MicroStockHub

Thesis Summary

Bitcoin (BTC-USD) is nearing $50,000, not too far from its all-time highs, while the S&P 500 is above 5000.

So what’s next? Does this rally have legs?

From the most basic perspective, the current rally in assets has been supported by increased global liquidity, something which will continue to increase, that is, as long as inflation doesn’t make a nasty comeback.

Bitcoin itself has even more upside potential at this point, which is supported by the upcoming halving cycle and the strong “fundamentals.”

In my last article, I discussed how Bitcoin could preempt the halving cycle this year. This is still a possibility, but there’s still plenty of upside left. With that said, I could see a pullback in Bitcoin before we continue much higher.

The Big Picture

It has been a strong start to the year for stocks and also Bitcoin. Over the past few months, we have seen both stocks and crypto rally together.

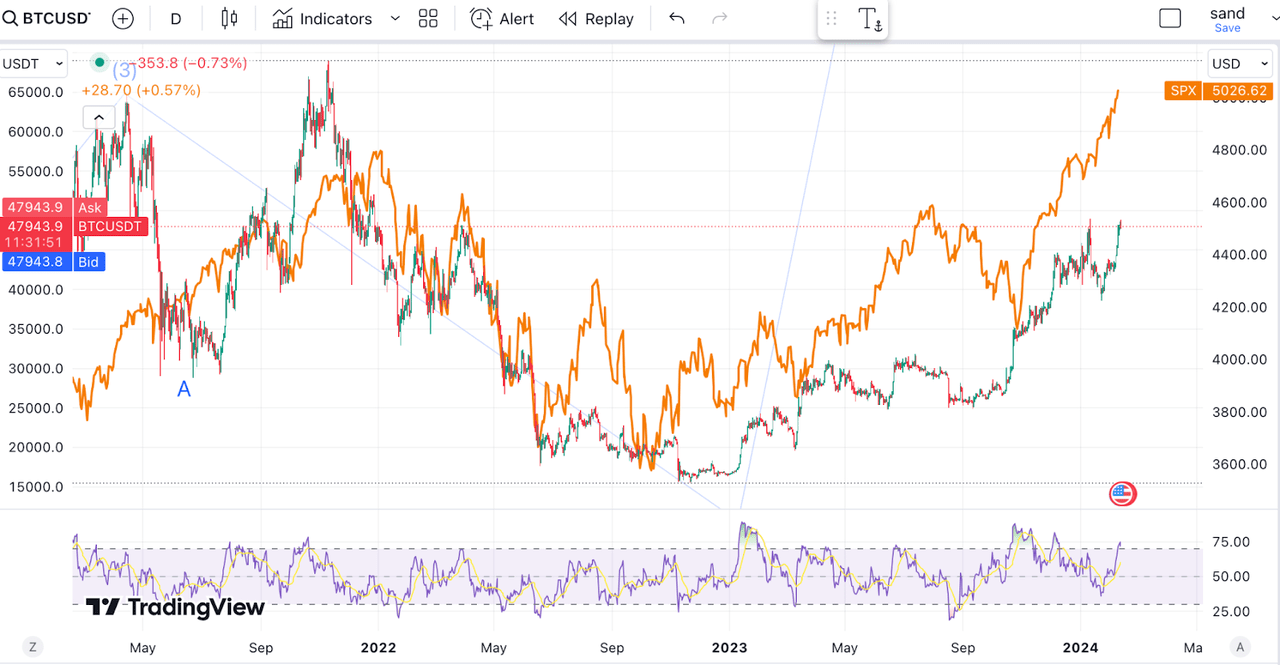

BTC and SPX (TradingView)

The correlation between the SPX and Bitcoin is quite clear, although Bitcoin does tend to make more aggressive moves at times. This makes sense since a lot of trading happens on margin, and also, crypto markets are not as deep.

