Uber (UBER) and Lyft (LYFT) have turned into two of the most interesting consumer stocks in my portfolio.

On one hand, these stocks are discretionary stocks. We often choose to spend money on a ride for convenience. Maybe to go to a concert or game and not have to worry about parking or the drive home after a “few.”

Then there’s the utility stock aspect. Both companies provide rides for out-of-town business travelers as well as daily transportation to riders in markets where owning a car doesn’t make sense.

Lyft’s earnings report last night felt like a coming-of-age report.

It beat analysts’ earnings expectations but missed their revenue targets. That’s been par for the course for companies this quarter. What was much better than par was the company’s outlook for the next year.

Lyft’s management guided their bookings and earnings guidance above Wall Street’s expectations, also adding that the company will generate positive free cash flow for the full year for the first time ever.

LYFT’s earnings report was so good that UBER’s board announced that their board has authorized a repurchase of up to $7 billion of UBER’s common stock over the next three years. That move has UBER shares trading 6% higher in early trading this morning.

SO, if both stocks are battling at the Boardroom level, which should you consider a buy right now?

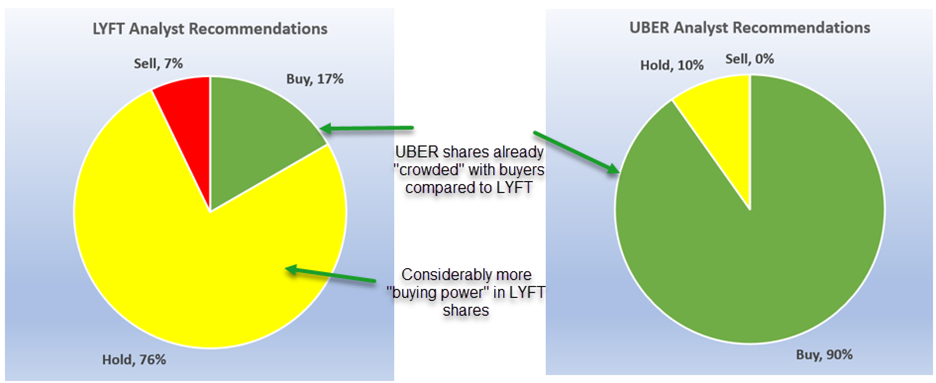

It all comes down to buying power, which can be tracked by checking where Wall Street currently has their buy/hold/sell recommendations for each stock.

The chart below displays the current Wall Street recommendations for LYFT and UBER. Note the large buy recommendations for UBER (90%) compared to only 17% for LYFT shares. That’s the tip of Wall Street’s hand that tells you which stock will outperform the other over the next three to four months.

I expect LYFT shares to see more analyst upgrade activity starting today. That activity will drive more retail investors into the stock, driving the price of LYFT shares higher faster than UBER.

Bottom Line

I’m expecting a 30% drive higher for LYFT shares over the next three months, which puts the shares right at their December highs of $16. From there, a break above those highs will target $20 as a round-numbered price target ahead of next quarter’s earnings.

By submitting your email address, you will receive a free subscription to Money Morning and occasional special offers from us and our affiliates. You can unsubscribe at any time and we encourage you to read more about our Privacy Policy.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.