large budgets that their competitors Nike and Adidas regularly do, and spends 4% on marketing versus 6-18%+ across its competitors.

✅ Though current CEO Calvin McDonald has low insider ownership (0.2% $100m shares), he is an athlete and has the rare support of Founder Chip Wilson. Calvin has also proven to be a strong CEO since he joined in 2018 from Sephora, leading it to strong growth and execution. He has 4.3 Stars from Glassdoor, with a solid 88% CEO Approval Rating and 84% Recommend to Friend.

✅ Valuations – At FY22 Revenue of $8.1b growing 18% CAGR based on their Power of Three x 2 plan, and if Lululemon can continue to grow and improve profit margins further, and assuming 7% capex margins to get to the following FCF margins, and assuming 30-50x EV/FCF multiples, at current fair valuations, one should be able to get above 20%+ returns if valuation multiples stay the same, or higher if LULU executes well.

Mistakes are inevitable in investing. We continue to try to buy well, so we sell little, but mistakes are unavoidable. If we are making too few mistakes, we are playing it too safe. Mistakes are okay, as long as we never get wiped out, which is the number one goal, to not lose money and be out for the game, and to keep staying in the game and playing it.

Selling mediocrity. We don’t get paid for activity, but from outperformance instead. Instead, most of our performance will come from being actively inactive. Selling remains a small percentage of the decisions and the activity that we do. Honestly, it doesn’t contribute much to our performance even if we don’t exit these small positions, but it does free up our attention and mental space to look at other new businesses instead.

Reasons for selling. As a reminder, we sell for only 3 reasons: (1) when the business fundamentals change for the worse, (2) when we got it wrong, and (3) when we find something better. Most of our selling decisions fall largely into the first two categories, rather than the last one, where we find we often make the most expensive mistakes when we do so, such as with Arista Networks (ANET), when we trimmed our position at the end of 2020.

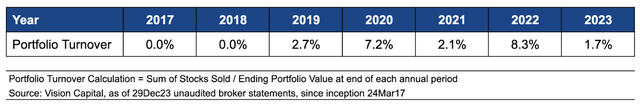

Low Turnover – We continued our history of low portfolio turnover in the single digit percentages with ~1.7% in 2023, which reflects our long-term investment approach. We exited 10 positions completely in our continued aim to reduce the number of holdings towards 50. Despite our Herculean efforts, we still stand at 55 holdings, and if we wanted to go below 50, we could have exited all 9 companies in our low-conviction / sell watch-list which accounted for less than 4% of the portfolio. But we continue to be patient investors, and still prefer to give our companies some leeway to show that the deceleration is far more structural, only then we will exit. We remain slow to sell.

Weeding out the weaker companies. We took the opportunity in 2023 to continue to intentionally reduce the number of holdings significantly from 64 to 55 with 10 position exits (~1.7% of portfolio) and 1 new position in Lululemon. We expect to continue to trim the number of holdings towards 50. A number of these companies largely did not perform as expected, and we do think that we could have better tightened our investing selection framework on some of the smaller starter positions, especially during 2020/21. Thankfully, it wasn’t a significant portion of the incremental capital invested back then.

We exited a total of 10 positions, they were Upstart (UPST), Peloton (PTON), Zoom (ZM), SentinelOne (S), ZoomInfo (ZI), Coinbase (COIN), Illumina (ILMN), PagSeguro (PAGS), Coupang (CPNG), and Sea Limited (SE). Overall, we continue to be broadly happy with the exit decisions that we have made.

Reasons for selling. Below details briefly and succinctly why we decided to exit:

For Upstart, it turned out to be much more cyclical than we thought and was more difficult to distribute and sell down the loans, which had a double whammy and worsened alongside rising default rates.

For Peloton, the new CEO Barry McCarthy did well to U-turn and reverse the losses, but we were no longer confident in the long-term business model, with the physical manufacturing business a horrible drag.

Zoom was a pre-COVID investment, and failed to leverage on their position of strength during the pandemic, with all the work-from-home conference calls against Microsoft Teams. I still think in an alternative universe and if there was no COVID, Zoom would have been a very good investment and would have become the dominant player.

SentinelOne started as a small-sized starter position in Cybersecurity play as an upcoming competitor on the XDR versus CrowdStrike’s EDR. Despite growing rapidly, it was still highly unprofitable, though showing signs of improving profitability. But growth decelerating rapidly and net retention declining rapidly, we were no longer confident of its long-term margin structure and ability to create long-term shareholder value.

