Bloomberg/Bloomberg via Getty Images

Thesis

CEMEX, S.A.B. de C.V. (NYSE:CX) is experiencing strong volume recovery primarily in its Mexican business. The company implemented a further price increase in January, which should drive the company’s top line in the coming quarters, despite a weak demand environment in the EMEA region due to a slowdown in construction activity. The company’s long-term scenario is also good due to some favorable trends in the market where Cemex operates.

The company’s margin profile has improved significantly as it reached the 2021 levels. I believe the company’s margin should benefit from a strong Urbanization solutions business, which has so far delivered extremely good margins that helped drive the overall profitability. Strong pricing and volume growth in the coming years across the region should also support the margins further. The company is trading at an attractive price point, which is about more than 50% lower than its historical average. As the margins are expected to expand further, the bottom line should grow as well, which should improve the company’s valuation further, making this stock a good “BUY” at the current levels.

Business Overview

Cemex is a construction material company headquartered in Mexico. The company manufactures and distributes Cement, ready-mix concrete, and aggregates globally. The company also provides building and paving solutions, logistic services, and design and engineering services. The company has a geographic footprint mainly in the United States and Mexico, with the largest share. Other regions include Europe, the Middle East, Asia, Africa, and South and Central America. CX mainly operates under four segments:

- Cement.

- Ready Mix Concrete.

- Aggregates.

- Urbanization Solutions.

While Cement, Concrete, and Aggregates are general products, the Urbanization solution business launched in 2019 consists of complimentary solutions for sustainable urbanization through performance materials, industrialized construction, waste management, and other related services.

Last quarter performance

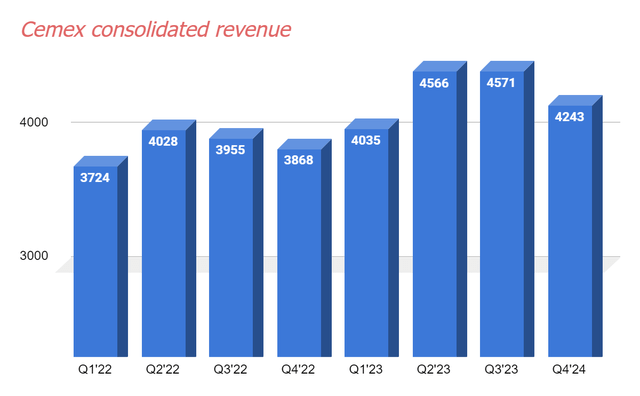

Despite a challenging demand backdrop in most of the markets, in which the company operates, the company’s revenue climbed approximately 9.7% to $4.24 billion in the last quarter of 2023 versus the prior-year quarter, however, down sequentially. This growth was driven by strong pricing increases across all the business segments and strength in the Urbanization solutions business, which fully offset the impact of volume declines in the Ready-mix and Cement categories. Strong pricing and moderating inflationary pressure also helped CX achieve its goal of recovering 2021 margin levels, as the EBITDA margin expanded by 200 bps to 19.2% for the full year 2023. Margins for Q4 expanded by 120 bps versus the prior-year quarter.

Cemex historic revenue (Research WIse)

The top line was primarily driven by robust growth of 31.2% in the Mexico business, the only region to report positive volume growth across all the product categories during the last quarter, followed by strong sector demand related to infrastructure and onshoring activity. However, Mexico’s margins were down 70 bps year over year in Q4 ’23 due to an unfavorable product mix and higher transportation costs.

