ChargePoint (CHPT 12.62%) stock is jumping Wednesday. The electric vehicle (EV) charging specialist’s share price was up 11.7% as of 3 p.m. ET, according to data from S&P Global Market Intelligence.

ChargePoint stock is gaining ground in conjunction with better-than-expected preliminary fourth-quarter results from Blink Charging. While Blink is a rival, the company’s preliminary Q4 results are actually signaling that the industry backdrop for ChargePoint may be more favorable than many investors had previously thought.

Blink Charging released preliminary Q4 and full-year results before the market opened this morning and posted numbers that came in well ahead of Wall Street’s target. The company expects to report revenue of more than $42 million for the fourth quarter, trouncing the average analyst estimate’s call for sales of $34.3 million. For the full year, management expects revenue of more than $140 million — beating its previous guidance for sales to be between $128 million and $133 million. The preliminary results have pushed the stock up roughly 30% as of this writing.

ChargePoint is scheduled to report its own Q4 results on March 5. Should investors be buying ChargePoint stock on the heels of Blink’s better-than-expected results?

ChargePoint could have explosive upside, but is very risky

Blink Charging’s preliminary Q4 revenue coming in far better than previous guidance and the average Wall Street targets is a promising sign for the overall EV charging space. Given Blink’s big beat, it’s not unreasonable to think that ChargePoint could also report fourth-quarter sales that come in significantly better than the market has been anticipating. On the other hand, that’s also not a sure thing, and a potential sales beat could still come in lower than some investors may now be expecting.

Additionally, posting one quarter of better-than-expected sales wouldn’t necessarily be a sign that ChargePoint’s business is at the start of a sustained upswing. Last quarter, the company’s revenue fell 12% year over year to $110 million, and the business posted a non-GAAP (adjusted) gross margin of -18%.

The company’s cost of goods sold is still significantly above its revenue, and that doesn’t take operating expenses into account. All told, the business posted a pre-tax adjusted net loss of $106.3 million in the third quarter.

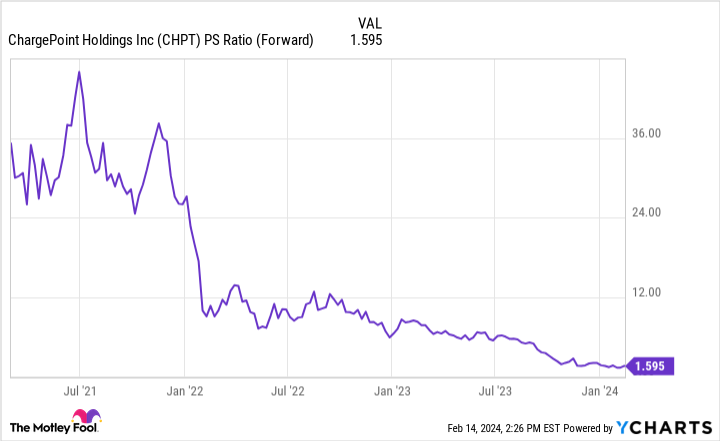

CHPT PS Ratio (Forward) data by YCharts

Even with today’s gains, the charging specialist’s share price is down 95% from its high. Trading at roughly 1.6 times this year’s expected revenue, ChargePoint’s forward price-to-sales multiple still looks quite low on a historical basis. But the company hasn’t been making enough progress on getting its gross margin into positive territory, and the economics of the business are still concerning.

In order to shift into posting profits, ChargePoint will need to leverage economies of scale. While the long-term growth outlook for the EV market remains promising, it looks like growth is poised to slow substantially in the near term — and that will make profitability more difficult. ChargePoint’s beaten-down valuation suggests the stock could have explosive potential, but it’s probably not a good fit for those who are looking to avoid risky, speculative investments.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.