ZoomInfo, the GTM SaaS platform, was initially experiencing very strong growth and was highly FCF profitable. But similar to SentinelOne, it experienced rapidly decelerating growth and rapidly declining net retention. More importantly, it was the cut in customer spend that reflected the less essential non-mission critical nature of its service that reflected our poor assessment of the quality of its revenues.

Coinbase was an investment as a tollbooth fee-based platform on cryptocurrency with a regulatory moat. However, it soon became clear as much as we were trying to be open to crypto, Web 3, and De-Fi, it continued to have very poor use cases, and we had to exit this investment.

Illumina, on the other hand, was a top dog in a razor blade business with its consumables with its genome sequencers. It was a COVID beneficiary which played a crucial role in the rapid mapping of the COVID virus, allowing for rapid development of mRNA vaccines. But its decision to re-acquire the previously divested GRAIL was a poor strategic decision that weighed on its financials and profitability that sparked our exit amidst its weaker core businesses as well.

PagSeguro was growing well as a payments company focusing on Brazilian SMEs and was one of the most profitable. However, growth quickly reached a snag, as it looked like the company had reached the top of its S-curve, with revenues, profits flat lining for a number of quarters. After giving it a number of quarters, we decided to part ways.

Coupang was the top dog in South Korean e-commerce, with a very strong logistics moat. We were patient to endure through the fulfilment centre fire in 2021, and for margins to recover. But it was the recently announced acquisition of Farfetch, a luxury international e-commerce player with flat lined growth, torrid economics and poor profitability, through a seemingly thoughtful structured transaction with limited downside, that sparked our exit.

Sea Limited for us was using the fragile, profitable Garena/Free Fire e-gaming franchise to build the e-commerce business, Shopee. But soon after, Free Fire peaked and went to a downward spiral, and network effects made it worse (just as it did on the way up). Profitability dropped, and Shopee was forced to close a number of overseas investments. For now, it remains a South East Asia, Taiwan and Brazil ecommerce play. After cutting expenses hard to achieve profitability, growth slowed, and the company soon had to reinvest in sales and marketing to drive growth, crimping profitability, but via building out its logistics moat, which we very much prefer. Wary about the eventual profitability of the Shopee ecommerce platform without a strong infrastructure moat that is reliant on sales and marketing boosts, we decided to exit our investment.

If it is not, a little is all we want. A good thing is that for most of our exits, they were initiated as small starter positions and were never added subsequently as the business did not do as well as we would have liked. Thus, most were not even in our top 20-30 positions. With the significant decline in confidence, we chose to exit our stakes in the businesses.

Thus, even with the exits where we got it wrong, it really did not hurt the overall portfolio as turnover, at 1.7%, still remains very low (<10%).

Tracking our Sell decisions. We like to track even our selling decisions to see what we can learn from it. Tracking our 55 position exits (51 full/ 4 partial) over the last 6 years, 38 (~69%) continued to further underperform with an average -28% post-exit underperformance, which means most of our sell calls turned out to be right. The table below details all our exits and its absolute and relative performance against the S&P 500.

Trimming Arista Networks. If we had to list one mistake that we should not have trimmed/sold on hindsight, it would probably be Arista Networks (+249% and +220% against S&P 500). Its demand rebounded strongly thanks to the cloud titans, and continues to gain market share against Cisco. It was one where we trimmed our position at the end of 2020 because it was too large a position relative to what we were overall comfortable with, and wanted higher allocation to other holdings, but thankfully we still kept a somewhat higher allocation. Arista Networks is our 6th largest position with a 3.5% allocation.

