Rubberball/Mike Kemp/Rubberball Productions via Getty Images

Investment Thesis

ContextLogic (NASDAQ:WISH) sells the majority of its business for $6.50 per share. The remainder of the business, its net operating tax losses (”NOLs”) with an estimated value of $2.7 billion, are available for sale.

So, what should investors do now? I recommend that investors cash in if they have any shares left. This price is arguably the best it’s going to get for a while.

In the very long run, there will be more cash returning to shareholders. However, I argue that the uncertainty of waiting with no news will leave investors ”bored” and all but the most patient of investors will struggle to get more than $6.50 per share for this stock.

ContextLogic – A Rapid Recap

In my previous analysis back in August, I said in a neutral analysis:

Despite writing clearly bearish analysis on this stock, many readers have reached out to me asking why I haven’t put a sell rating on this stock. Is it that I’m still hopeful?

Rather than answer individually, I’ve decided to pen out my analysis. Here, I argue that even though I recognize the structural issues plus ongoing concerns Wish faces, I also recognize that the full bear case, namely, liquidation, can take a long time.

In the interim period, given its high short ratio, the stock is primed to exhibit high levels of volatility. In other words, although I believe I’ll be right in the long term, the short term may be punctuated with periods of excessive volatility and short covering. (emphasis added)

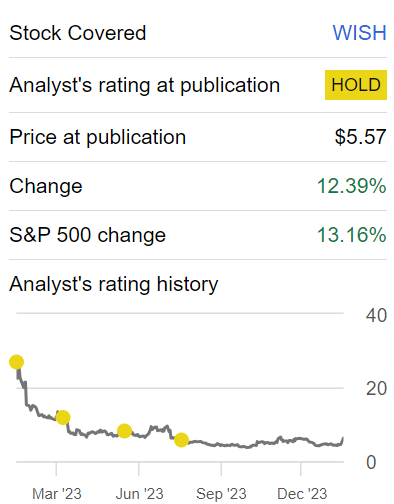

Author’s work on WISH

And that, in essence, is the difference between the amateur and the professional. The amateur is dogmatic. The professional is pragmatic. The amateur would much rather be right in the very long run. The professional is always mindful of the exposure to risk. Preservation of capital is the ultimate investing game.

And even though I remain bearish on WISH. I stand by my assertion, that I don’t want to put a sell rating on this stock and have the stock jump higher in the very short term.

WISH Stock Valuation – Too Much Uncertainty

The stock is now at $6.30. Therefore, the immediate upside would be around 3%. Of course, this is a typical arbitrage spread, and this spread isn’t likely to close until the deal is done and dusted, and the cash is guaranteed to be showing up in investors’ accounts imminently.

And therein lies the problem. The Board intends to use the proceeds from the sale to help monetize its NOLs. This means that until a suitable purchaser comes to pay for the NOLs, the cash could take 6 months, or it could be significantly longer. After all, what incentive does the Board have to speed up the sale and cut out their salaries?

Therefore, yes, there’s likely to be even more capital showing up for investors. But the problem here is the uncertainty until the investor gets paid out. So, investors can either cash in the unexpected windfall now. Or they can wait for an undetermined period of time to get the cash in their bank accounts.

What’s more, it’s difficult to know how much a capable and willing buyer would be inclined to pay for the NOLs?

In my experience, I know that this isn’t something the vast majority of investors are any good at doing. Dealing with uncertainty and being incredibly patient waiting for an outcome. As the months drag on and there’s no news coming out of ContextLogic, at some point, investors just throw in the towel.

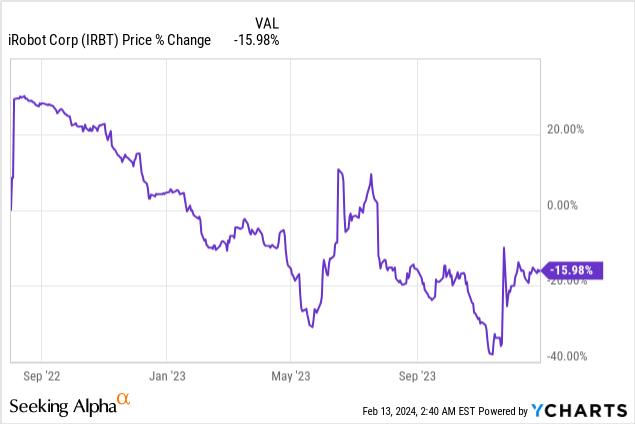

As an indirect example, consider iRobot’s (IRBT) share price performance in the months ensuing the announced purchase by Amazon (AMZN). Even before the deal ultimately fell through in January of this year (the sell-off after the purchase was canceled is not shown above).

The Bottom Line

In conclusion, I find myself at a decisive juncture with ContextLogic.

The recent sale of the majority of the business at $6.50 per share leaves the remaining value tied to uncertain net operating tax losses (”NOLs”), making the current stock price of $6.30 offer a modest upside of around 3%.

While the allure of potential gains from the NOLs is undeniable, the lingering uncertainty and the unpredictable timeline until investors see the cash in their account make cashing in now a prudent move.

Navigating the complexities of waiting for a suitable buyer and the inherent risk of prolonged uncertainty is a challenging game.

While there might be more capital in the future, seizing the current opportunity provides a more certain and immediate return. As the adage goes, preservation of my capital remains paramount, and in this instance, cashing in aligns with my pragmatic approach to investment.