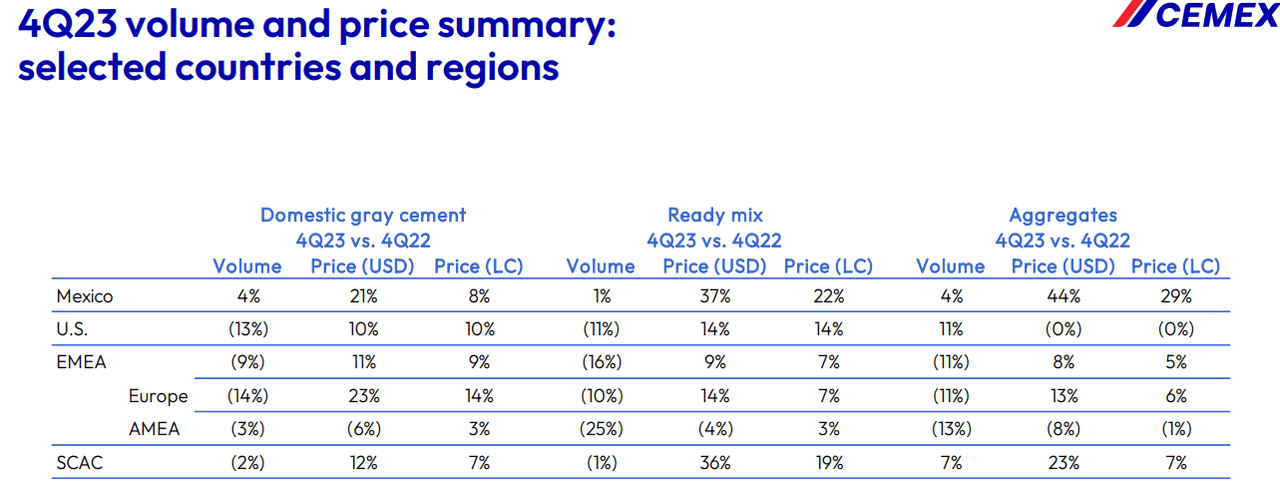

Cemex region-wise Volume and price change (Company presentation)

The U.S. grew in the low single digits, thanks to strong pricing which offsets the impact of lower volumes in cement and ready-mix due to bad weather, lower commercial construction activity, and loss of some market share due to pricing strategy during the last quarter. The margin for the U.S. operation expanded 230 bps to 18.8% during the quarter.

South Central America also experienced growth year over year in its topline and margins. However, EMEA was down year-on-year due to a double-digit volume decline across cement, ready mix, and aggregate in Europe due to the economic slowdown in the region, which also resulted in a margin contraction of 110 bps to 11.1% versus the prior-year quarter.

Overall, the last quarter’s performance of CX was good mostly when compared to last year’s quarter, however, the growth rate moderated sequentially.

Outlook

While the demand conditions were challenging in most markets, the company continued to deliver topline growth, majorly through pricing strategies. However, since last quarter, the company has started to experience volume growth in most of its business, primarily in the Mexico region.

I anticipate that the company’s revenue should benefit from the recovery in Cement volume in the Mexican region in 2024, which holds a significant portion of CX’s total revenue. Demand for the Bag cement category has also seen a surge in this region in the late half of 2023, which is also a positive sign for volume growth and should continue further from formal demand by infrastructure and near-shoring activities particularly in the North and Southeast. In addition to these, the company has implemented a price increase during January, which should also support the company’s revenue in the Mexican region in the coming quarters.

While the Mexican operation is experiencing volume recovery, other geographies are still majorly relying upon pricing strategies, which also resulted in lost market share in the U.S. region. So, does that mean, these regions will continue to underperform in 2024 as well? I would say not really, here’s why.

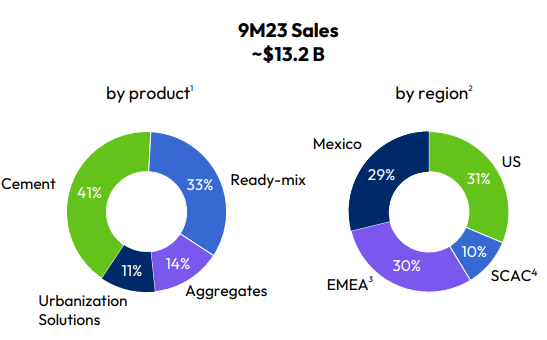

The U.S. region, which accounted for about a third of CX’s total revenue, faced headwinds during 2023 from factors that are not permanent, such as bad weather and the winding down of some large projects. And these factors are not expected to impact the business further. Apart from these, the company is also expecting to regain the lost market share gradually over time.

CX’s revenue distribution for TTM 9 months (Company presentation)

Talking about the lower level of construction activity, despite some near-term slowdown, I am optimistic about the growth prospects in infrastructure and commercial construction due to nearshoring trends and funding available under the CHIPS Act, Inflation Reduction Act (IRA), and IIJA, which is set to fuel the growth of infrastructure across the region, potentially benefiting the company’s revenue in the coming years.

In EMEA, I anticipate volume declines to continue due to a slowdown in construction activity, particularly in Europe. The volumes are, however, reflecting a slight recovery, but at a slower pace, which should negatively impact the topline in this region in 2024. Overall, I am optimistic about the company’s growth prospects in the longer term across all the regions. While EMEA is expected to continue to remain under pressure due to lower volumes, strength in other regions should support the company’s topline growth in the quarter ahead.

Urbanization business

Cemex launched Urbanization Solutions as one of its core businesses in 2019. Since then, this has been the fastest-growing business of the company, with its EBITDA growing at a CAGR of 24% over the last four years, reaching approx 9% of total EBITDA. The primary and largest contributor to the growth of Urbanization was its Circularity business, which is focused on waste & alternative raw materials.