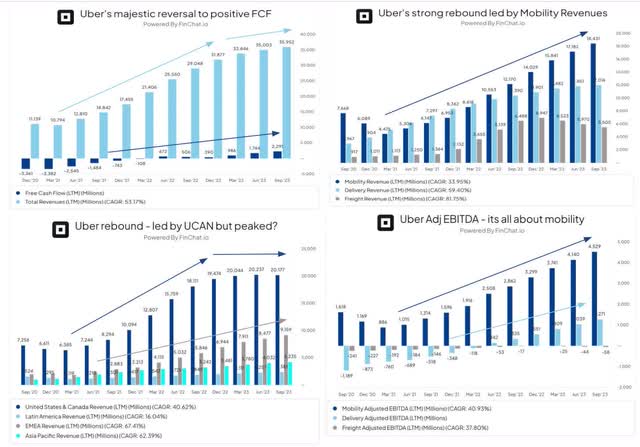

Getting Uber wrong for now. Uber’s (UBER) CEO Dara Khosrowshahi, who was ex-Expedia had replaced Travis Kalanick in 2017, really turned Uber around as he promised, turning into a business with TTM FCF of $2.2bn. The four charts below help to tell the story of FCF rebound led the strong growth in UCAN and EMEA, Mobility and Delivery revenues and disciplined improving Adj EBITDA profitability in the Mobility and Delivery business, and operating leverage. The learning from our exit in 2022, was that we were seeing parallels from Grab in small island Singapore, where they raised prices and attracted more competitors. But more importantly, there was a near perfect substitute in cheap reliable public transportation (train and bus), where customers would take instead if prices were too expensive. Our failure to realise that in the US and EMEA, that there were poor substitutes in public transportation versus a small city state of Singapore, resulted in continued persistence in customer usage of mobility for Uber despite higher prices. But longer-term, with the possibility of self-driving robo-taxis, we still see that as an imminent threat longer-term for Uber. We could well be very wrong with this exit. Time will tell.

Source: Finchat.io (Jan 2024)

Stronger companies will emerge. A number of our companies have gone through cost-cutting exercises and are reinvesting less as the broader macro conditions are on the weaker side but have been showing some signs of bottoming/not worsening. Thus, growth is on the slower side and FCF margins on the slightly higher side. We believe if growth does reaccelerate, 2024 and beyond could continue to differentiate the long-term structural winners, away from the seemingly short-term winners who had weaker products/services, business models and unit economics.

Our strategy remains unchanged. Our single investing strategy with its mission and principles below continues to focus on the (1) business growth of quality, durable and growing compounders (where we have higher control and higher probability) with strong sustainable and durable long-term competitive advantages, and are continuing to reinvest at high and increasing rates of return (i.e. ROIC), and (2) not paying up too much excessively for them. Note that we tend to invest in companies in the earlier part of the S-curve life cycle and more often, many of the companies that we are buying, often seem expensive based on current valuation multiples, but are actually cheap based on forward valuation multiples.

Not investing in companies that we do not agree with. We will not invest in businesses that have substantial interests in gambling, casinos and gaming, adult entertainment (pornography), tobacco, metals and mining, brewers, distillers and vintners, defence and military equipment companies.

They say, “tell me what you read, and I will tell you who you are”. In investing, I say “tell me what you invest in, and I will tell you what type of investor you are”. We too will stray away from any investors who invest in any of the above, where there are no morals as to what money can be made, e.g. in gambling stocks.

There are many ways to make money, and we choose to make money by taking the high road. Though we might make less, it is okay. We sleep well at night, and you will sleep well too, with us as stewards of your capital. That is Vision Investing at Vision Capital. You play a huge part in allowing us to invest in companies that reflect our best vision for our future, to change and shape the world for the better. You are our strength.

Investment Framework

Mission: To invest in companies that reflect our best vision for our future, changing and shaping the world for the better.

Vision Capital’s Ten Core Investment Principles:

- Horizon: We are dedicated to a long-term investment approach driven by bottom-up business fundamentals, focused only on publicly listed equities. We seek to hold our investments for at least 3-5 years, if not 7-10 years or more.

- Diversification: We strive to maintain a high-conviction diversified portfolio of at least 25 investments, which could increase with time. Diversification, not concentration, keeps us in the game, allowing us to hold & not trim our winners.

- Vision Investing: We seek to invest in top dog and growing disruptive companies that bring innovative solutions into their fields that are or can be either monopolies or oligopolies. We prefer founder-led and owned businesses with large total addressable markets, supported by long-term structural/secular tailwinds, with strong competitive advantages (particularly network effects), scalable business models with strong unit economics, recurring and growing revenues, improving profitability, strong reinvestment opportunities and financially strong. The chosen businesses should be highly durable and enduring, and must be changing and shaping the world for the better. We tend to avoid turnarounds, cyclicals, complicated companies, lacklustre businesses in deteriorating industries.

- North Star: Where revenues, profits and free cash flows go, the stock price eventually flows. We are long-term business focused investors, and we know that in the long term, it is ultimately revenue, profits and free cash flows that drive returns, not valuation multiples.

- Excellence: Find excellence, buy excellence, hold excellence, add to excellence and sell mediocrity, that’s how we invest. We buy far more than we sell, and if we ever sell, it is because the fundamentals have deteriorated rapidly beyond our thesis.

- Price Volatility: We do not focus on the day-to-day gyrations of the stock market, and our investment performance is measured over the course of years and decades, not in days, weeks, months, or even quarters.

