Perry Spring/iStock via Getty Images

Introduction

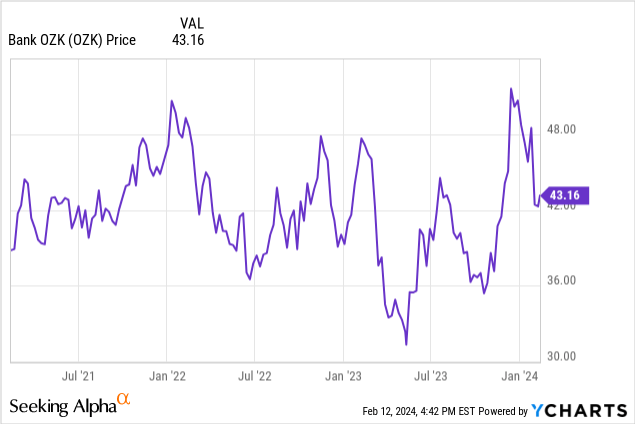

Although I generally don’t like non-cumulative preferred shares, I do own some preferred share issues by banks. One of my relatively larger positions (among the non-cumulative issues) is the sole preferred share series issued by Bank OZK (NASDAQ:OZK). That stock is trading with (NASDAQ:OZKAP) as a ticker symbol. The preferred shares pay a quarterly dividend of $0.289 per share, and as the stock is trading at a discount of over 30% compared to its par value of $25/share, the preferred shares are currently yielding just over 7.1%.

The Q4 results of Bank OZK were satisfying and the preferred dividends remain very well covered

When looking at Bank OZK, I’m mainly interested in seeing how well the preferred dividends are covered. I currently have no position in the bank’s common shares, so my entire focus is on the well-being of the preferred shares.

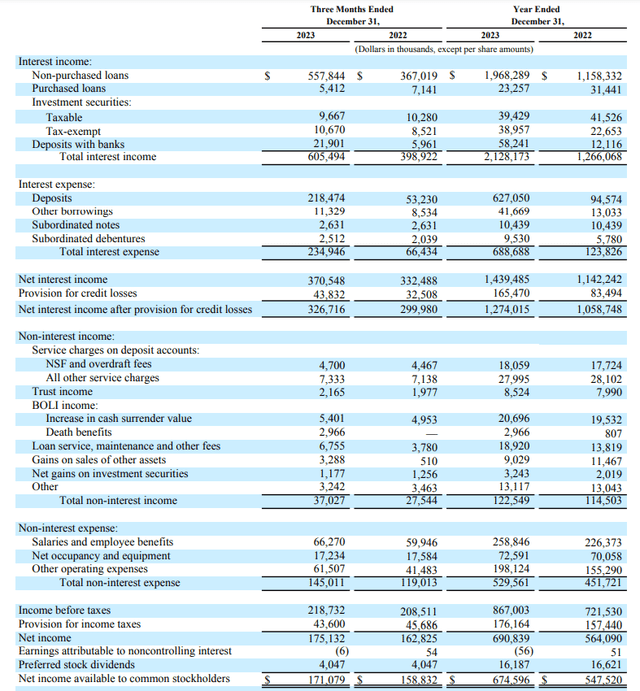

In the fourth quarter of 2023, Bank OZK generated a total interest income of in excess of $605M, which is an increase of almost $207M compared to the same quarter in 2022. As was generally expected, the bank’s interest expenses increased as well, but, surprisingly, the YoY interest expenses increased by just $168M. This indeed meant the net interest income increased by in excess of 10% to $370.5M.

Bank OZK Investor Relations

The bank also recorded a total non-interest income of $37M and non-interest expenses of $145M, resulting in a pre-tax and pre loan loss provision income of $262M. After deducting the almost $44M in loan loss provisions and the $43.6M in taxes, the net profit generated by the bank in the fourth quarter of 2023 was approximately $175M. Bank OZK needed approximately $4.05M to cover the preferred dividend payments, which means the net income attributable to the common shareholders of Bank OZK was $171M which worked out to $1.51 per share.

Looking at the FY 2023 results, we see a very healthy net interest income of $1.44B and even after allocating in excess of $165M to loan loss provisions, the reported net income in FY 2023 was $675M which already includes the $16.2M in preferred dividend payments.

Looking at the Q4 and FY 2023 results respectively, Bank OZK needed just 2.3% and 2.35% respectively of its net income to cover the preferred dividends. Or in other words, the preferred dividends were covered by a factor of in excess of 4,000%. So although the preferred shares are non-cumulative in nature (the bank can skip preferred dividend payments and does not have to make the preferred shareholder whole on the missed payments), I think the preferred dividends are very well-covered, reducing the risk of Bank OZK skipping a payment.

