traffic_analyzer/iStock via Getty Images

Hold rating for Eldorado Gold Corporation

This analysis assigns a Hold rating to Eldorado Gold Corporation (NYSE:EGO) shares, as over time the stock should offer the entry point seen as associated with greater upside potential amid the expected robust outlook for safe-haven gold and EGO’s robust production and elevated margins.

The Outlook for Gold Prices

The troy ounce of gold bullion was trading at $2,022 at the time of writing, but Trading Economics analysts expect the price to tend to rise in the next few months, reaching the forecast value of $2,112.48/oz.

This analysis is consistent with analysts’ assessment, as the demand for gold for investment purposes is bound to be strong as the economy is hit by a recession in 2024. Gold will be in high demand as its properties are sought as a safe haven for the portfolio against the headwinds caused by the impending economic recession. This is also according to the World Gold Council‘s gold demand outlook, whose analysts also expect that while supply will continue to recover this year, it will still be below record levels in 2018, meaning the supply deficit will put strong upward pressure on the price per ounce.

Retail investors may want to link the return of their portfolio to the expected increase in the price of gold, but investing directly in gold bullion is not a suitable activity for them, as it requires a massive capital investment that they do not have. They can, however, do it more efficiently: they can use shares of North American listed gold mining stocks, as these stocks usually tend to mimic the price action of the yellow metal.

Eldorado Gold Corporation Offers Incredible Growth Opportunities

Driven by a strong positive correlation with gold prices, as its portfolio of gold production performs robustly, Eldorado Gold Corporation offers an effective option to benefit from the rising price of gold instead of the physical yellow metal.

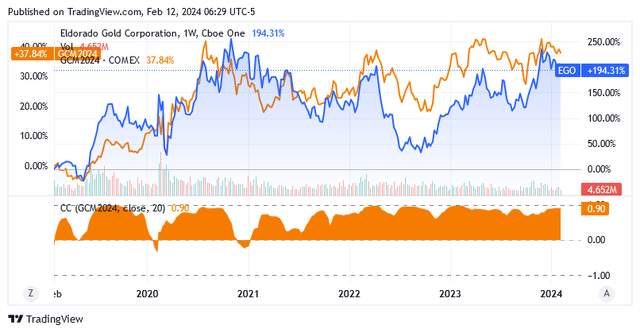

EGO shares and gold prices – gold prices have their benchmark in gold futures prices (GCM2024) – are positively and even strongly correlated, as the yellow area in the lower part of the chart has almost always been above zero over the past 5 years. The yellow area graphically represents the mentioned relationship between the two securities.

A positive correlation implies a bullish gold price-bullish EGO stock price or a bearish gold price-bearish EGO stock price. Therefore, given the gold price outlook, this condition bodes well for EGO price. A positive correlation has nothing to do with returns because the securities can deliver very different returns even though they tend to be affected by the same market sentiment.

Eldorado Gold Corporation: Robust gold production

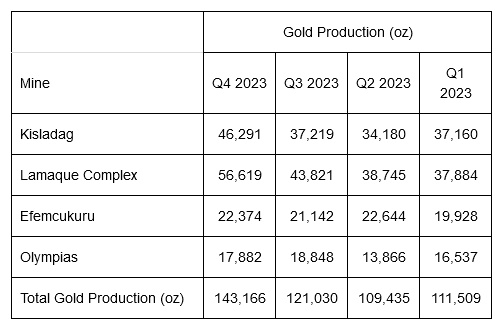

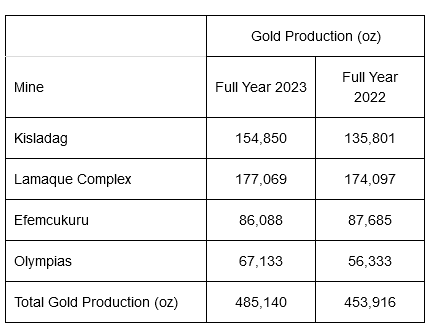

Eldorado Gold Corporation produces gold in the Lamaque Complex in Canada, as well as Kisladag and Efemcukuru in Turkey, and Olympias in Greece.

Based on EGO’s preliminary results of fourth-quarter and full-year 2023 gold production, EGO assets benefit from the following operational improvements, which the retail investor can expect to be accretive beyond 2023 when gold is expected to soar, as they are due to the expansion of existing systems.

Turkish assets (48% of total production) will benefit from the recent commissioning of a larger area of the northern heap leach platform at Kisladag and more efficient management of waste materials and dry tailings through the operation of new storage infrastructure at Efemcukuru. The continued favorable trends in throughput and average grades are expected to continue to act as an additional driver to maintain Efemcukuru production levels in the coming quarters.

Greek assets (12-13% of total production) will benefit from the installation of an improved ventilation system at the mine, which will help reach points of the mine body that were previously more difficult to reach and enable the use of bulk mining methods to take advantage of larger stopes. According to the company, these on-site technical improvements enabled gold production to reach record levels in 2023.