- Cash & Opportunity: We have no requirement to be fully invested at all times. We embrace price volatilities (not business volatility), and see market sell-offs as normal (10-40% in any given year) as wonderful opportunities to add more (not sell). We are especially opportunistic when others are fearful. We generally keep 5-20% of the portfolio in cash, this will allow us to capitalise on opportunities and add to our highest convictions during declines.

- Asymmetric Outcomes: We are relentlessly focused on investing in our winners. But we know that we will get it wrong sometimes, and we will have losers. We expect our overall outperformance to be driven largely by the disproportionate multibagger gains from our winners that will outweigh the losses from our losers combined.

- Simplicity: We will not employ any form of leverage, short-selling, FX hedging, speculative/short-term trading nor the use of any derivatives and options. Not doing this ensures that we will never be wiped out. Being able to stay in the game, and not being taken out of it, is half the battle won and provides longevity & durability.

- Skin in the game: We are owner-operators. A significant portion of our net worth is invested. We will return capital should the scale or our size impede our strategy execution and/or returns, or when prevailing opportunities no longer make financial sense.

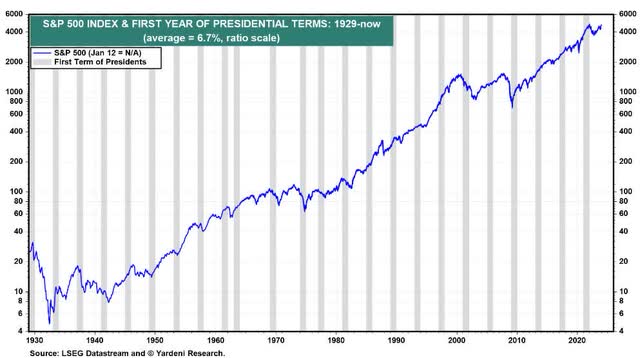

US Presidential cycles matter less in the grand scheme of things. We will have the US Presidential elections in 2024, expect lots of noise. We do not know who will win for sure, and as long as the country is not run to the ground, we are agnostic. This chart of the S&P 500 and Presidential cycles says it best on our stance.

Source: Yardeni Research (14 Jan 2024)

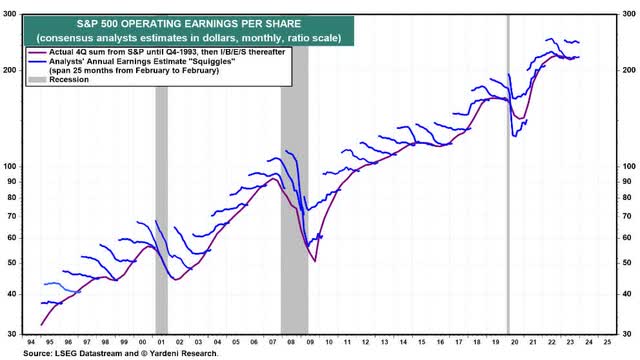

Focused more on the destination than the journey. We prefer to be approximately right focusing on the likelihood of the longer-term path than to focus our energies on short-term predictions (i.e. squiggles), and be spending all of our energy and attention trading and market timing our entry and exits, and be absolutely wrong over the long term. Prefer to be focused about what the business would eventually do, where its revenues and earrings could eventually be, its business growth path, than its price chart path. That is why we do not make any short-term stock market predictions, as they are most likely to be wrong. Focus on the long-term path, don’t get lost in the earnings squiggles that are most likely going to be wrong anyways. Have expectations, don’t make predictions.

S&P 500 Operating Earnings Squiggles – Focus on the long-term trend than the short-term fluctuations in expectations

Source: Yardeni Research (14 Jan 2024)

Being focused on what we own. We prefer to own businesses that we know are likely to keep growing revenues, improving or maintain profit and FCF margins, reinvesting at high ROIC versus cost of capital. We’d rather not fret over short-term noise, that’s not our expertise, to try and market time vs. near-term expectations, and we want to avoid it at all costs. We let the business narrative drive our investments, not the price narrative.

