SweetBunFactory

Standex International Corporation (NYSE:SXI) recently delivered better than expected EPS Actual, and announced new transactions to be closed in 2024 as well as restructuring efforts for 2024 and 2025. Moreover, with expositions to growing sectors, like renewable energy and electric vehicles, and a solid balance sheet with little debt, Standex will most likely deliver organic and inorganic growth in the coming years. Tariffs and intense competition appear to be risky, and goodwill impairments could happen, however SXI appears to show upside potential in the stock price.

Standex International

Standex International Corporation runs an industrial manufacturing business model, headquartered in Salem, New Hampshire, and excels in diverse markets with six key operating segments: Electronics, Engraving, Scientific, Engineering Technologies, hydraulics, and Specialty Solutions.

Established in 1975, the company appears to have a strong track record of quarterly dividends since going public in 1964. In addition, Standex is positioned for sustainable growth, focusing on areas such as renewable energy, electric vehicles, and defense.

The company offers a full range of services to global automotive OEMs, product designers, Tier 1 suppliers, and toolmakers. Its scientific products are marketed to medical distributors, laboratories, health centers, research universities, pharmaceutical companies, and pharmacies. Besides, Engineering Technologies components are sold to companies in space, aviation, defense, energy, and medical sectors as well as to the suppliers to these companies. In my view, the business model reflects Standex’s diversification and global leadership.

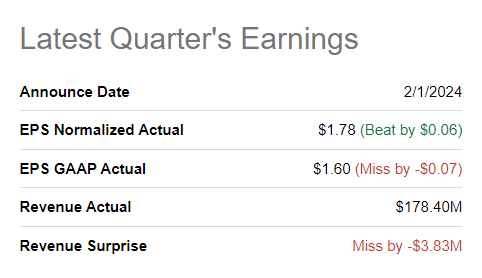

In the last quarterly report, Standex reported better than expected EPS Normalized earnings of $1.78, with lower than expected quarterly revenue of $178 million. I believe that analysts are expecting an increase in the EPS in 2024 and 2025, so I am not worried about the recent quarterly revenue figure. I see some optimism in the market.

Source: Seeking Alpha Source: Seeking Alpha

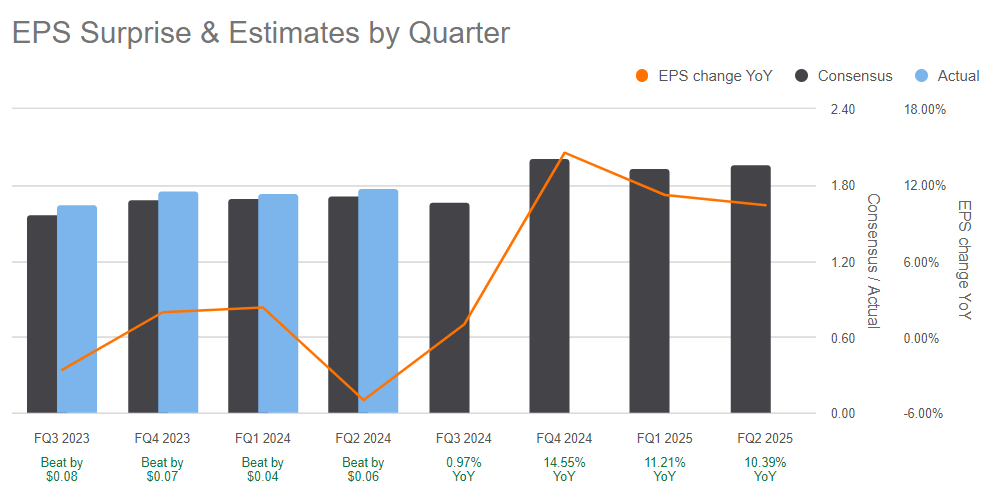

Balance Sheet

I believe that the balance sheet appears quite solid. Standex finances its operations with a small amount of debt. The rest appears to be offered by shareholders. The business model is also ideal as Standex does not need a lot of property and equipment to run its operations.

