FABRICE COFFRINI/AFP via Getty Images

Palantir Technologies Inc. (NYSE:PLTR) reported better-than-expected 4Q-23 earnings last week that caused a new wave of excitement and investor euphoria.

Palantir Technologies’ stock price surged more than 30% last week, advancing to the highest price since November 2021, but the stock is now heavily overbought which puts investors that chase the price here at great risk.

I also think that while Palantir Technologies’ sales momentum in US commercial exceeded expectations, the company is priced for perfection and even the growth in US commercial sales doesn’t justify the extreme price tag that it tacked onto Palantir Technologies’ stock.

My Rating History

My rating history with respect to Palantir Technologies is resoundingly bearish because of a number of issues, such as a big accumulated deficit, high SBC expenses and slowing sales growth, which I thought would lead to a reality check for investors which it did only temporarily.

After 4Q-23 earnings, Palantir Technologies’ stock skyrocketed again and driving the stock up to a valuation that prices the software maker to perfection.

Not even the stronger-than-expected sales growth in US commercial justifies the frothy valuation multiple and I think investors have to be really careful here.

Accelerating US Commercial Detaches Valuation From Fundamentals

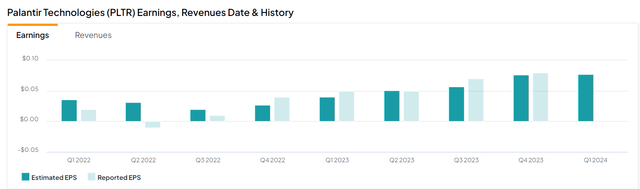

Palantir Technologies’ earnings for 4Q-23 were pretty much in line with what the market was expected as the software maker reported 8 cents per share in adjusted earnings. Sales rose 20% YoY and hit $608.4 million versus$602.4 million anticipated.

Earnings (Yahoo Finance)

It was a good earnings report all things considered, but nothing really that spectacular that would have justified a 30% bump to the company’s market valuation.

As to the company’s fourth quarter results: Palantir Technologies had another quarter of GAAP profits while it also grew the number of customers that are using its software products, particularly in US commercial. These products are used by customers to accelerate their IT transformations and generate new data-driven business insights that companies can exploit.

A key driver of this growth is Palantir AI, which is marketed as AI Palantir, short AIP. Alexander Karp has said that Palantir Technologies is seeing “unrelenting” demand for Palantir AI which unfortunately did not translate into a substantial bump in the sales growth rate.

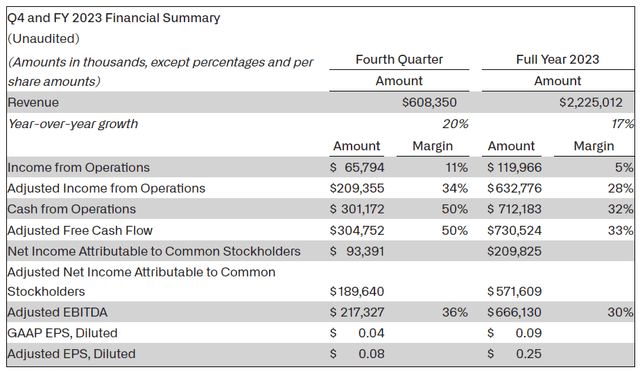

Palantir Technologies’ sales went up 20% in 4Q-23 as opposed to 18% in 4Q-22. This growth in sales, however, was primarily pushed by US commercial which produced $131 million in sales in the last quarter and booked 12% QoQ sales growth. YoY, US commercial’s sales went up 70%, primarily because of growing interest for Palantir AI platform from the commercial sector. Presently, US commercial has all the momentum as total commercial sales grew 32% YoY and government sales only 11%, YoY.

While demand for AI may clearly be there, according to Karp’s statements accompanying the earnings release for 4Q, it apparently doesn’t translate into an upswing in the sales growth rate. Investors should also remember that Palantir Technologies does not match its previously stated long-term sales growth rate of 30% annually.

Q4 And FY 2023 Financial Summary (Palantir Technologies)

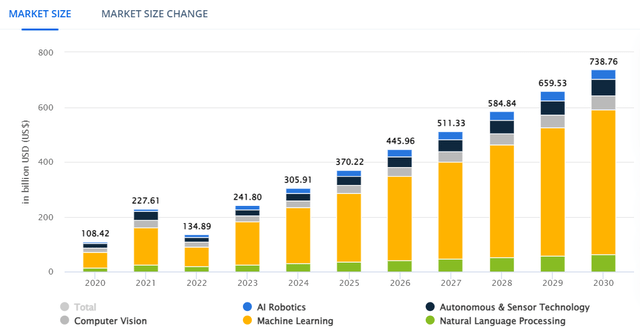

AI-related growth is obviously the latest fascination for investors, and I think it has led to Palantir Technologies’ stock getting pushed into bubble territory. Though the market is clearly attractive from a growth standpoint and there is an improving demand outlook for AI platforms, such as the one operated and deployed by Palantir Technologies, a 20% sales growth rate hardly justifies a 20x sales multiple.

