monsitj

In this article I outline why I think CleanSpark, Inc (NASDAQ:CLSK) is a buy with an opportunity to almost double an investor’s money. I will explain my thesis by analyzing price action, a chart pattern, momentum, volume, and relative strength all on a weekly time frame. Let’s examine the chart.

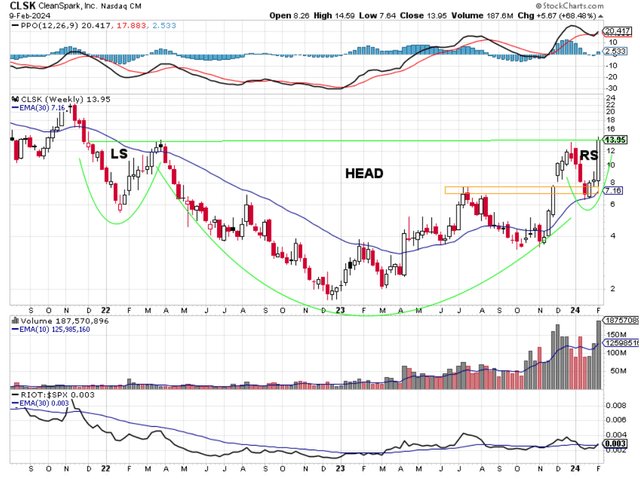

Chart 1 – CleanSpark with 30-week EMA, Momentum, Volume, and Relative Strength

When I am examining a stock, I like to look at the weekly time frame. Chart 1 above shows the weekly price action of CLSK along with the 30-week exponential moving average (EMA). The 30-week EMA was discussed recently in this article, and in short, I see this time frame, 30 weeks, as an intermediate to long term time frame which allows good trends to manifest. On the upper left-hand side of the price chart, you can see that CLSK once traded around $24 per share back in November 2021. Then it started to decline with the decline in the overall market. In late November 2021, CLSK closed below its 30-week EMA and stayed below that level until April 2023 with one brief exception. Investors like me who trade the trend, saw no reason to be long CLSK as it stayed below its declining 30-week EMA. Trend traders like to be long stocks that trade above an upward sloping 30-week EMA. Trend traders short or stay out of stocks that are trading below a downward sloping 30-week EMA. CLSK went from about $24 all the way down to its low of $1.74 in December 2022. Simply using the 30-week EMA would have kept investors out of trouble during that decline. After that low, the price action of CLSK started to improve. Often a stock must flatten out, consolidate, or base, before it can advance after a big decline. That’s what CLSK did over the few months. It traded between $1.74 and just shy of $4.00 while building a base. One bullish signal that price action showed in March 2023 was that CLSK managed to put in a higher low. After CLSK rallied to just under $4.00 in February 2023, it then sold off. However, this sell-off halted at a low of $2.04. This meant that CLSK put in a higher low compared to the low in December 2022. Then CLSK rallied and closed above its 30-week EMA in April 2023 on a big bullish candle and closed above the February 2023 high of $3.84. With the close at $4.13 in April 2023, CLSK now put in a higher high to go with the previous higher low. At that point, a trend change happened and CLSK was now trending higher. The 30-week EMA started to slope upwards and anyone who simply bought CLSK because it closed above its rising 30-week EMA would have made some money. For the most part, CLSK has stayed above its rising 30-week EMA and the EMA is trending higher. CLSK has put in a series of higher highs and higher lows, which is the definition of an uptrend. Last week CLSK had a strong bullish candle off of its 30-week EMA. I see the price action of CLSK as bullish.

If you look at the curved green lines on the chart you can see the outline of a wide bullish head and shoulders pattern. This pattern is a common pattern that stocks go through before a big advance. The left shoulder is marked by the letters LS, the head is shown with HEAD, and the right shoulder is identified with the letters RS. The significance of this pattern is that it can give clues to a potential price target. The distance between the neckline of the head and shoulders pattern, shown with the horizontal green line, and the lowest price in the pattern, is the potential upside move, once price breaks above the neckline of the head and shoulders pattern. In this case the neckline is drawn at $13.50, while the low of the pattern is low made in December 2022 at $1.74. That’s a difference of $11.76. Adding $11.76 to $13.50 gives a potential price target of $25.26 which is 81% higher than its current price. Almost a double. Since CLSK closed above its head and shoulders neckline on Friday, I think the head and shoulders pattern and price target are viewed as bullish.

Momentum for CLSK is strong and is shown using the Percentage Price Oscillator (PPO) in the top pane of Chart 1. Momentum is shown in two ways. When the black PPO line is above the red signal line that shows short term bullish momentum. Right now, the black PPO line is above the red signal line so short-term momentum is bullish. If the black PPO line was below the red signal line, then short-term momentum would be bearish. The second way to see momentum with PPO is whether the black PPO line is above or below the zero or centerline of the PPO chart. Being above the zero or centerline indicates long term bullish momentum and being below the zero or centerline indicates long term bearish momentum. Right now, the black PPO line is reading 20.417, well above zero. I say long term because you can see that the PPO doesn’t cross the zero or centerline often. Once it crosses it often stays above or below for long periods of time. PPO is a confirming indicator to me. Notice that PPO crossed below the zero line shortly after CLSK closed below its 30-week EMA in November 2021. You want to be on the right side of momentum as a trader and right now both short term and long-term momentum are bullish for CLSK.

Volume is also bullish for CLSK. The large black volume bars show that institutional investors, or smart money, are accumulating shares in CLSK. The only reason they would do that is because they think that CLSK is undervalued at its current price. I prefer to own stocks that smart money is buying. Volume is bullish for CLSK.

The last thing I look for in investment opportunities is the relative strength of the stock versus the SP 500 index. To beat the major index, you must own stocks that outperform the major index. The bottom pane of Chart 1 shows the price ratio between CLSK and the SP 500. When the black line is rising that means that CLSK is outperforming the major index. Conversely, when the black line is falling CLSK is underperforming the major index. Since its low in December 2022, CLSK has been outperforming the major index. Recently, the relative strength line turned higher, indicating outperformance. The relative strength indicator is not the most bullish indicator on the chart, but it is starting to head higher.

CLSK had a massive move last week, up over 68%, which is why I say this is a speculative opportunity. I believe the target price could be in play in the over the next several weeks or months, but CLSK could pull back and consolidate its recent gains. In April 2023 when CLSK closed above its 30-week EMA it did so with a big bullish candle like last week’s candle. In April 2023, CLSK then consolidated over several months before moving higher. It also gave back some of those gains, so you should be prepared for that to happen again this time. I’m not saying that this is how it will play out, I’m saying you should be prepared for price volatility. Potential strategies include buying fewer shares to initiate your position or waiting for a price pull back to buy shares. Also, any close below the 30-week EMA going forward indicates the bullish thesis is in jeopardy and I would therefore sell or at least reduce my position.

In summary, CLSK offers the potential for a near double. It has bullish price action as it is in an uptrend with price above an upward sloping 30-week EMA. The bullish head and shoulders pattern suggests a potential $25.26 price target which is 81% higher than the current price. Momentum is bullish on both the short term and long term. Institutions are buying CLSK which is bullish. Relative strength could be better, but it has recently turned higher. As always, have an exit strategy in case the bullish thesis proves incorrect.