As of December 31, 2023, the company reported cash and cash equivalents worth $142 million, accounts receivable worth $125 million, and inventories worth $98 million. Total current assets are close to $435 million, and the current ratio is larger than 2x, so I do not expect a liquidity crisis soon.

With property, plant, and equipment of about $132 million, intangible assets close to $82 million, and goodwill worth $280 million, total assets are equal to $1005 million. The asset/liability ratio is larger than 4x. Hence, I believe that Standex appears to have a solid balance sheet.

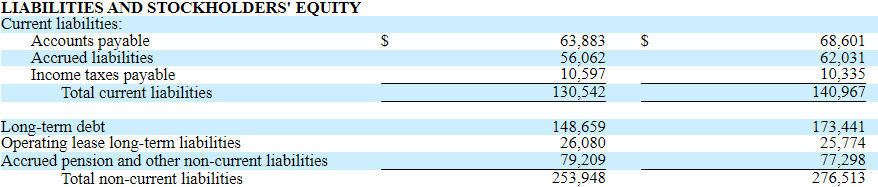

Source: 10-Q

Accounts payable is close to $63 million, with accrued liabilities worth $56 million and long-term debt of about $148 million. With operating lease long-term liabilities, which I included for the calculation of the net debt, total non-current liabilities stand at about $253 million.

Source: 10-Q

In order to assess the cost of capital, I checked the effective interest rate on borrowings reported by Standex. Standex renewed its existing credit agreement through an amended and restated third credit agreement. The credit facility, with a borrowing limit of $500 million, expandable to $250 million, includes sub-limits for swing line loans and letters of credit. The variable interest rate and commitment fees vary based on the financed debt to EBITDA ratio. The loans can be used for various purposes, and the company complies with current financial covenants, including interest coverage ratios and leverage ratios.

According to the last quarterly report, Standex’ debt includes an interest rate close to 2.65%. I wanted to be very conservative with regard to the WACC, so I used a cost of capital close to 7% and 10% in my financial models.

The Company’s effective interest rate on borrowings was 2.65% at December 31, 2023. Our interest rate exposure is limited primarily to interest rate changes on our variable rate borrowings and is mitigated by our use of interest rate swap agreements to modify our exposure to interest rate movements. At December 31, 2023, we have $150.0 million of active floating to fixed rate swaps with terms through fiscal year 2025. These swaps convert our interest payments from SOFR to a weighted average rate of 0.85%. At December 31, 2023 the fair value, in the aggregate, of the Company’s interest rate swaps was assets of $6.7 million. A 25-basis point increase in interest rates would not materially change our annual interest expense as most of our outstanding debt is currently converted to fixed rate debts by means of interest rate swaps. Source: 10-Q

Assumption #1: Acquisitions Could Bring FCF Margin Growth

Inorganic investment in high-margin, growth businesses is a key factor. The company seeks to grow business units through initiatives that complement products and expand global presence. The company prioritizes innovative opportunities, such as its renewable energy project, and makes strategic acquisitions while divesting non-strategic businesses.

A few months ago, Standex reported the acquisition of Sanyu Switch Co., Ltd. The transaction could close in the third quarter of fiscal year 2024. In my view, the market will most likely study the closure of this transaction carefully. If the acquisition integration is successful, and the authorities approve the deal, I believe that 2025 net sales expectations will most likely increase.

On November 1, 2023, the Company entered into a definitive agreement, through its subsidiary Standex Electronics Japan Corporation, to acquire privately-held, Japanese-based Sanyu Switch Co., Ltd. Sanyu Switch Co., Ltd. designs and manufactures reed relays, test sockets, testing systems for semi-conductor and other electronics manufacturing, and other switching applications. The transaction is expected to close in the third quarter of fiscal year 2024, subject to required regulatory approvals. Its results will be reported in the Electronics segment upon closing. Source: 10-Q