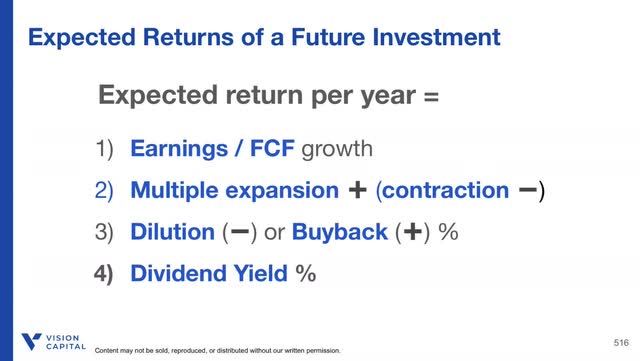

Remain focused on the north star of what drives long-term stock returns. In our minds, the drivers of long-term stock returns stem from 4 key factors (our four-legged stool): (1) growth of earnings / free cash flows (+) (driven by growth of topline revenue and margins), (2) change in relative valuation multiples (+/-) (which we have almost zero control), (3) stock buybacks (+) / dilution (-), and (4) dividends (+) (we tend not to favour, because of high withholding taxes and that most tend also to be slower growth, have far fewer reinvestment opportunities, and are in the maturing stage of their company life cycle.

Another, more precise way to think about long-term returns, is that it can also be approximated by the sum of the growth in FCF per share (business return) and the FCF yield (vs price you pay). It is just different ways of looking at the same factors.

Source: Vision Investing Cohort 2 Presentation Slides

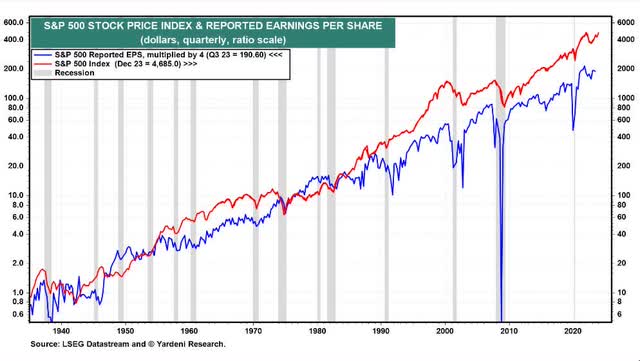

Where revenues, earnings and cash flow, eventually the stock price flows. That’s what eventually drives long-term stock market returns. That’s the biggest investing secret lying in plain sight. When you have a portfolio of companies whose earnings and free cash flows in aggregate keep growing over the years, so will your portfolio’s market value eventually. The market is a voting machine in the short term, but a weighing machine in the long term.

The growth in earnings is what provides the underlying value to a business.

Source: Yardeni Research (14 Jan. 2024)

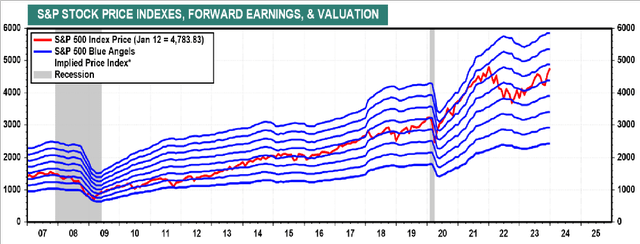

Normalisation of Valuation Multiples. We continue to remain long-term optimistic on stocks. While slightly on the higher side, we don’t think stocks are extremely overpriced in terms of valuation multiples. We still believe that it is okay to pay up for good companies, but not excessively such that future returns are more likely to be poor than good.

Source: Yardeni Research (14 Jan. 2024)

Still attractive opportunities. We think there are still attractive long-term investment opportunities for the right companies that can reinvest through and end up becoming even stronger at the end of it all. The durability of profitable growth is our margin of safety.

Future returns look more attractive. With the normalisation of valuation multiples back towards the middle of long-term averages, our portfolio should be expected to earn at least the returns of the businesses, i.e., earnings/FCF growth (weighted average TTM Rev +30%, Free Cash Flow (“FCF”) Margin 25%, Rule of 40 at 55), adjusting for dilution/buybacks, and adding dividends (if any) even if multiples remain unchanged.

The journey is not going to be smooth. There will be a lot of ups and downs, and sometimes the market can even go sideways for a while. Sometimes Mr. Market will like something more, and others less, but one thing for sure is that he always comes back to the ones that keep doing well over time. We remain unperturbed, and continue to remain focused on what the long-term drivers of businesses and stock market returns are. As Benjamin Graham said, Mr. Market is a voting machine in the short term, but a weighing machine over the long term. We only prefer to focus our energy and time on the latter.

Market Declines are very normal. Since we started the portfolio back in March 2017, we have experienced our 3rd broad market decline of 20% over the last 5 years at a far higher historical frequency (typically once every 3-5 years). Each time, we underperformed more each time, declining 40% and more. We assure you that our short-term performance will tend to be more volatile. Thus, this price decline is not the first one for us, the only difference is that it is for much longer. One thing we can guarantee you is that there will always be market declines, the only question is when and by how much.

