Yuichiro Chino/Moment via Getty Images

Dear Fellow Investors and Friends,

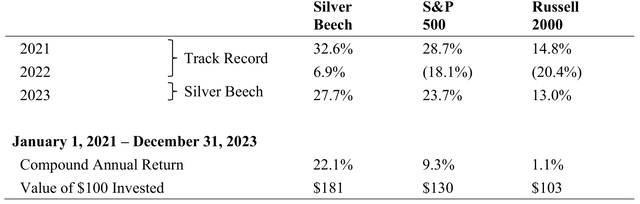

The estimated full-year 2023 and historical net performance for Silver Beech Capital, LP (“the Fund” or “Silver Beech”) is presented below.

Performance Summary1:

Performance Comparison: Value of $100 Invested at Inception1

| Returns presented above for Silver Beech are net of 1% management fee and 20% incentive fee above a 6% hard hurdle as of December 31, 2023, and since inception (January 11, 2023). Actual performance will vary depending on the timing of contribution(s) and fees. Returns for the S&P 500 and Russell 2000 are total returns and include dividend reinvestment. 2023 returns begin January 11 to match Silver Beech’s inception. Please see additional disclosure. |

Silver Beech returned 27.7% for the full-year 2023 net of fees, in comparison to the S&P 500’s (SP500, SPX) 23.7% return and the Russell 2000’s (RTY) 13.0% return.1 Over the last three years since track record inception, Silver Beech has compounded at a 22.1% annualized return, which equates to 12.8% annualized outperformance over the S&P 500.

We are proud of our strong performance over the past three years and particularly proud of our index- beating performance in 2023. Last year was a challenging year for stock pickers to beat the S&P 500 as just seven companies, known as the Magnificent 7, made an outsized contribution to the S&P 500’s overall return, while a record 72% of individual companies in the S&P 500 underperformed the index return.

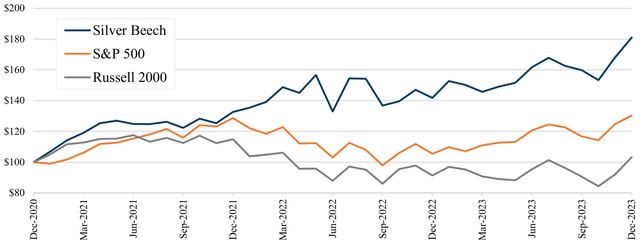

Today, we find the overall market to be rather overvalued. One might also expect Silver Beech’s portfolio to be overvalued after our strong performance in 2023, but we do not believe it is. We have taken profits from many of our best-performing investments and redeployed them into what we believe are even superior opportunities.

As depicted below by Silver Beech’s lower Price-to-Earnings Ratio2 compared to that of the S&P 500, Silver Beech’s portfolio is comparatively inexpensive, but possesses similar growth and operating metrics.

As a reminder, although Silver Beech’s portfolio is optically cheaper than the S&P 500, we do not invest for the sake of cheapness itself: our investment process balances valuation against quality and growth. We diligently execute this investment process to own a concentrated portfolio of attractive high-conviction ideas, while the broader market passively allocates its capital across 500 companies.

Throughout 2024, we expect the timing and scale of the Federal Reserve’s interest rate decisions will have a meaningful impact on near-term asset pricing, as will sentiment around the upcoming U.S. presidential election. Silver Beech is a fundamentals-driven investor so we follow these consequential events with interest but remain focused on investing in companies that can win and outperform in the current environment and across various unknown macroeconomic and political outcomes.

We are excited by Silver Beech’s portfolio and opportunity set. The broader financials and real estate sectors were a fertile hunting ground for attractive investment opportunities in 2023. We expect our focus on these sectors, combined with our downside-oriented, high-conviction investment approach, to reward us in 2024 and in the years to come.

Portfolio Update: for this quarter, we have written about our investments in Brookfield Corporation (BN, BN:CA) and Energy Transfer Partners (ET).

Brookfield Corporation (BN, BN:CA)

Brookfield Corporation is a high-quality business with an excellent investing track record that has amassed one of the world’s largest discretionary pools of capital focused on managing and owning investments in infrastructure, renewables, real estate, insurance, private equity, and credit. Brookfield Corporation offers investment products and services focused on these verticals to institutional and retail clients through its asset-light investment management business named Brookfield Asset Management (BAM).

