d3sign/Moment via Getty Images

Prices continued to rise in January, but at a more moderate pace than at the same point last year. A higher than expected reading, however, unnerved markets in the early morning trading hours.

The Labor Department reported Tuesday that the consumer-price index (“CPI”) increased 3.1% from a year earlier in January. The index rose 0.3% for the month. This follows a revised 0.2% increase in December. Surveyed economists had expected a YOY and monthly figure of 2.9% and 0.2%, respectively.

Stripping out the volatile categories, such as food and energy prices, core CPI rose 0.4% for the month and 3.9% from a year ago. This compares to estimates of 3.7% and 0.3%, respectively. The YOY core reading continues to hold below the 4% milestone, a level it attained last month and its lowest reading in more than two years.

Indexes gave back further gains in the pre-market trading hours after settling from record territory on Monday. Thus far through 2024, markets have been buoyed by a combination of healthy corporate earnings and a furious rally in shares of technology shares.

The Dow Jones Industrial Average (DJI) and the Nasdaq Composite (COMP.IND) were each down over 200 points immediately following the release, while the S&P 500 Index (SP500) was more muted. Longer-term Treasury yields, which have been holding above 4% in recent periods, spiked higher after closing at 4.170% on Monday. The spike in yields likely factored into some of the early morning selling pressures in the broader markets.

As a prerequisite to a change in monetary policy, Federal Reserve (“Fed”) Chairman, Jerome Powell, had previously stated that the Federal Open Market Committee (“FOMC”) would need greater confidence that inflation is moving sustainably toward 2%. In my view, today’s report is unlikely to move the confidence needle. While the trend in inflation is encouraging, key components are still holding at elevated levels. Interest rate observers, therefore, should continue to expect a status quo in monetary policy through at least the first half of the calendar year.

January CPI Highlights

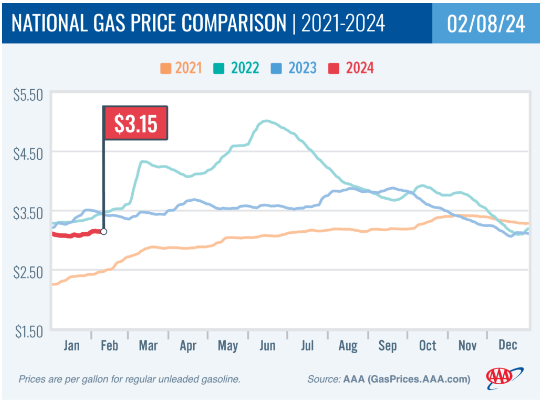

Recent data surrounding consumer sentiment has been positive. Most recently, sentiment rose to its highest level since July 2021. While one could cite various factors for the rise, declining price of gasoline is likely among the most impactful. The most recent report from AAA on the national average for a gallon of gas pegs the average at $3.15. While this is up on the month, it’s nearly 30 cents lower than a year ago.

AAA – Trend In National Gas Prices From 2021 – 2024

The lower gas prices continue to be reflected in a positive light in the monthly CPI. In January, gasoline prices were down 3.3% on the month and were down 6.4% YOY.

While positive, sentiment in the near-term surrounding prices at the pump may have reached a peak, in my view. Recent demand trends, for example, have AAA projecting higher prices in the months ahead.

And any gains in gasoline prices would likely compound the continued pressure Americans face on necessities, such as groceries. In January, the index for food at home rose 0.4% over the month, while the index for food away from home rose 0.5%.

During the month, consumers saw increases in the price of sugar and sweet, as well as fats and oils. Additionally, the index for non-alcoholic beverages rose 1.2% during the month.

The pricing pressures felt in categories such as food, transportation, and medical care, were offset to a degree by reprieve in other categories, such as the used cars and trucks index. The index was down 3.4% in January, a notable reversal from the increases seen over the last two months.

January Shelter Component

A broad consensus of observers expects the shelter component of CPI to decelerate this year. The lagging nature of the index in relation to more leading indicators, such as Zillow’s Asking Rent Report, is one reason for the optimistic take.