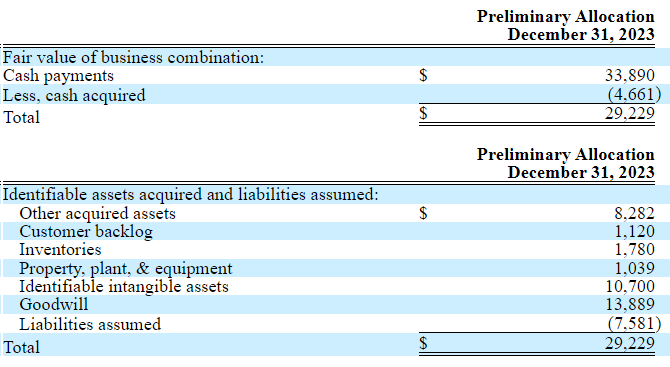

Standex also reported the acquisition of Minntronix, which included customer backlog, a number of intangible assets, and goodwill. In my view, with new know-how acquired, Standex may deliver net sales acceleration from 2024.

On July 31, 2023, the Company paid $29.2 million in cash for the purchase of all the issued and outstanding equity interests of Minntronix, a privately held company. Source: 10-Q

Source: 10-Q

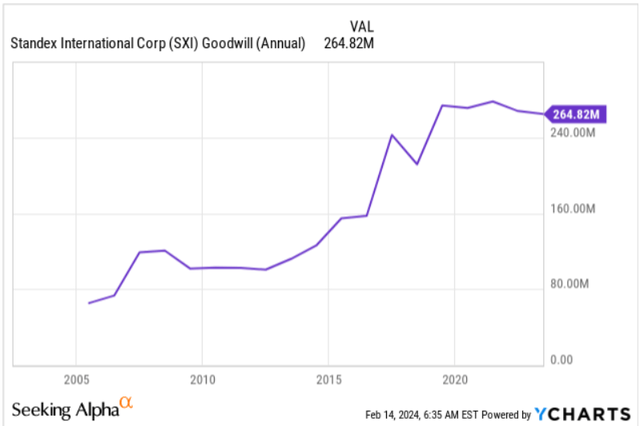

Given these acquisitions and accumulated goodwill, I believe we could see new additions. Given the increase in goodwill since 2005, I think past performance in inorganic growth was beneficial. I did not see many goodwill impairments in the last 10-k.

I assumed that inorganic growth could lead to higher net sales growth in the coming years. Note also that the net leverage ratio appears low. Standex could increase its total debt to acquire new competitors.

On December 31, 2023, the company’s leverage ratio was 0.65:1. Source: 10-Q

Assumption #2: 2024 And 2025 Restructuring Efforts May Lead To Higher FCF Margin

Standex is making a significant amount of efforts with regard to costs and productivity. Given that the consolidations and restructuring are expected to continue in 2024 and 2025, I believe that we may see the effects of these actions in the future. If Standex’ efforts do not fail, in my view, we could see FCF margin improvements. In this regard, the company made the following comments about the efforts made in the Engraving, Electronics, and Engineering Technologies segments.

The Company expects the 2024 restructuring activities to be completed by fiscal year 2025. Source: 10-Q

We incurred restructuring expenses of $1.4 million and $3.3 million in the second quarter of fiscal year 2024 and the six months ended December 31, 2023, respectively, primarily related to productivity improvements, facility rationalization activities, and global headcount reductions within our Engraving, Electronics and Engineering Technologies segments as well as the Corporate headquarters. Source: 10-Q

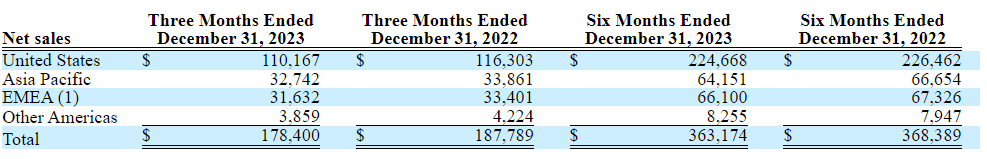

Assumption #3: Internationalization Is Expected To Bring Lower Net Sales Volatility

Given the presence in EMEA, Asia, and American regions outside the United States, I think that net sales’ volatility may be less significant than that of competitors operating only in the United States. I also assumed that internationalization efforts could bring economies of scale and perhaps FCF growth.