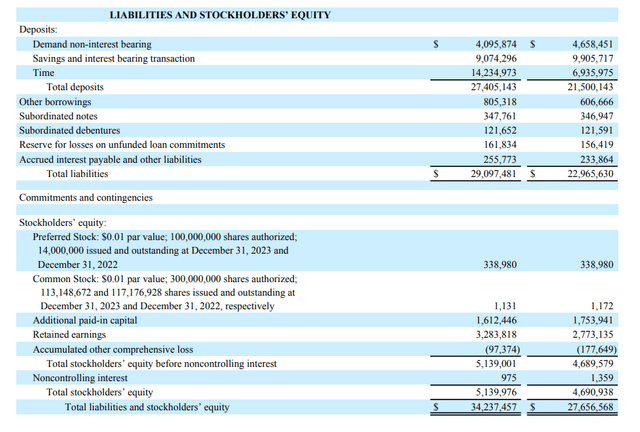

Looking at the balance sheet of the bank, Bank OZK had a total equity position of $5.14B of which $350M was attributable to the preferred shareholders (note, I use the principal value of the 14 million preferred shares, which have a par value of $25 each). This means there is approximately $4.8B in equity ranked junior to the preferred shares. And after deducting the $661M in goodwill and other intangible assets, the net tangible equity value ranked junior to the preferred shares was in excess of $4.1B.

Bank OZK Investor Relations

So while the market is focusing on the risks related to commercial real estate, I have the impression that Bank OZK is navigating through the risks pretty well.

At the end of December, Bank OZK’s non-performing loan ratio (excluding purchased loans, which represent just 1% of the loan book anyway) was just 0.23%. Meanwhile, the total allowance for loan losses was 1.29% of the loan book. Not only does this mean that the current amount of non-performing loans is just $60M, it also means those soured loans are very well covered by the existing provisions. Even if the bank doesn’t recoup a single dollar from those loans – a very unlikely scenario – the existing allowance is more than sufficient to cover the bank’s entire risk.

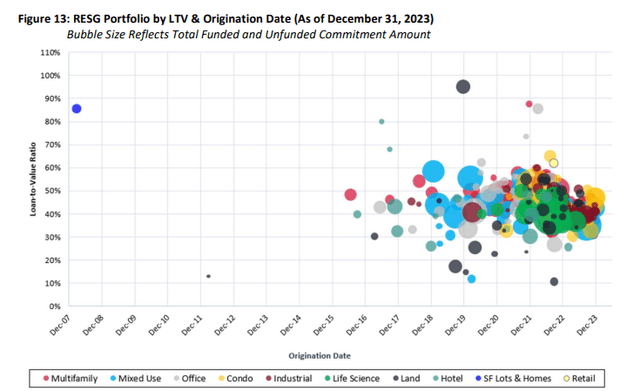

Keep in mind the bank is keeping its risks in the real estate segment relatively limited. The current LTV ratio is just 42% and even if you’d include the full funding scenario of every committed loan, the LTV ratio would be just around 52%.

Bank OZK Investor Relations

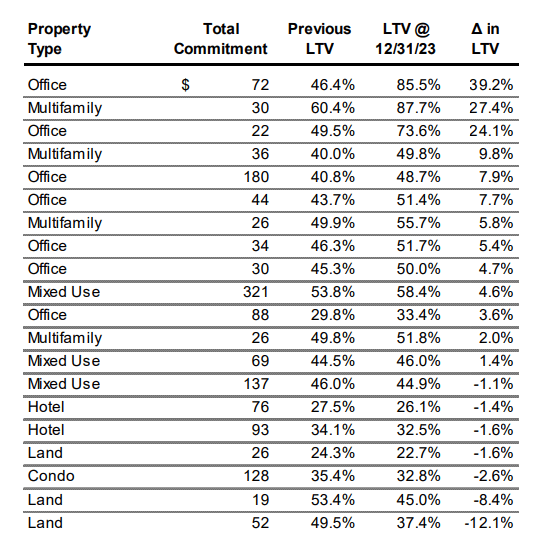

As you can see above, there are some office assets with higher LTV ratios but the vast majority of the office loans has a LTV ratio of 40-50% which should be manageable, even during the current downturn for that real estate segment. And that includes the loans that were recently re-appraised. As you can see below, there are some loans where the value of the collateral has decreased, but fortunately, the size of those loans is very manageable. And even if the borrower defaults, the bank will likely be able to monetize a portion of the loans.

Bank OZK Investor Relations

The table above discusses just 20 loans that were re-appraised. But as they represent a total value of just over $1.5B and thus almost 10% of the real estate loan book, it does provide a useful look under the hood.

Investment thesis

I currently only have a long position in Bank OZK’s preferred shares but after seeing the Q4 results and the strong earnings, I am starting to get more interested in the bank’s common shares as well. The earnings are strong and the strong net interest income should help the bank to deal with potentially higher loan loss provisions should its loan portfolio require additional loss allowances. However, at the end of 2023, the tangible book value of the bank was approximately $36.58 which is a $5 increase compared to the end of 2022. Trading at just under 1.2 times book, Bank OZK’s common shares are actually appealing as well, especially as OZK’s management has guided for an EPS increase this year as well.

For now, I am sticking with the preferred shares. And I will likely add to my position as the 7.1% yield offers an excellent risk/reward ratio.