Avoiding permanent loss of capital. However, the true risk of investing, to us, really is the permanent loss of capital. We do not run our portfolio as though we are playing a Russian Roulette (a revolver with one bullet in the chamber, spinning and shooting the gun at one’s head), by trying to get supernormal returns by underwriting risks that kill when it does come. Because black swans are actually frequent, and they will appear. We do not think our portfolio is structured to be significantly exposed to this left tail risk (unless the world comes to an end, which honestly all the wealth in the bank would not matter).

Differentiate slower temporary growth from long-term structural decline. While some of the businesses are experiencing somewhat weaker sales conversion in the near-term, leading to slower revenue growth, as purse strings of businesses and individuals tighten, it is crucial for us as capital allocators to differentiate if it’s more short-term temporary or long-term structural. Like for many of the SaaS companies, it is crucial to differentiate which are more mission-critical, the must-have, versus the good-to-have, that the businesses cannot do without.

We certainly do not expect smooth sailing revenue growth. The key is to hold them through these “tough” times, rather than to time and trade them through such expectations. We are not short-term traders of businesses, but long-term owners of them. So we really do prefer to hold them for as long as we can, especially the good ones.

Our belief in eventual outperformance. If the companies in our portfolio can sustain average annual revenue growth of greater than 25% CAGR for the next 5-7 years, while producing healthy Free Cash Flow growth even after low single digit dilution, we believe it is not difficult for us to outperform the S&P 500 over time (long-term 7-9% CAGR).

Generating alpha. How we think of our own alpha generation is that when the broad market declines, we tend to underperform much more than the market, but when the broad market rises, we tend to significantly outperform the market by a much larger fold. We have done so over a number of times with the types of businesses we own. Eventually, we will let the durability of growth of our portfolio businesses speak for themselves.

A Marathon, not a Sprint. I turned 40 in 2023. After investing for almost 7 years with my own capital, I do hope to continue investing for the next 30-40+ years, and hopefully even

30-40+ years for as long as I can. To be one of the world’s greatest investors, it is not just about doing well for a very short period of time, but being able to do well for a very long time, and that’s why Warren Buffett is up there amongst the very best.

Source: Vision Investing Cohort 2 Presentation Slides

Tribute to Charlie Munger

Charlie Munger, one of the true investing greats, passed away peacefully on 28 November 2023 just shy of his 100th birthday. I loved Charlie’s no bull-shit wisdom on investing, business and life, and his uncanny wit and ability to call it out and say it as it is.

I was truly thankful to be able to head up to Omaha and attend the 2023 Berkshire Hathaway AGM earlier this year, and to be able to see Charlie Munger speak in person.

In remembrance, I wanted to share some of my favourite lessons from Charlie Munger:

Most of the money is made in owning great companies, and letting them compound.

You find a few great companies and then sit on your ass. The big money is not in buying or selling, but in the waiting. It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. The first rule of compounding: Never interrupt it unnecessarily.

One can do well in investing, paying up and owning great businesses.

A great business at a fair price is superior to a fair business at a great price.

Forget what you know about buying fair businesses at wonderful prices; instead, buy wonderful businesses at fair prices.

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years, and you hold it for that 40 years, you’re not going to make much difference than a 6% return-even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result. So the trick is getting into better businesses.”

Master the best from those who have figured it out.

I believe in the discipline of mastering the best that other people have ever figured out. I don’t believe in just sitting down and trying to dream it all up yourself

Always keep reading and learning with curiosity.

Be a little bit wiser than the other guys, on average, for a long, long time. Those who keep learning will keep rising in life. Develop into a lifelong self-learner through voracious reading ; cultivate curiosity and strive to become a little wiser every day. I constantly see people rise in life who are not the smartest, but they are learning machines.

It is okay to know what you know and don’t know.

Acknowledging what you don’t know is the dawning of wisdom. Be extraordinarily good at knowing the limits of their knowledge

Read History, it provides perspective.

There is no better teacher than history in determining the future.

Have time to think and invert.

Insist on a lot of time being available almost every day to just sit and think. Invert, always invert: Turn a situation or problem upside down. Look at it backward.

Find out what works, and then do it. Find out what does not work, and then avoid it.

Have strong opinions, loosely held.

We all are learning, modifying, or destroying ideas all the time. You must force yourself to consider arguments on the other side.

Understand Statistics and Probability.

