Galeanu Mihai

My best-performing investments tend to come from macro trends and themes that play out over several years. Artificial intelligence, growth stocks, and cryptocurrencies have all been lucrative megatrends in the last decade.

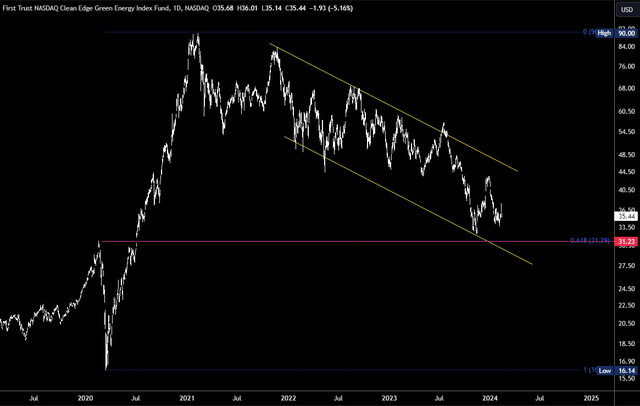

Could 2024 be the year clean energy stocks join this group? They had a good run in 2020 after the COVID-19 crash but topped in early 2021 and have been drifting lower ever since. I don’t think this downtrend will be sustained, however – clean energy is not something that will disappear. On the contrary, I think the sector will get more and more important and the rally could start up again.

As this is a macro idea, I want exposure to the entire sector rather than a specific stock. I will therefore look at the First Trust NASDAQ Clean Edge Green Energy Index Fund ETF (NASDAQ:QCLN) as a potential investment.

Why Clean Energy?

Despite some scepticism about climate change and the role of clean energy, it is an issue that most major governments, central banks, and international companies feel the need to address. It is ubiquitous; even BlackRock ETFs are graded on “Sustainability Characteristics” with metrics such as “MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES).”

President Biden’s Inflation Reduction Act of 2022 was “the single largest investment in climate and energy in American history.”

Within its energy and climate provisions, IRA appropriates approximately $11.7 billion in total for the Loan Programs Office (LPO) to support issuing new loans. These amounts increase loan authority in LPO’s existing loan programs by approximately $100 billion.

The Republican Party, and especially Donald Trump, have been critical of some of the clean energy “handouts,” and in 2017 Trump withdrew the US from the Paris Agreement on climate change mitigation. However, this took around three years to implement and Biden re-joined in 2021, which meant the withdrawal lasted only 107 days.

Republicans have said that they would repeal the IRA, and this could weigh on the likes of QCLN going into the election if Trump leads the polls. However, the Paris Agreement debacle and also the failure to roll back Obamacare highlights some of the problems they could face. The CEO of NextEra Energy (NEE), John Ketchum, recently said.

In the 21 years I’ve been at the company, as we’ve changed administrations and as we’ve seen changes in Congress, we’ve never seen a change or repeal of tax credits, no matter what form they’ve taken

…[it is] really hard to overturn existing law… no matter what the political winds are

In short, the IRA and other schemes are unlikely to be completely unwound by a Republican government. There may be a dip in QCLN if Trump were to win in November, but this could well be a buying opportunity as it would be driven by sentiment rather than an immediate change in the fundamental backdrop. In the long run, clean energy is a sector that looks set to grow rather than shrink.

QCLN

QCLN is a medium-sized fund with $941M in AUM. Liquidity is excellent, with an Average Daily Dollar Volume of $9.32M. A small dividend of 0.88% and an expense ratio of 0.58% are worth noting, but this is a volatile fund – QCLN rallied 450% in less than a year from the 2020 bottom – so I don’t think these are relevant.

