J. Michael Jones

Summary

Since our initial report on Alpine Income Property Trust, Inc. (NYSE:PINE), the shares have been largely rangebound. The market reacted favorably to a [strong] Q4 ’23 earnings report, but promptly retraced back down to the ~$16/share level. This report provides our thoughts on the quarter, revised valuation, and outlook for the year ahead. Overall, we feel much better about the story, given Alpine’s capital allocation activity during the quarter and are upgrading it to a weak Buy. Given that it is externally managed and a relatively small platform in the net lease space, we still have some concerns about the business. However, the valuation appears too compelling to maintain a Hold.

Earnings Update

Recall from last quarter that Alpine’s results have been impacted by the bankruptcy of tenant Mountain Express, an operator of Valero-branded gas stations at 7 of Alpine’s properties. While these credit losses were a drag on Q4 earnings, management says 2 of the sites have been leased, 3 more are being negotiated, and they are in preliminary discussions for the remaining 2. The re-tenanting of these locations is already baked into the forecast for ’24 (n.b., FFO and AFFO per share guidance for FY ’24 is ~1% below FY ’23).

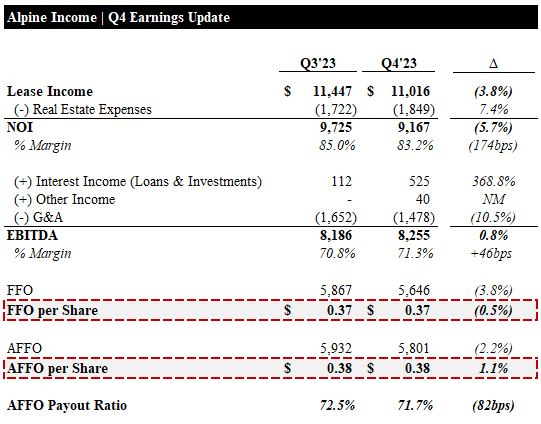

The bad debt issues, partially offset by lease escalations, contributed to lease income for the quarter being down ~4% sequentially. Operating costs for the portfolio were up ~7%, leading NOI to drop ~6% (n.b., ~174bps of NOI margin compression). Due to the recent loan investments, interest income from loans and investments was up significantly. This, along with a ~11% decrease in G&A, offset the decline in net income to keep EBITDA materially flat. FFO and AFFO declined ~4% and ~2%, respectively. However, share repurchases (details to follow) offset the declines, keeping these metrics materially unchanged. The AFFO payout ratio remained at ~72%.

Earnings Update | Summary Financials (Empyrean; PINE)

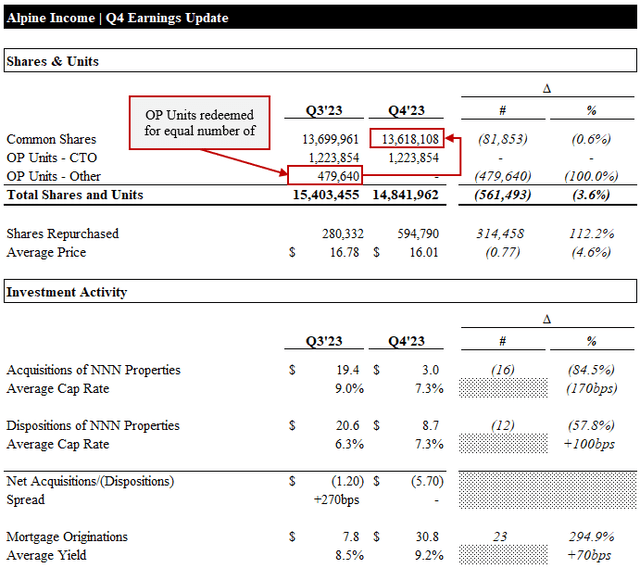

During the quarter, the ~480k OP Units not held by CTO were redeemed in exchange for an equal number of common shares, and the Company repurchased ~600k shares for an average price of ~$16/share. This resulted in the diluted number of shares and units declining ~4%.

Acquisition and disposition volumes were down significantly QoQ, with ~$3MM of properties acquired for an average cap rate of ~7.3% and ~$9MM sold for an average cap rate of ~7.3%. The acquisitions and disposition cap rates deteriorated QoQ (i.e., acquisition cap rates were lower than the PQ, and disposition cap rates were higher). In the earnings call, management highlighted that it is finding more attractive opportunities in repurchases of its own stock and mortgage investments. Alpine originated ~$31MM of mortgages in the quarter, with an average ~9% yield.

Earnings Update | Share Count & Investments (Empyrean; PINE)

While the capital recycling program was necessary and has appeared value accretive (i.e., selling at low cap rates and investing at higher caps), it has hampered FFO and AFFO per share growth in recent quarters as Alpine has been a net seller of properties. Guidance for ’24 indicates a matched acquisition and disposition volume, which could indicate an inflection point in portfolio growth. As long as management remains disciplined on pricing, we see this as a positive development. By addressing the bad debt and tenant credit quality issues that have plagued recent quarters, we think Alpine is positioned well.

Valuation

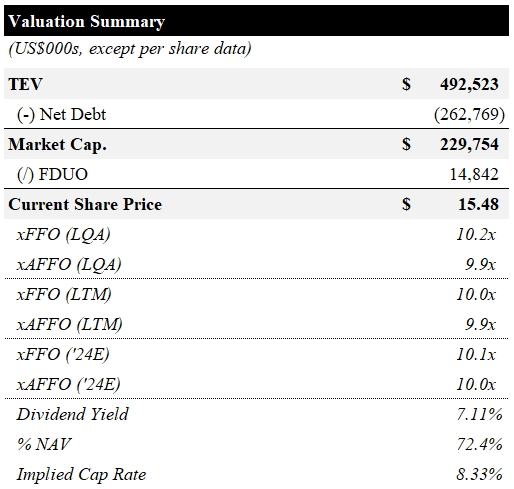

Alpine is currently trading at ~10x FFO and AFFO on an LQA, LTM, and ’24E basis. It yields ~7.1% and is trading at a ~28% discount to our updated NAV estimate (n.b., ~8.3% implied cap rate).