If you don’t get this elementary, but mildly unnatural, mathematics of elementary probability into your repertoire, then you go through a long life like a one-legged man in an ass-kicking contest.

Don’t do what everyone else is doing, do it differently.

Mimicking the herd invites regression to the mean.

Do the hard work.

Own your work and compound credibility.

Mistakes are inevitable.

There is no way you can live an adequate life without making mistakes.

Knowing what you don’t know is more useful than being brilliant.

Give back by teaching and helping.

The best thing a human can do is to help another human being know more.

Seek win-win, not win-lose.

Seek win-win business, do win-win things. Do business that way. Not win-lose, lose-win or lose-lose, don’t seek or do any of these, they usually don’t last or do well for long.

Always have high integrity in everything that you do.

Always take the high road, it’s far less crowded.

Good things are not easy.

It’s not supposed to be easy. Anyone who finds it easy is stupid.

My most favourite one to sum it all.

It is so simple: you spend less than you earn. Invest shrewdly. Avoid toxic people and toxic activities. Try to keep learning all your life. And do a lot of deferred gratification.

If you do all those things, you are almost certain to succeed. And if you don’t, you will need a lot of luck. And you don’t want to need a lot of luck.

You want to go into a game where you’re very likely to win without having any unusual luck.

Giving Back via Teaching and Donating

Giving back – We had always wanted to give back, not just in monetary benefits, but also with a positive impact on people’s lives. Time is the most precious resource we have, and by teaching investing to individuals the right way via Vision Investing, we together as a collective can invest better and hopefully help to change the world for the better. And by investing the net proceeds from that in Vision Give Back Fund, allowing a growing perpetuity of, we can be able to be a growing force of good.

With the net proceeds from the first Vision Investing cohort with an additional top-up rounding it up to S$10,000. We invested it in a portfolio of 20 stocks in the same philosophy as Vision Capital, and I am pleased to report that the Vision Give Back Fund has outperformed and returned +49% in 2023 against the S&P 500’s +24%. We made a total absolute gain of S$5,127 and will be donating 20% of the annual gains, i.e. $1,031 to philanthropic causes. We are in the midst of finalising our giving back strategy.

Last year, we completed our annual 2nd Vision Investing course, and will be deploying 100% of the net proceeds of S$5,311 (S$6,342 net proceeds minus $1,031 in donations) into the Vision Give Back Fund in 2024 into new positions.

Small steps, giant leaps. The Vision Give Back Fund at S$22K might be small now, but hopefully with many years of continuous addition (with even bigger cohorts) and after decades of compounding, we think it can become a very powerful force for good.

When the Vision Give Back Fund becomes bigger, and the unit economics make sense economically, we will incorporate it as a stand-alone non-for-profit vehicle.

A hearty congratulations to our second cohort of Vision Investing graduates and for your beautiful testimonials. As always, a big thanks to my good friend Chong Ser Jing of TheCompounder Fund for coming in to help judge the final presentations.

Right LPs. The right partners matter. Thank you for trusting us with your hard-earned capital, always giving us even more to invest for you when prices fall, and never taking it away when prices are at all-time highs. We deeply appreciate the faith, trust and support in us, especially in difficult times like the last few years, and your deep understanding of our long-term investing approach and philosophy that we do here at Vision Capital. Thank you once again for being wonderful, patient investors, and playing a significant role in allowing us to maintain our behavioural edge. As always, we look forward to making yours and our portfolio reflect our best vision of the future, changing and shaping the world for the better.

Final Words

Life changes in a single moment. I just turned 40 a few months back. For those who don’t know me, I am just an average Singaporean boy born to an average family, who had a near-death/paralysis accident where I broke my neck (C1 Jefferson Fracture) 10 years ago, which still remains broken to this very day. My life changed in that one single moment, henceforth for the better in a purposeful and mission driven way.

Quest on a learning journey. Post my recovery, I sought to master the art and science of investing in stocks. Instead of reading hundreds of investing books, I went through the unconventional route, going back to first principles. I was asking three questions, (1) which kind of companies do well, (2) which investors did well long-term and what did they do right and wrong, and (3) what did I think that was good that I can formulate into my own investing strategy that suits me and my temperament.

Discovering the holy grail. I soon realised that investing has to be for the long term. For the probabilities of winning to stack in my favour, only a few winning stocks were worth investing in. These winning multibagger stocks can generate life-changing returns, and there are actually observable patterns and traits that can get us closer to the honey pot.