The AI machine learning market is anticipated to grow at 19% annually each year until the end of this decade. Since Palantir Technologies’ sales growth was 20% in 4Q-23 and only 17% in 2023, I think there is a real question about whether the software maker can actually outgrow the market.

Market Size (Statista)

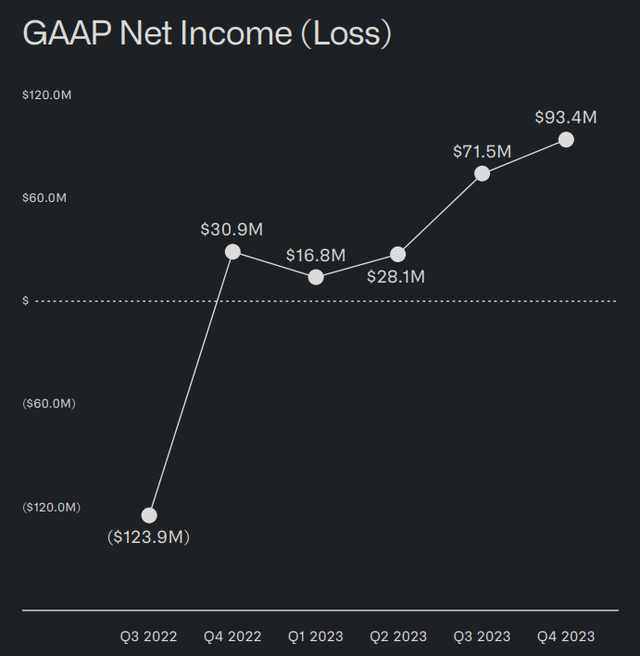

What worked to the benefit of Palantir Technologies, however, was that the software maker’s net profits in 4Q-23 grew to $93.4 million, up from $30.9 million last year. It was also the fifth straight quarterly profit for the company, proving to the market that it can turn a profit on its software intelligence services.

GAAP Net Income (Palantir Technologies)

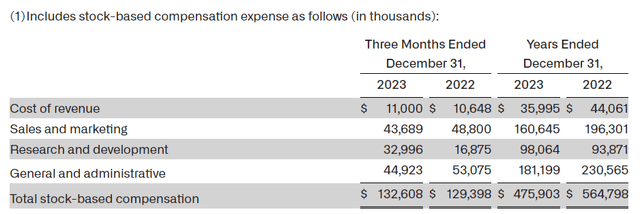

SBC And Shareholder Interest Misalignment

If you have followed the Palantir Technologies’ growth story closely over the last few years, you’d know that the market has bid up the software maker’s price primarily because of two reasons:

- Palantir Technologies is seeing interest for Palantir AI, particularly in US commercial; and

- The company is now profitable.

Investors obviously were quite happy about the $209.8 million in total profits the company reported for its 2023 financial year, particularly because it was the first year for Palantir Technologies to actually make a profit (it was the first year since the business was started 21 years ago).

But this unfortunately brings up the excessive nature of Palantir Technologies’ stock-based compensation again. If it wasn’t for Palantir Technologies’ excessive and obscene levels of executive compensation, the company’s profit in 2023 would have been more than three times larger.

Adjusting for SBC, Palantir Technologies’ profit for 2023 would have been $685.7 million, which continues to raise serious interest alignment concerns.

Now, this has been discussed before, but I think it makes sense to bring this up again in the specific context of investors cheering the company’s first-ever full year profit: If it wasn’t for SBC expenses in the amount of almost half a billion dollars in 2023, Palantir Technologies’ profits would have tripled compared to what the company actually reported.

Put differently, investors paid executives $475.9 million in SBC in order to produce a $209.8 million profit. The SBC issue alone is worth dismissing Palantir Technologies as a serious investment.