Brookfield Corporation owns a controlling 75% stake in Brookfield Asset Management and both companies are led by Bruce Flatt. Bruce has been at Brookfield virtually his entire career, having joined the company at 25 years old. Bruce was made CEO in 2002 when he was 37 years old. Bruce and other insiders are aligned with shareholders as they own over $10 billion of Brookfield Corporation stock.

Brookfield Asset Management is a scaled and high-growth business that has attracted hundreds of billions of capital in recent years due to its strong-performing investment funds. Brookfield’s fee- bearing funds have grown from $138B in 2018 to $457B in 2023; this equates to a 27% compounded annual growth rate. Approximately half of Brookfield’s fee-bearing capital is also carry-eligible (an even more profitable fee stream that pays out when Brookfield meets investment performance criteria). Brookfield’s carry-eligible capital has grown at an even more impressive 31% compounded annual growth rate since 2018.

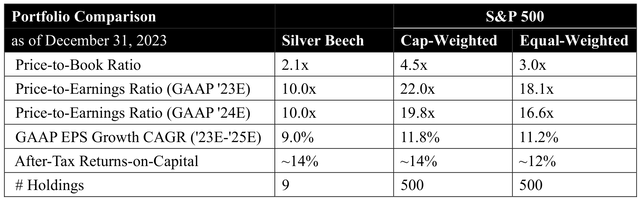

Brookfield Corporation’s other holdings are numerous, more asset-intensive than the asset manager, and relatively complex by public markets standards. We believe this surface-level complexity is partly responsible for Brookfield Corporation’s substantial undervaluation. We graphically depict a high- level overview of Brookfield Corporation’s holdings in Figure 1 below.

Figure 1

|

Note: 1. Brookfield Corporation’s economic ownership as of September 30, 2023. |

As you can see, Brookfield Corporation has economic interests in several subsidiaries. Many of these holdings are also publicly traded. For example, Brookfield Corporation has a 75% economic interest in Brookfield Asset Management, which is listed on the New York Stock Exchange and Toronto Stock Exchange under the BAM ticker.

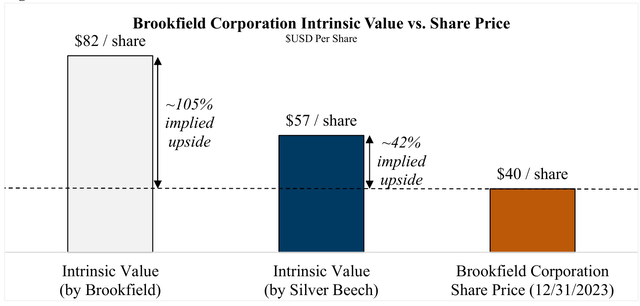

In Figure 2, we show that our estimate of Brookfield Corporation’s intrinsic value is substantially below the company’s share price. We construct a “look-through” estimate of the company’s intrinsic value using public market valuations of Brookfield Corporation’s public subsidiaries and modest valuation assumptions for holdings that are not publicly traded.3 Brookfield Corporation’s own intrinsic value estimate is $82, a 105% premium to the company’s December 31 share price.

As shown in Figure 2, Brookfield Corporation’ shares sell at a substantial discount to management’s estimate of intrinsic value and Silver Beech’s estimate of intrinsic value.

Figure 2

We would not be interested in Brookfield Corporation if it were simply selling at a discount to that implied by its public subsidiaries – we also believe that the company’s public subsidiaries are undervalued with embedded upside and are poised to outperform due to their high quality and constructive financial leverage. As interest rates rose in 2023, highly leveraged public company valuations were penalized. However, we believe Brookfield’s public subsidiaries’ high leverage is well managed, and, going forward, expect strong subsidiary operating performance combined with this leverage will result in increases to levered cash flows and accretions to equity value.

We believe Brookfield Corporation is an attractive investment because:

- Leading investment track record: Brookfield’s funds in infrastructure, private equity, real estate, and credit, have leading track records across multiple vintages spanning decades of investing in different market environments. Since Bruce Flatt became CEO in 2002, Brookfield’s stock has compounded at ~19% annually despite recent underperformance.