Writing a book. Realising that there was no such book written on investing for individuals with a strategy that was backed by data, I published my first investing book titled “VisionInvesting: How We Beat Wall Street & You Can, Too! “ back in 2020. It was also the year when I made my first early-stage venture capital Seed Investment as an angel in a start-up, and I have since invested in 81 start-ups over the last 4 years.

Stepping out into the public eye. I also decided to step out by being on Twitter and LinkedIn sharing my learnings and observations publicly, and update and share my own investment performance month after month through both good and bad times, and do quarterly earnings reviews for all the companies I own in the portfolio. It has been a great journey and I have made so many new friends, and new connections.

The Master Plan. Relooking back to the Vision Capital Master Plan that was conceived years back: In short, the plan is to: earn more, spend less, save more, and invest well. Use that savings to invest our own capital in public listed businesses very well, and expand that to startups. Use that knowledge and experience, to invest even more capital (for ours and others) even better, across both public listed businesses and startups. While doing so, teaching others, giving back, thus helping to make the world better with our capital, and with others. Investing capital for others was the only one that was yet to be done.

Helping others invest. As much as I wanted to help others to invest better, there are others who want to learn it from and do it themselves, and there are others who want you to do it for them. And there have been a number of such requests through the years. The only thing left that I have yet to do is to manage capital externally for others.

Taking the big step to manage capital. If 2022 was the year of preparation, 2023 is the year of becoming. I am currently in the midst of making preparations to start my own investment fund to accept and manage external capital this year in 2024. The investment strategy and philosophy will be exactly the same.

It is starting and building your own business. Starting your own investment fund is a huge, gigantic step, as one becomes an entrepreneur with his own business, working for himself and his fellow investors. There is never a right time, but I know if I never do this, it will be my life’s regret. I will give it all of my best, and I am really excited to see where this adventure takes us.

A good investment fund is one with a solid diversified investment strategy with a long-term investing approach with the right psychological and behavioural make-up, strong consistent transparent communication – written and verbal that is genuine and authentic, building strong rapport, operating with high integrity, backed by sticky long-term capital from the right patient investors (high net worth individuals, endowments and family offices), supported by solid providers, with low but reasonable fees and expenses.

All I want to know is where I’m going to fail, so I’ll never go there.

Inverting – A horrible investment fund has an inconsistent investment strategy with very high concentration, high turnover, frequent trading and market timing, poor and infrequent opaque communication that is impersonal, ingenuine, builds poor rapport, backed by fragile and fickle institutional capital / individuals with trading mentality that tends to give capital to invest when markets are at all-time highs, and taking it away when it is at all-time lows or run at the first signs of underperformance, supportive by expensive and poor quality providers, encumbered with high fees and high expenses.

Having skin and soul in the game. The significant majority of my personal investable net worth, which is currently invested in Vision Capital, which will be wholly transferred to be invested alongside my investors under the same terms. Investing is my Ikigai and is what I want to keep doing for the next 30-40 years of my life while still remaining fit and healthy. It is my life’s mission. If I can do it every day for the rest of my life, while building transformational wealth, helping businesses and individuals while changing and shaping the world for the better, impacting many positively, I will be happy to depart from this world, a very happy man.

Reaching out. If you are interested in joining me on this journey, and want to find out more, please do not hesitate to drop me an email at eugene.ng@visioncapital.group, we can have a chat to explore further.

Excelsior,

Eugene

Ng Founder & Chief Investment Officer, Vision Capital

15 January 2024

P.S.: You can find all of our past investors’ letters here.

Disclaimer

This letter is solely for informational purposes and is not an offer or solicitation for the purchase or sale of any security, nor is it to be construed as legal or tax advice. References to securities and strategies are for illustrative purposes only and do not constitute buy or sell recommendations. The information in this report should not be used as the basis for any investment decisions.

Whilst, we use reasonable efforts to obtain information from sources which we believe to be reliable and up to date. We make no representation nor give any warranty as to the accuracy, completeness or reliability of any information contained in this report, including third-party data sources. No responsibility or liability can be accepted for any errors or omissions or for any loss resulting from the use of the Information. The views expressed are as of the publication date and subject to change at any time.

Hypothetical performance has many significant limitations, and no representation is being made that such performance is achievable in the future. Past performance is no guarantee of future performance.

The copyright and other intellectual property rights in the Information are owned by Vision Capital. Any use of the material for any purpose is accordingly prohibited except as stated below. You may not reproduce, transmit, modify, store, archive or in any other way use for any public or commercial purpose any of the Information without the prior written permission of Vision Capital.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.