Source: 10-Q

Assumption #4: Segment-Specific Growth Catalysts May Bring Higher Operating Margin

There are several growth catalysts that I would like to mention. First, the electronics segment is expected to show higher volume in Q3 2024, which may also enhance the operating margin.

In the third quarter of fiscal year 2024, on a sequential basis, we expect slightly to moderately higher revenue and slightly higher operating margin due to higher volume. Source: 10-Q

Besides, the Scientific business segment could also report an increase in new product sales, as we saw in the last quarter. The company is expecting a higher operating margin in Q3 2024.

In the third quarter of fiscal year 2024, on a sequential basis, we expect slightly higher revenue and similar to slightly higher operating margin. Source: 10-Q

Finally, about the engineering technologies group, favorable project timing, pricing, and productivity initiatives could also represent revenue growth catalysts.

We also anticipate significant sequential growth in the fourth quarter of fiscal year 2024 reflecting more favorable project timing. Source: 10-Q

My Base Case Scenario Using My Assumptions

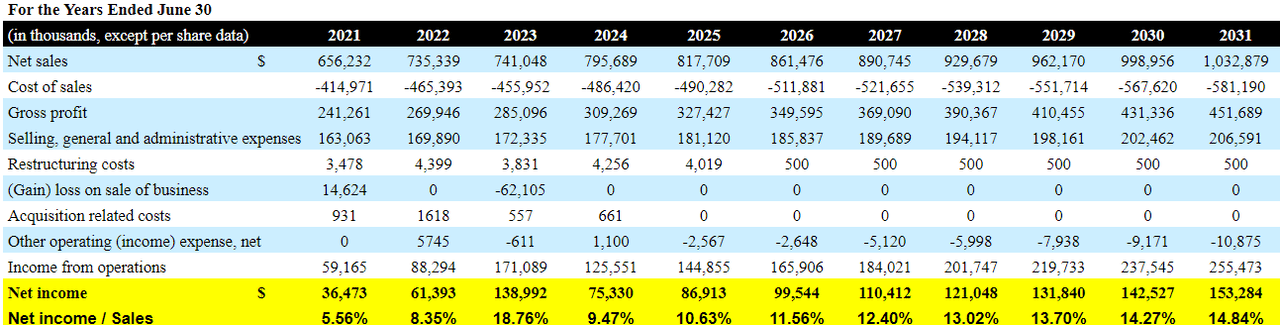

Under my conservative case scenario, I assumed 2031 net sales worth $1.032 billion, with cost of sales close to -$582 million, gross profit of about $451 million, and selling, general, and administrative expenses close to $206 million.

I assumed no restructuring costs in 2031 or losses on sale of business and acquisition related costs, however I did include 2031 other operating expenses of -$11 million. Finally, I obtained income from operations of $255 million and net income close to $153 million.