The Lamaque complex in Canada (39.5% of total production) leaves its problems behind: these were interrupted shifts in the second quarter after the forest fires in Quebec province. The company is now poised to deliver remarkable performance following record production levels in the fourth quarter and full year 2023.

Source: Eldorado Gold Production Q4 and Full 2023 Preliminary Production Results

In 2023, EGO’s assets were able to mine a total of 485,140 ounces of gold, an increase of almost 7% compared to the previous year.

Source: Eldorado Gold Production Q4 and Full 2023 Preliminary Production Results

As full 2023 production was in the middle of the 475,000-495,000 ounces guidance range for the year, that means the assets have significant room to top the higher limit and deliver significantly higher ounces in 2024, assuming bad headwinds similar to the Quebec wildfires will not occur.

Tailwinds from increased production combined with the expected rise in gold prices will have a positive impact on margins, which is a strong driver for the share price, potentially pulling out the horns aggressively.

Robust Gold Margin: an Effective Share Price Driver

As a measure of profitability, EGO has a 12-month EBITDA margin of 40.35%, which compares favorably to the industry average of 17.3%, meaning EGO’s business is significantly more profitable than most competitors in the gold mining industry.

EGO’s 12-month EBITDA margin of 40.35% was calculated as EGO’s [1/EV / EBITDA (TTM)] of 6.43 x EV / Sales (TTM) of 2.59: 0.156 x 2.59 x 100 = 40.4%.

A sector median 12-month EBITDA margin of 17.3% was calculated as EGO’s [1/EV / EBITDA (TTM)] of 8.78 x EV / Sales (TTM) of 1.52: 0.114 x 1.52 x 100 = 17.3%.

Of course, the gold price rose sharply by 12.76% year-on-year to an average value of $1,890.08/ounce. Over the past 12 months through the third quarter of 2023 has proven critical to EGO’s EBITDA margin.

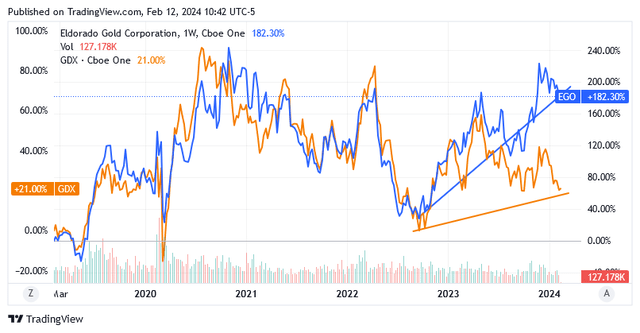

Subsequently, EGO shares have risen approximately 96% from the low of early October 2022 to the end of September 2023 (see the blue segment line on the chart), significantly outperforming the VanEck Gold Miners ETF (GDX) + 32% (see the yellow segment line on the chart). The latter security is the benchmark for gold mining companies listed on the US market.

The EGO stock price return has been nothing short of astounding, taking advantage of the strong stance of this gold stock’s high-performing gold assets to move in tandem with the gold price movement. In fact, despite all of Wall Street’s obsessive AI hype campaign, the S&P 500 was only able to grow by 20% over the selected period.

The improvement in EGO’s business provides greater opportunities for a second Greek EGO project for significant gold production in Skouries, and the subsequent market optimism also had a positive impact on the share price.

Eldorado growth project in Greece

In Skouries the company is working on the construction of an open-pit mining and underground deposit to extract gold. The asset is expected to begin multi-year gold production by the end of 2025, starting with approximately 80,000 to 90,000 ounces of gold in 2025. Production is then expected to increase to commercial production of 145,000 to 155,000 in 2026 and 195,000 to 205,000 in 2027, according to EGO’s five-year growth profile outlook published in early 2023.

To continue its mineral business and provide hope for future higher ounces at competitive AISC of $1,190 to $1,240/oz. against an industry high of $1,358 AISC/oz, reflecting positively on shares through increased margins, Eldorado Gold Corporation leverages a financial position that as of September 30, 2023, looks as follows: Cash and cash equivalents: $476.6 million as of September 30, 2023. It increased $20.4 million sequentially due to robust sales volumes and gold prices, as well as competitive costs. While the debt was $596.5 million. Over the trailing twelve months through the third quarter of 2023, the business generated operating income of $126.7 million (up 21.5% year over year), well above interest expense of $30.9 million (down 11% year over year), meaning the company is in a position to do so: being able to honor its obligations as a result of outstanding debts.

Waiting for an Attractive Entry point: not be Unproductive in such a Climate

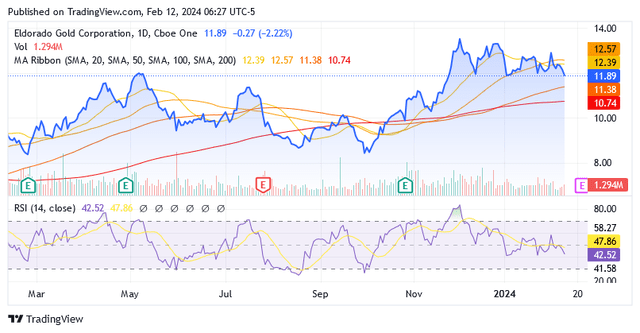

There is strong upside potential for EGO, and it could be greater if retail investors wait for a lower share price than the current $11.89, which gives the company a market cap of $2.43 billion.