Valuation Summary (Empyrean; PINE)

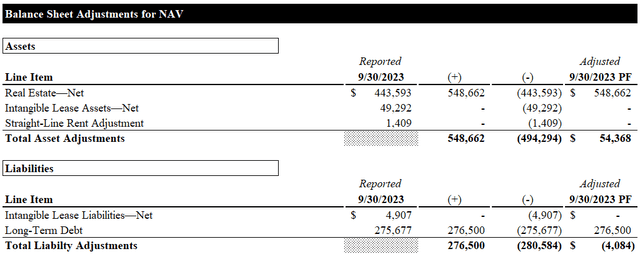

The major balance sheet adjustments for our NAV calculation are shown below. Our real estate valuation is based on a 6.75% cap rate.

Balance Sheet Adjustments for NAV (Empyrean; PINE)

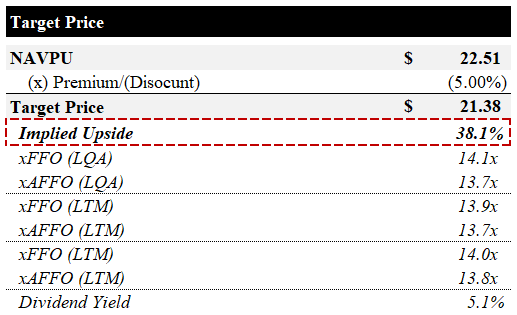

Our new NAV per share estimate is ~$22.5/share. Our target price is set at a 5% discount to NAVPS, reflecting the external management and low trading liquidity. Our target price implies ~38% upside to current prices, a ~14.0x / ~13.8x FY ’24E FFO / AFFO multiple, and ~5.1% yield.

Target Price (Empyrean; PINE)

With the Mountain Express issue nearly in the rearview mirror, management is now focused on improving its tenant quality and using the remainder of its share repurchase authorization, and a more attractive margin of safety, we are upgrading Alpine to a Buy.

We see 3 key risks to watch over the next few quarters.

1) Tenant Credit Issues

The most obvious tenant issue in the last quarters has been Mountain Express. However, 3 of Alpine’s top 5 tenants are worth watching: Walgreens (#1 tenant with ~12% of ABR), Dollar Tree/Family Dollar (~9%), and Dollar General (~5%).

While Walgreens (WBA) is worth watching closely, we are not overly concerned. WBA has recently made several significant moves to address its recent underperformance, including key leadership changes, a dividend cut, and multiple asset sales. Alpine’s management has stated it is a clear goal to reduce its exposure to WBA over time.

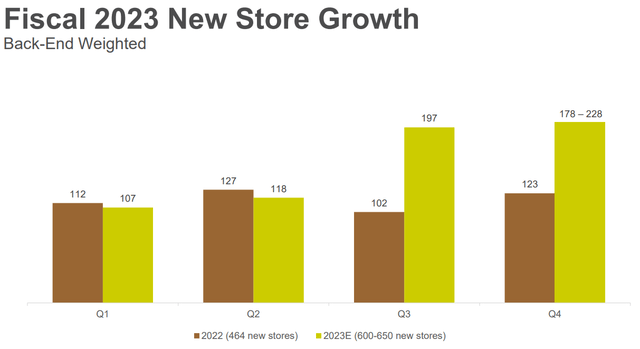

While dollar stores (DG / DLTR) have been facing various pressures recently, we note that they are both still planning on adding to their real estate footprint.

DLTR New Store Growth (DLTR)

“With that in mind, we are pleased to announce today our real estate growth plans for fiscal year 2024, which include approximately 2,385 projects in total, including 800 new stores, 1,500 remodels, and 85 relocations. This is a modest slow down compared to the number of projects in recent years, which we believe is prudent in this environment. We are excited about the opportunities these projects provide to serve both new and existing customers, while also driving strong financial returns for the business and laying the foundation for future growth. Looking ahead, we are confident in this business model and its ability to create long-term shareholder value.” (Dolar General)

As with WBA, we think these are worthwhile tenants to watch closely but do not warrant immediate concern.

2) Overreliance on Mortgage and Loan Investments

As explicitly stated by management, loan investments have been a key focus in recent quarters as they believe they offer superior risk-adjusted yields than NNN equity, given the current market conditions. Although this does appear to have been the case over the last 2 quarters, we are concerned that an overreliance on land investments will alienate certain investors seeking pure-play NNN equity exposure. Alpine’s loan book is small in the context of the entire business, but it certainly increases its complexity. We are also concerned that it is a band-aid solution to the lack of attractive equity opportunities. For now, it appears management has been able to strike some attractive deals, but this is definitely an area to watch.

3) Low Trading Liquidity

Our final major concern is a lack of depth in trading volumes. The shares are definitely investable from a liquidity perspective, but the small size of the business and shrinking float due to high buyback activity may prevent large institutions from taking meaningful positions that close the valuation gap.

Conclusion

While Alpine’s Q4 results showed some weakness, this was well anticipated. With the shares trading slightly below the levels we initially issued a Hold at, we have revised our target price upward to ~$21.4/share. We now see an adequate margin of safety and a clear path to addressing the immediate tenant credit issues, and we are upgrading Alpine to a Buy.