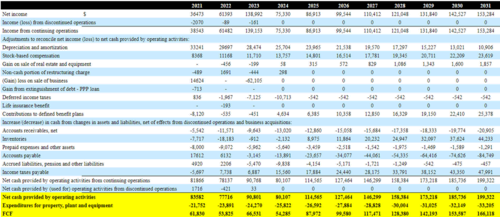

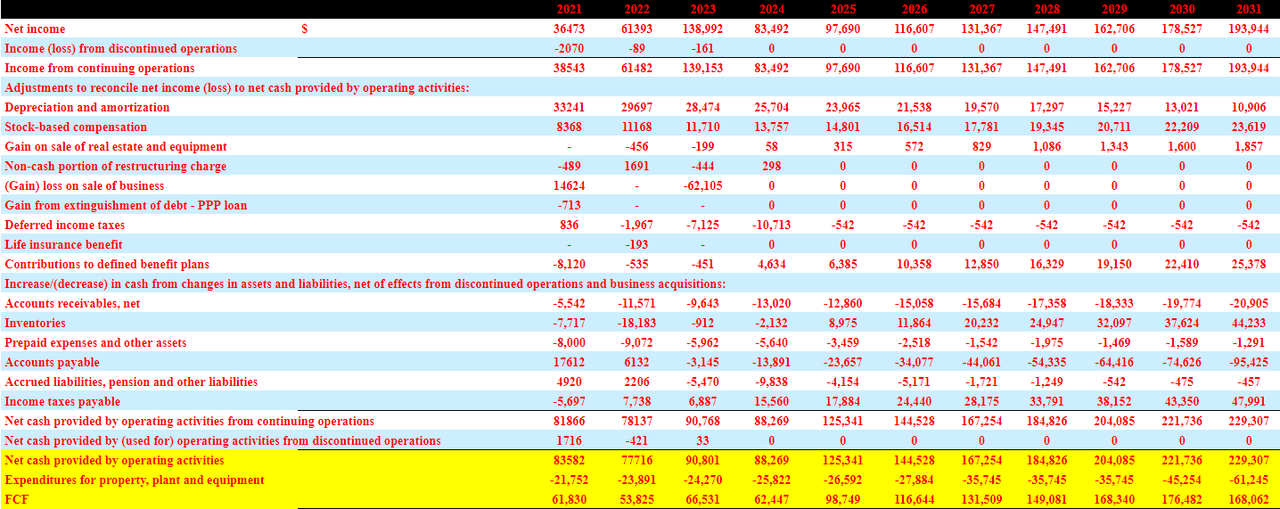

My cash flow statements include the following adjustments to reconcile net income to net cash provided by operating activities. First, I assumed 2031 depreciation and amortization of $10 million, with stock-based compensation of about $23 million and gain on sale of real estate and equipment of about $1 million.

With contributions to defined benefit plans worth $25 million, changes in accounts receivables of -$21 million, and changes in inventories worth $44 million, I also included changes in accounts payable close to -$85 million.

If we also take into account income taxes payable worth $47 million, net cash provided by operating activities from continuing operations results in $199 million. Finally, with net cash provided by operating activities worth $199 million and expenditures for property, plant, and equipment of -$34 million, 2031 FCF would stand at $166 million.

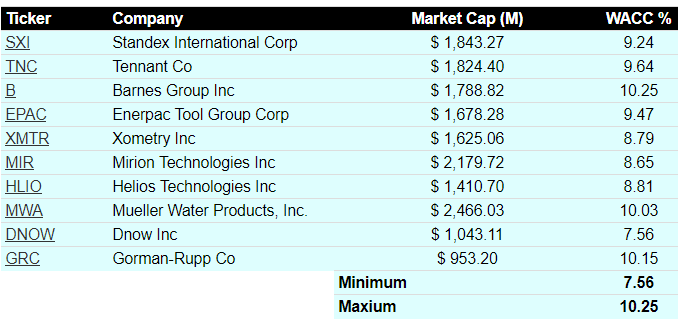

For the assessment of the WACC, I took a look at the WACC of other competitors. I obtained a maximum WACC of 10% and minimum WACC of 7%, which I used for my base case scenario and my worst case scenario.