Shares are currently very close to the upper bound than the lower bound of the 52-week range of $8.12 to $13.71 and above the longer trendlines of the 100- and 200-day simple moving averages of $11.38 and $10.74.

There doesn’t appear to be strong bearish sentiment on the stock at the moment, but retail investors should bet on a lower share price as it will suffer from some headwinds fueled by statements from Federal Reserve policymakers last week. On interest rates, Fed Chairman Jerome Powell suggests there is a risk of moving too hastily when more work might be needed to curb inflation. Cleveland Fed President Loretta Mester reiterated Chairman Powell’s stance on Tuesday last week, sharpening the tone to be very cautious about rate cuts because of the risk of premature implementation. Minneapolis Fed President Neel Kashkari even thinks further hawkishness on interest rates may be necessary. The escalation of tensions in the Middle East is likely to lead to fears of a rebound in inflation as energy and transport costs rise. Additionally, even Richmond Fed President Tom Barkin, a dovish Fed official, is urging caution, citing the risk of cutting rates too soon despite progress in containing inflation.

An extension of the “higher-for-longer” interest rates policy will negatively impact gold prices, as fixed-income assets such as US bonds that compete with the yellow metal become more attractive than the ounce.

This will put some negative pressure on gold and EGO, which has plenty of room to the downside to form a more convenient entry point (measured by a 14-day RSI of 42.52) ahead of the expected gold price rise due to the economic recession. The negative economic cycle with its feared negative effects on portfolio value favors gold as a safe haven remedy.

The Upward Catalyst of the Economic Recession

The economic recession will be a consequence of the US central bank’s restrictive interest rate policy to combat core inflation, as this combination is unfavorable to consumption and investment. To protect profit margins, companies reduce the number of employees, as labor costs account for the majority of total operating costs. A strong sign of a slowdown in spending comes from the fourth-quarter earnings season so far: While higher margins on cost-cutting have boosted earnings that topped consensus well, Ohsung Kwon, equity strategist at Bank of America Corporation (BAC), emphasized that the companies barely beat analysts’ sales estimates so far. The slightly higher actual revenues than analyst estimates are most likely due to increased core inflation rather than sales volumes. Signs that business investment is not recovering include high money costs hampering lending to the private sector and fears of somewhat headwinds in the financial system after regional banking problems in spring 2023. Regarding the latter factor, Fed Chairman Jerome Powell, and US Treasury Secretary Janet Yellen seem to hope that banks will retain liquidity rather than invest money during this difficult time for the economy. Banks are currently being suggested to cut dividends and share buyback plans, and to use higher profits to increase provisions for the high risk of losses due to weakness in the commercial real estate sector.

It may only be a matter of time, but the deterioration in employment levels will be what is missing to trigger an economic recession: the numbers add up in this sense, as companies continue to cut jobs: Layoffs are hitting the tech industry in particular, with 262,682 layoffs in 2023 and 164,969 layoffs in 2022, as well as a new round of layoffs in tech approximately 34,000 in early 2024, but the job loss trend is spreading to other sectors of the business world.

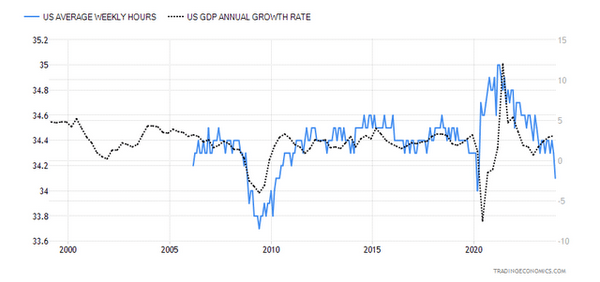

But while the labor market still appears resilient to most market participants, there are signs of a slowdown in some metrics that some economists view as a strong indicator of an impending recession: says Lakshman Achuthan, co-founder of the Economic Cycle Research Institute says that the number of hours worked have fallen in a manner typical of a recession.

Source: Trading Economics

Conclusion

With its robust and highly profitable gold production, Eldorado Gold Corporation represents a very exciting opportunity to participate in the upcoming 2024 gold price rally.

The company will benefit from improving mineral assets and robust gold price conditions, potentially having, as has happened recently, a very positive fallout for the share price.

Continued progress at another gold production project in Greece is driving extra positive sentiment for the stock. As a safe haven amid a looming negative cycle due to the recession, gold prices will see increasingly better times in 2024. While investors wait for the Fed member’s recent rate statements to weigh on prices, they can take advantage of a better entry point for EGO stock forming going forward.

This analysis sees a chance for an entry point below 200-SMA, but not soon. It will take time, as the question of what the Fed will do next will slow the stock price movement to reach the desired bottom.