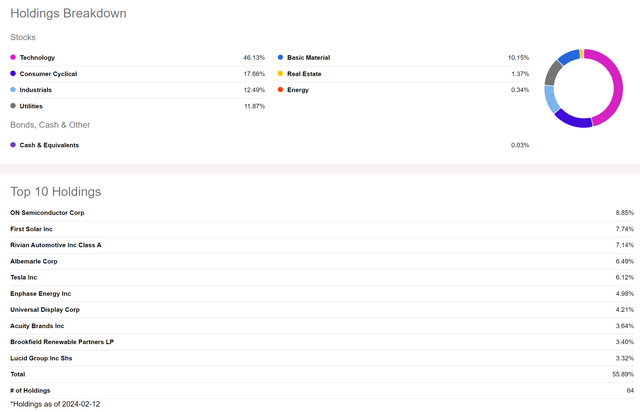

QCLN has a total of 64 holdings, with the following breakdown:

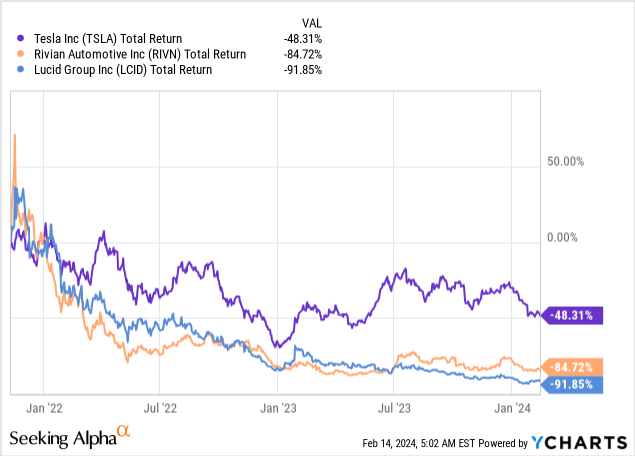

There are two notable aspects in the graphic above. Firstly, the top 10 holdings make up over 55% of the fund, which means they must perform well for QCLN to perform well. Unfortunately, this is not the case. The second notable aspect is there are three automotive manufacturers in its top 10 holdings, and these have been a drag on performance in the last three years. Indeed, QCLN topped the same year Tesla (TSLA) did.

Thankfully, QCLN’s top holding is performing well and constitutes 8.8% of the fund. ON Semiconductor Corporation (ON) is in a hot sector and gained over 10% after earnings were released in February.

QCLN is a passively managed fund that tracks the NASDAQ Clean Edge® Green Energy IndexSM. According to the Factsheet, the index is a “modified market capitalization weighted index, designed to track the performance of clean energy companies that are publicly traded in the U.S. and engaged in the manufacturing, development, distribution and installation of emerging clean-energy technologies including, but not limited to, solar photovoltaics, biofuels and advanced batteries.”

The NASDAQ® Clean Edge® Green Energy IndexSM is a modified market cap weighted index in which larger companies receive a larger index weighting. The index weighting methodology includes caps to prevent high concentrations among larger alternative energy stocks. The Index is reconstituted twice a year in March and September and rebalanced quarterly.

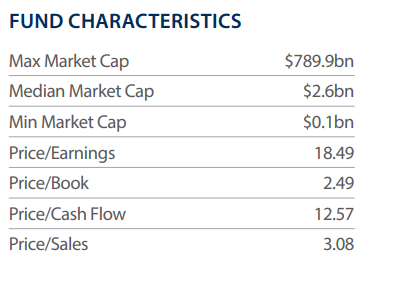

A look at some of the characteristics of the fund shows the three-year drop from $90 to $35 has created an attractive valuation. Its PE ratio is only 18.49.

QCLN Characteristics (FT Factsheet)

Electric vehicles, solar, and semiconductors are all interesting growth areas. While they may benefit from current government policies, they don’t seem overvalued at price/sales of 3.08 and the current pullback in QCLN looks to have created a buying opportunity.

Technical Analysis

Technical analysis can help with entries and exits. QCLN has traded inside a descending channel since the 2021 high and is approaching the 61.8% Fibonacci retrace, which comes in at $31.23. This happens to line up with the 2020 high and should offer a good entry. The first target is the channel high in the mid $40s, but longer-term I think this can return to the $90 high.

Risks

The main macro risk comes from changes to government support for the clean energy industry. As discussed in the first section, it would likely take some time for these changes to be implemented, but this is not a certainty.

QCLN could also underperform if its top holdings, particularly the three automotive manufacturers, continue in their current trends.

Conclusions

QCLN has been in a correction for three years, which has created an attractive valuation. It is approaching technical support at $31.23 which could be a good entry for a long-term hold. Clean energy is a sector that will likely grow in importance, and while a Republican government could be less supportive, the existing stimulus will be difficult to revoke and will likely remain in place.