Source: Gurufocus

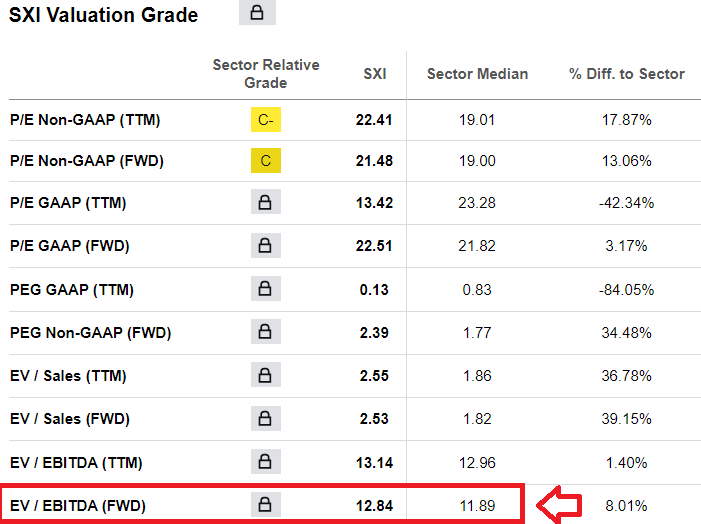

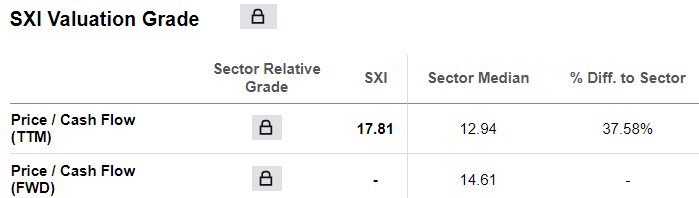

For the assessment of the exit multiples, I reviewed the trading multiples of other companies in the same sector. The sector median EV/EBITDA stands at about 12x-13x cash flow. Standex trades at close to 17x cash flow because of lack of significant net leverage and recent inorganic growth. Hence, with these figures, I believe that assuming an exit multiple between 13x FCF and 19x FCF would make sense.

Source: Seeking Alpha Source: Seeking Alpha

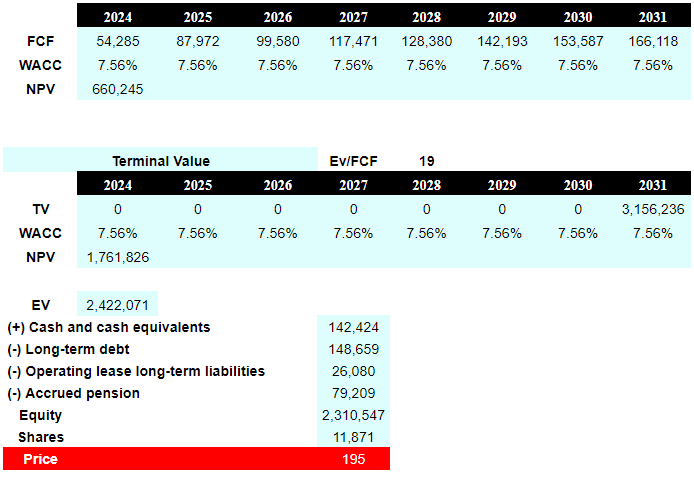

With a WACC of 7.56% and EV/FCF of 19x, the implied enterprise value would be $2.4 billion. Adding cash in hand and subtracting debt and operate lease liabilities, I obtained an equity valuation of $2.31 billion and a fair price of $195 per share.

Source: DCF Model

Risks To Take Into Account In My Worst Case Scenario

In my opinion, Standex’s low-cost domestic sourcing strategy includes manufacturing in China and importing components subject to tariffs imposed by the US government. It tries to pass these costs on to customers, but competition, including competitors who import from countries without tariffs, may limit its ability to maintain price increases. In my view, the persistence of tariffs in the long term could affect the value of investments in Chinese operations. The imposition of tariffs can also influence the sourcing habits of end users, affecting sales, profits, and cash flows. In addition, price fluctuation and possible disruptions in the supply of raw materials may negatively impact operating profits and delay sales.

I also assumed that failed M&A transactions could bring goodwill impairments and lower net revenue expectations and FCF expectations. As a result, I believe that market analysts may lower their expectations, and the stock price could fall. Another risk to take into account is a lack of potential acquisition targets. If Standex cannot bring more inorganic growth, I believe that net sales expectations could also lower, which may lead to lower stock valuation.