- High growth: Due to Brookfield’s leading investment track record across multiple asset classes, fee-bearing AUM has grown at a 27% CAGR over the last five years. Carry-eligible capital has grown at an even more impressive 31% CAGR over the same period. In addition to strong AUM growth at Brookfield Asset Management, we believe Brookfield Corporation should be able to compound its intrinsic value at 15%+ returns over the next five years by investing effectively across its unique global opportunity set and opportunistically repurchasing shares.

- Misunderstood high-quality company:

- Holding company complexity: Brookfield has direct and indirect economic interests in several public subsidiaries and often exercises disproportionate control and governance rights over them. In the past, Brookfield has also used its ownership of public subsidiary stock as a tax-advantaged currency for M&A. The public market’s distaste for such holding company complexity results in an unreasonably large trading discount for Brookfield stock. If this discount persists, we expect management to address the complexity by further simplifying the business and repurchasing shares as they have done in the past.

- Real estate & leverage misperception: when we speak with other investors about Brookfield, we usually hear concerns regarding the company’s large commercial real estate portfolio of offices and malls. It is true that Brookfield owns a large portfolio of commercial real estate. This real estate is out of favor and the market’s perception is that Brookfield’s continued ownership will hamper the broader company’s operating performance for years to come. Furthermore, a simple quantitative screen of Brookfield on Bloomberg shows an overleveraged company saddled with $220+ billion of consolidated debt. Digging just one inch deeper, it is easy to get comfortable with Brookfield’s real estate exposure and leverage: easily less than 20% of the company’s enterprise value can be attributed to the real estate portfolio, and over $200 billion of Brookfield’s consolidated debt represents asset-level financings that are non-recourse to the holding company.

- Attractive valuation: Brookfield trades at an unreasonably large discount to a look-through estimate of its intrinsic value using valuations of its public holdings; we also believe Brookfield’s publicly traded subsidiaries are undervalued. We think Brookfield’s intrinsic value is more than 40% greater than its December 31 share price.

Energy Transfer Partners (ET)

Energy Transfer Partners owns and operates the largest and most balanced collection of energy infrastructure assets in the United States. ET’s assets include 125,000 miles of oil and natural gas pipelines, export facilities on both the Gulf Coast and East Coast, and more than 1 million barrels per day of natural gas liquid fractionation capacity. ET accounts for 20% of worldwide natural gas liquid exports. Further, ET is uniquely connected to every major hydrocarbon basin in the United States.

By assembling energy infrastructure to gather, process, transport, and store hydrocarbons, ET connects exploration and production companies (“E&Ps”) with downstream end users such as gas stations, utilities, and export facilities. As an end-to-end midstream solution, ET enables its customers to focus on their portion of the value chain without the burden of significant but essential midstream logistics. ET’s services thus add tremendous value to all constituents of the energy marketplace.

Though natural gas is a relatively clean source of fuel, restrictive federal and state regulations and other permissions severely restrict the building of natural gas pipelines and other infrastructure in North America that would help facilitate abundant hydrocarbon production. Pipelines are by far the cheapest and greenest method of transporting hydrocarbons; pipelines reduce emissions from truck transport and reduce congestion on highways, rail, and shipping routes.

Because of this restrictive environment that inhibits competition, ET is in an enviable position with decades of growth ahead secured by growing demand for American hydrocarbons. Though negative sentiment around the energy sector discourages many investors, we couldn’t disagree more with their black-and-white approach to forgoing an investment in ET at today’s low valuation: this is an opportunity to own essential infrastructure that facilitates global energy security and American leadership in the global transition from dirty hydrocarbons (like coal) to cleaner hydrocarbons (like natural gas).

We believe Energy Transfer Partners is an attractive investment because:

- High-quality business: ET is in an enviable competitive position having spent years assembling a large collection of synergized energy infrastructure. Future cash flows should be relatively capex- light compared to ET’s historical capex needs. The nationwide footprint has been built and the company should be able to focus on accretive, high-return growth projects that further optimize ET’s dense network. The company’s cash flow profile is less cyclical than other companies in the energy sector, like E&Ps. Only 10% of the company’s expected 2023 EBITDA is exposed to commodity price volatility: the remaining 90% is linked to fixed and volume-based fees.

- Manageable risks:

- Leverage: ET is optically highly levered at more than 4x Net Debt/EBITDA. However, ET is structured as a master limited partnership and thus does not pay corporate tax. A tax-free corporate structure results in greater free cash conversion and leverage capacity. ET’s credit ratings have been rising on upgrades as the company has shown discipline by financing M&A with equity versus debt.

