It’s easy to zoom out on a price chart for a winning stock and see how it’s created life-changing wealth for those who held it over the years. Take Tesla (TSLA -2.81%) for example. The stock has returned 12,000% since its initial public offering in 2010.

That’s a great result, but there were bumps and bruises along the way, including the company nearly going under while ramping up Model 3 production five years ago.

Today, the stock is down over 50% off its high. The company is caught between its recent success and preparing for what will drive its future growth, which CEO Elon Musk admitted in the company’s fourth-quarter earnings release.

So, can Tesla stock still make millionaires out of long-term investors? It certainly can, and the company’s recent stumble might be why.

The market only cares about the short term

If there’s one tip all long-term investors should know, it’s that the stock market, aka Wall Street, only cares about the short term. Stocks live and die by the quarter because professional money managers must perform quickly or lose clients. In the short term, Tesla’s business has slowed down in recent quarters.

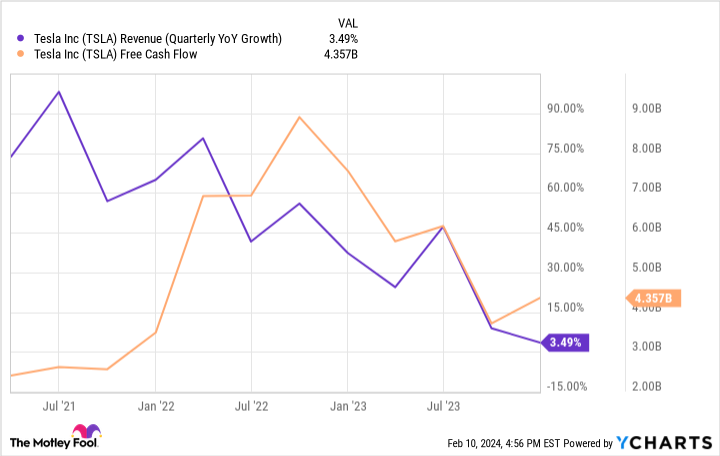

Not only are consumers grappling with record levels of household debt and higher interest rates, but Tesla has aggressively cut prices on its vehicles, shrinking profit margins and free cash flow while slowing revenue growth. Is Musk wrong to cut prices? Perhaps not. Lower prices have put a dent in Tesla’s competition, and considering that just a low-single-digit percentage of vehicles are electric, there’s still a ton of market share to grab.

TSLA Revenue (Quarterly YoY Growth) data by YCharts

To be clear, Tesla’s financials have taken a hit. It’s not that the stock dropped for no reason. But has Tesla, which delivered over 1.8 million vehicles in 2023, peaked? The likely answer is no. Consumers have indicated that price and range are the biggest hurdles to going electric. Tesla is arguably the best positioned to address those fears with an extensive charging network (which competitors are signing up to use) and likely range improvement across the broader EV field as battery technology improves.

Looking at Tesla’s next growth wave

Tesla rode the Model 3 and Model Y to tremendous growth over the past five years. Tesla’s next stretch of growth should come from new products that potentially entice new customers to the brand.

For example, the recently launched Cybertruck is still in its infancy of production and brings Tesla to the passenger pickup segment, the bread and butter of legacy American automotive companies. Musk also hinted at a new low-cost vehicle in development during the company’s Q4 earnings call.

Meanwhile, artificial intelligence (AI) remains a focal point for Tesla. Full self driving (FSD) development continues, and Tesla is working on a humanoid robot to bring to market later this decade.

Lastly, Tesla remains heavily invested in the energy business. Its energy storage business deployed 14.7 gigawatt hours in 2023, more than double its 2022 mark. Investors have to think about Tesla over a long time frame. As Warren Buffett once said about his general investing philosophy: “Nobody buys a farm based on whether they think it’s going to rain next year. They buy it because they think it’s a good investment over 10 or 20 years.”

This mentality is afforded only to individual long-term investors, and it’s an investing superpower.

Adversity could benefit investors

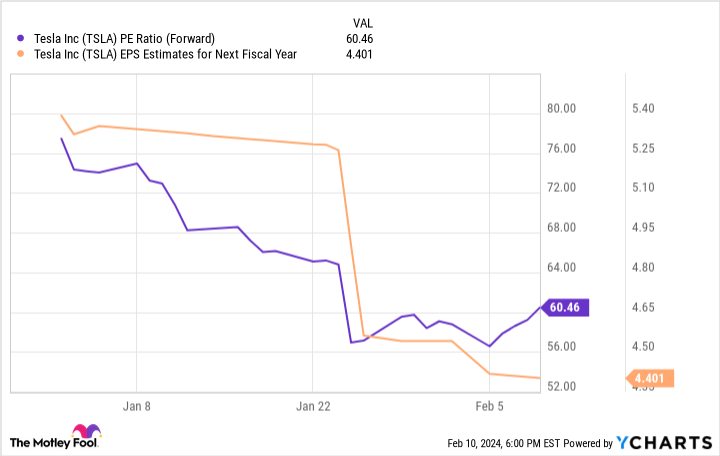

Expectations can be a powerful thing. Analysts once believed Tesla’s earnings could grow at triple-digit rates, but now expect just 15% annual growth. The pessimism is weighing on shares, dragging Tesla’s forward P/E lower — despite analysts also lowering their earnings estimates:

TSLA PE Ratio (Forward) data by YCharts

As I said above, Tesla’s profits and growth have suffered setbacks, so I understand why shares have fallen. But should investors avoid the stock because it’s raining, or own it because it could be a far bigger business in 10 years? Tesla’s next growth phase could bring billions of dollars of free cash flow, which would all drive investment returns.

Only time will tell how it all plays out, but writing off Tesla’s long-term growth and investment potential seems pretty shortsighted.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.