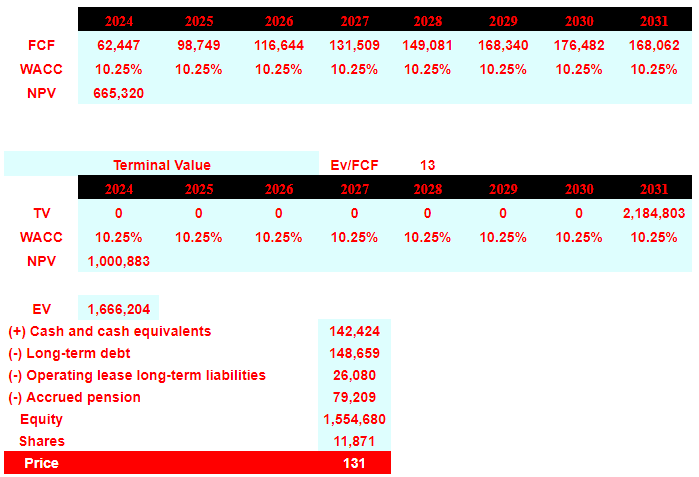

I also took into account an increase in the beta or the volatility in the market or increases in the cost of debt. As a result, Standex may suffer from an increase in the WACC assumed by other investment analysts. In the worst case scenario, I assumed that the WACC would increase to 10.25%.

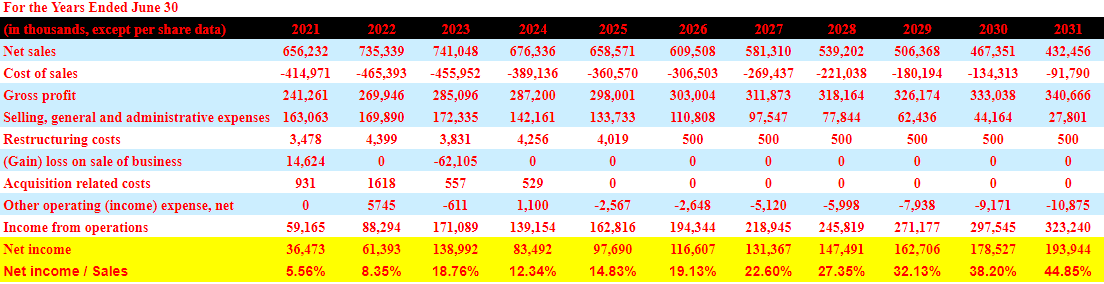

Expectations Under My Worst Case Scenario

Under this scenario, I assumed 2031 net sales of about $432 million, with cost of sales worth -$92 million, gross profit of about $340 million, and selling, general, and administrative expenses close to $27 million.

Finally, without restructuring costs, $0 million, and loss on sale of business or acquisition related costs, I included other operating expenses of -$11 million, which implied income from operations of about $323 million. Finally, 2031 net income would be close to $193 million.

Source: Author’s Expectations

Under this scenario, I assumed 2031 net income worth $193 million, 2031 depreciation and amortization of close to $10 million, 2031 stock-based compensation worth $23 million, and contributions to defined benefit plans of about $25 million.

Finally, with changes in accounts receivables of -$21 million and changes in inventories worth $44 million, I also assumed prepaid expenses and other assets worth -$2 million, changes in accounts payable of about -$96 million, and changes in accrued liabilities, pension, and other liabilities of -$1 million.

My results include 2031 net cash provided by operating activities from continuing operations worth $229 million. In addition, with expenditures for property, plant, and equipment of -$62 million, 2031 FCF would be $168 million.

With a WACC of 10.25% and EV/FCF of 13x, the implied total valuation with debt is equal to $1.6 billion. If we add cash and subtract debt, the implied equity would be $1.554 billion, and the fair price would be $131 per share.

Source: DCF Model

Competitors

In my opinion, Standex faces varied competition in all its product groups, with national and international rivals. In my view, despite maintaining prominent positions, competition arises in factors such as industry experience, design, product performance and technology, prices, delivery times, quality of services, and other terms and conditions. The company excels by competing through customer intimacy, where its teams collaborate closely with customers, acting as extensions of their organizations. This approach allows the company to apply experience and technology to offer personalized solutions, highlighting differentiation in the market.

My Opinion

Standex International recently delivered better than expected quarterly EPS actual, and announced recent acquisitions to be closed in 2024 and ongoing restructuring efforts. I also believe that the company is well positioned to take advantage of opportunities in growing sectors, such as renewable energy and electric vehicles. In addition, with little debt and a solid balance sheet, I think that more inorganic growth can be expected in the future. Intense competition pose risks, and goodwill impairment could occur. With that, I believe that the upside potential in the stock price appears larger than the downside risks.