At its core level, I think Bitcoin tracks global liquidity quite closely, and while the SPX may also react to other catalysts like earrings, it’s also quite closely linked.

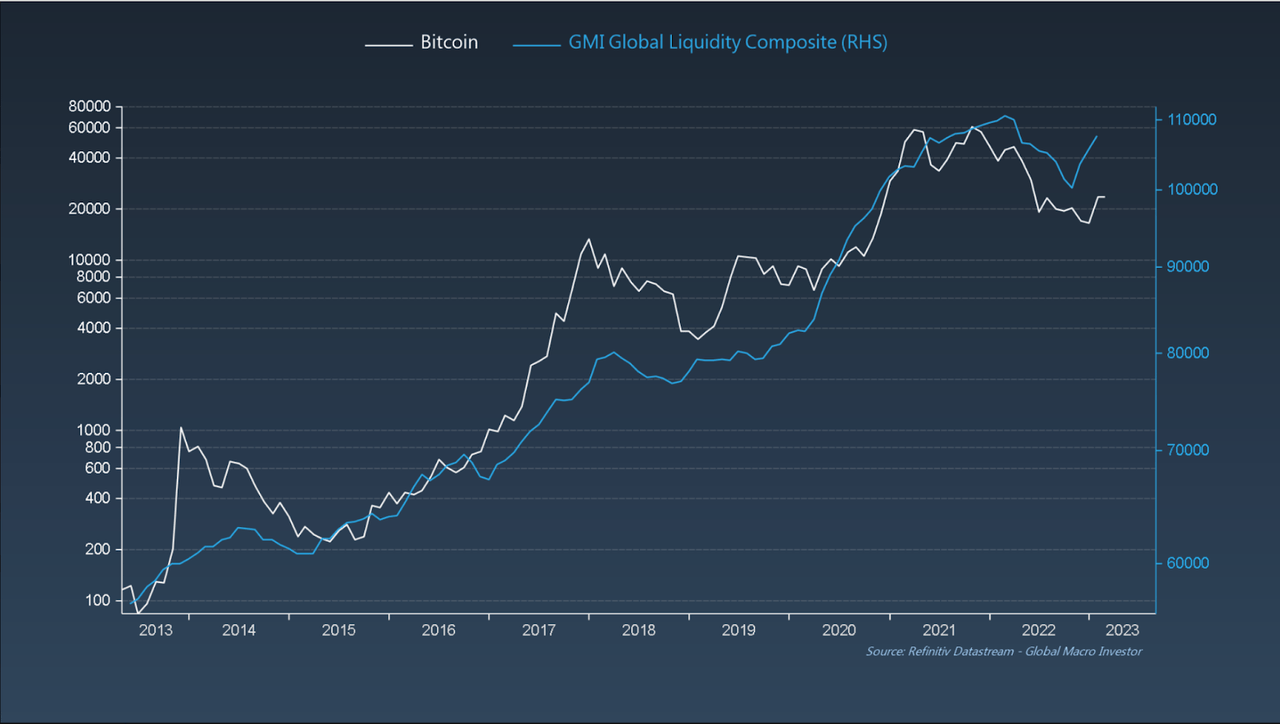

BTC and Global liquidity (Refinitiv)

Liquidity bottomed in 2022, and now the stage is set for a continuation of more tailwinds.

The Fed will be cutting rates soon; there have even been talks of ending QT, and, most significantly, we will see a continuation of high fiscal stimulus. As I mentioned in a previous article, the stage is set in 2024 for higher prices.

With that said, Bitcoin is also benefiting from strong fundamentals, such as higher demand and the upcoming fall in supply.

Bitcoin Fundamentals Strong Ahead Of Halving

Bitcoin has a lot going for it at the moment.

For starters, we are seeing a big rise in network utilization, which is reflected in the higher network fees.

