Stock splits generate tons of attention for the stocks in question, even though a split does not fundamentally change the value of the investment. For instance, if you have a stock worth $100 per share that splits 4:1, you have four shares valued at $25 per share. Nothing fundamentally has changed. However, the marketplace doesn’t operate purely on fundamentals.

What effect do stock splits have?

Stock splits create buzz, and investors sometimes flock to these stocks before the split date — but not always. Here are two recent examples from the same company.

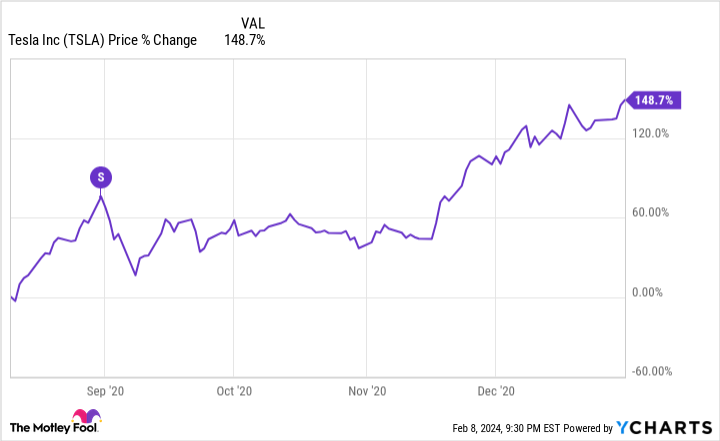

Tesla (NASDAQ: TSLA) announced on Aug. 10, 2020, that the stock would split 5:1. The stock catapulted 76% higher before the split took place just three weeks later on Aug. 31. As shown in the chart, it gave up much of those gains right after the split before embarking on another epic run (the “S” in the chart signifies the split date).

But this doesn’t make every stock split a “no-brainer” buy. Tesla again split its stock in August 2022, and the stock has plummeted, as depicted in this chart. The electric vehicle market softened significantly in that time frame.

It turns out that fundamentals generally win over the long haul. I’ll take you through some of Nvidia’s fundamentals.

Why is Nvidia stock going up?

A Roman philosopher once said that “luck is when preparation meets opportunity,” which describes Nvidia (NVDA 0.97%) to a T. The company spent years and billions of dollars on R&D, creating the best graphic processing units (GPUs) and artificial intelligence (AI) hardware and software. Nvidia’s technology is integral to state-of-the-art data centers.

Now, AI has hit the stock market and business world like a bomb. Generative AI applications (ChatGPT is an example of generative AI) require immense infrastructure that few can provide. This has driven unprecedented demand for Nvidia’s products.

This graphic makes it easier to visualize Nvidia’s dominance.

First, notice the top number in purple: Total revenue grew more than 200% year over year (YOY) in Q3 of fiscal 2024 to $18 billion. This type of growth is nearly unprecedented at this scale. The reason is the data center revenue, which grew more than 278% YOY to $14.5 billion in the quarter. Nvidia’s position as the market leader met the AI tailwinds, resulting in dramatic sales increases.

The tremendous demand for Nvidia’s products means that Nvidia sets the market price. It cannot manufacture enough to meet demand, so the company has tremendous pricing power. This can be seen in the direct center of the graphic: operating income.

Operating income is the amount of profit generated from Nvidia’s central operation. The $10.4 billion in the quarter represents a 57% operating margin, virtually unheard of among semiconductor companies.

Is Nvidia stock a buy now?

Nvidia stock has experienced a meteoric rise, and these stats show that it isn’t driven by mere hype. Nvidia is growing exponentially and is hugely profitable at the same time.

But it isn’t that simple, of course. The company’s growth is not a secret, and the stock is up nearly 400% over the last three years — including 55% over the previous three months alone, as shown in the chart.

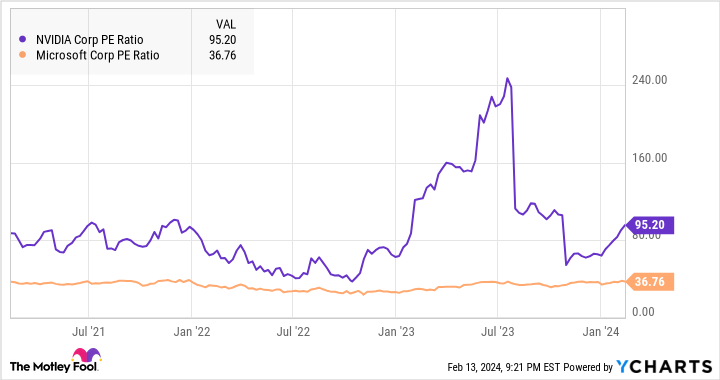

Nvidia stock trades at a price-to-earnings (P/E) ratio of 95, which seems absurd. However, the ratio dives to 35 on a forward basis — less than Microsoft’s (NASDAQ: MSFT) valuation:

NVDA PE Ratio data by YCharts

NVDA PE Ratio data by YCharts

Note that Microsoft is also trading at a very lofty valuation historically, 21% higher than its five-year average P/E.

Nvidia is one of the most important companies in the world right now. Investors will probably do very well in the long run. However, the recent surge increases the near-term risk in the stock. New investors in the stock should consider dollar-cost averaging or look at lesser-known Nvidia partners.

Bradley Guichard has positions in Nvidia. The Motley Fool has positions in and recommends Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.