Despite the consensus viewpoint, the component hasn’t yet exhibited signs of pulling back. In January, the index was up 6.0% YOY, nearly double headline CPI. In prepared remarkets at the last FOMC meeting, Chairman Powell noted that the committee would need to have greater confidence before making a move on interest rates. In my view, the greater confidence would likely arise once the shelter component of CPI begins to measurably decelerate.

A flood of deliveries in supply may contribute to continued easing in asking rents. Demand drivers, however, such as rising wages and an increase in the number of those in the younger demographic in their prime working age may contribute to either current rents staying higher for longer or for rents to begin growing more appreciably in the months ahead.

Interest Rate Expectations

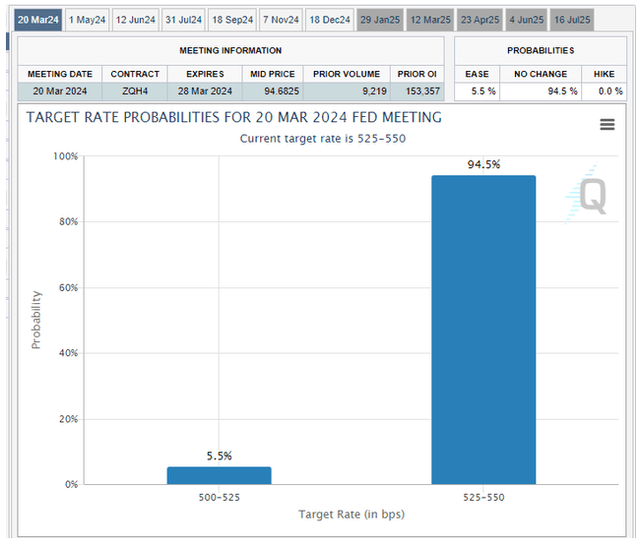

Recent data surrounding job growth that blew past expectations has tempered some of the anticipation surrounding a rate cut in the first half of the calendar year. CME’s FedWatch Tool, for example, sees a less than 15% chance of lower rates come March. This represents a rapid comedown from the 40-50% mark seen just a few months ago.

CME FedWatch Tool – Target Rate Probabilities For March 2024 Fed Meeting

Commentary from Fed policymakers also suggests there is little rush in pivoting from the current policy positioning. San Francisco Fed President Mary Daly noted in a speech that “policy is in a good place” and that patience is key when it comes to lowering interest rates.

Dallas Fed President Lorie Logan echoed the thought process, saying, “I’m really not seeing any urgency to make any additional adjustments to rates at this time.” The comments follow Richmond Fed President Tom Barkin’s statement that the Fed needs time to build confidence before initiating a policy change.

The commentary, in conjunction with today’s CPI report, which still shows stickiness in key categories, suggests that the rate environment is likely to remain fixed for at least the first half of the calendar year.

Final Thoughts On January CPI Report

In prepared remarks at last month’s FOMC meeting, Chairman Powell noted that “inflation has eased from its highs without a significant increase in unemployment.” In my view, this statement could be re-worded to reflect the fact that overall inflation has eased despite sustained strength in the labor market. Over 300K jobs were added in each of the last two months, well above the monthly average of 225K throughout 2023.

Yet despite robust job gains in recent months, broader inflationary pressures appear at bay. But for investors seeking direction on the path of interest rates, this doesn’t necessarily move forward the timetable for the first highly anticipated interest rate cut.

Heading into the print, CME’s FedWatch Tool showed an 85% chance of rates staying unchanged in March and about a 50% chance of a first rate cut in May. This needle dropped significantly following today’s release, with the probability of a cut in March now at about 5.5% and the probability of a cut in May at a more tempered 37.5%.

While Fed policymakers have expressed confidence with recent inflationary trends, Powell notably remarked that the committee will need to gain greater confidence that inflation is moving sustainably toward its 2% target. Would today’s report provide the necessary level of greater confidence? In my view, it wouldn’t.

The interest rate inflection would likely occur with a pronounced decline in the shelter component. In January, the index was still up at an annualized rate of 6.0%, almost double the headline rate. I will begin to have greater confidence in an impending rate cut once this index begins to move lower. I believe the Fed would, too.