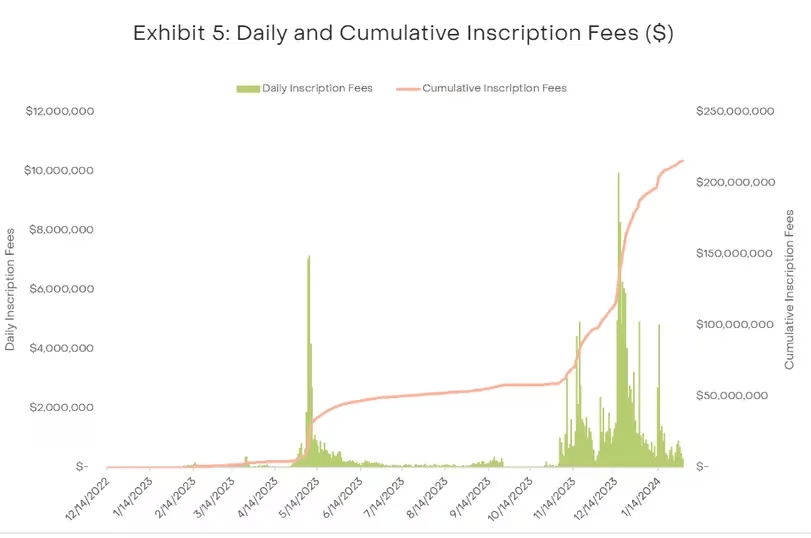

BTC fees (Coindesk)

A lot of experts are pointing towards the popularity of Ordinals to explain this rise in network fees. Ordinals are like “Bitcoin NTFs”. Through this protocol, a Satoshi, the smallest unit of measure in Bitcoin, can be given a serial number and, therefore, made unique.

The popularity of Ordinals is boosting demand for Bitcoin, which is increasing fees, and, therefore, is actually also quite bullish for Bitcoin miners.

On the other hand, demand is now also being pushed by institutional adoption though the recently approved Bitcoin ETFs.

According to recent data, over 3% of the Bitcoin supply is held by ETFs. That’s a considerable amount in such a short span of time.

BTC ETFs are being well received by institutions and the public, creating another source of demand when Supply is only months away from being cut in half,

Right now, 6.25 BTC are offered as a reward for each block mined. At today’s price, that would be equal to a little over $15 billion in what we could call selling pressure.

This will then be halved in approximately 65 days, which would mean halving that selling pressure. Of course, this also depends on the price, but even if Bitcoin doubles from here, there’s not much new supply coming in.

Not, in my opinion, when you compare that to the projected $145 trillion in worldwide AUM that Bitcoin can now draw from

Is This Time Different? (Technical Analysis)

We are now about two months away from the halving, and this is, so far, playing out quite predictably.

In my last article on Bitcoin, I showed this chart.

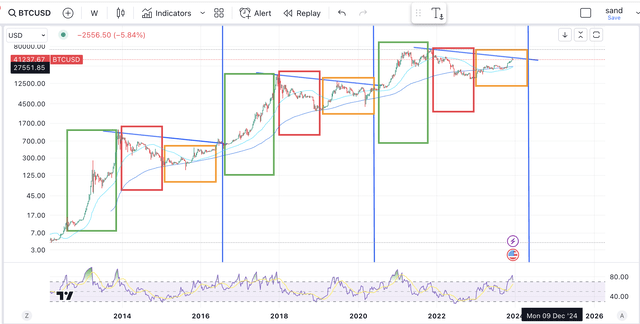

BTC cycle (Author’s work)

As we can see, there’s a pretty clear three part cycle following the halving. Bull market, bear market and consolidation. Right now, we are in a consolidation phase.

Now, a lot of people would expect to see a sell-off leading up to the halving. Kind of like we saw in 2019. However, that was also accompanied by a global pandemic.

Right now, we are hovering just at 48K, and there are two paths forward.