Stock-Based Compensation (Palantir Technologies)

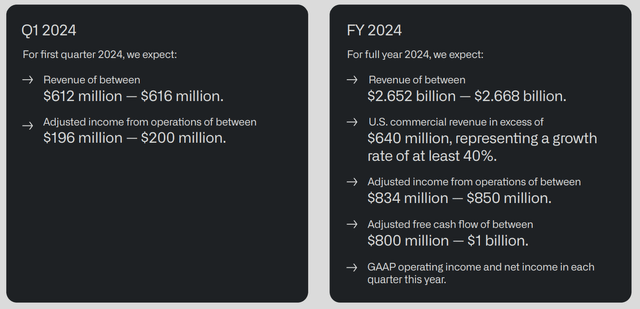

Sales Outlook 2024

Palantir Technologies expects to see between $2.652 billion and $2.668 billion in sales in 2024 which reflects a sales growth of 19.5%. In 2022, Palantir Technologies grew 16.7%, so growth is expected to ramp up a little bit, but not by much and as I said above, this growth rate is only a tiny bit better than the expected CAGR for the AI machine learning market.

FY 2024 Revenue Expectations (Palantir Technologies)

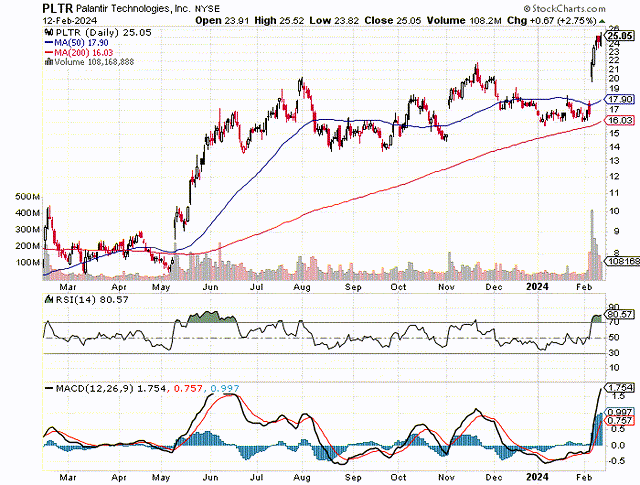

Technical Situation: Breakout, But Unfavorable Setup

Palantir Technologies’ stock price skyrocketed 30% after the software maker presented its earnings for the fourth quarter. The stock broke through the 50-day moving average line, a bullish short-term technical signal, but the Relative Strength Index signals that PLTR is hopelessly overbought with an RSI value of 80.

This means that Palantir Technologies is at high risk of falling back into a consolidation pattern which could, at the very least, lead to a pullback to the 50-day moving average line which presently runs at $17.90.

Relative Strength Index (Stockcharts.com)

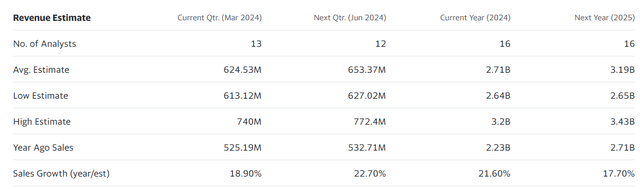

Peak Valuation

Palantir Technologies’ US commercial fourth quarter growth was impressive, there is no denying it. US commercial does have a lot of traction, but this doesn’t change the fact that Palantir Technologies’ is even more outrageously overvalued than it was.

I used to value Palantir Technologies at 4-5x leading sales which implies a market value of $14-16 billion. After the most recent price surge, Palantir Technologies has a market valuation of $55 billion which I don’t consider to be sustainable.

The implied sales multiple here is 20.3x which is excessive and not justified based on Palantir Technologies’ sales growth rate of approximately 20% annually. Nvidia Inc. (NVDA) is selling for 18x sales despite being expected to grow its sales three times faster than Palantir Technologies.

Palantir Technologies’ stock is in bubble territory, as far as I am concerned, and I fully expect this AI-hype driven bubble to deflate in the near future.

Revenue Estimate (Yahoo Finance)

Why Palantir Technologies May Beat Expectations

US commercial is doing extraordinarily well which is good for Palantir Technologies. The software maker clearly has an opportunity with its AI platform, the question will ultimately be, can Palantir Technologies convert this growth into real profits and can the company grow faster than the market? At the present time, I am not so sure about the second point. If Palantir Technologies were to achieve this feat, however, then the stock could grow into a larger valuation over time.

My Conclusion

In my view, Palantir Technologies’ stock is in a very vulnerable situation.

The software maker’s stock price skyrocketed more than 30% after the company released earnings last week and PLTR is now heavily overbought. To me, Palantir Technologies is back in bubble territory and once the market realizes that Palantir Technologies’ results weren’t really that great (with the exception of US commercial), we could see a major pullback that drives the stock price back to the 50-moving average line.

Palantir Technologies’ valuation, even under consideration of robust US commercial sales growth, is not sustainable, in my view.

The software maker is also paying way too much for its executives (relative to its actual earnings) and I have seen no evidence that Palantir Technologies can actually grow its sales faster than the market.

The outlook for 2024 also implies only 20% sales growth which I am afraid is not enough to back up Palantir Technologies’ high sales multiple.