- Shareholder alignment: We believe one reason for ET’s low valuation is management’s checkered history of shareholder alignment. In particular, in 2016, Kelcy Warren, the company’s founder and executive chairman, was criticized for issuing convertible preferred units to himself and a small cadre of insiders. At a high level, these special units forwent dividends for a period in exchange for favorable conversion terms. Warren argued that skipping the dividends (effectively equitizing them at a discounted price to the common units) helped the company manage a high debt burden. The episode is a clear negative, but we think Warren is now aligned with shareholders. Today, there is only one unit structure, so management is on the same footing as regular investors. ET’s management owns ~11% of the company (~$5 billion in value) under this single unit structure.

- Capital allocation: ET has been a large acquirer of adjacent midstream assets. These acquisitions have significantly expanded the company, resulting in more complexity and constraints on management time. These acquisitions also resulted in the company amassing a very strategic infrastructure footprint. We believe ET’s brightest days are ahead and management’s M&A strategy over the last five years will prove prescient and strategic.

- Commodity cycle and politics: Unlike E&Ps whose revenues are directly linked to commodity prices, ET’s exposure to the commodity cycle is linked to production and volume. If, for example, American production of hydrocarbons slowed, ET’s services would be in lower demand. ET is also subject to political and regulatory risk from Presidential administrations. For example, President Biden has intended to stifle American energy production and export, whereas President Trump promulgated American energy. We believe that commodity cycle risk and political risk are somewhat mitigated by secular demand for hydrocarbons that underpin higher living standards and cleaner emissions.

- Secular tailwinds: ET benefits from secular trends in global and domestic demand for American hydrocarbons, in particular natural gas. North American natural gas export capacity should rapidly expand over the next 5 years so American producers can sell to an international market experiencing significant supply shortages. Going forward, we expect American natural gas will play a larger role in global energy consumption to achieve ambitious emissions reduction targets.

- Attractive valuation: ET trades at a TEV/EBITDA of ~8x (2023E) and ~7x (2024E) and has a mid-teens free cash flow yield. ET’s valuation is lower than its peers and we believe too low for a company with an advantaged collection of energy infrastructure that provides essential services and has multiple high-return growth opportunities. We believe Energy Transfer’s intrinsic value is more than 40% greater than its December 31 share price.

Conclusion

We would like to thank all our investors for your trust and confidence. It is our great privilege to be your partner and manage your capital alongside our own. Thank you for your referrals and capital introductions – we greatly appreciate the trust and conviction that this represents.

Please keep an eye out for K-1 tax forms. We expect them to be distributed by early March. Please do not hesitate to reach out with any questions.

Sincerely,

James Hollier, Partner & Portfolio Manager

James Kovacs, Partner Silver Beech Capital, LP

Silver Beech Capital, LP – Fund Summary as of December 31, 2023

|

Fund Holdings: |

|||

|

Name |

Ticker |

Sector |

Description |

|

Asbury Automotive |

Auto Dealerships |

Large U.S. automotive retailer that sells new/used cars and products/services across the vehicle ownership lifecycle. |

|

|

Brookfield Corporation |

Asset Management |

Holding company primarily comprised of asset manager, reinsurer, real assets, fund stakes, and carried interest. |

|

|

Burford Capital |

Asset Management |

Leading global investor and asset management company focused on litigation finance. |

|

|

Citigroup |

Banks (Diversified) |

Global diversified financial services company that provides banking, advisory, trading, and treasury services. |

|

|

Crocs |

Footwear & Accessories |

Manufacturer and retailer of iconic foam casual footwear brand Crocs. Also owns HeyDude footwear brand. |

|

|

Dentalcorp |

Medical Care Facilities |

Largest and fastest growing owner, acquiror, and partner of Canadian dental practices with over 500 practices. |

|

|

Energy Transfer |

Oil & Gas (Midstream) |

Leading owner of U.S. energy infrastructure assets that treat, transport, store, and export hydrocarbons. |

|

|

Fairfax Financial |

Insurance (P&C) |

Holding company primarily comprised of property and casualty insurers and reinsurers. |

|

|

Fidelity National |

Insurance (Specialty) |

Leading U.S provider of title insurance and real estate transaction services. Also 85% owner of life insurer F&G. |