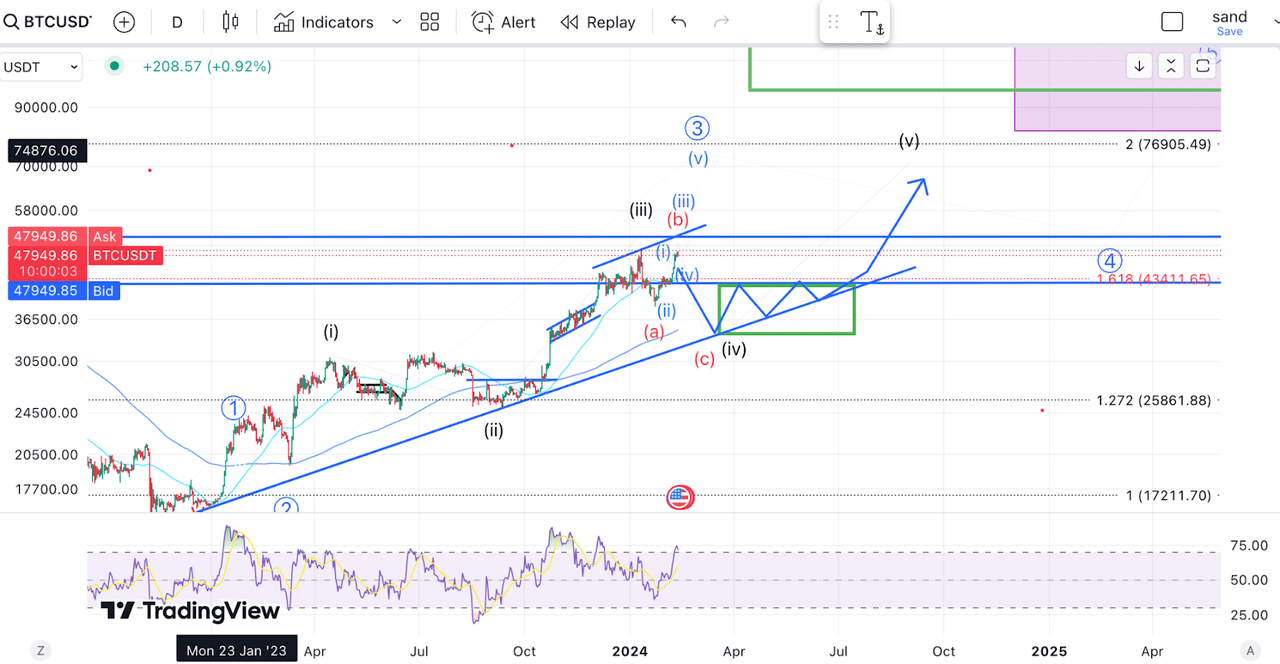

BTC TA (Author’s work)

It’s possible that the recent sell-off towards $38K saw us complete a wave iv retracement, meaning we could now rally towards +$70K to complete the large-degree wave 3.

However, we have yet to see a completed impulse, five waves, which break above the recent high. We also have a more bearish scenario shown by the red abc, where wave IV still has more room for the downside.

If things were to play out like before, then we would likely see us compete in wave 3 soon, sell-off over the next two months in 4, and then finish off with a blow-off top in wave 5 after the halving.

Risks

Bitcoin has yet to finish its halving cycle, and while I do expect higher highs, there is one thing that could derail this. A return of inflation, leading to tighter monetary policy and a fall in liquidity, could certainly put a dampener on the bull thesis.

However, as I have pointed out in my last macro article, deflation almost seems like more of a risk at this point. While a COVID-like crisis/deflation could certainly give us a 2019-style sell-off, I’d expect Bitcoin would quickly recover from this, much like it did back then, supported by what would probably be a very aggressive Fed response.

Final Thoughts

All in all, I remain quite bullish on Bitcoin, at least until we reach my minimum target. With that said, I am also weary of the fact that everyone is expecting the halving to lead to a bull rally; this could also play out like the BTC ETF, which could be described as a sell-the-news.