FatCamera

Self-reflection is one of the most important traits when it comes to investing. It can be difficult to determine whether an investment that is not working out the way you thought it was is underperforming because you just need to be more patient, or if it’s because you were wrong, or due to fundamental conditions changing. Even when conditions do change, investors sometimes aren’t quick enough to change their mind about the opportunity in question. But the more you reflect on the opportunities that you have looked at and on your own strengths and weaknesses as an investor, the easier differentiating these things becomes.

One company that I think is illustrative of this is Carter’s (NYSE:CRI), a firm that is dedicated to selling young children’s apparel throughout North America under the Carter’s, OshKosh B’gosh, Skip Hop, and Little Planet Brand names. Back in January of 2023, I ended up rating the company a ‘buy’ because, even though the firm had experienced some weakness for a couple of quarters from a revenue, profit, and cash flow perspective, shares of the enterprise looked to be trading on the cheap. But after more than a year of underperformance, with shares generating downside for investors of 0.4% at a time when the S&P 500 is up 24.4%, the picture has worsened to the extent that the stock looks a bit more expensive than it did previously. Add on top of this how shares are priced relative to similar firms and a continued decline in revenue, and I have no problem downgrading the firm to a ‘hold’.

Assessing recent weakness

Although we do not yet have data for the final quarter of the 2023 fiscal year, there is no denying that 2023 was rather painful for Carter’s. Consider, for instance, the first nine months of the year. During that time, revenue came in at $2.09 billion. That represents a drop of 9.3% compared to the $2.30 billion generated the same time one year earlier. During this window of time, the business experienced weakness across all three of its operating segments. The US Retail unit, for instance, reported an 11.4% drop in revenue year over year from $1.15 billion to $1.02 billion. Management attributed this decline to macroeconomic factors that pushed consumer demand lower. The end result was a reduction in store traffic and a decrease in units per transaction for the company’s online channels and at its physical locations. Some of this may have also been the result of management increasing prices in order to try to offset inflationary pressures.

While the US Retail segment was impacted the most, the other two segments the company has were also harmed. The US Wholesale segment, for instance, reported a 6.4% drop in sales from $819.8 million to $767.2 million. Management said that the same macroeconomic factors, combined with planned inventory reductions by its wholesale customers, caused this pain. Meanwhile, the International segment reported an 8.7% drop in sales from $327.2 million to $298.6 million. That decline, according to management, was largely the result of weaker demand for the company’s products in Canada, as well as foreign currency fluctuations.

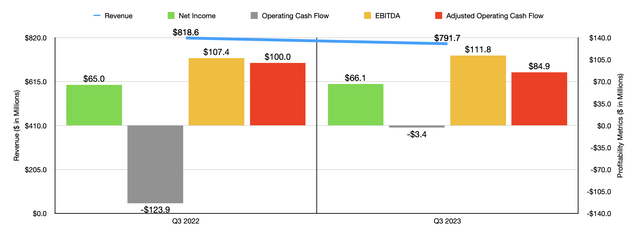

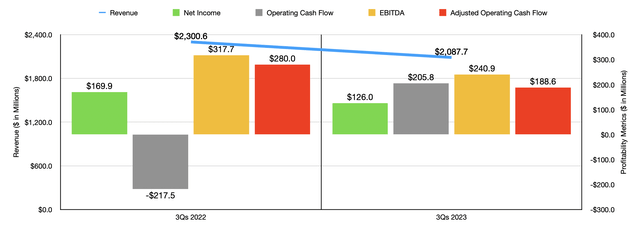

In the retail space, you can normally expect a drop in revenue to bring with it a drop in profits. And that is exactly what we saw. During the first nine months of 2023, net profits of $126 million came in lower than the $169.9 million reported one year earlier. Decline in operating income that resulted from sticky selling, general, and administrative costs, all played a role. Royalty income for the business pulled back from $20.3 million to $16.6 million. Not every profitability metric worsened during this time. As an example, operating cash flow went from negative $217.5 million to positive $205.8 million. But if we adjust for changes in working capital, we would get a plunge from $280 million to $188.6 million. Meanwhile, EBITDA for the company fell from $317.7 million to $240.9 million. As you can see in the chart above, there was not really any major reprieve when looking at the most recent quarter, which is the third quarter of 2023. Although net profits inched up slightly, the other profitability metrics for the firm were mixed year over year.

When it comes to the 2023 fiscal year in its entirety, management did say that investors should expect some weakness on the top line. Revenue should be between $2.95 billion and $2.965 billion. To put this in perspective, for 2022, sales totaled $3.22 billion. In terms of profitability, management is forecasting earnings per share of between $5.95 and $6.15. That would imply, at the midpoint, net income of $220.5 million compared to the $250 million reported for 2022. Although profits are expected to fall, management did say that operating cash flow would be over $350 million. That’s well above the $88 million reported for 2022. On an adjusted basis, however, for 2022, it was $376.1 million. Following that trend, we should expect EBITDA to decline from $423.5 million in 2022 to around $394.1 million for 2023.

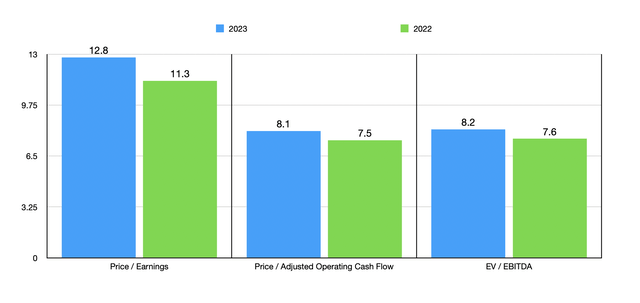

Using these figures, I then valued the company as shown in the chart above. The stock does look slightly more expensive on a forward basis using the 2023 estimates than using the historical 2022 results. But that’s not surprising when you are showing a scenario where profitability worsens year over year. On an absolute basis, shares do look attractively priced. But then, in the table below, I compared the enterprise to five similar firms. On a price to earnings basis, three of the five companies were cheaper than it. This number drops to two of the five using the other two profitability metrics. All in all, this places Carter’s right around the middle of the pack when it comes to valuation.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Carter’s | 12.8 | 8.1 | 8.2 |

| Hanesbrands (HBI) | 6.4 | 3.7 | 15.2 |

| Kontoor Brands (KTB) | 15.9 | 15.6 | 11.1 |

| Canada Goose Holdings (GOOS) | 32.4 | 18.6 | 8.5 |

| Oxford Industries (OXM) | 10.0 | 7.3 | 5.9 |

| Under Armour (UAA) | 8.7 | 63.2 | 7.4 |

Takeaway

Operationally speaking, Carter’s isn’t doing awful, but it is far from doing great. The drop in sales for 2023 is discouraging, though even with that, cash flows are robust. On an absolute basis, the stock does look fairly attractively priced. But when we consider how shares are priced relative to similar firms, and you look at the recent weakness that management can’t seem to escape from, it’s difficult to give the company anything more bullish than a ‘hold’ rating.