|

|

Fund Composition By Market Capitalization: |

|

|

Weight |

|

|

Large Cap (greater than $12 billion) |

56.8% |

|

Mid Cap (greater than $2 billion) |

29.3% |

|

Small Cap (less than $2 billion) |

13.9% |

|

Total |

100.0% |

|

Monthly Net Returns: |

||||||||||||||

|

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sept |

Oct |

Nov |

Dec |

Year |

S&P 500 TR |

|

|

2021 |

6.8% |

6.9% |

4.2% |

5.3% |

1.3% |

(1.7%) |

(0.1%) |

1.3% |

3.1% |

4.9% |

(2.3%) |

5.9% |

32.6% |

28.7% |

|

2022 |

2.1% |

2.8% |

6.9% |

(2.5%) |

8.0% |

(15.2%) |

16.2% |

(0.1%) |

(11.3%) |

2.0% |

5.4% |

(3.6%) |

6.9% |

(18.1%) |

|

2023 |

7.7% |

(1.6%) |

(3.0%) |

2.3% |

1.7% |

6.6% |

3.8% |

(3.1%) |

(1.7%) |

(4.1%) |

9.6% |

7.8% |

27.7% |

23.7% |

|

Returns presented above for Silver Beech are net of 1% management fee and 20% incentive fee above a 6% hard hurdle since inception (January 11, 2023). Each Limited Partner’s actual performance will vary depending on the timing of their contribution(s) and fees. Returns for the S&P 500 include dividend reinvestment. Please see additional disclosure. |

|

Footnotes 12023 returns start on January 11, 2023 to match Silver Beech’s inception on January 11, 2023. 2Price-to-Earnings Ratio is an imperfect valuation metric but one that is standardized thus enabling comparability between Silver Beech’s portfolio and the S&P 500. 3Brookfield Corporation has several privately owned holdings, such as Brookfield Property Partners and Brookfield Corporation’s “Other” holdings depicted in Figure 1 (cash, carried interest, and direct investments). IMPORTANT DISCLOSURES Silver Beech Capital Management, LLC (“Silver Beech”) is a New York limited liability company that serves as the investment manager to Silver Beech Capital, LP (the “Fund”), a Delaware limited partnership. The principals of Silver Beech are James Hollier, who serves as the portfolio manager and managing partner of the Fund, and James Kovacs, who serves as the managing partner of the Fund. All performance results presented herein refers to the performance of an unrestricted investor in the Fund since its inception. Net performance is presented net of the highest performance allocation in effect at the time (20%) above a 6% hurdle rate, the highest actual management fees (1.0%) charged at the time, and net of other expenses, and includes the reinvestment of all dividends, interest, and capital gains. Performance for investors who subscribed on different dates, or who pay different fees would necessarily be different from the performance presented herein. The rate of return is calculated on a “time weighted” rate of return basis, which minimizes the effect of cash flows on the investment performance of the Fund. All monthly performance data presented herein reflects unaudited data, unless otherwise specified, and as such its accuracy cannot be guaranteed. Past performance is not necessarily indicative of future results. All securities transactions involve substantial risk of loss. The material presented is compiled from sources thought to be reliable, including in certain instances, from outside sources, but accuracy and completeness cannot be guaranteed. Any opinions expressed herein reflect the judgment of Silver Beech and are subject to change. The information in this letter is for discussion purposes only. Nothing contained herein should be construed as an offer to sell, or a solicitation of an offer to buy or sell any security or investment strategy or a recommendation as to the advisability of investing in, purchasing or selling any security or investment strategy, which may only be made in the Fund’s confidential offering memorandum and operative documents (collectively, the “Offering Documents”). Before making an investment decision with respect to the Fund, prospective investors are advised to read the Offering Documents carefully, which contain important information, including a description of the Fund’s risks, investment program, fees, expenses, redemption and withdrawal limitations, standard of care and exculpation, etc. Prospective investors should also consult with their tax and financial advisors as well as legal counsel. The Offering Documents are the sole documents on which a potential investor is entitled to rely in evaluating an investment in the Fund. The information in this letter does not take into account the particular investment objectives, restrictions, or financial, legal or tax situation of any specific prospective investor, and an investment in the Fund may not be suitable for many prospective investors. This letter is not intended to be, nor should it be construed or used as, investment, tax or legal advice. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.