Urbanization Solutions Business verticals (Cemex presentation)

In my opinion, this business should continue to outperform as it is closely aligned to some megatrends rolling out in the global construction industry, including decarbonization, resiliency, circularity, and urbanization. In addition to this, this business also complements all the value offerings and solutions that the company has in cement, ready-mix, and aggregates, highly integrated into those businesses, which should be beneficial for the company in the coming years.

Financials are improving

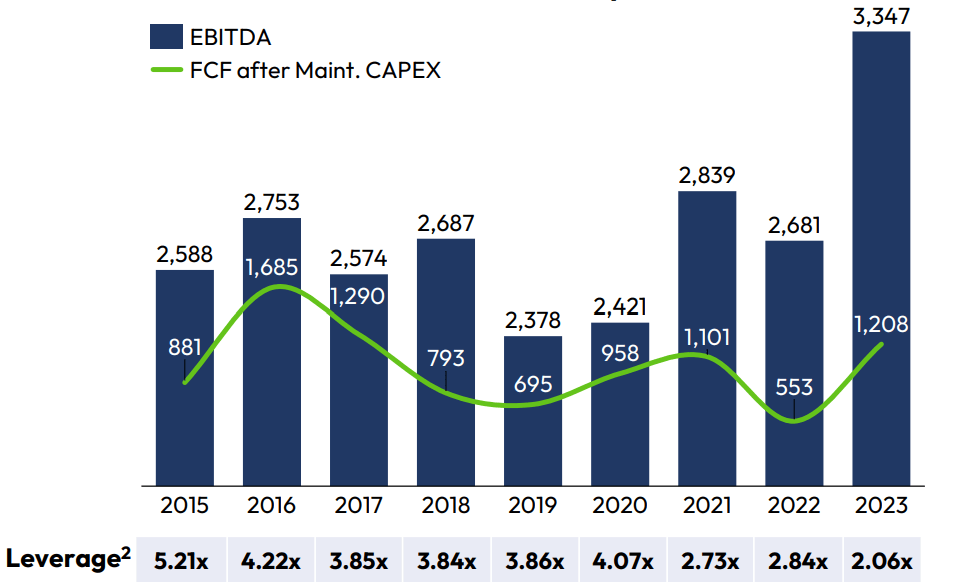

The company’s financial position has improved in the past few years. The consolidated EBITDA jumped to $3.34 billion in FY23, about 25% higher than FY22. Due to higher EBITDA, FCF generation was also strong throughout the year. The FCF for the fourth quarter of 2023 has more than doubled to $403 million as compared to the prior year’s quarter. Strong FCF then helped the company in its net debt reduction by over $700 million during the year, which has resulted in an improved financial leverage of 2.06x, the lowest since 2009.

Historic EBITDA and leverage ratio (Company presentation)

In my opinion, the improved financial position should accelerate the company’s bolt-on growth strategy, which was under pressure due to the company’s not-so-good financial position earlier. The strategic bolt-on acquisition should further drive the company’s revenue in the coming years.

Valuation

Currently, the CX’s stock is trading at a forward P/E ratio of 8.91x based on FY 24 EPS estimates of $0.86, which is at a significant discount of about 58% to its five-year average of 21.05. When compared to the sector median, which is currently at 16.05x, the stock is still at a good discount of over 40%.

The company’s revenue should be on the weaker side and experience modest growth in the mid-single digits in FY24 due to ongoing headwinds primarily in the EMEA region, however, the company’s long-term prospects look intact, with its strong market position and long-term tailwind in those markets. The margins are also experiencing expansion and have already reached their 2021 levels after a slight downfall. The Urbanization business continues to do well with its strong margin contribution, which should further benefit the company’s margin, resulting in a more reasonable valuation in the future.

Risk

In the past few quarters, the company’s profitability has improved significantly, which resulted in reduced leverage, as we discussed above in the financials part of this article. My thesis is built upon the strong margin prospects of the company in the coming years, from which the company will continue to reduce its debt burden. However, if the company’s profitability suffers in the future due to either continued softness in the EMEA region or any other uncertain reason, the company’s financial position may deteriorate, leading to difficulty in certain activities of the company that are linked with the company’s future growth prospects, which could potentially lead to poor stock performance in the future.

Conclusion

As we discussed earlier, the company’s stock is trading at a really good discount, both to its historical levels and its sector median. In my opinion, the company’s long-term prospects are strong, and along with a pipeline of extremely profitable projects, strong pricing, and volume recovery should help the company in its margin expansion in the coming years. The financial position of the company is also improving. Due to these reasons and an attractive price point, I would recommend a “Buy” rating for this stock.